1 5 Divided By 1 50 are a versatile option for any person seeking to develop professional-quality documents quickly and easily. Whether you require personalized invitations, returns to, coordinators, or calling card, these templates permit you to personalize material easily. Simply download the theme, modify it to match your demands, and print it in the house or at a printing shop.

These themes conserve time and money, using a cost-efficient choice to employing a developer. With a large range of styles and styles readily available, you can discover the ideal design to match your individual or service demands, all while keeping a polished, professional appearance.

1 5 Divided By 1 50

1 5 Divided By 1 50

This website has tons of free printable wallpaper in scale for dollhouses There are probably 100 different designs I love the result Download dollhouse wallpaper. Click on the link below and print the entire document or just the pages of the wallpaper you like. The wallpapers are free.

DIY Dollhouse Decor Free Miniature Wallpaper and Tile Printables

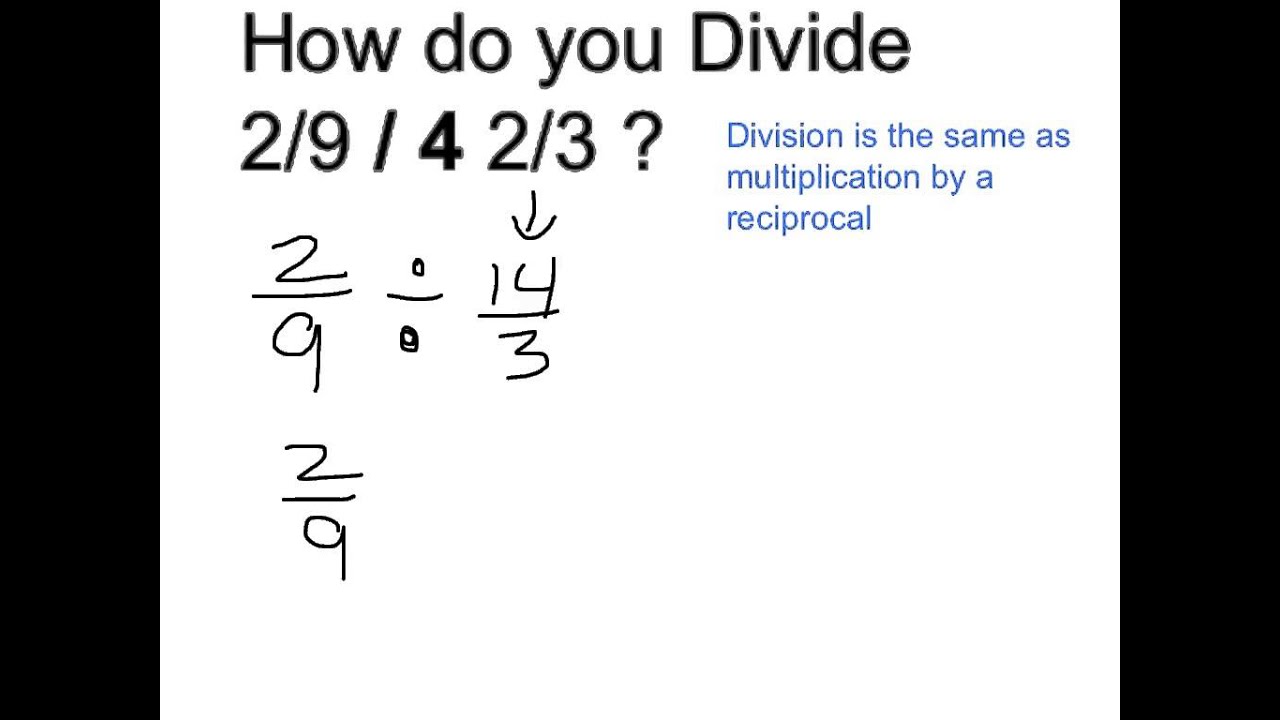

5 Divided By 1 8 Five Divided By One Eighth YouTube

1 5 Divided By 1 5012 Dollhouse Vintage Wallpaper Patterns - 12 Sheets in A4 format - Instant Download - Print, cut and glue to your dollhouse - PDF Sheet These miniature wallpapers are meant for 1 12th scale doll s houses but they can be used for other projects as well People have used them for decorating

