150 Divided By 30 Percent are a functional solution for anybody seeking to create professional-quality files promptly and conveniently. Whether you need personalized invites, returns to, organizers, or business cards, these layouts allow you to customize content with ease. Just download and install the template, modify it to fit your needs, and publish it in your home or at a print shop.

These design templates conserve time and money, supplying a cost-efficient alternative to employing a designer. With a variety of designs and formats readily available, you can locate the best style to match your individual or business needs, all while maintaining a polished, specialist look.

150 Divided By 30 Percent

150 Divided By 30 Percent

Get these easy to download free printable Easter gift tags and add a custom touch to your holiday gifts Both bunny and religious themes available Mar 13, 2020 - Explore Rhonda Fogle's board "Easter Tags" on Pinterest. See more ideas about easter tags, easter, easter printables.

Easter gift tags for students TPT

10

150 Divided By 30 PercentCheck out this cute free printable Easter gift tag! What an easy way to customize. What fun Easter crafts are you working on? Browse high quality Easter Tag templates for your next design Print 50 starting from 15 00 Format Print ready Style Theme Price Color 67 templates

You'll find a button to download our printable Easter gift tags at the foot of this post. We'd love to see how you use yours – tag us on your images using # ... 6 Divided By 100 6 Divided By 100

120 Easter Tags ideas Pinterest

12 5 150 Divided By 25 4 22 175 1 7 50 51 Divided By3 7 50

Use one of these free printable Easter tags to add a little something extra special to your Easter gifts or Easter baskets this year Division And Multiplication

17 Free Printable Easter Gift Tags1 Pastel Bunny Easter Tag Printables2 Have a Tweet Easter Free Printable Gift Tags3 Colorful Free Printable Easter 10 Divided By 1 2 28 Divide By 30

