169 1 4 Divided By 2 are a flexible solution for any individual looking to produce professional-quality documents quickly and easily. Whether you require personalized invitations, resumes, organizers, or calling card, these templates allow you to customize content effortlessly. Merely download the design template, edit it to match your needs, and publish it at home or at a printing shop.

These layouts save time and money, supplying an economical choice to hiring a developer. With a wide range of styles and styles offered, you can find the best style to match your personal or organization demands, all while maintaining a sleek, specialist look.

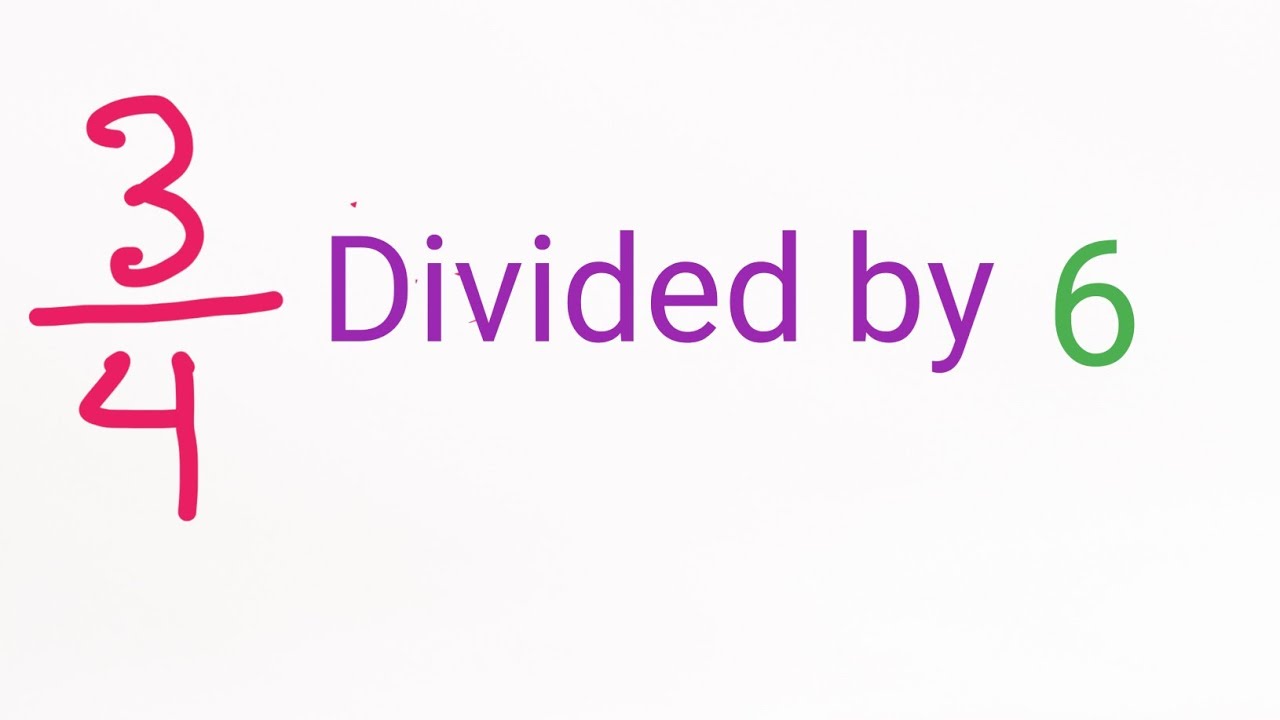

169 1 4 Divided By 2

169 1 4 Divided By 2

Search for hidden words in these fun printable puzzles featuring Mickey and Minnie Mouse Winnie the Pooh Moana and other Disney characters A great collection of word search puzzles covering Disney movies, characters, songs and villains.

Printable Disney Word Search Cool2bKids

Pin On TeacherPayTeachers The Efficient Classroom

169 1 4 Divided By 2Word search contains 33 words. Print, save as a PDF or Word Doc. Add your own answers, images, and more. Choose from 500000+ puzzles. Word search contains 38 words Print save as a PDF or Word Doc Add your own answers images and more Choose from 500000 puzzles