Printable Wallpaper in a a floral design for 1:12 scale JPG format to print on 8.5" x 11" • Instructions • Upon checkout you will be prompted to download ... 12 Divided By 100 What Is 3 Divided By 1 8

Dollhouse wallpaper free download Micki

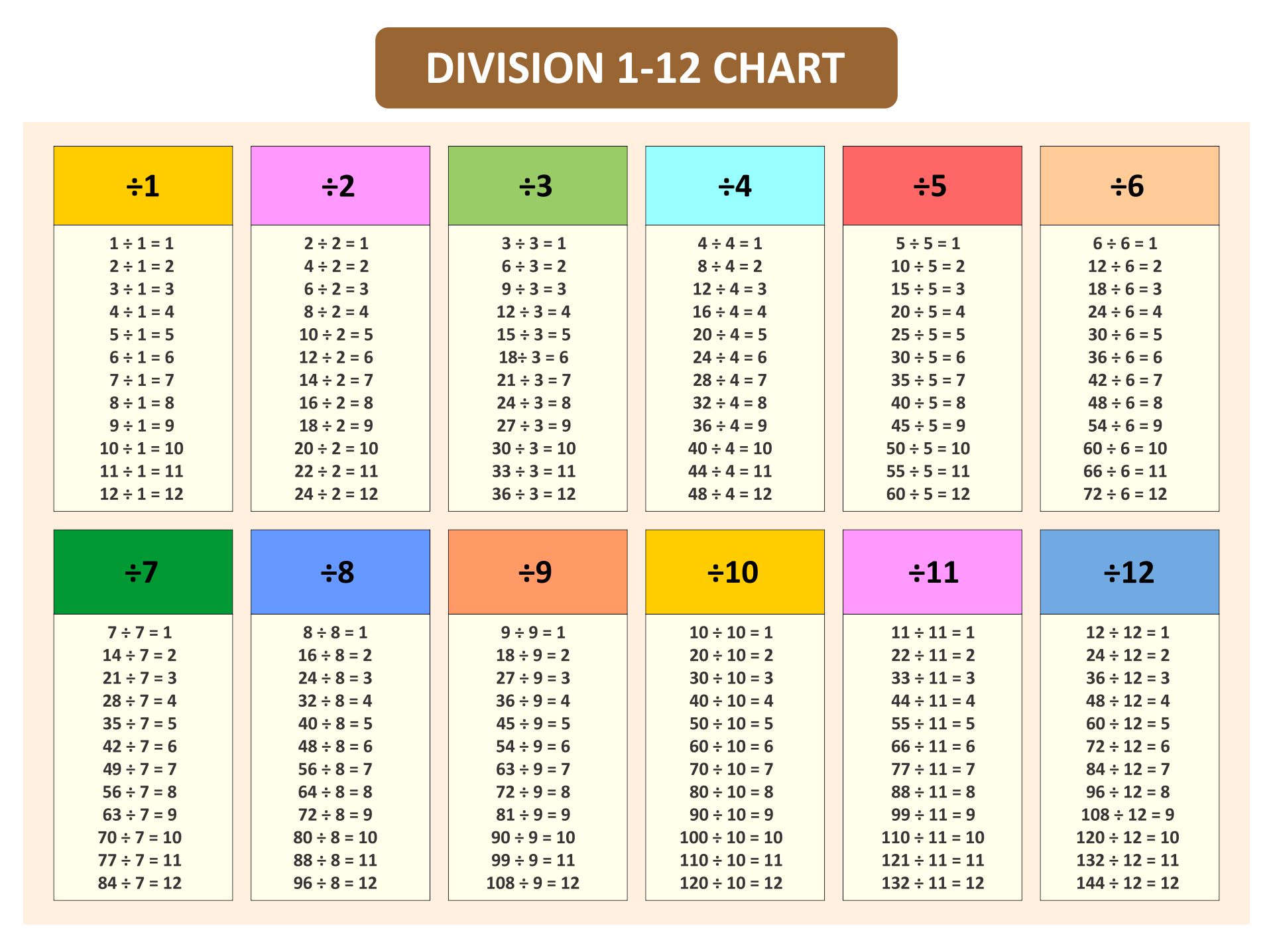

27 15 Simplified Form

Printable dollhouse wallpaper in 1 6 and 1 12 scale Free downloadable PDFs with seamless patterns and solid coordinates in various themes 4 5 Divided By 1 2

