15 2 Divided By 5 6 In Simplest Form are a versatile service for anyone looking to develop professional-quality records swiftly and conveniently. Whether you require customized invites, resumes, organizers, or business cards, these design templates enable you to customize material effortlessly. Merely download and install the design template, modify it to fit your requirements, and publish it at home or at a printing shop.

These themes save time and money, using a cost-effective option to hiring a developer. With a large range of styles and layouts offered, you can discover the best layout to match your individual or business demands, all while preserving a refined, professional look.

15 2 Divided By 5 6 In Simplest Form

15 2 Divided By 5 6 In Simplest Form

20 Free St Patrick s Day worksheets for kids These worksheets include leprechauns pots of gold rainbows and more and cover topics like counting Free printable St Patrick's Day coloring pages, including shamrocks, leprechauns, rainbows, and pots of gold!

60 St Patrick s Day FREE Printables Handmade in the Heartland

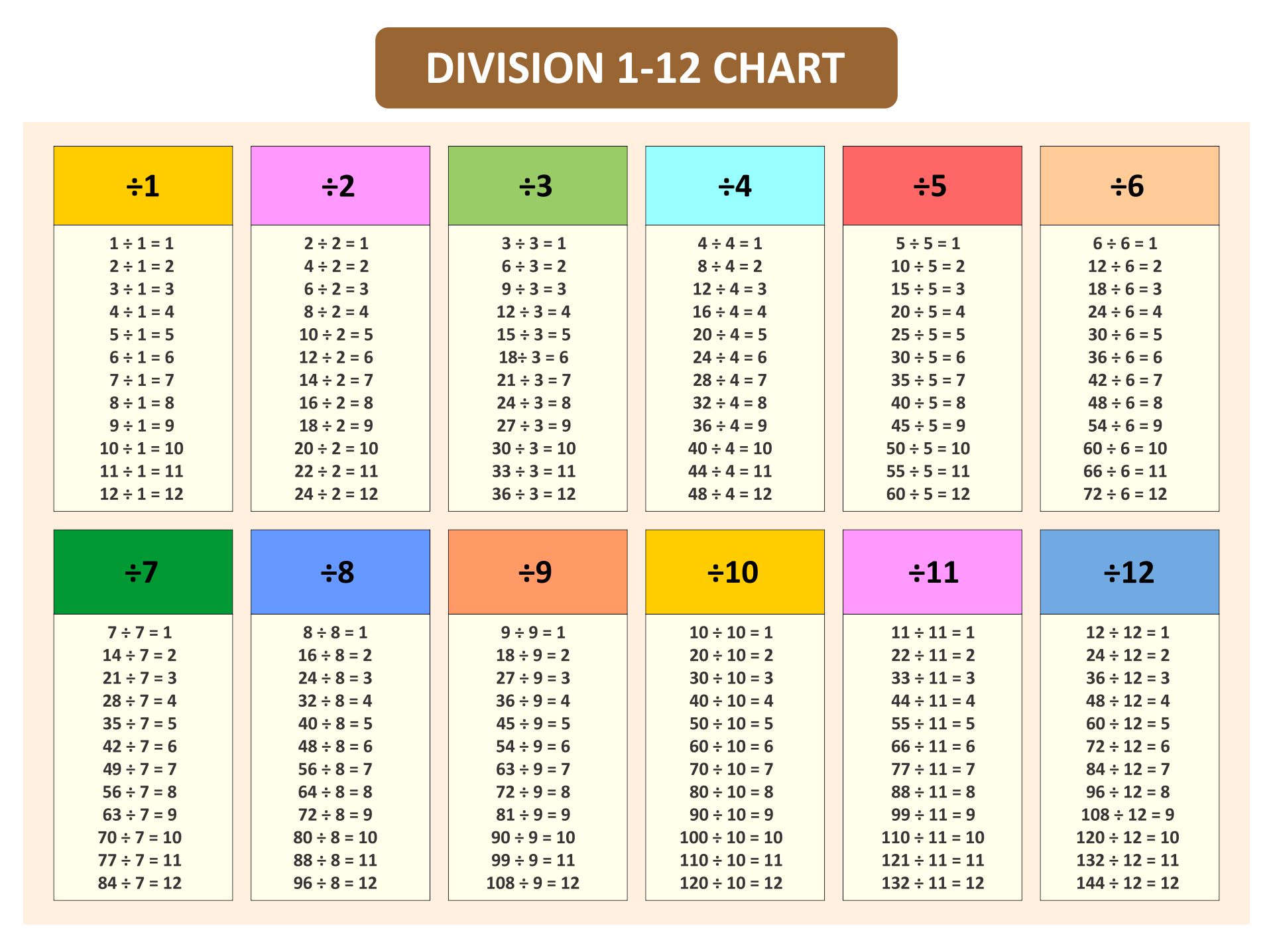

15 Divided By 23

15 2 Divided By 5 6 In Simplest FormOur vibrant and engaging St. Patrick's Day worksheets celebrate the annual Irish holiday with fun facts, historical lessons, challenging puzzles and ... We ve got you covered this Saint Patrick s Day with cute green easy crafts that you can share with your little leprechauns

Leprechauns, shamrocks and Bogies—OH MY! Printable St. Patrick's Day activity sheets for kids are here just in time for the lucky day. Enjoy a word. 1 4 Divided By 40 Free Printable Division Facts

Free St Patrick s Day Coloring Pages for Kids Adults

.png)

Bar Diagram Fractions

Celebrate St Patrick s Day with our 10 page instant download of coloring and activity pages Bring leprechaun fun your way right away 28 Divide By 4

22 productsEaster tags and flags 2024 CollectionSt Patrick s Day Bookmarks Printable bookmarksSt Patrick s Day 2024 Frame TV SetDoll House St Simple Fraction Questions And Answers 4 5 Divided By 1 2

