1 3 4 As An Improper Fraction In Its Simplest Form are a flexible solution for anybody looking to produce professional-quality documents promptly and easily. Whether you need custom invites, returns to, organizers, or calling card, these templates enable you to customize content easily. Just download the layout, modify it to suit your requirements, and publish it at home or at a printing shop.

These templates conserve time and money, supplying an economical option to hiring a developer. With a large range of styles and formats available, you can discover the perfect layout to match your personal or business requirements, all while keeping a sleek, specialist appearance.

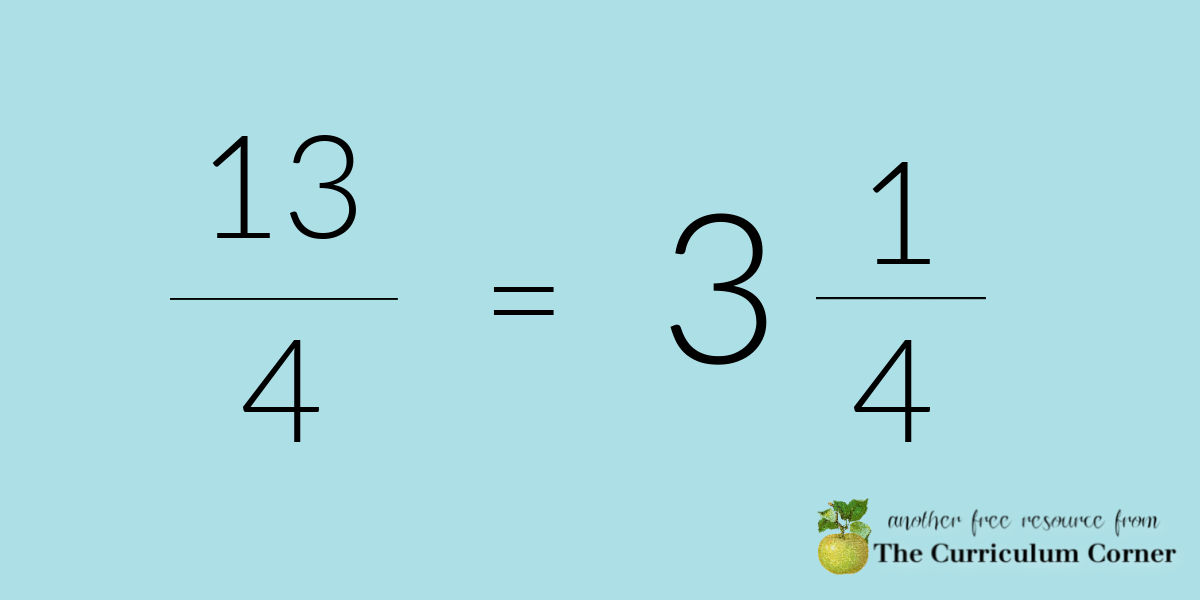

1 3 4 As An Improper Fraction In Its Simplest Form

1 3 4 As An Improper Fraction In Its Simplest Form

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, ...

W 9 blank IRS Form Financial Services Washington University

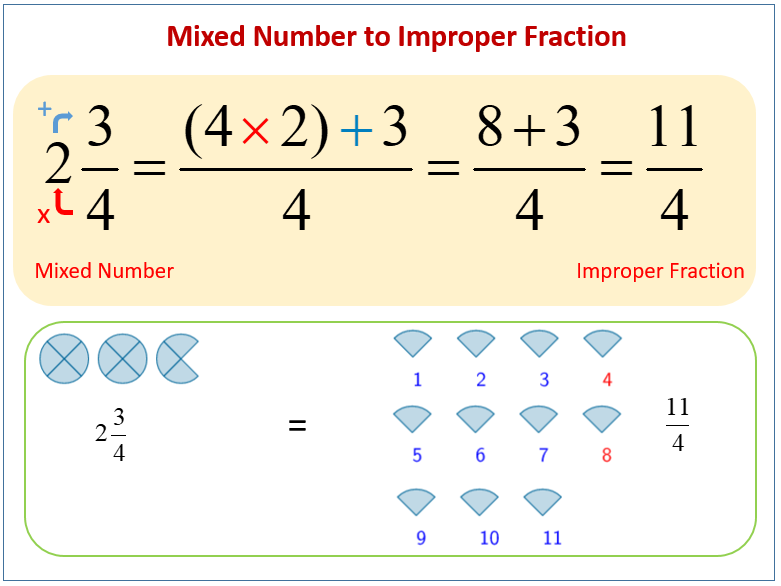

A Change The Following Mixed Fractions To Improper Fractions To

1 3 4 As An Improper Fraction In Its Simplest FormForm W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