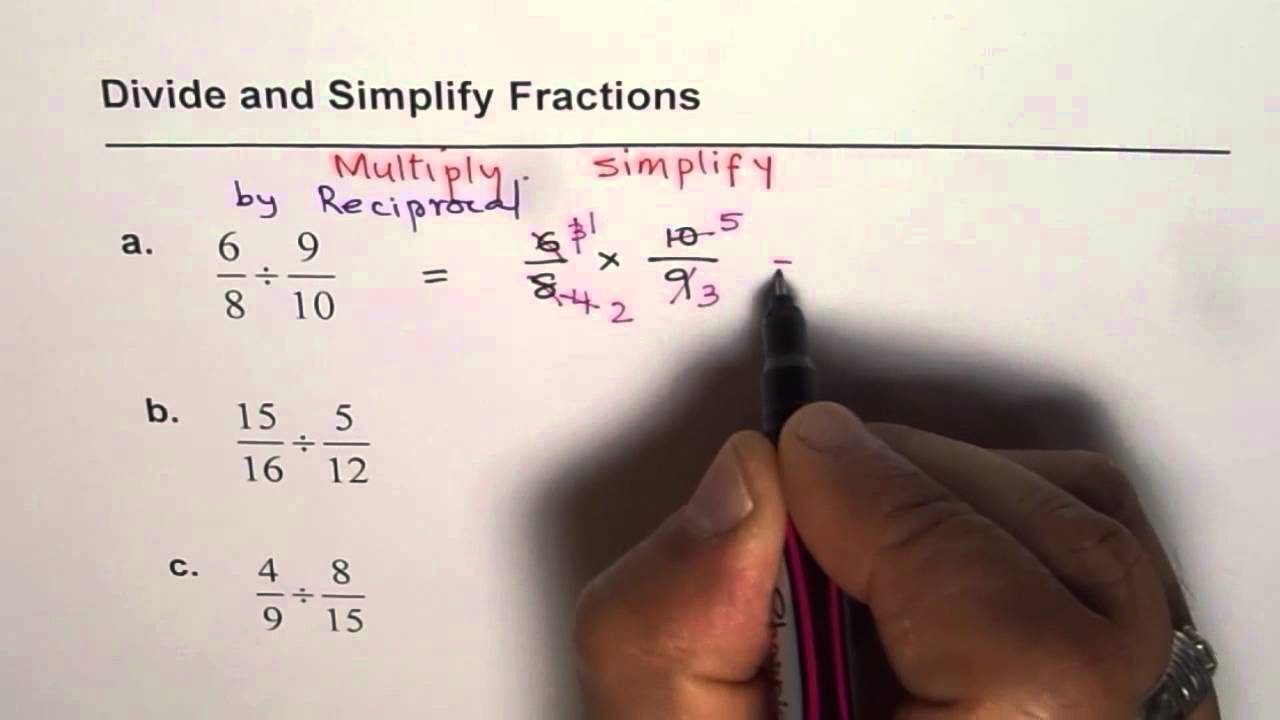

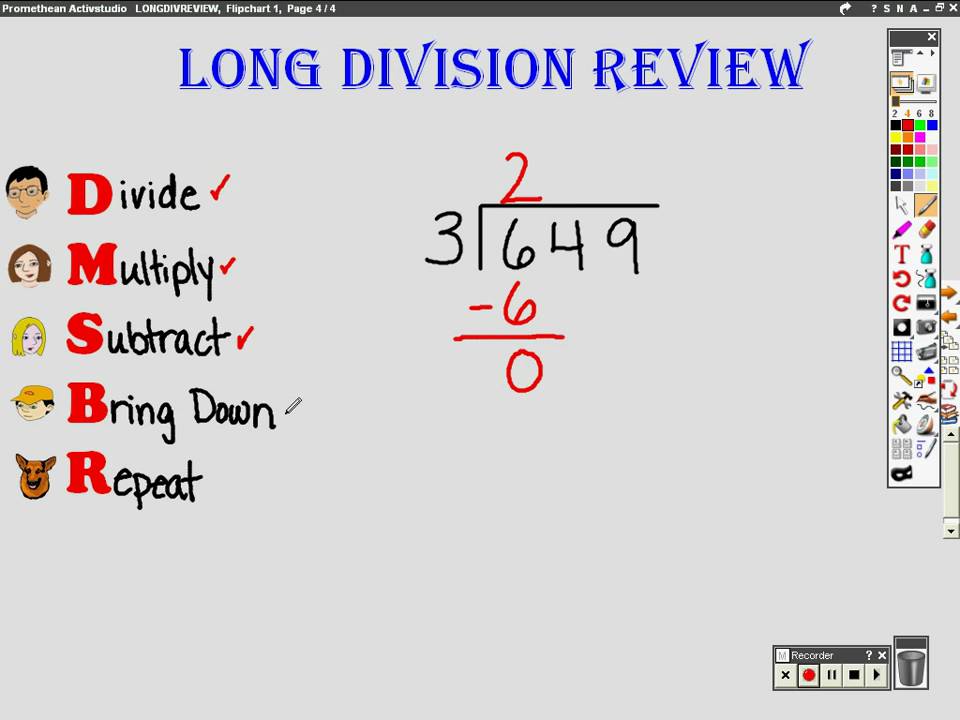

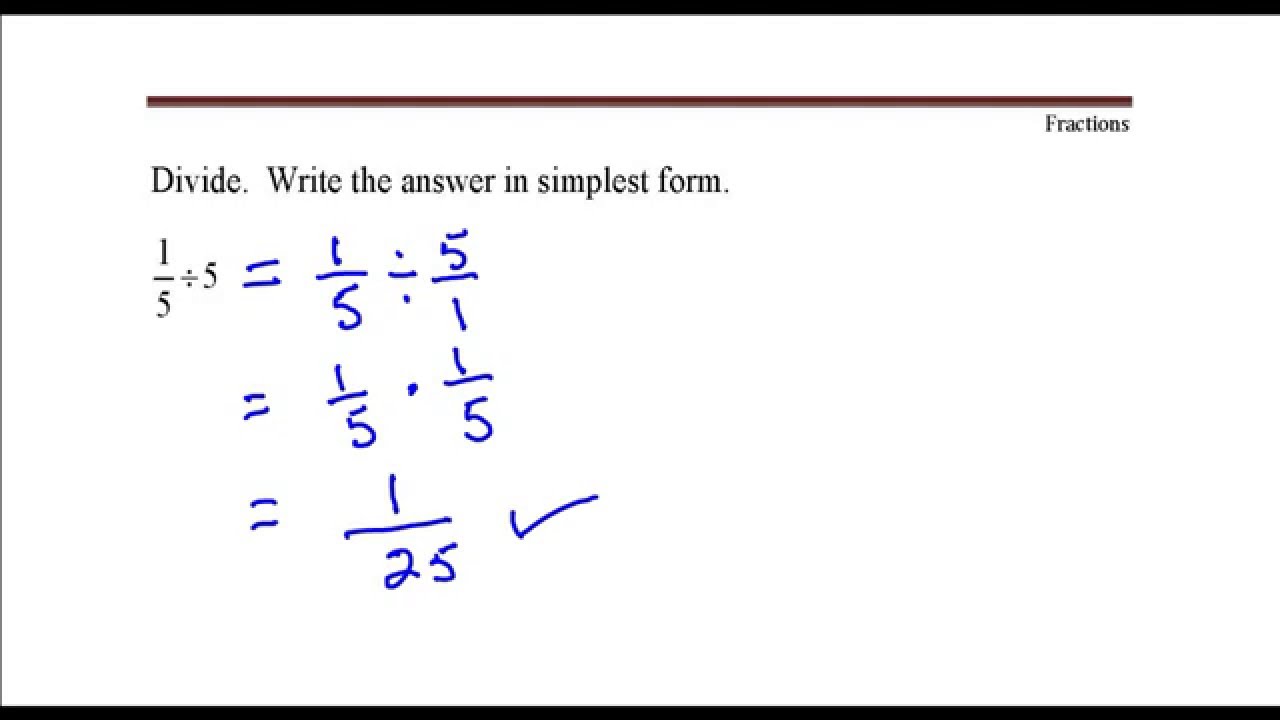

Feb 23 2024 Explore Karla van Baarle s board Dolls house printables wallpaper flooring on Pinterest See more ideas about wallpaper Divide Numbers By Fractions Math Division Rules

