12 Times What Is 600 are a flexible remedy for anybody looking to develop professional-quality documents promptly and quickly. Whether you require custom-made invitations, resumes, coordinators, or calling card, these layouts permit you to personalize material effortlessly. Just download the design template, edit it to fit your needs, and print it at home or at a print shop.

These themes save time and money, providing a cost-effective option to working with a developer. With a wide range of styles and styles readily available, you can locate the excellent design to match your individual or organization requirements, all while keeping a sleek, specialist look.

12 Times What Is 600

12 Times What Is 600

Download or printable workout infographicDumbbell Chest Workout Day 1Dumbbell Back Workout Day 2Dumbbell Shoulder Workout Day 3 30 Day Dumbbell cropped Challenge Printable, Printable ARM Workouts with Dumbbells Search Shopping cropped.

30 Day Dumbbell hotsot Challenge Printable

What Times What Makes 48

12 Times What Is 600A free 12-week, total body, dumbbell workout plan for beginners that includes a PDF calendar of the 49 best dumbbell exercises. It allows you to have a visual guide right in front of you detailing various exercises you can do with dumbbells

30 Day Full Body Workout With Dumbbells Printable | Bonus Infographic Included | A4 & US Letter | Easy to Follow Fitness Program. [img_title-17] [img_title-16]