Simplest Terms Fractions

4 5 Divided By 1 2

28 Divide By 30

4 6 Divided By 1 2

6 Divided By 100

10 Divided By 1 2

1 4 Divided By 3

28 Divide By 4

4 5 Divided By 1 2

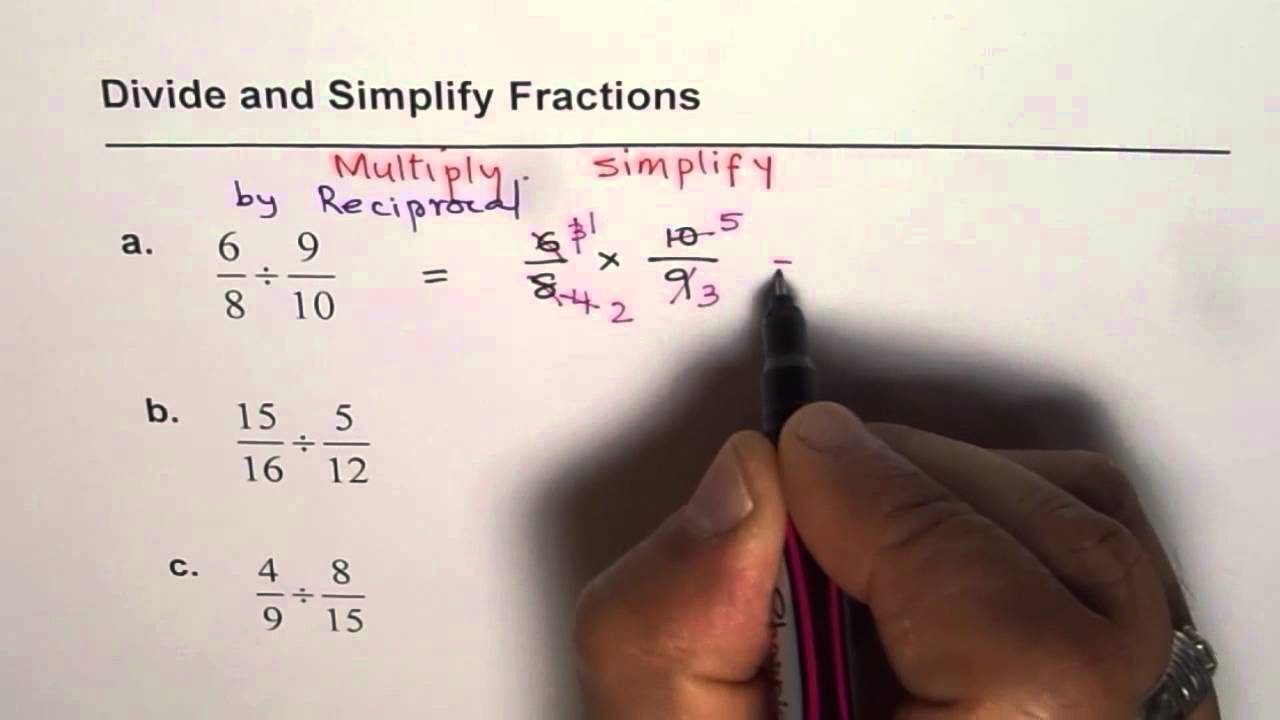

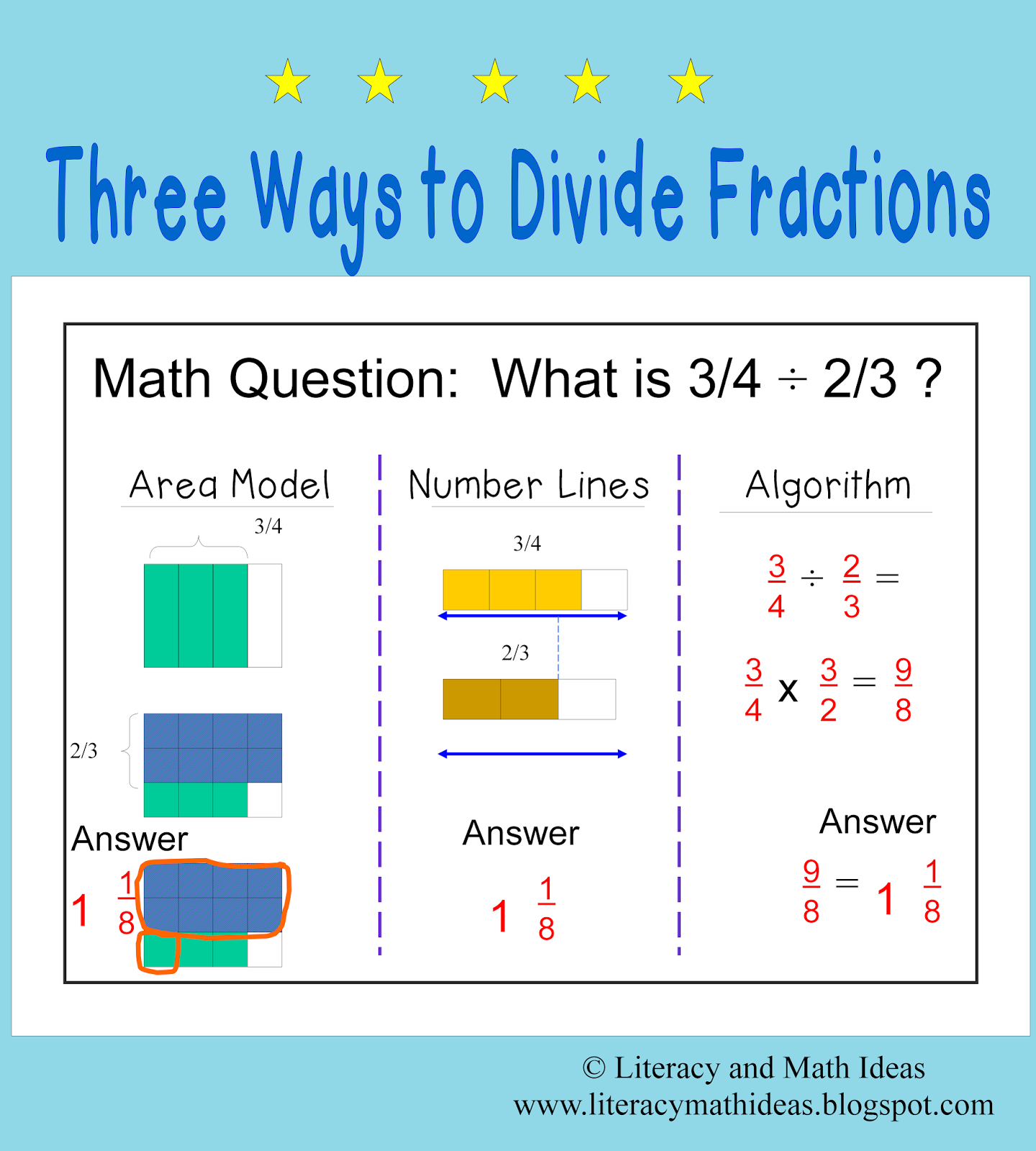