28 Divide 400

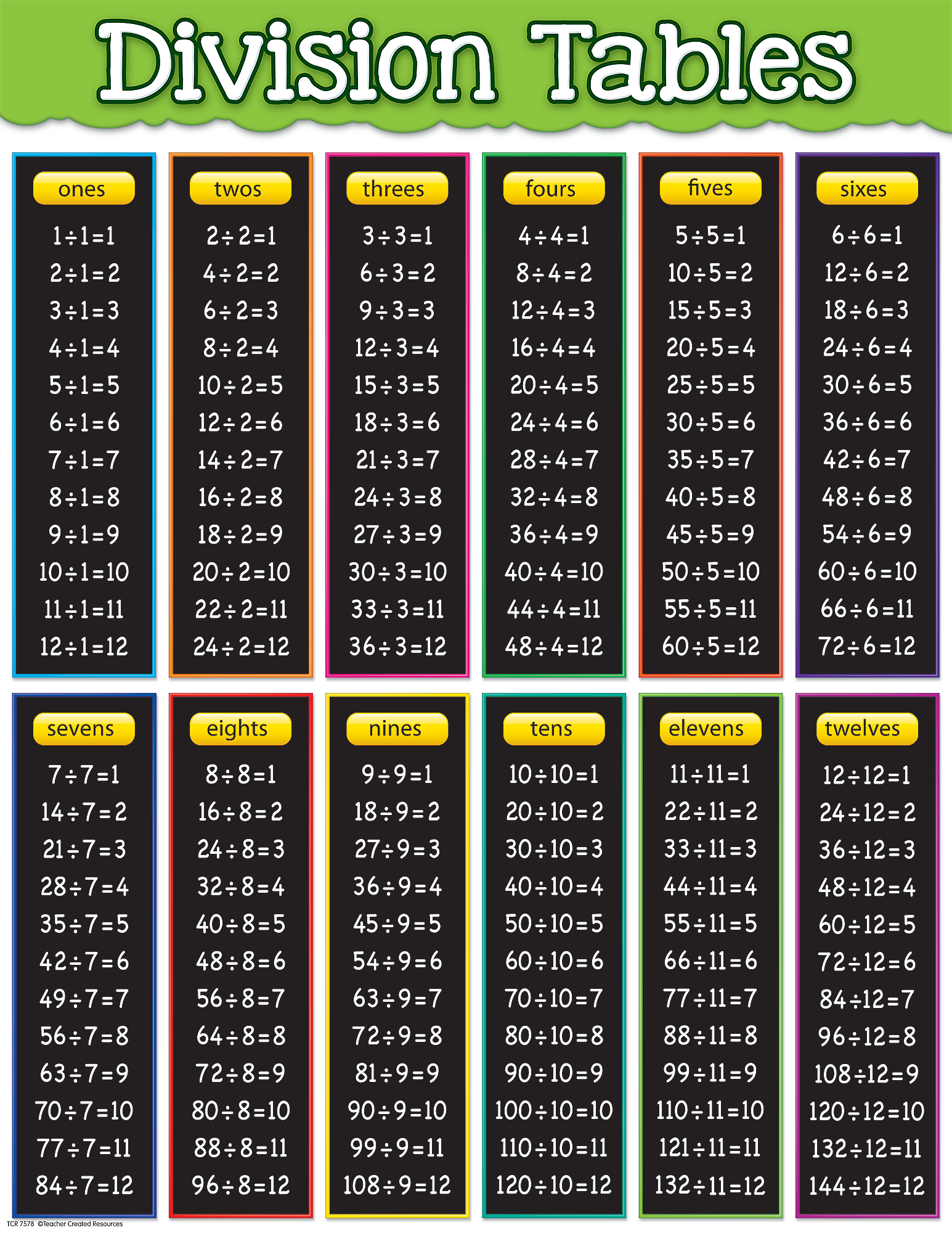

10 Division Table

28 Divide By 30