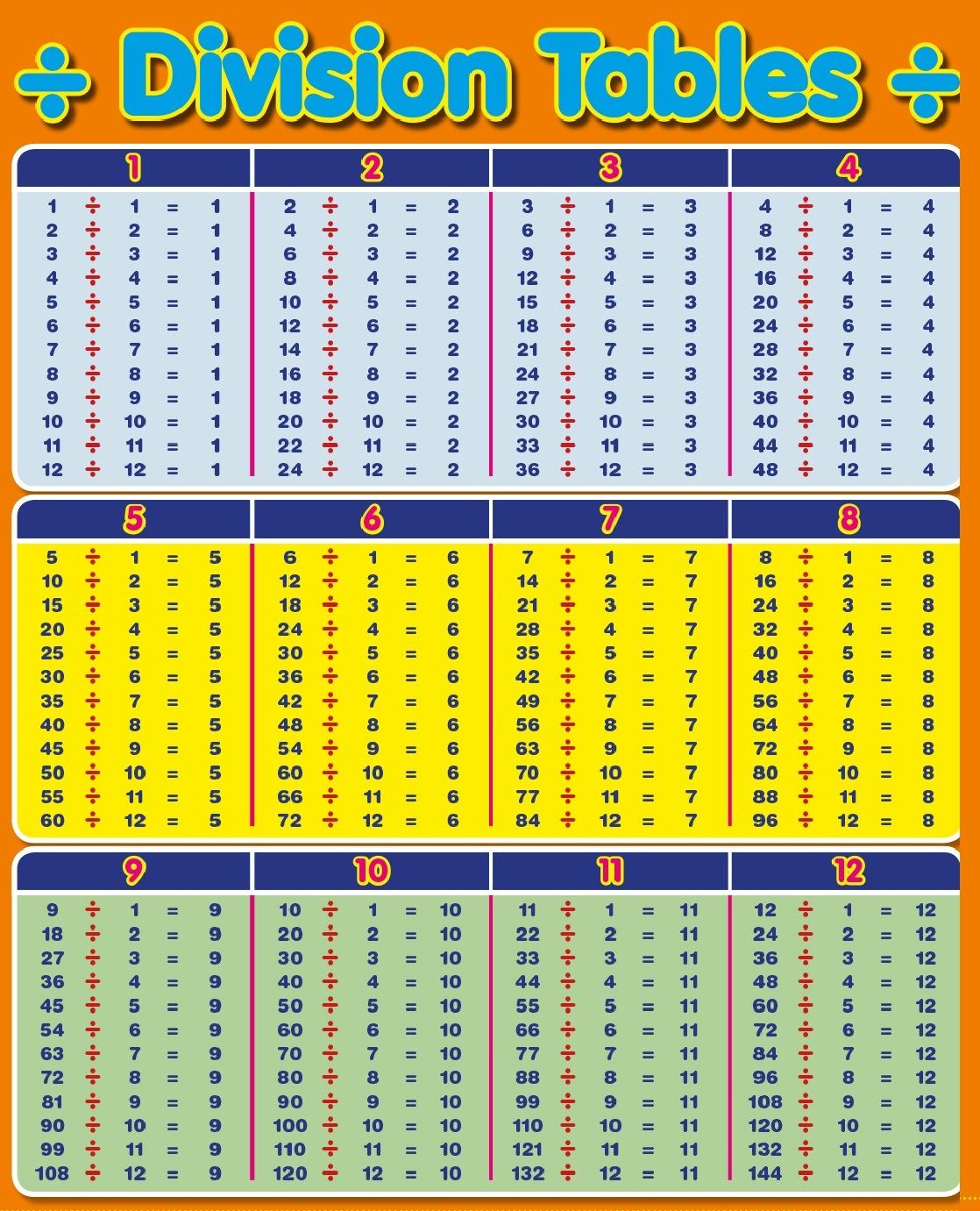

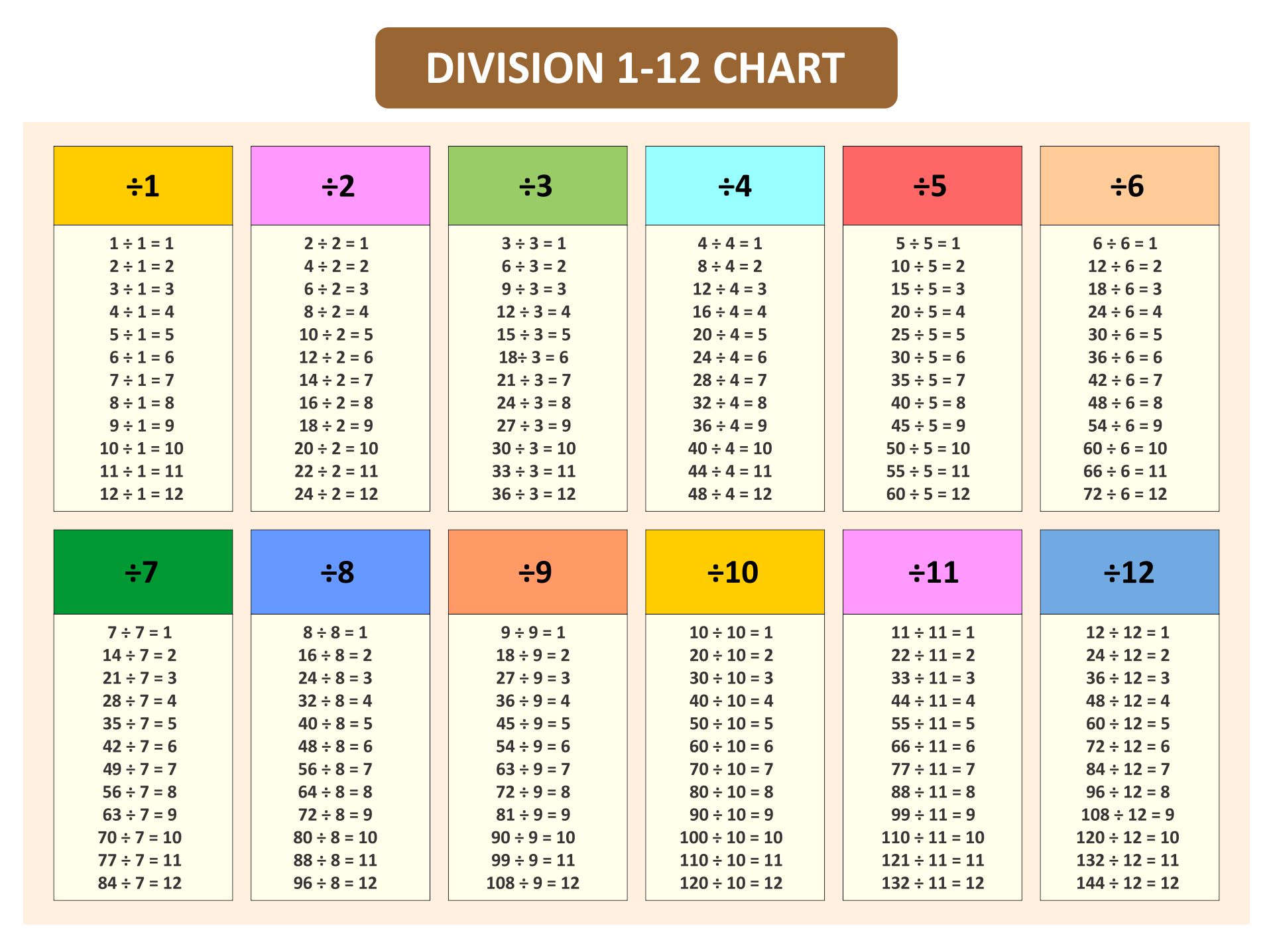

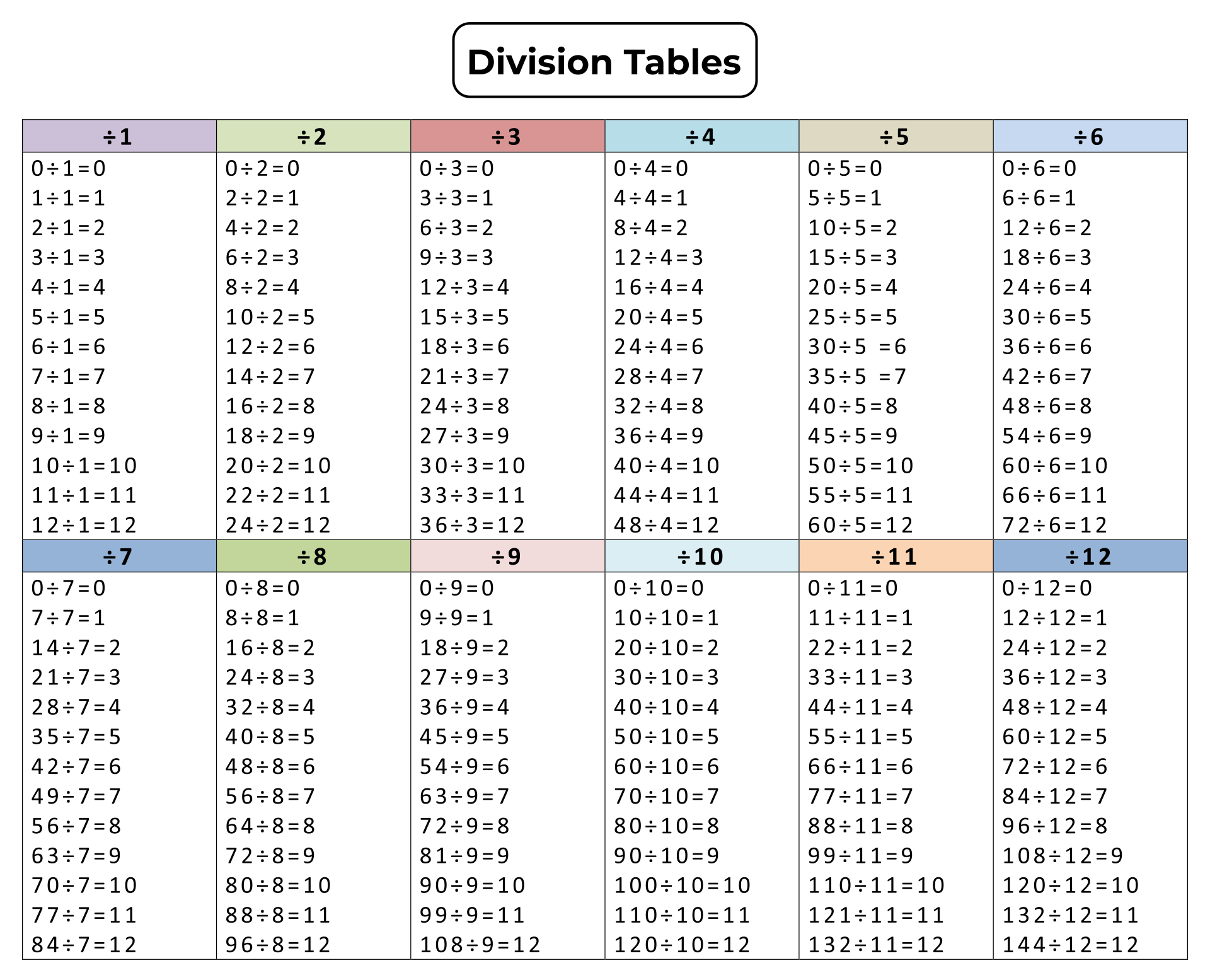

Disneyland Word Search Puzzle with Coloring US Tourist Attractions shielded, Printable Disney Word Search Games shielded, Funny Interactive Disneyland T ... Divided By 3 Tables Division Table 1 12 Learning Printable

