10 1 6 As An Improper Fraction Calculator are a flexible remedy for anyone aiming to produce professional-quality papers swiftly and quickly. Whether you require custom-made invitations, resumes, coordinators, or business cards, these themes permit you to personalize material easily. Simply download the layout, modify it to suit your needs, and print it at home or at a print shop.

These templates save time and money, using an affordable choice to employing a developer. With a vast array of styles and formats available, you can discover the best design to match your individual or business needs, all while keeping a sleek, professional appearance.

10 1 6 As An Improper Fraction Calculator

10 1 6 As An Improper Fraction Calculator

The gallery for Season 1 images of Dora can be found here The gallery for Season 2 images of Dora can be found here The gallery for Season 3 images of On this page, you will find 36 Dora the Explorer coloring pages that are all free to download and print!

Top 10 Dora the Explorer Printables of All Time Nickelodeon Parents

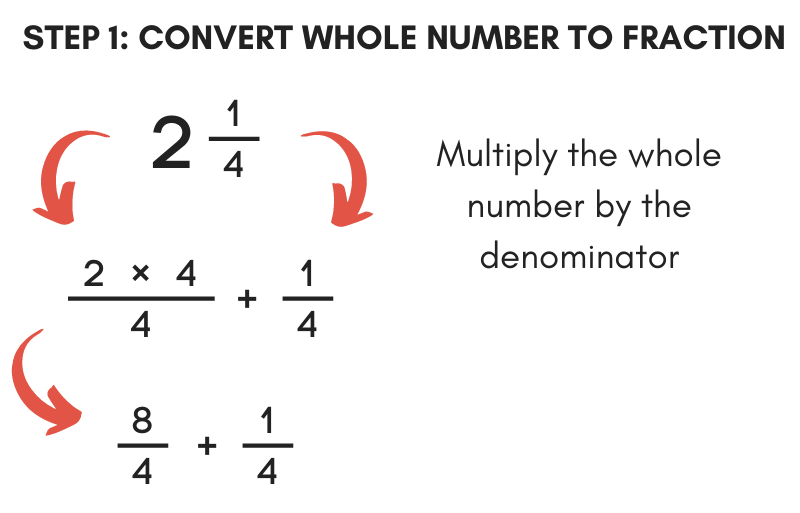

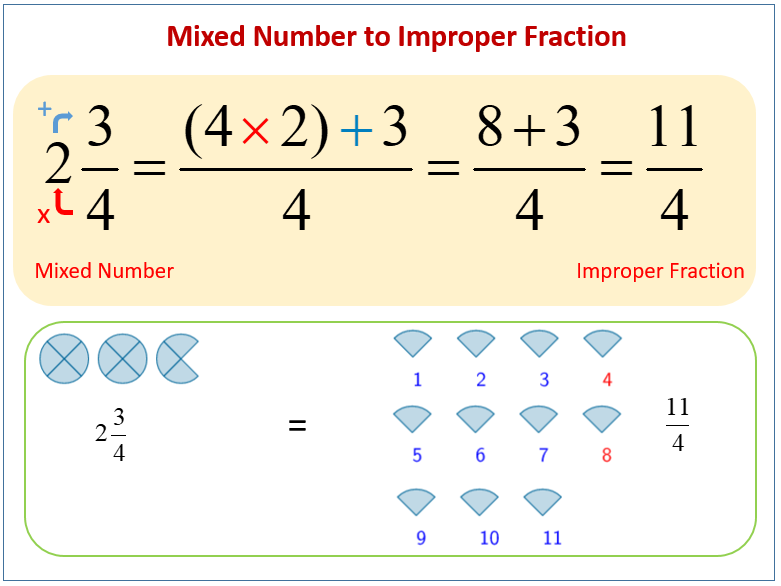

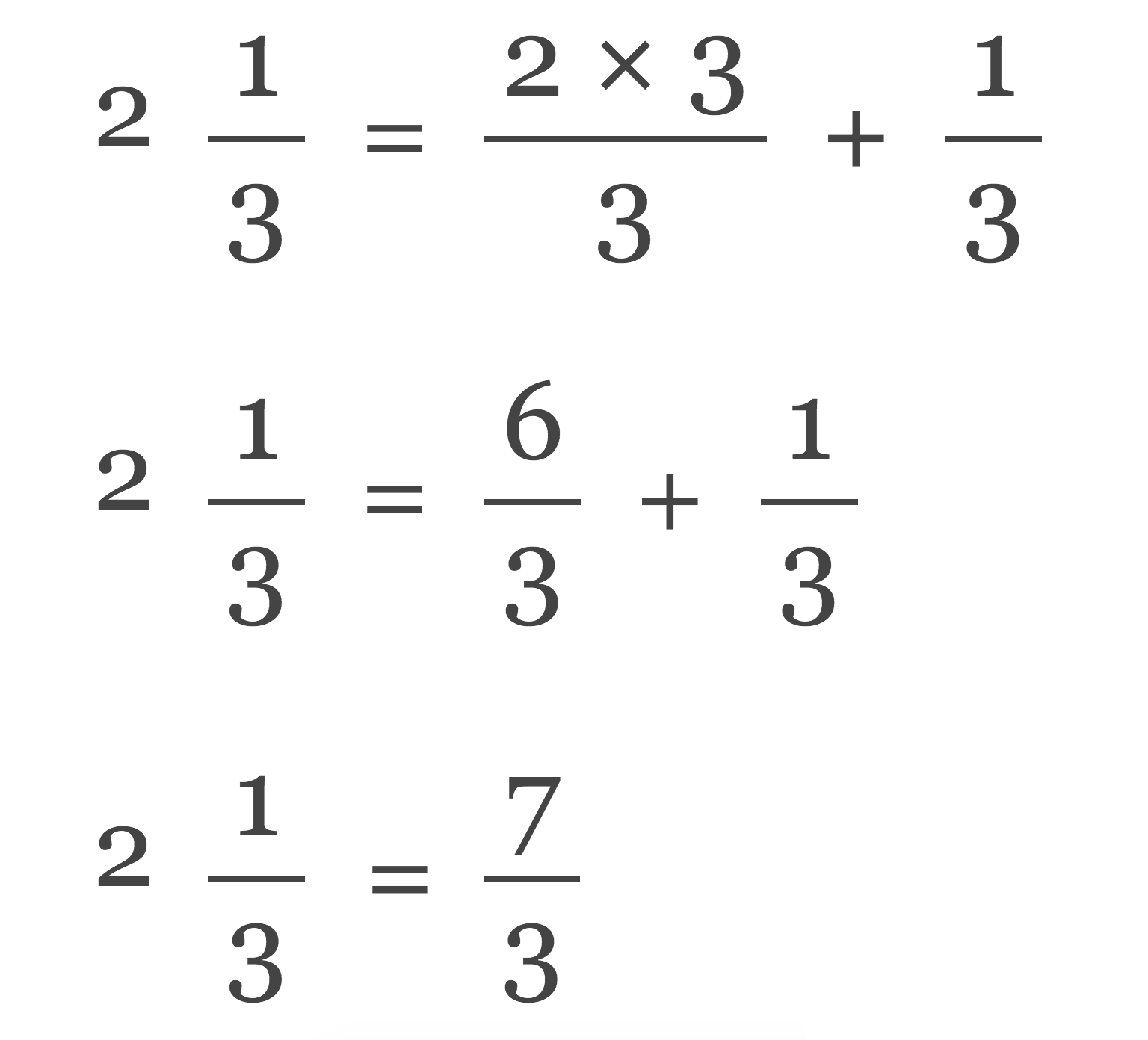

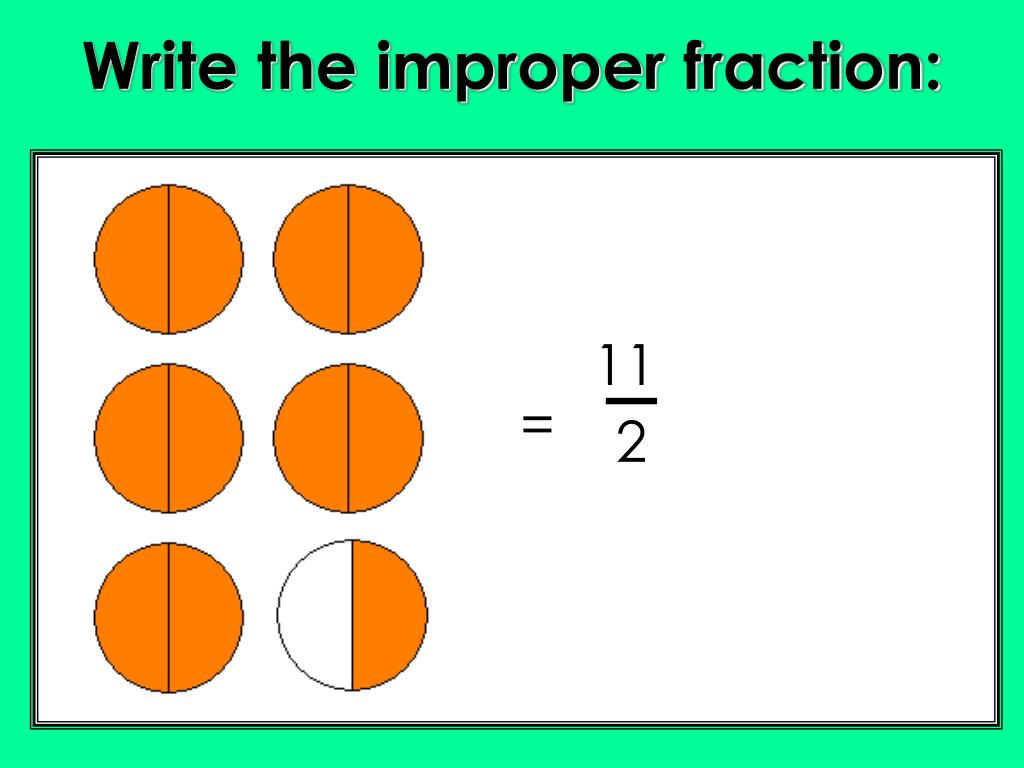

Mixed Number To Improper Fraction RudymcyGrant

10 1 6 As An Improper Fraction CalculatorClick the The Map coloring pages to view printable version or color it online (compatible with iPad and Android tablets). This is a printable Map from Dora the Explorer i need one for my daughters birthday and couldnt find one so i made it my self Simply print and roll

Charlotte's very own Dora Map to show where Mommy and Daddy are flying off to this week, and where Momma J is coming from to visit her. Converting Mixed Numbers To Fractions Solve Improper Fraction