500 Divided By 15

28 Divide By 30

8 9 Divided By 8

Blank Division Chart

4 5 Divided By 1 2

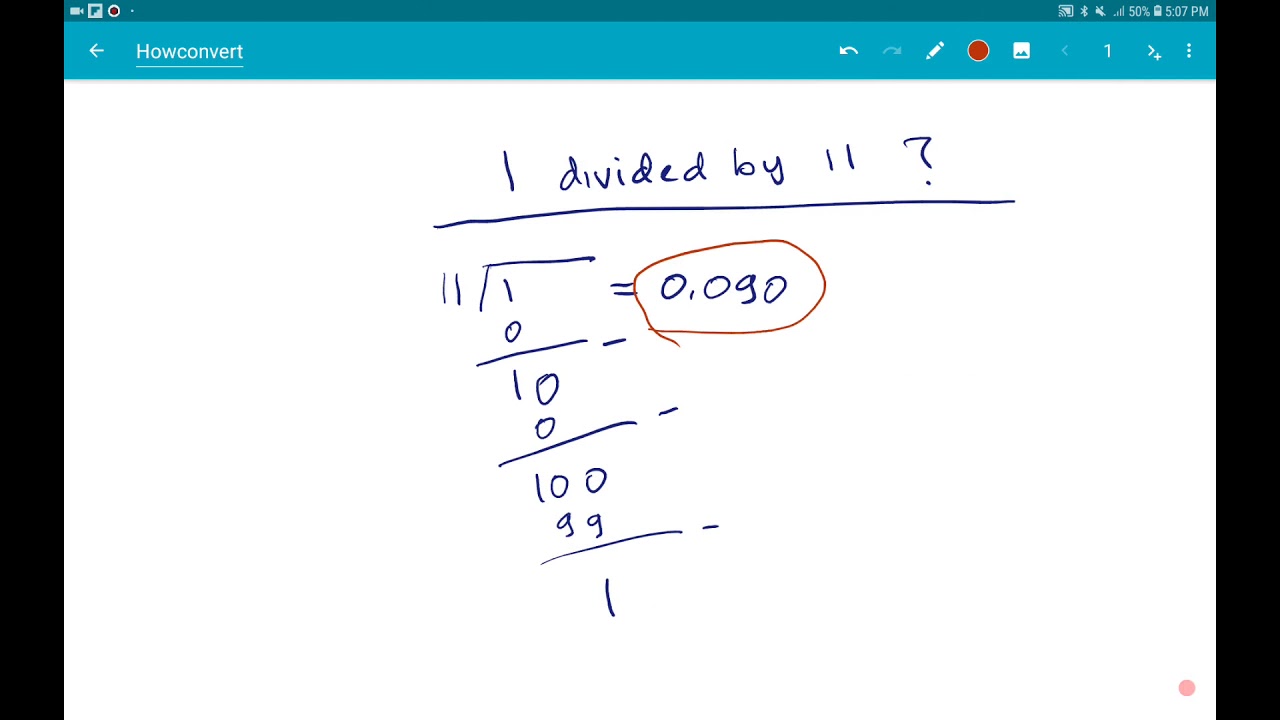

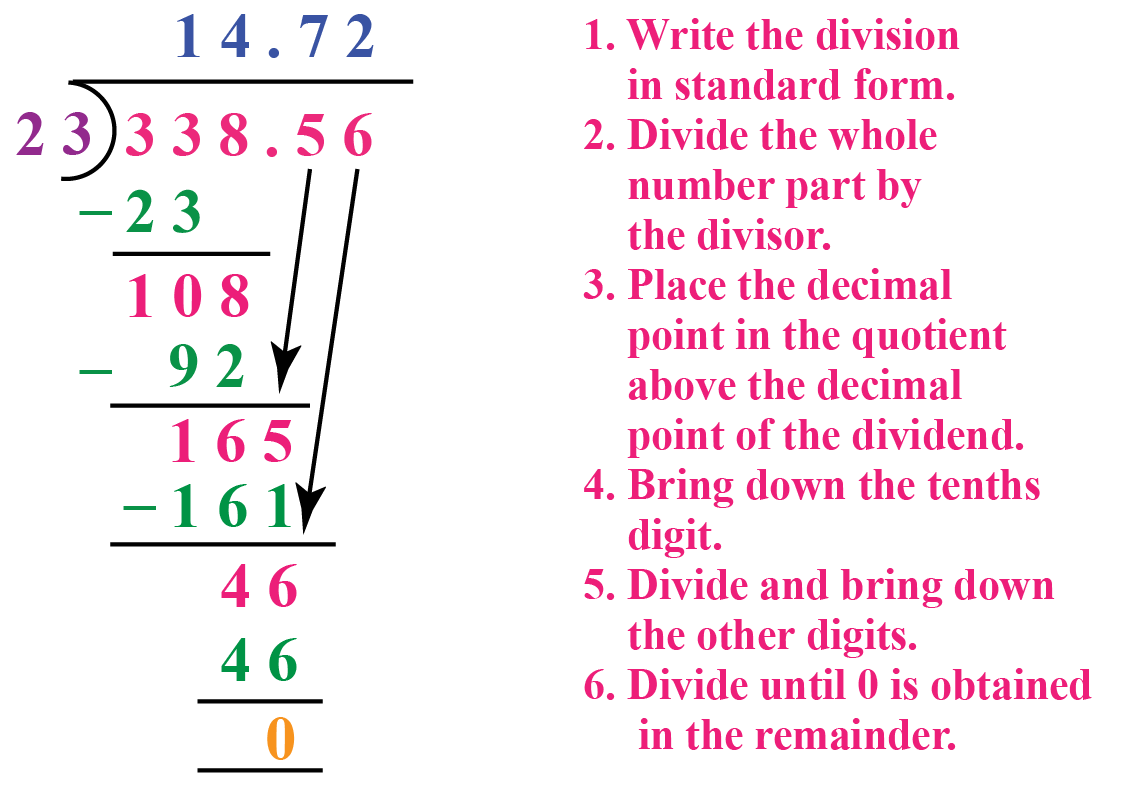