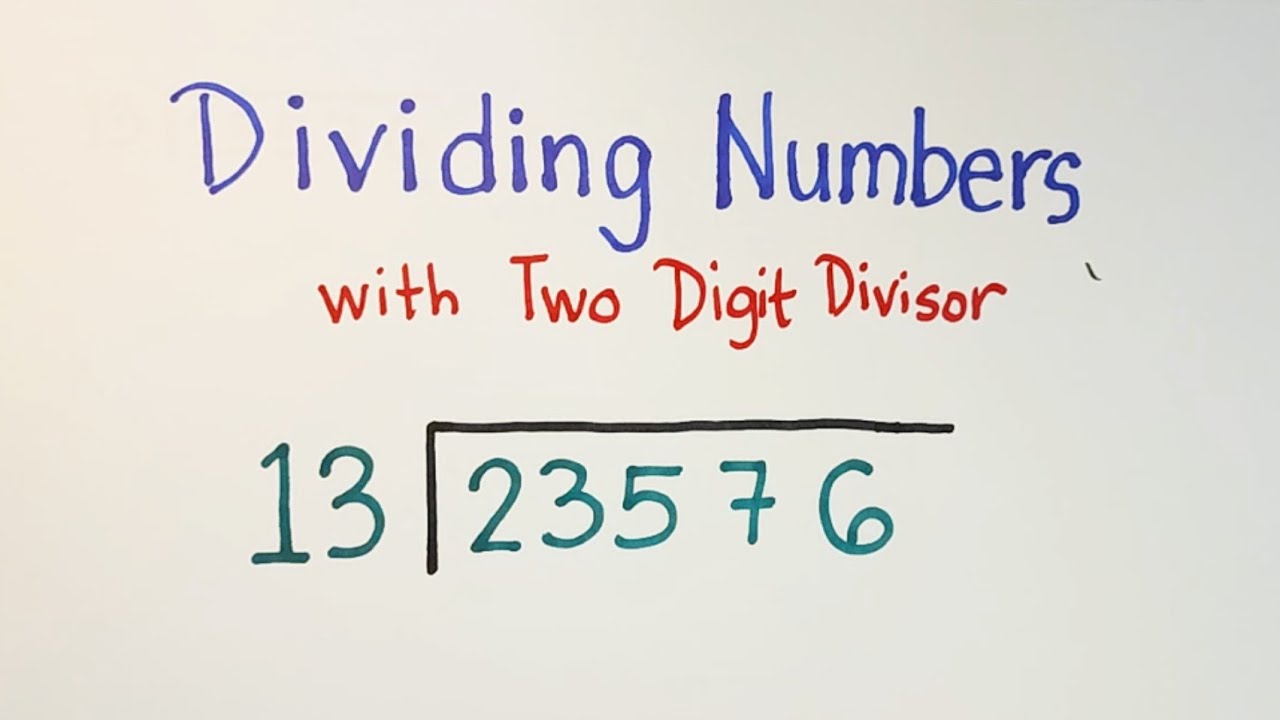

Divided By 7 8

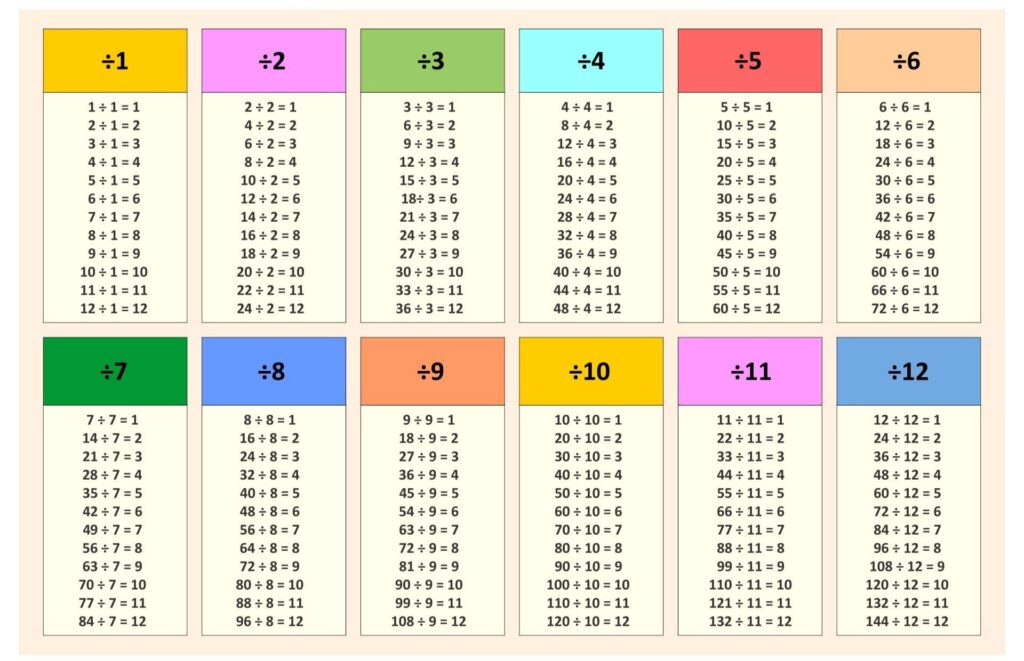