Disney Word Search

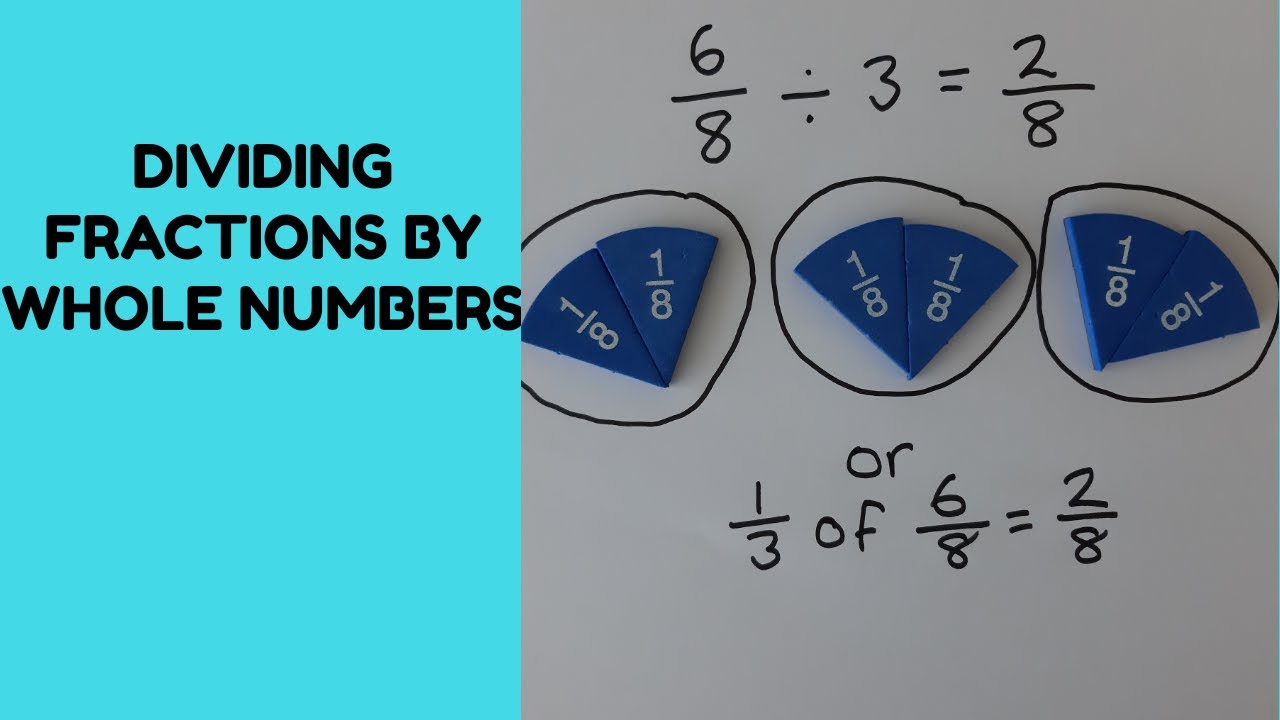

Divided By 3 Tables

There are a lot of famous Disney characters to be find in this word search puzzle Select a difficulty easy medium or hard and try to find them 1 4 Divided By 4

The words included are Captain Hook Crocodile Darlings Fairy London Lost Boys Mermaid Neverland Peter Pan Pirate Smee Tiger Lily Divide 0 02 By 1000 1 4 Divided By 4