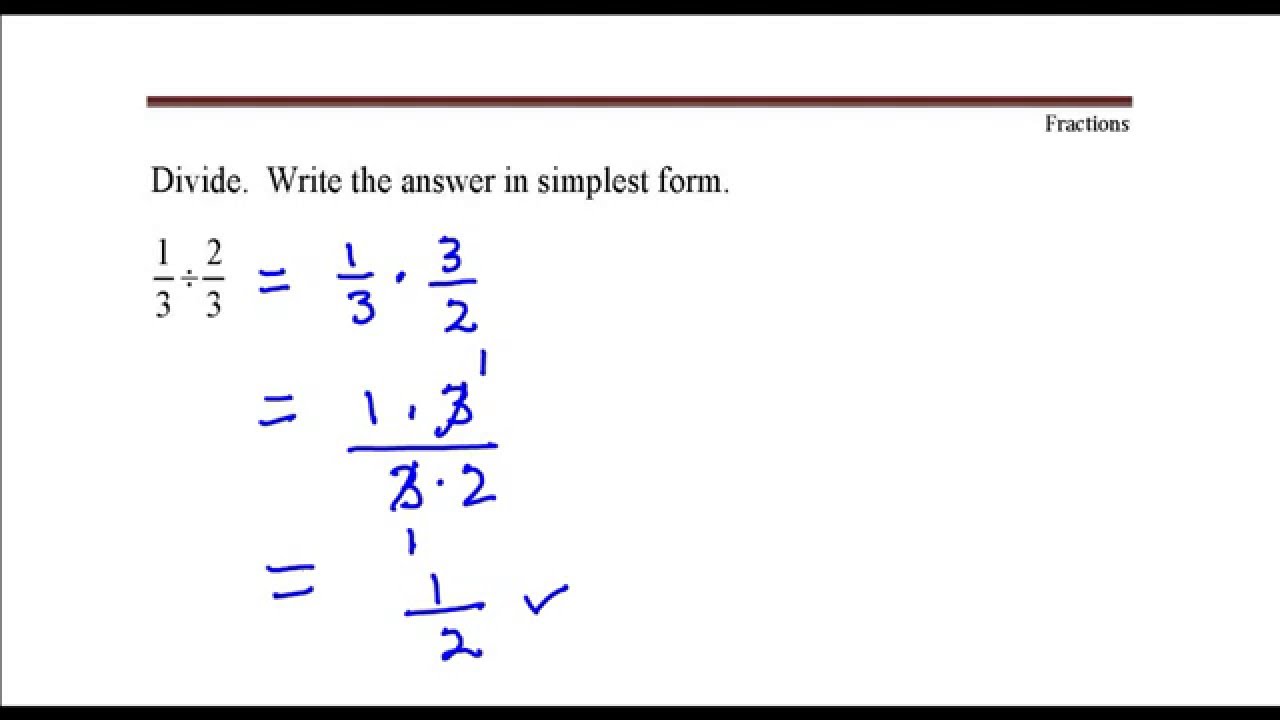

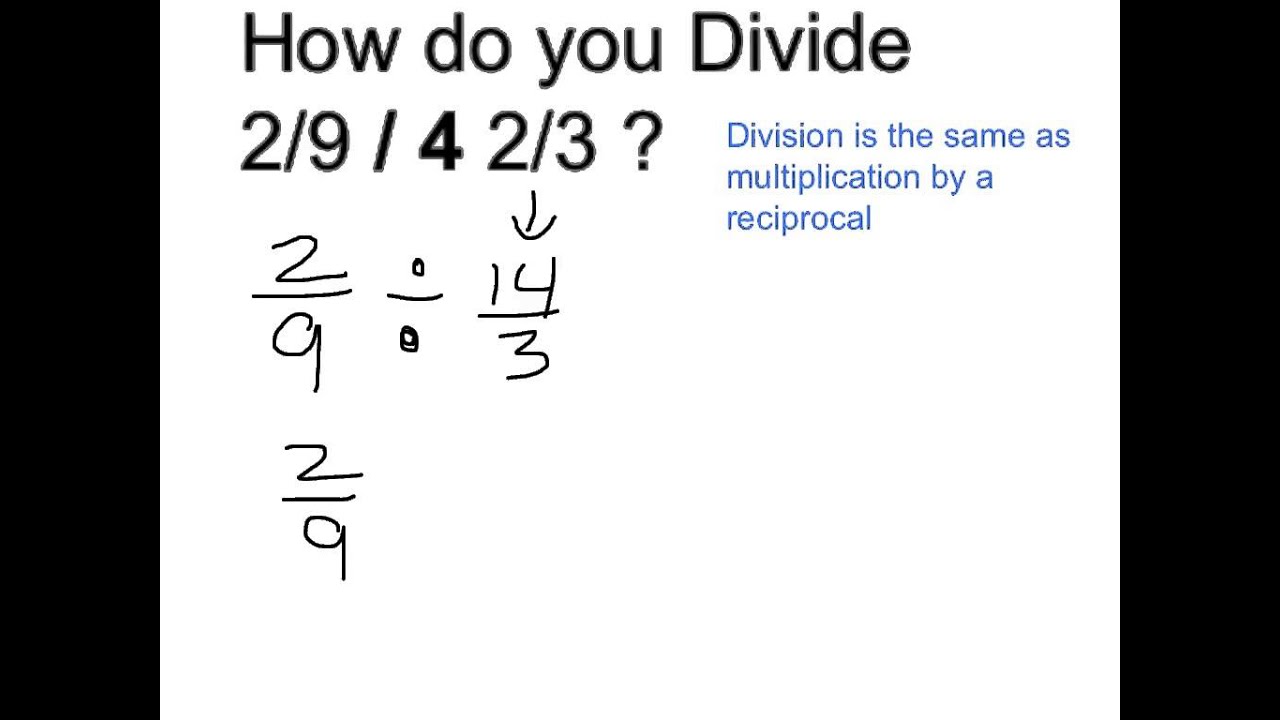

