1 In 60 Rule are a functional option for any individual looking to develop professional-quality files promptly and conveniently. Whether you need custom-made invitations, resumes, coordinators, or business cards, these themes enable you to customize material with ease. Simply download and install the theme, modify it to fit your needs, and print it at home or at a printing shop.

These templates save time and money, supplying a cost-effective choice to working with a developer. With a large range of designs and styles offered, you can discover the ideal design to match your individual or service demands, all while keeping a refined, specialist look.

1 In 60 Rule

1 In 60 Rule

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

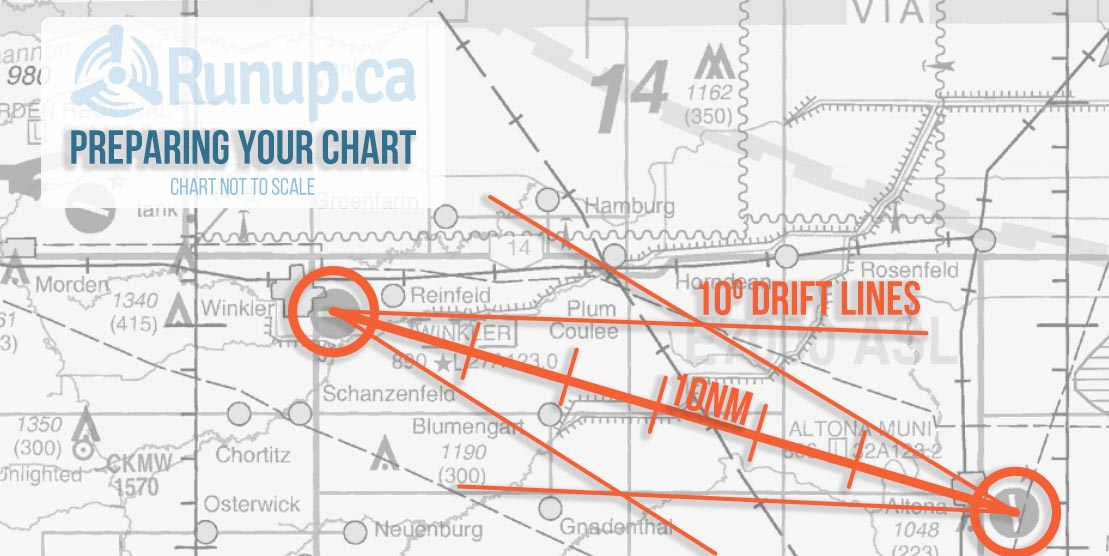

How To Use The 1 In 60 Rule To Calculate Heading Corrections Runup ca

1 In 60 RuleYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... 1 In 60 Rule Explained For Flight Training Learn To Fly YouTube 60 70 Hour Rule Fv3 YouTube

About Form W 4 Employee s Withholding Certificate

How To Use The 1 In 60 Rule To Calculate Heading Corrections Runup ca

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Navigation How Can I Solve This Question Using The 1 In 60 Rule

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Keith Hoodlet OSCP Posted On LinkedIn 1 IN 60 Rule In Aviation Rule Of The Sky s The Limit

You Can t Ignore The 1 In 60 Rule Matt Symes

HAVE YOU EVER HEARD OF THE 1 IN 60 RULE Matt Symes

Aero Circus The 1 In 60 Rule Part 1 Australian Aviation

The 1 In 60 Rule For Predicting Your Future

Predicting Project Success Tips From The 1 In 60 Rule

The 1 in 60 Rule Happiness Equations More

The 1 In 60 Rule How Remarkably Successful People Stay On Track To

Navigation How Can I Solve This Question Using The 1 In 60 Rule

I Can t Stop Thinking About This Mind bending Concept The 1 In 60

![]()

Laiteskaba Telia Yhteis