30 Day Dumbbell cropped Challenge Printable

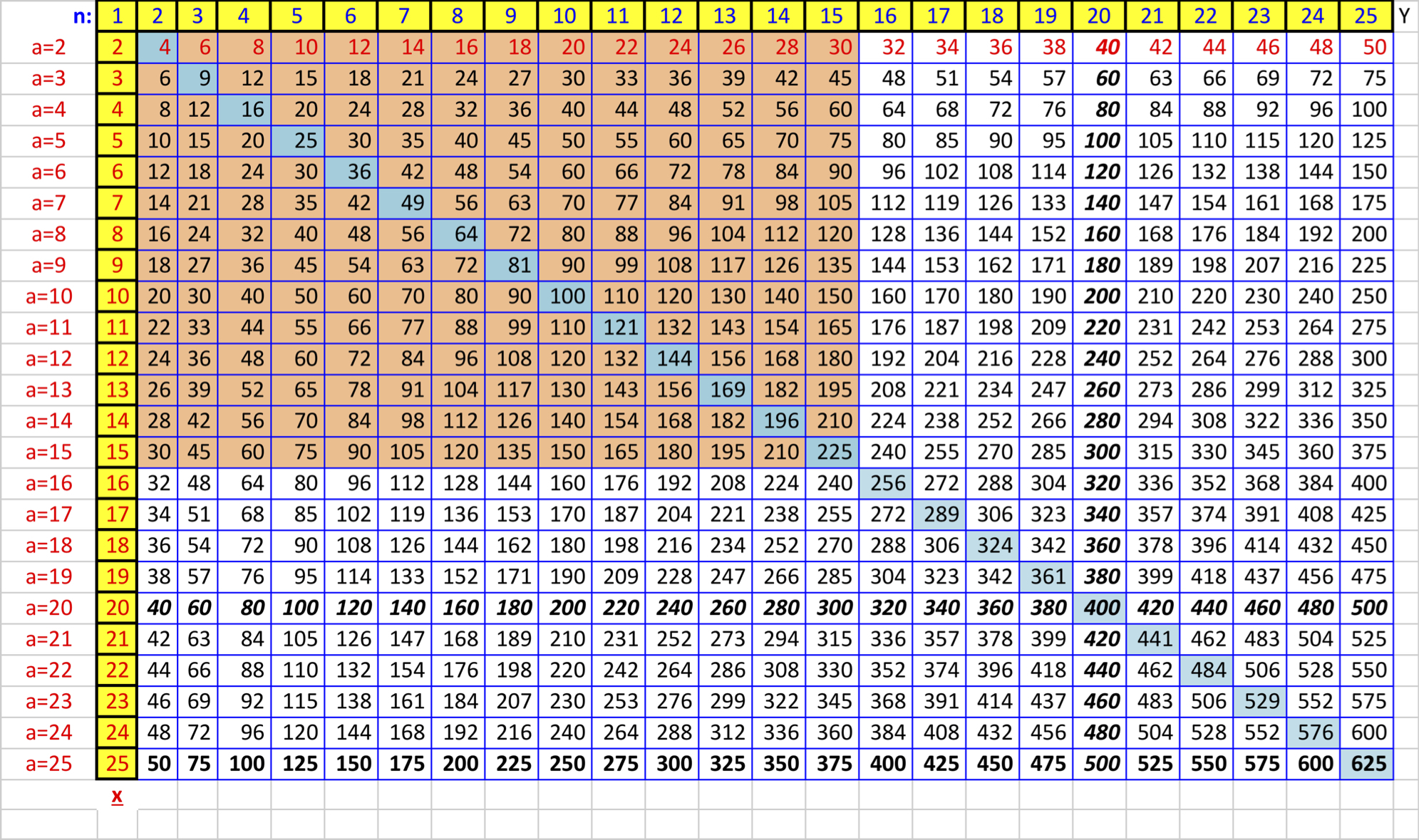

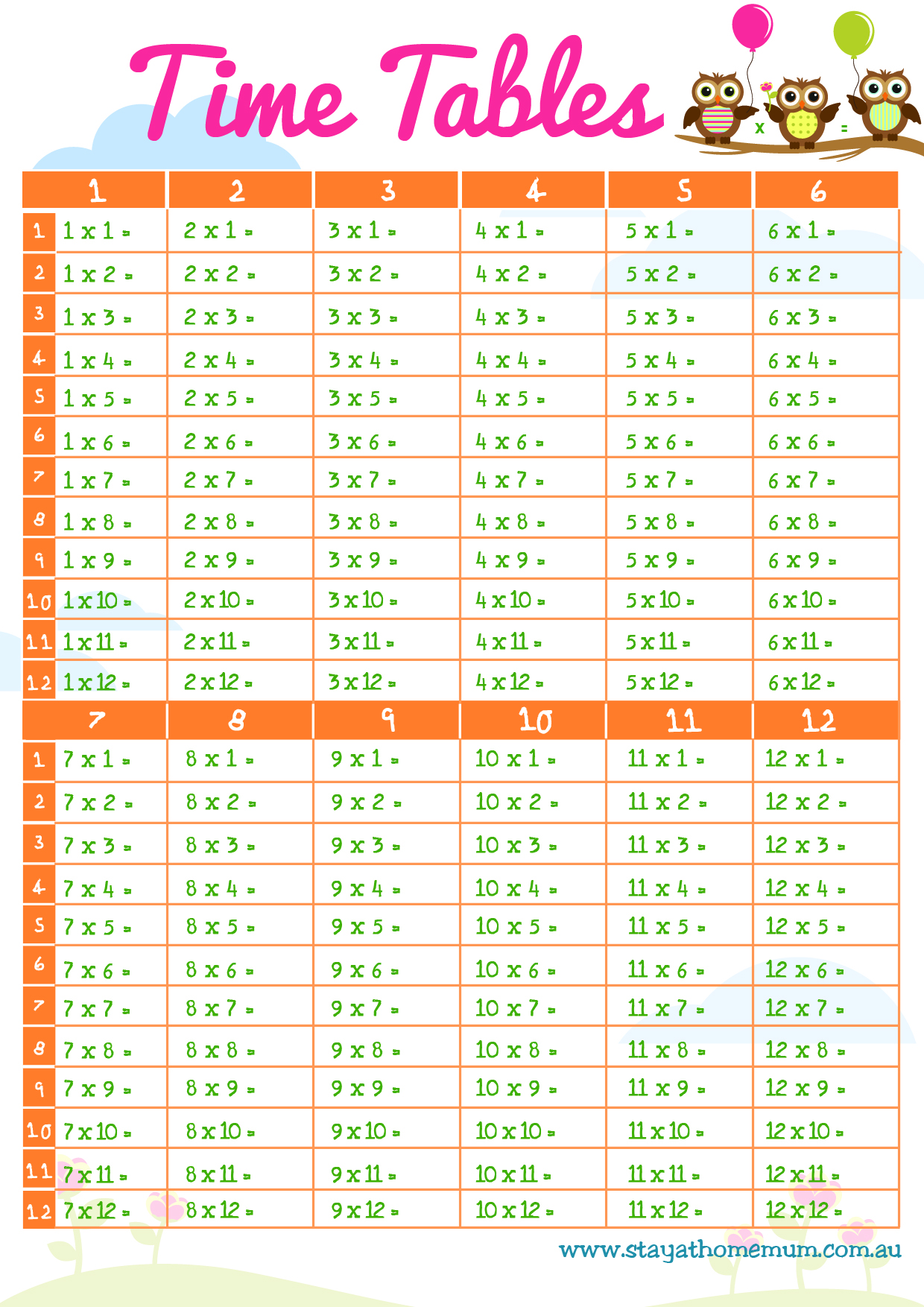

How To Create A Times Table To Memorize In Excel 6 Steps

This month s workout focuses on 15 minute routines that are easy to squeeze in to a busy schedule and only requires a set of dumbbells [img_title-11]

Check out our printable arm dumbbell routine selection for the very best in unique or custom handmade pieces from our fitness exercise shops [img_title-12] [img_title-13]