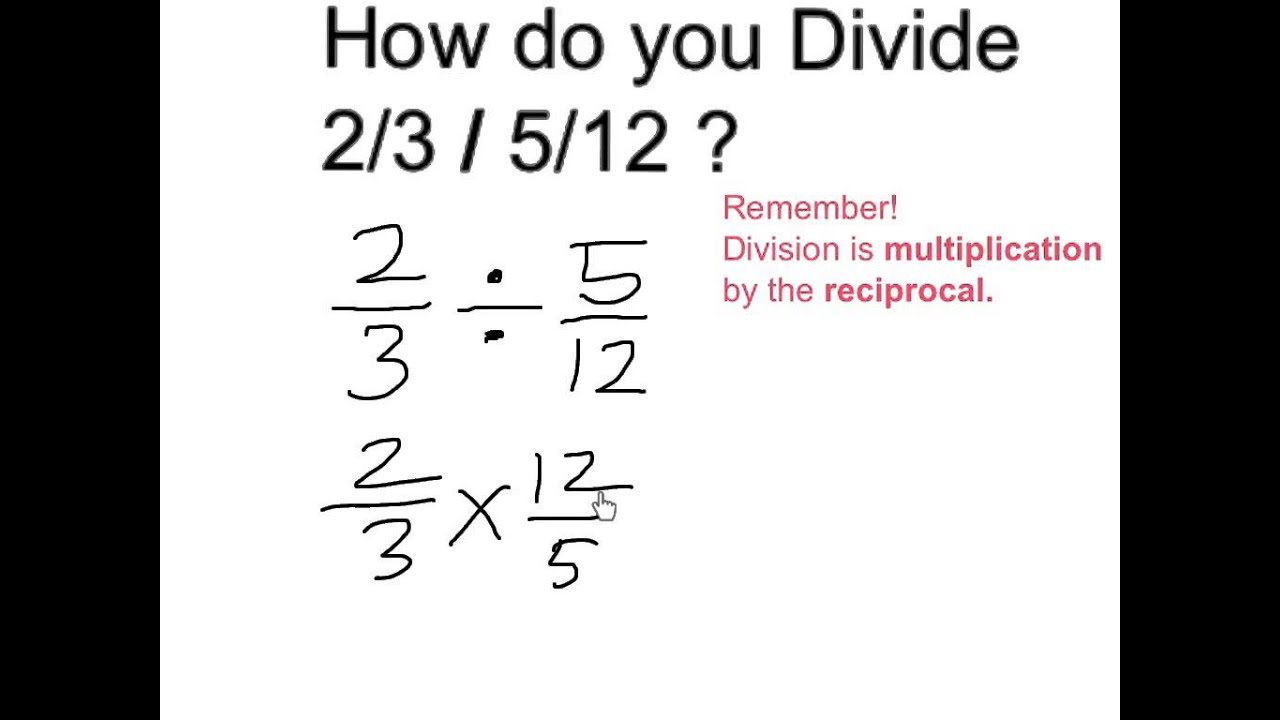

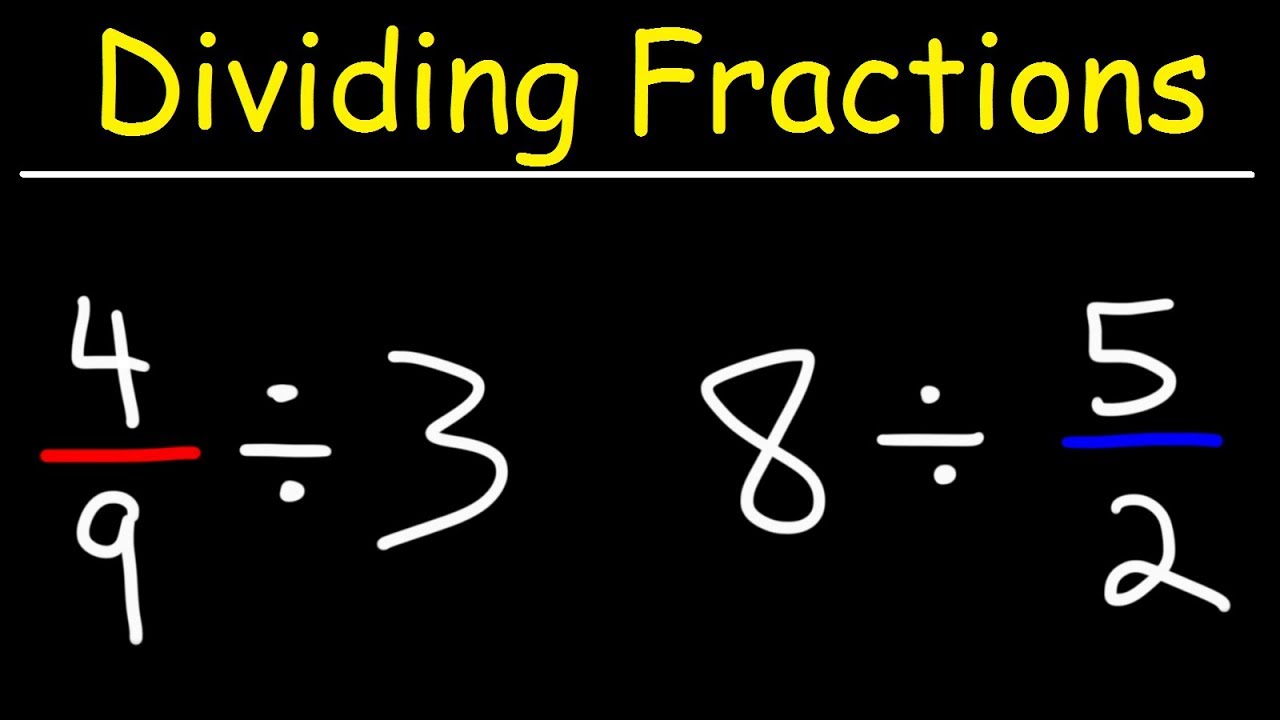

To Divide Fractions