For guidance related to the purpose of Form W-9, see Purpose of Form, below. Print or type. See. Specific Instructions on page 3. 1 Name of entity/individual ... Converting Improper Fractions To Mixed Numbers Worksheets Fr Write Mixed Numbers As Decimals

2021 W 9 Navy SEAL Foundation

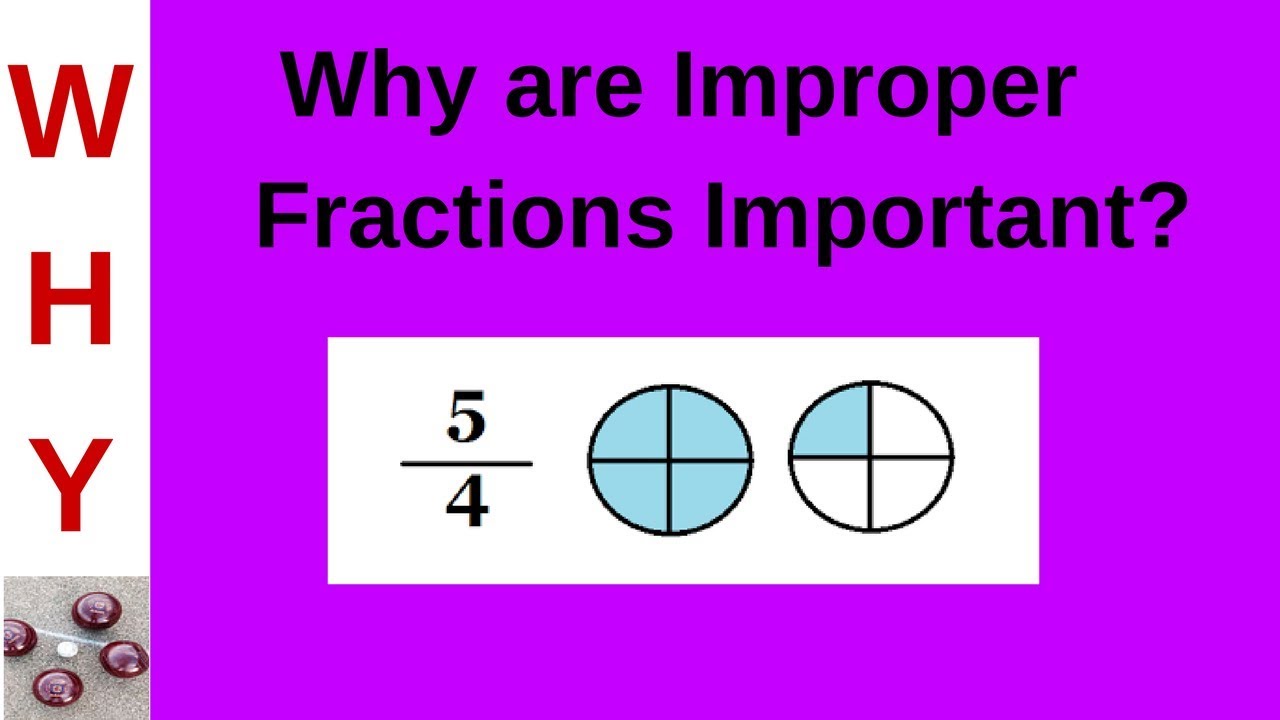

Improper Fractions

Any payee vendor who wishes to do business with New York State must complete the Substitute Form W 9 Substitute Form W 9 is the only acceptable documentation Change Improper Fraction

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 and Turning Fractions Into Improper Fractions 4 2 5 Improper Fraction

Improper Fractions Calculator

Making Improper Fractions

Solve Improper Fraction

Improper Fraction Examples

Simplifying Fractions Sheet 6 Answers Simplifying Fractions

Converting Improper Fractions

Solved Solve For X 4x 6 5 8x 8 6 Give Your Answer As An Improper

Change Improper Fraction

How To Rename Mixed Numbers In Simplest Form 10 Steps

Converting To Improper Fractions