36 Dora The Explorer Coloring Pages Free PDF Printables

1 4 As A Improper Fraction

Young children will develop their mapping skills as they help Dora find her way to the blueberry patch in this printable activity and coloring sheet How To Convert Improper Fractions Into Mixed Numbers 9 Steps

Apr 27 2019 Explore rebeccaneil s board Dora map on Pinterest See more ideas about dora dora map printable coloring pages Mixed Fraction To Improper Fraction Converting Improper Fractions Calculator

Solve Improper Fraction

Change Improper Fractions

Change Improper Fractions

Change Improper Fractions

Improper Fractions

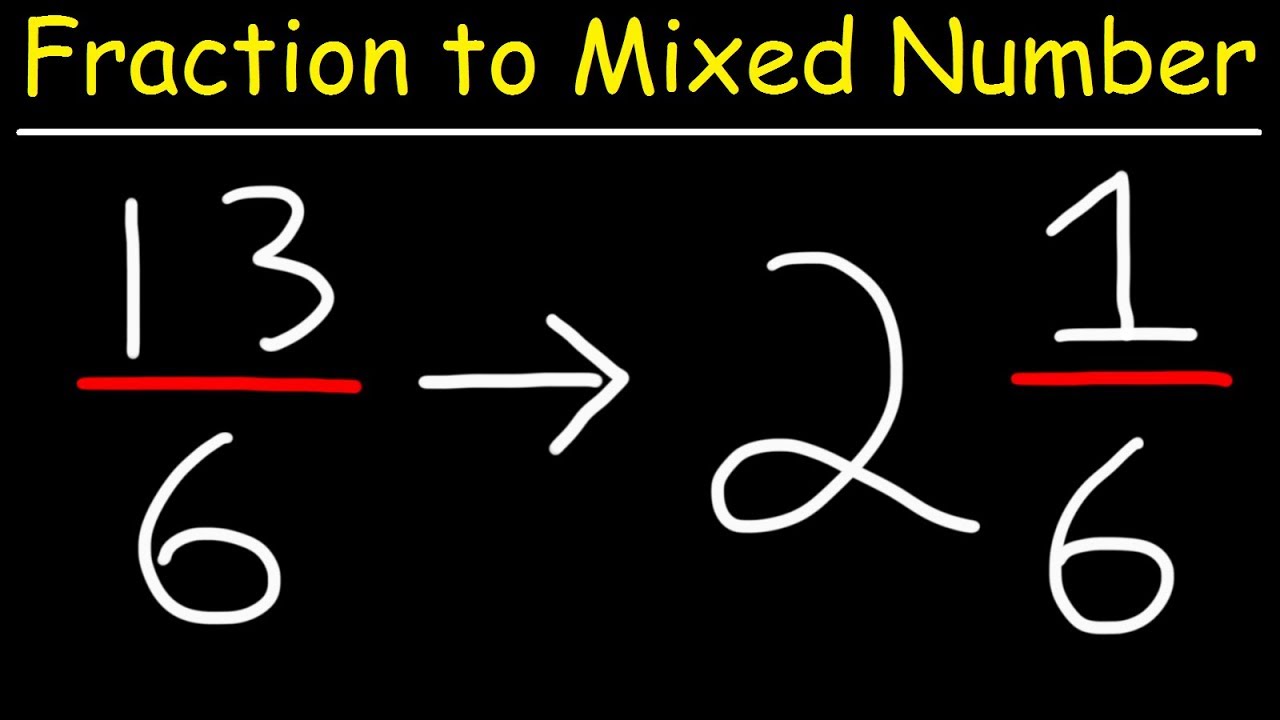

Converting Fractions To Mixed Numbers

Convert Improper Fraction

How To Convert Improper Fractions Into Mixed Numbers 9 Steps

Fraction Into Improper Fraction Calculator

4 2 5 Improper Fraction