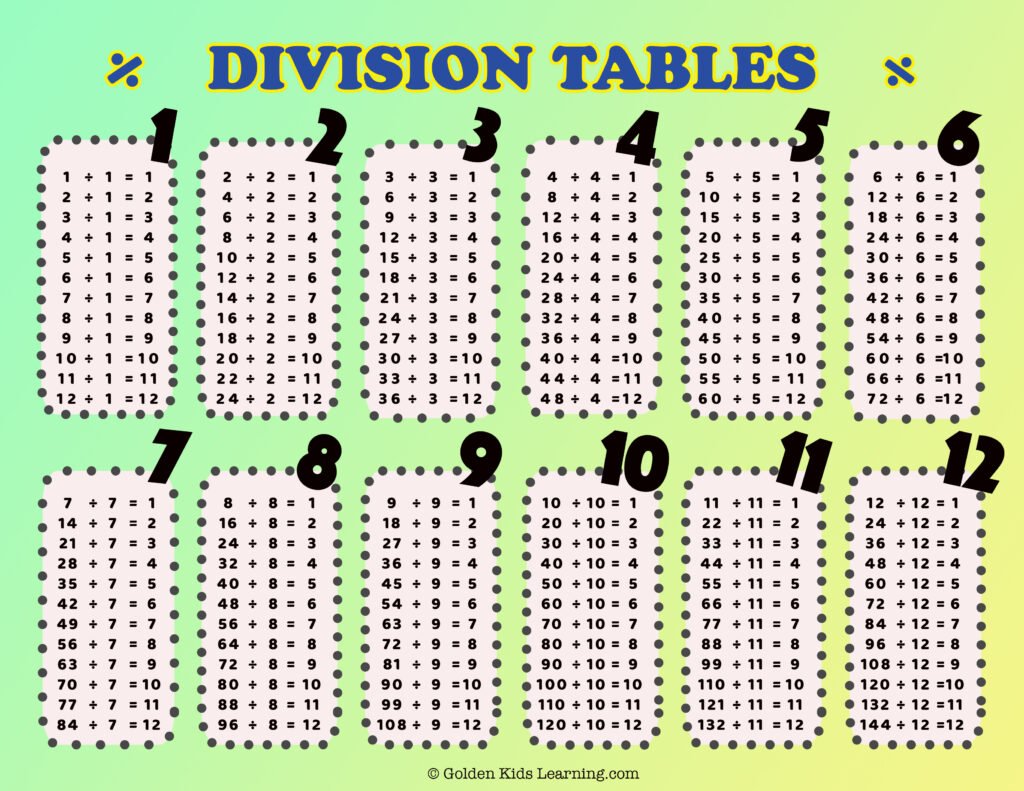

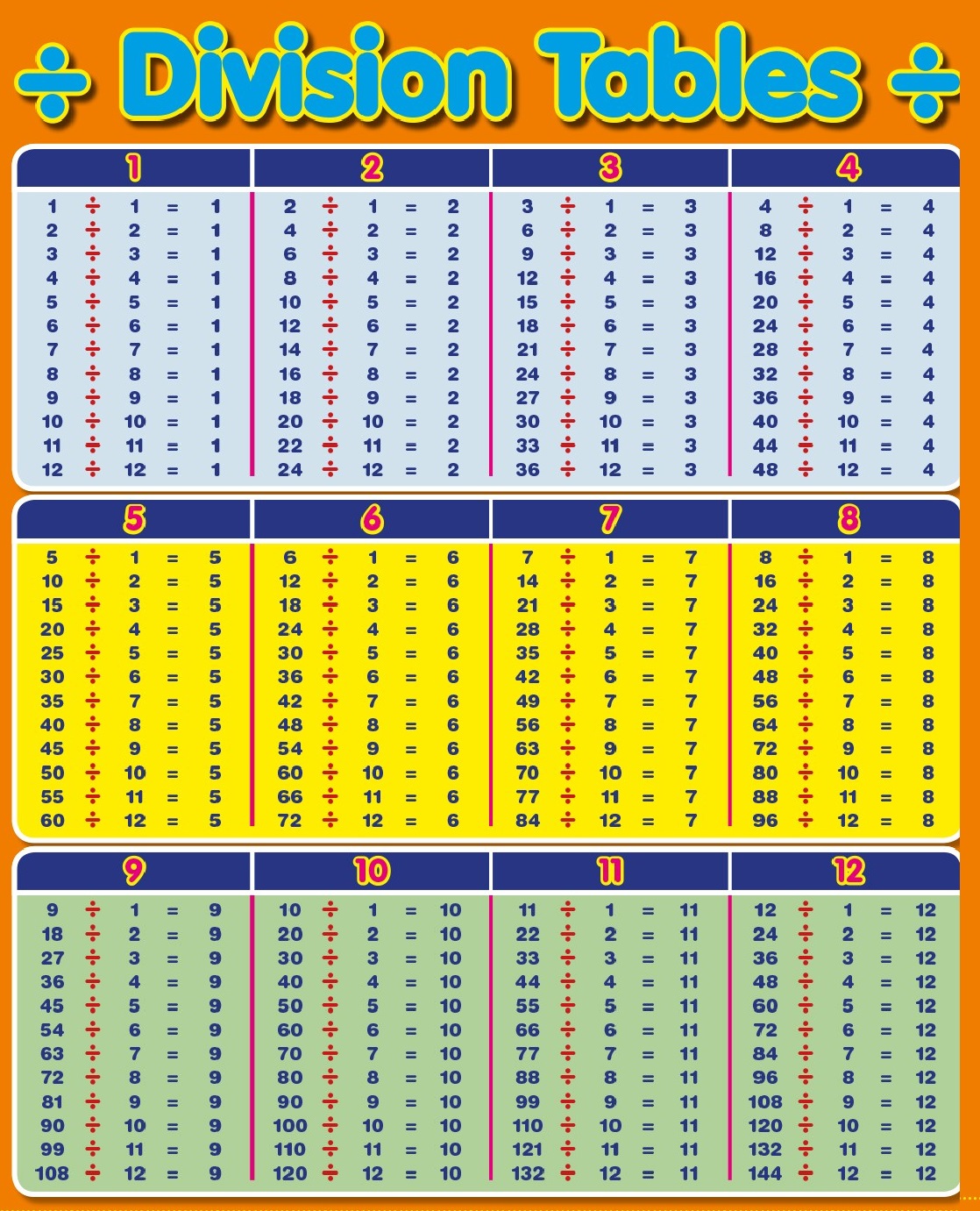

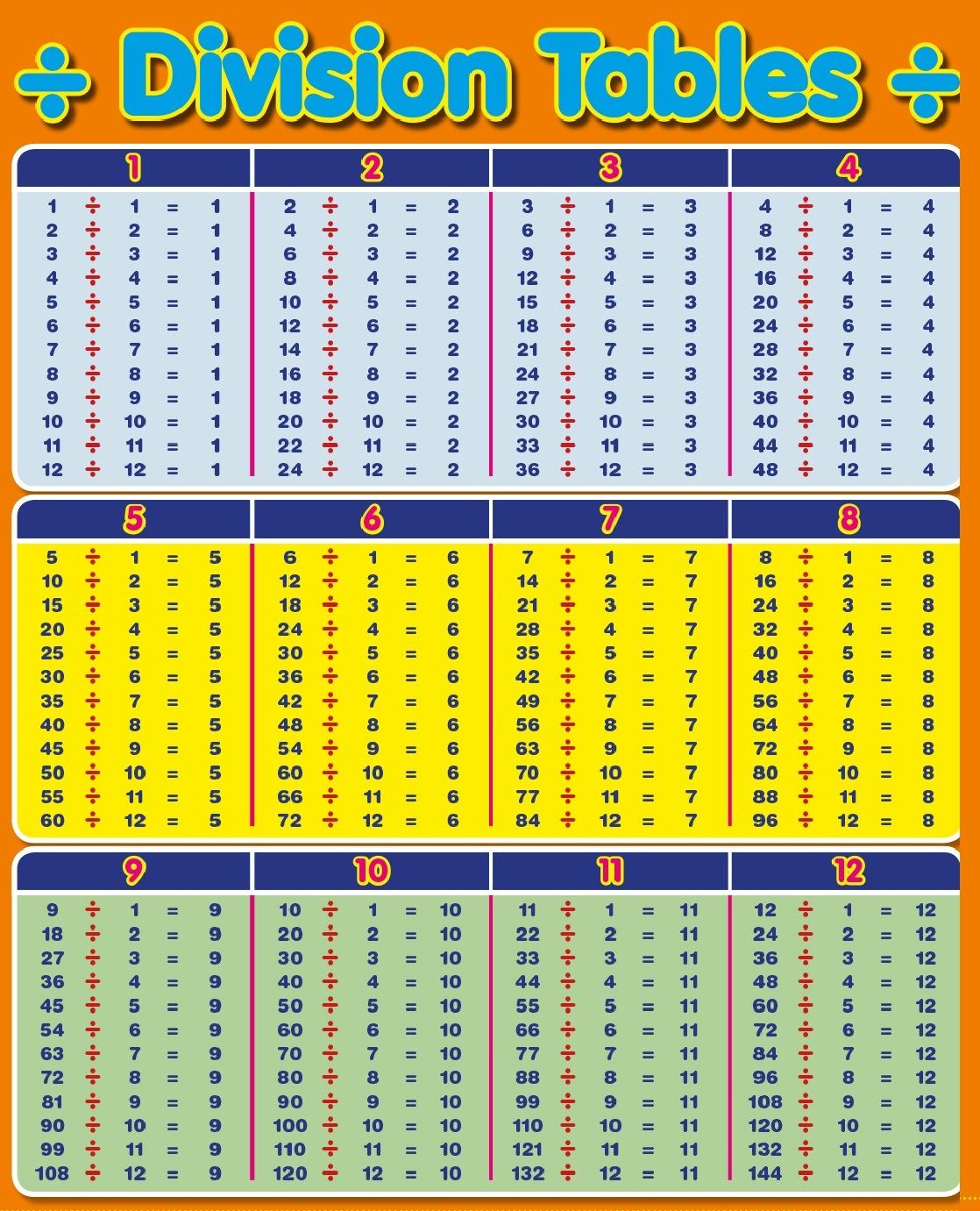