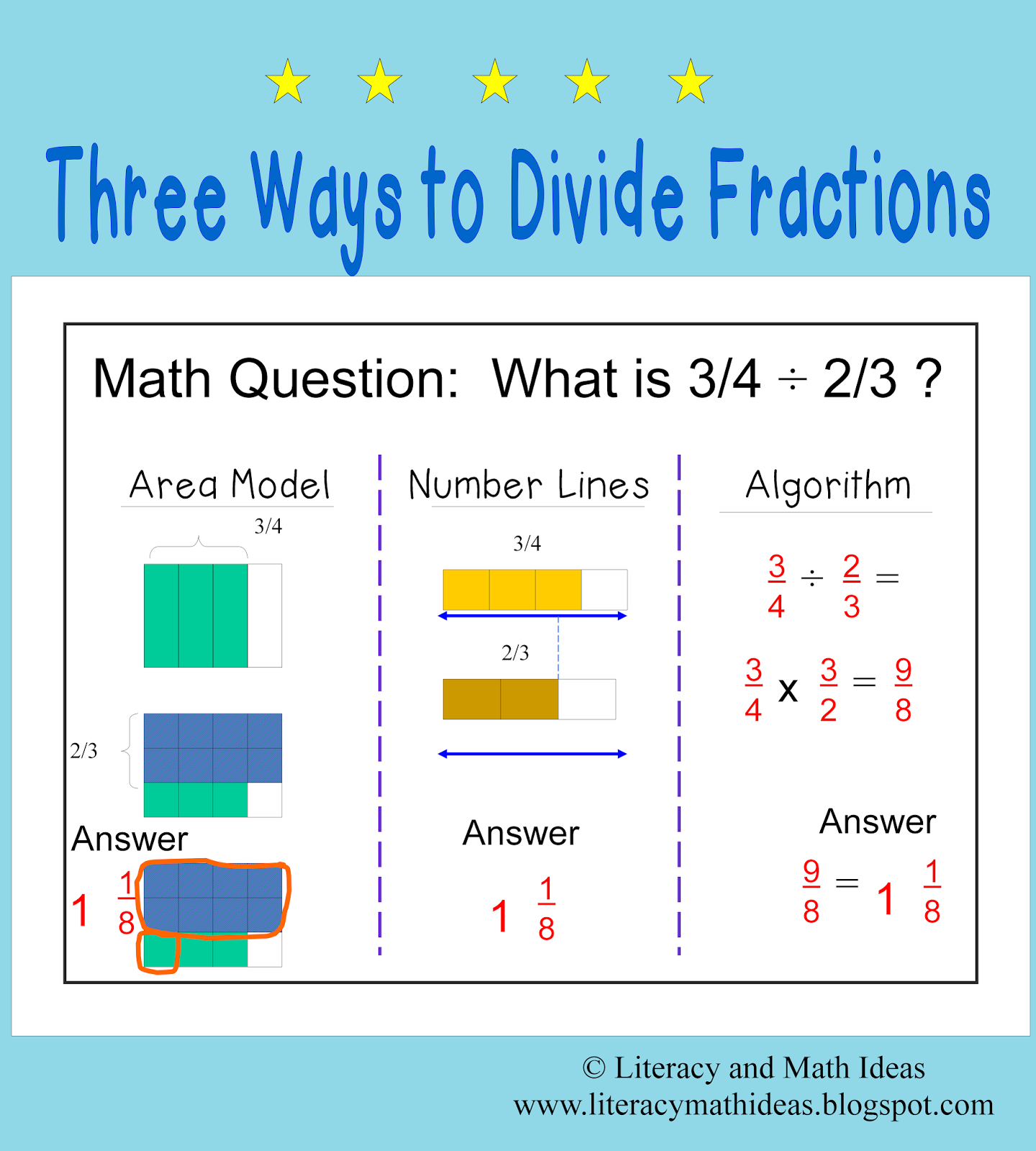

Three Division

Division By 1

Three Division Tables

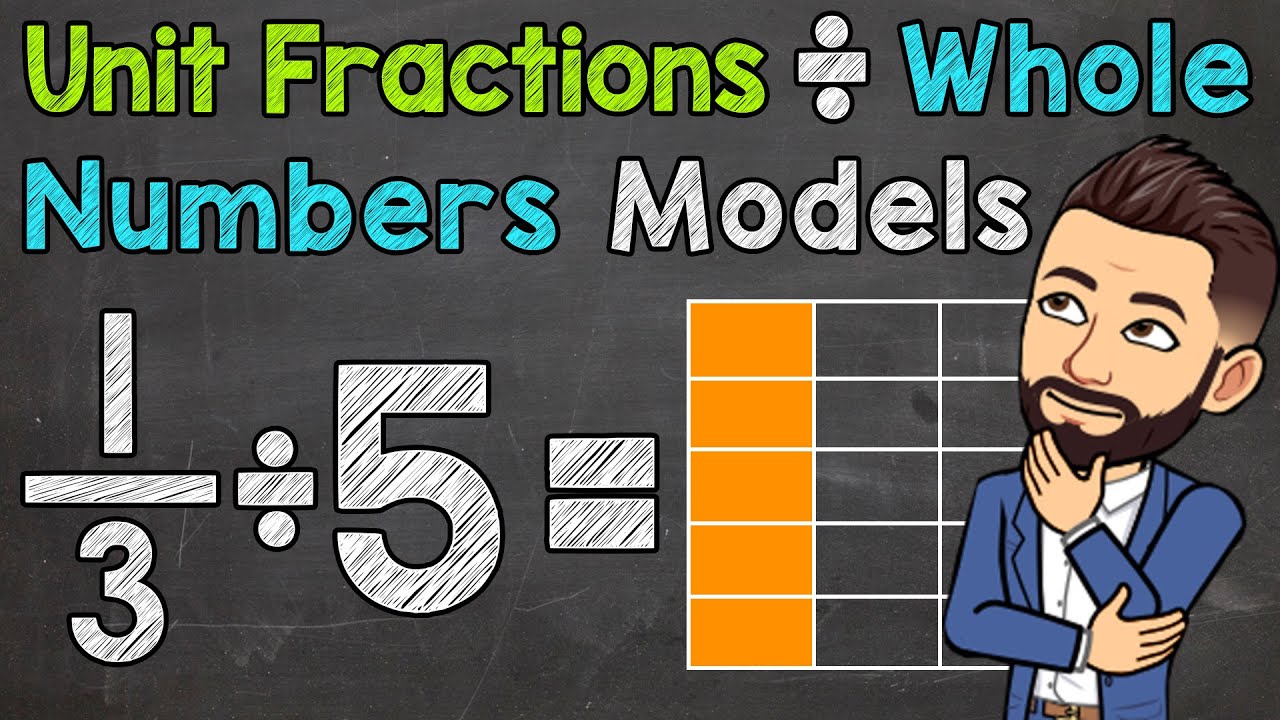

1 4 Divided By 7

Number Chart Division

.png)

Bar Diagram Fractions

1 4 Divided By 7

1 4 Divided By 4

1 4 Divided By 12

1 4 Divided By 20