Long Division Decimals And Remainders

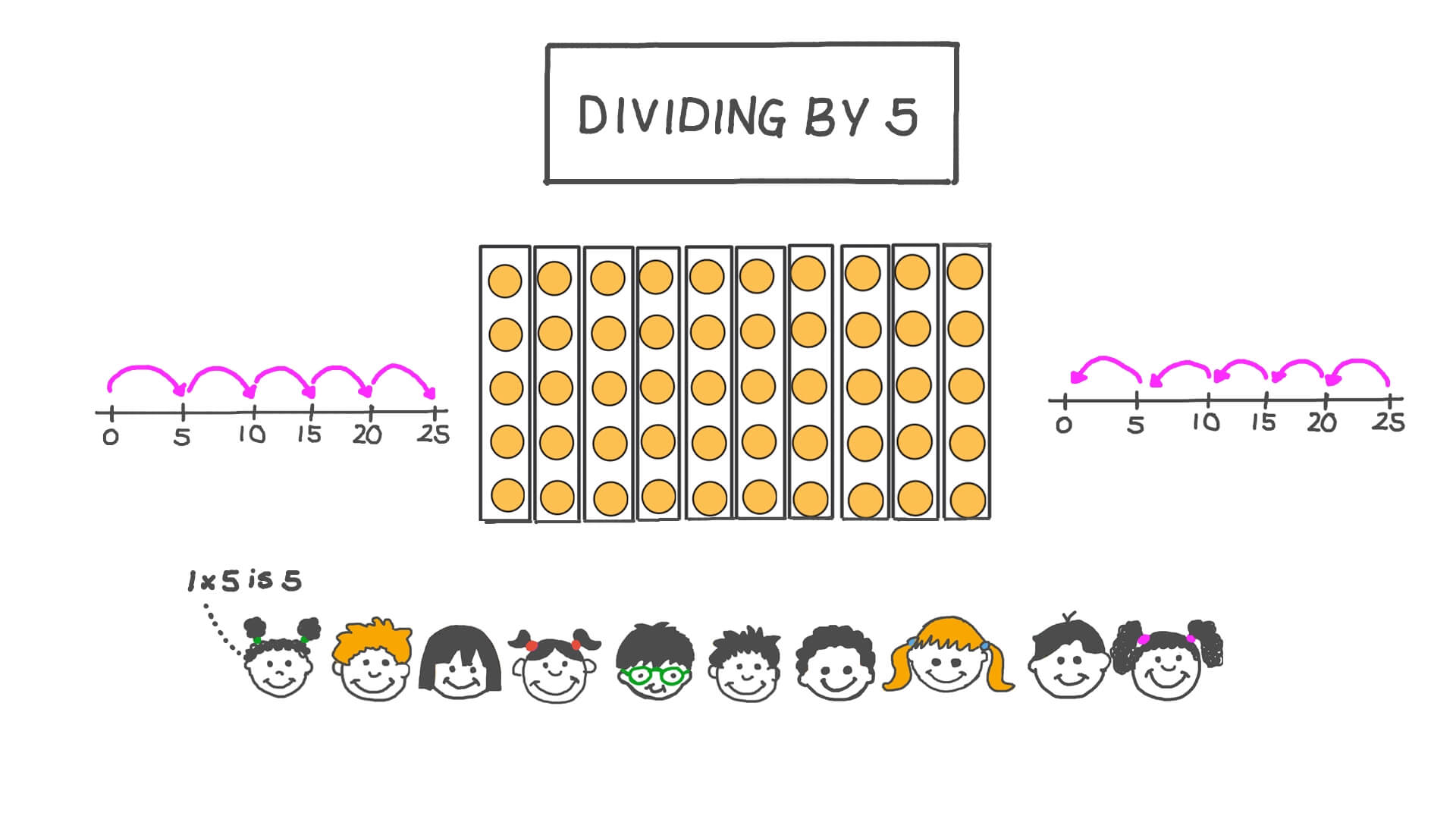

20 Divided By 5 5 8