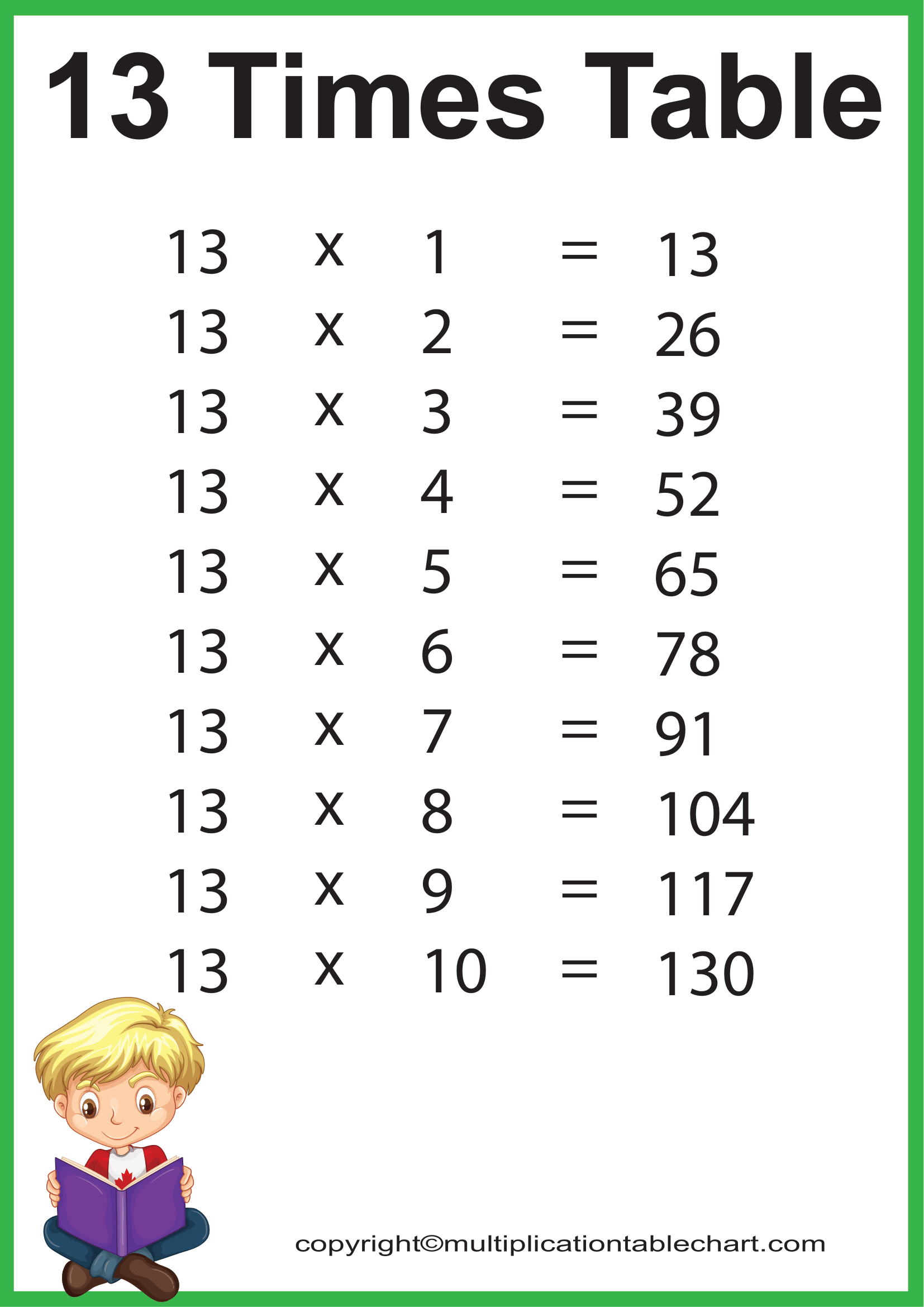

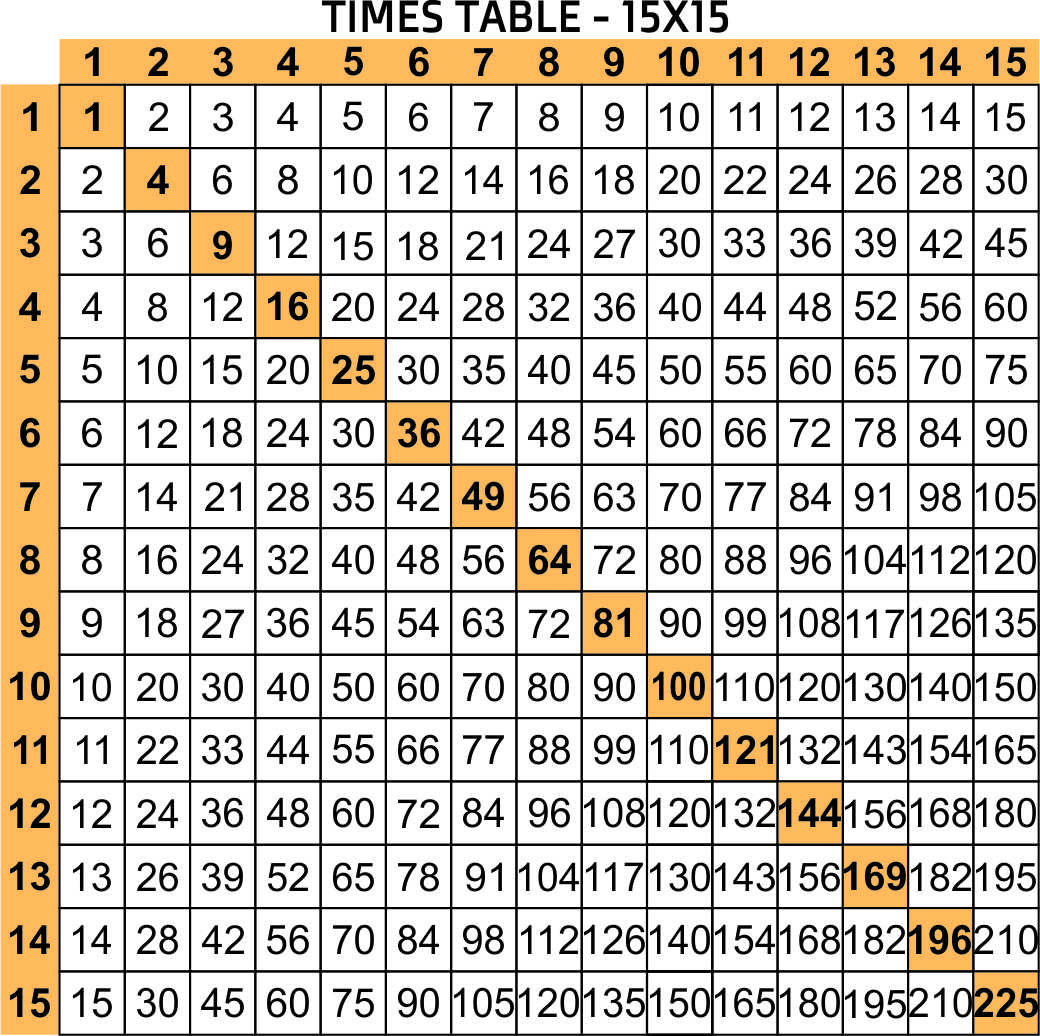

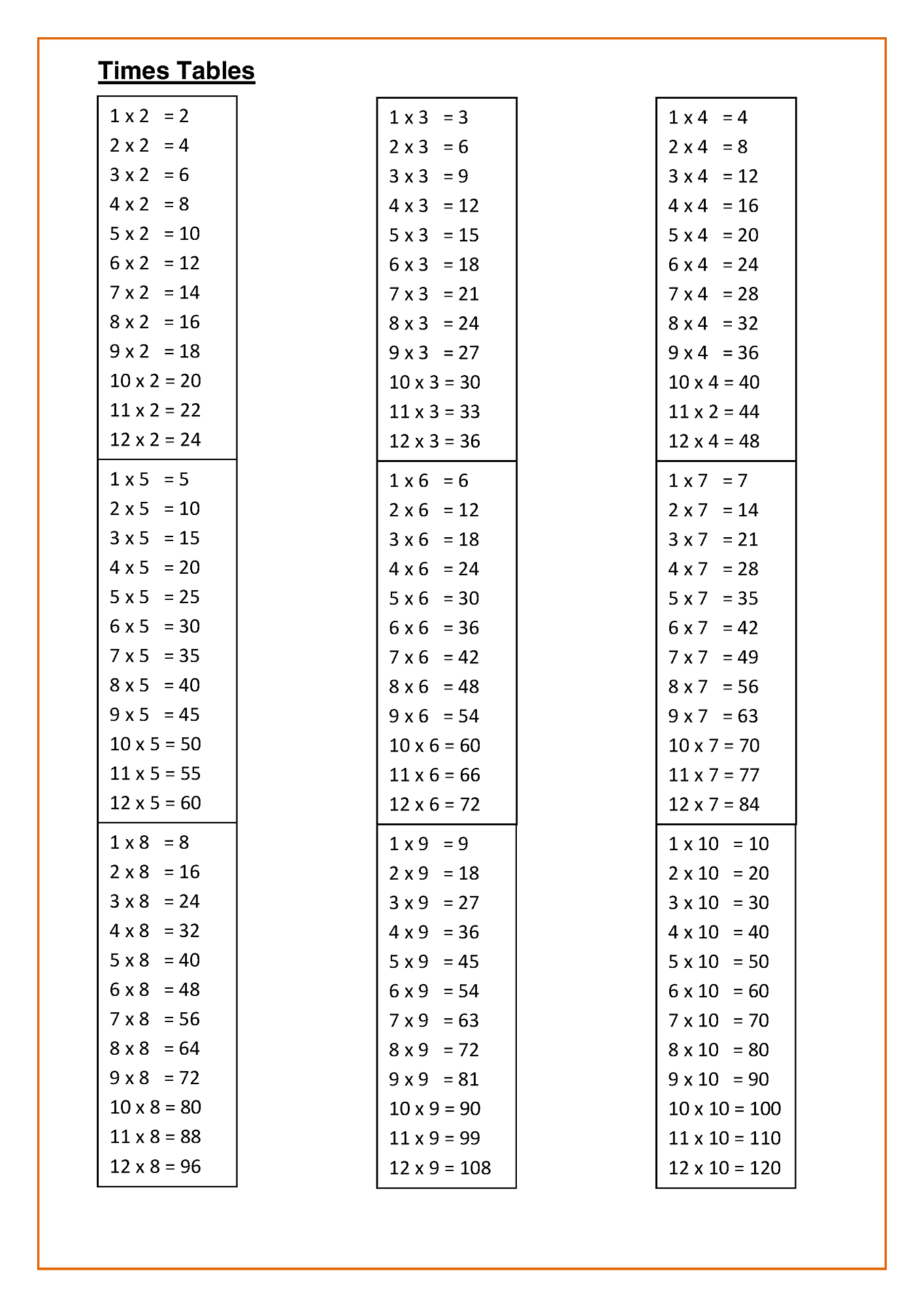

Times Table Printable Chart

Times Table Practice Worksheets

Maths Times Tables Worksheets

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]