Divide Table Chart

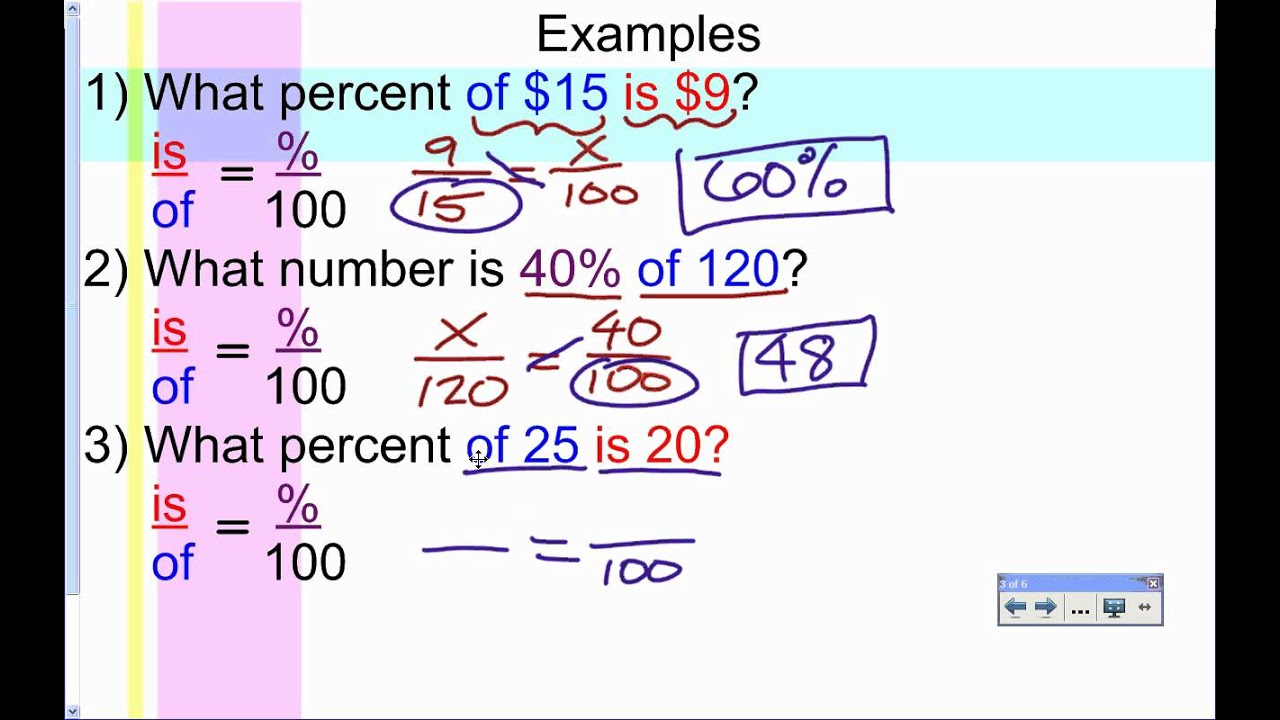

Whats 20 Percent Of 25

