10 Percent Of 1000 Pesos Philippines are a flexible option for anyone aiming to produce professional-quality documents swiftly and easily. Whether you need custom invites, resumes, coordinators, or calling card, these templates allow you to personalize material effortlessly. Simply download and install the template, edit it to match your demands, and print it in the house or at a printing shop.

These design templates conserve time and money, providing an economical option to hiring a designer. With a vast array of designs and layouts readily available, you can locate the best design to match your individual or service needs, all while keeping a refined, specialist look.

10 Percent Of 1000 Pesos Philippines

10 Percent Of 1000 Pesos Philippines

Our detailed wedding checklist maps out your journey from the moment you get engaged to the six month mark and through to the day after Stay organized and on-budget with Truly Engaging's free wedding planning checklist. We have all of your important wedding details covered for 12+ months!

The Ultimate Wedding Planning Checklist and Timeline Brides

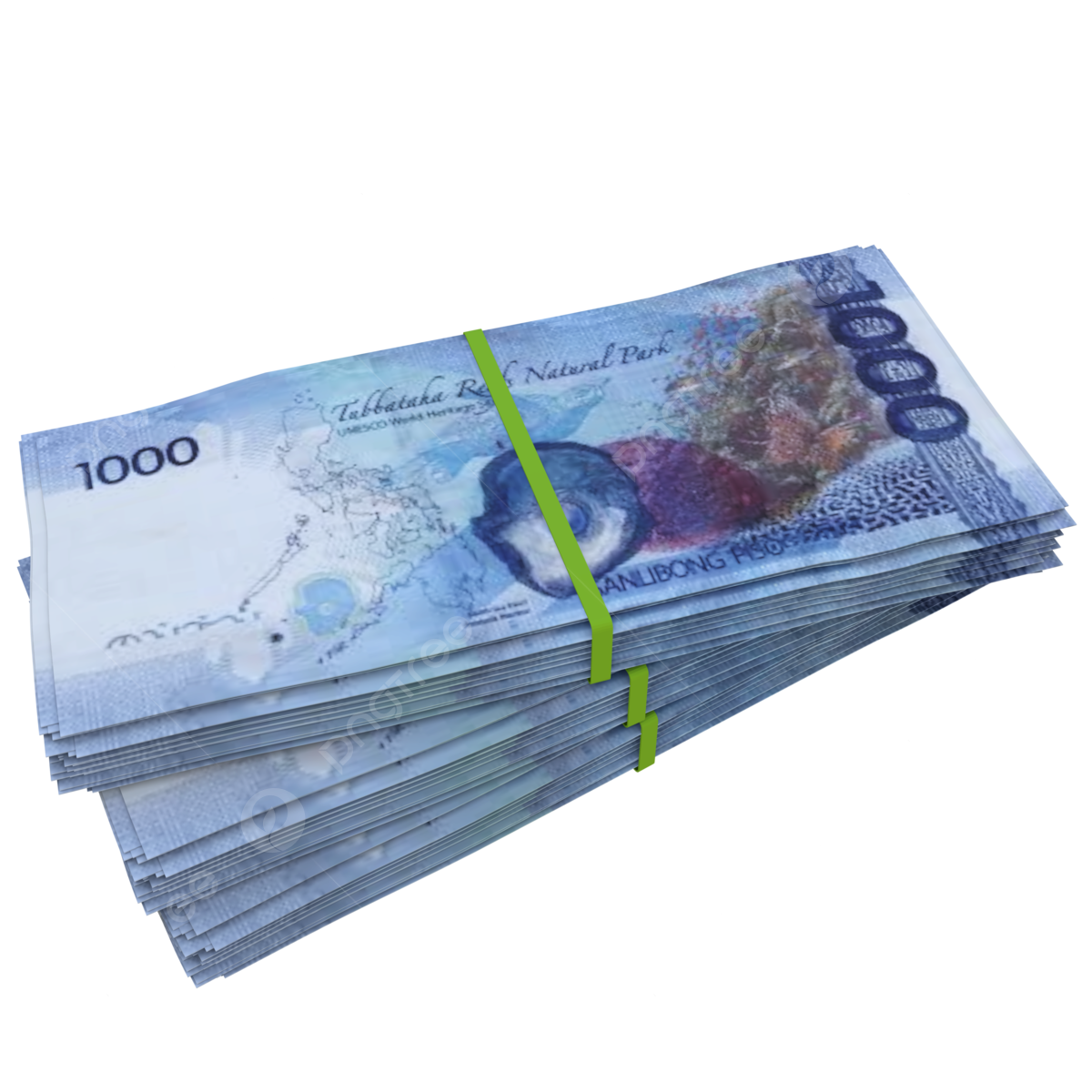

Front And Back Of Philippine Paper Bill Of 1000 Pesos Stock 43 OFF

10 Percent Of 1000 Pesos PhilippinesEngaged? Start planning with our free wedding printables! From wedding checklists and timelines to worksheets and questionnaires, ... COMPILE YOUR PRELIMINARY GUEST LIST You ll need that guest count CHOOSE YOUR WEDDING PARTY Who do you want by your side at the altar Ask them now to

With our comprehensive wedding checklists that, by the way, can easily be downloaded or printed, whatever floats your boat, your wedding planning will be a ... 1000 Philippine Peso Bill Philippine Peso Bills

Free Wedding Planning Checklist Printable Timeline Guide

Philippine Pesos

Free wedding planning checklist that you can edit before you print Available in fillable PDF Excel Word Google Docs Sheets What Is 10 Percent Of 1000 Calculatio

We ve listed out 12 months of to dos so you can rest easy knowing you ve got it all written out Scroll down to view it and don t forget to download your Philippine Peso Lupon gov ph Thousand Eyes Png Logo

Philippine Peso Stock Photo CartoonDealer 4085358

Philippine Peso Royalty Free Stock Image CartoonDealer 837250

Philippine Peso Stock Photo CartoonDealer 4085358

Pesos

Philippine Peso Bills In A Row Stock Photo CartoonDealer 209380284

Money In The Philippines My Philippine Dreams

1000 Php To Usd Textnipod

What Is 10 Percent Of 1000 Calculatio

What Is 10 Percent Of 1000000000 Solution With Free Steps

1000 Philippine Pesos Png