Three Division Tables

Two Division Tables

Division Charts Printable

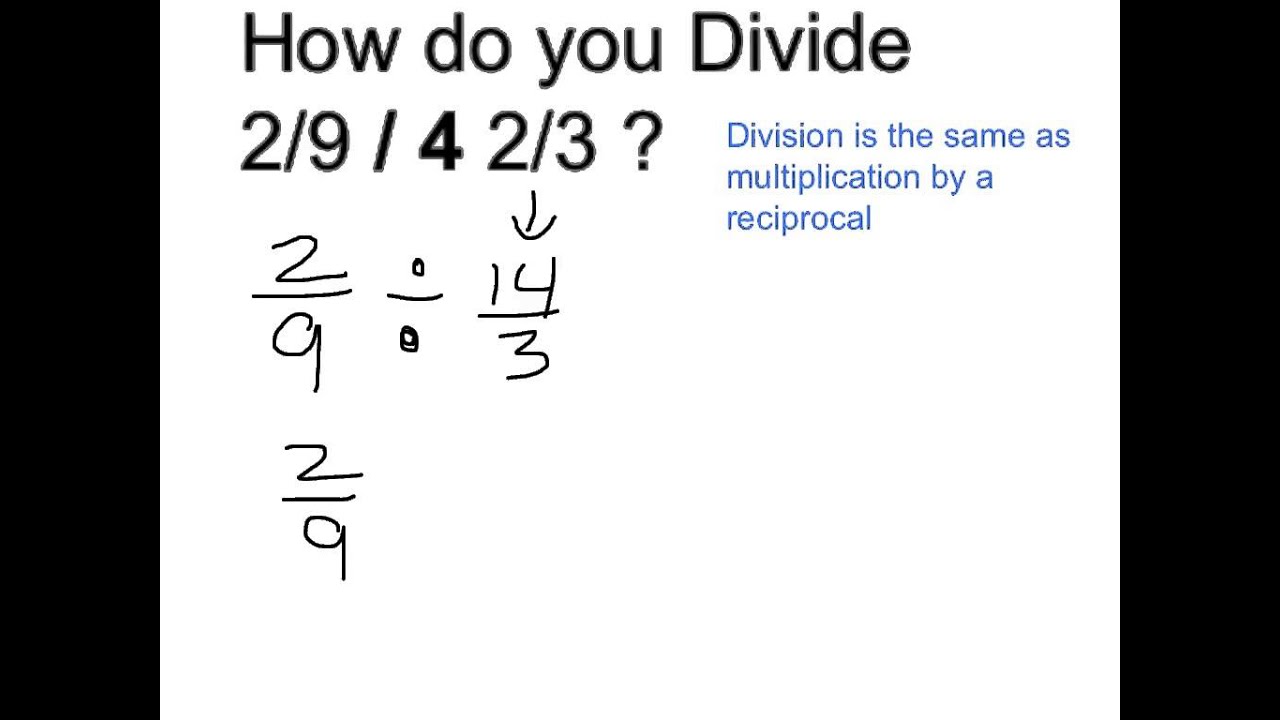

The Division Help

Division And Multiplication

10 Divided By 1 2

Times Table And Division