17 Percent Of 4000 Dollars are a flexible remedy for any individual aiming to develop professional-quality documents promptly and quickly. Whether you require custom invites, resumes, planners, or calling card, these layouts permit you to individualize material easily. Merely download the theme, edit it to match your demands, and publish it in your home or at a printing shop.

These themes save time and money, using an economical option to employing a developer. With a vast array of styles and formats offered, you can locate the ideal style to match your personal or business needs, all while maintaining a sleek, expert look.

17 Percent Of 4000 Dollars

17 Percent Of 4000 Dollars

Create custom water bottles with VistaPrint Choose from a wide range of bottles of different types capacity and materials and personalize them with your Hydrate in style with a cool water bottle design. Our fully customizable templates can help you personalize drink containers for giveaways, gifts, and more.

Custom Water Bottles in Bulk Totally Promotional

Honda Used Cars For Less Than 4000 Dollars HondaCarsUnder4000ForSale

17 Percent Of 4000 DollarsPrintable Water Bottle: Express yourself with a customizable canvas; design your bottle with logos or graphics, showcasing your unique style in a functional ... Our Printable Eco Friendly Steel Water Bottles are great for promoting your company to an eco friendly market customizable and 100 recyclable

Shop custom water bottles personalized with your logo. Buy custom plastic water bottles printed with your design with bulk and wholesale pricing & FREE ... DealShare Raises 165 Mn From Tiger Global Equitypandit Instagram Business Model

Free custom printable water bottle templates Canva

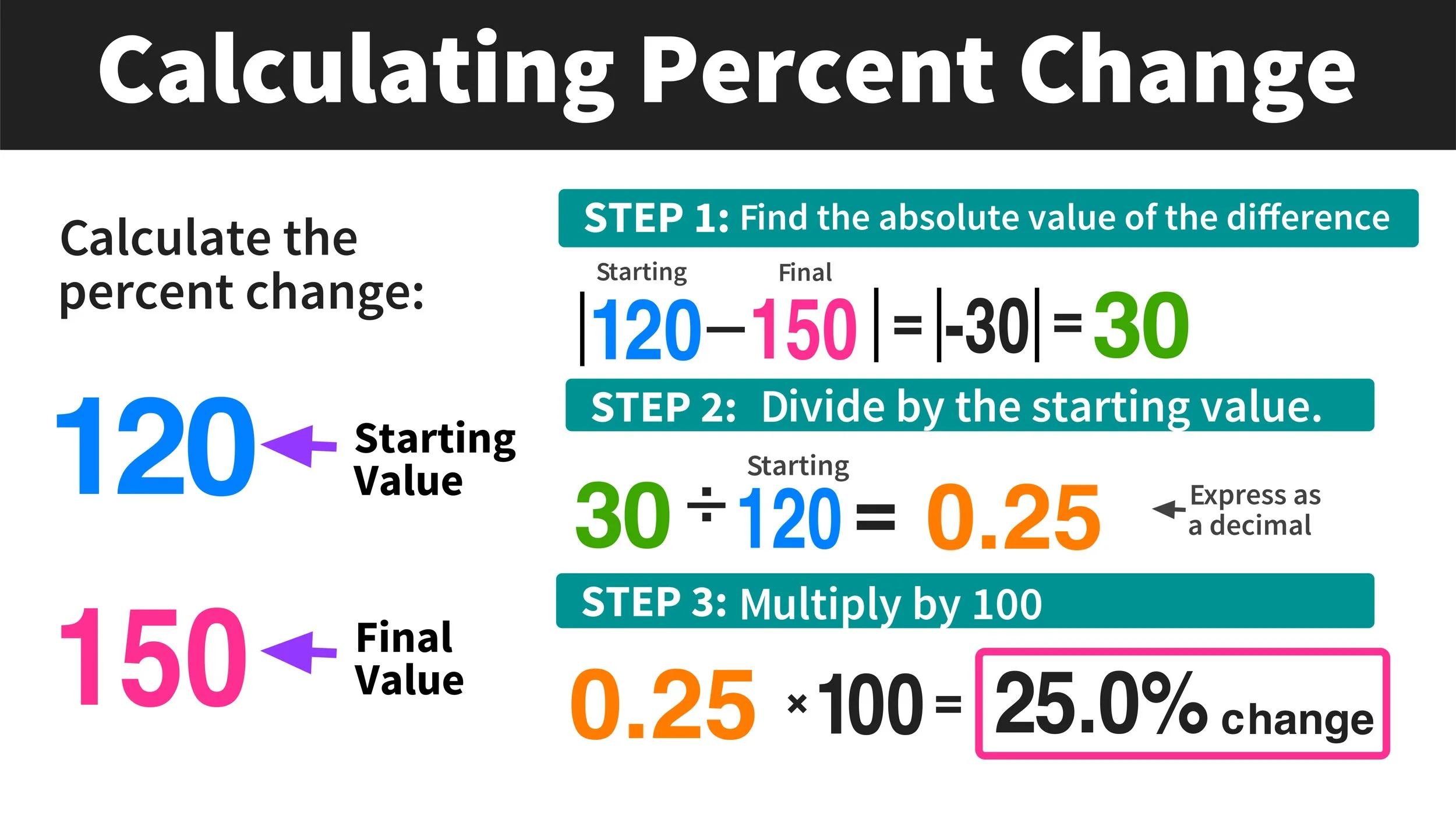

Percent Change Calculator Mashup Math

Custom water bottles for branded merchandise or gift giving Design and print your own water bottle at Canva with free standard shipping What Is 60 Off 4000 Calculatio

Personalized water bottles are available with volume discounts when you pick the quantity using our exclusive Glide tool showing you the lowest minimum Decimal To Fraction Equivalent Chart Gippsland Skies Offshore Wind Mainstream Renewable Power

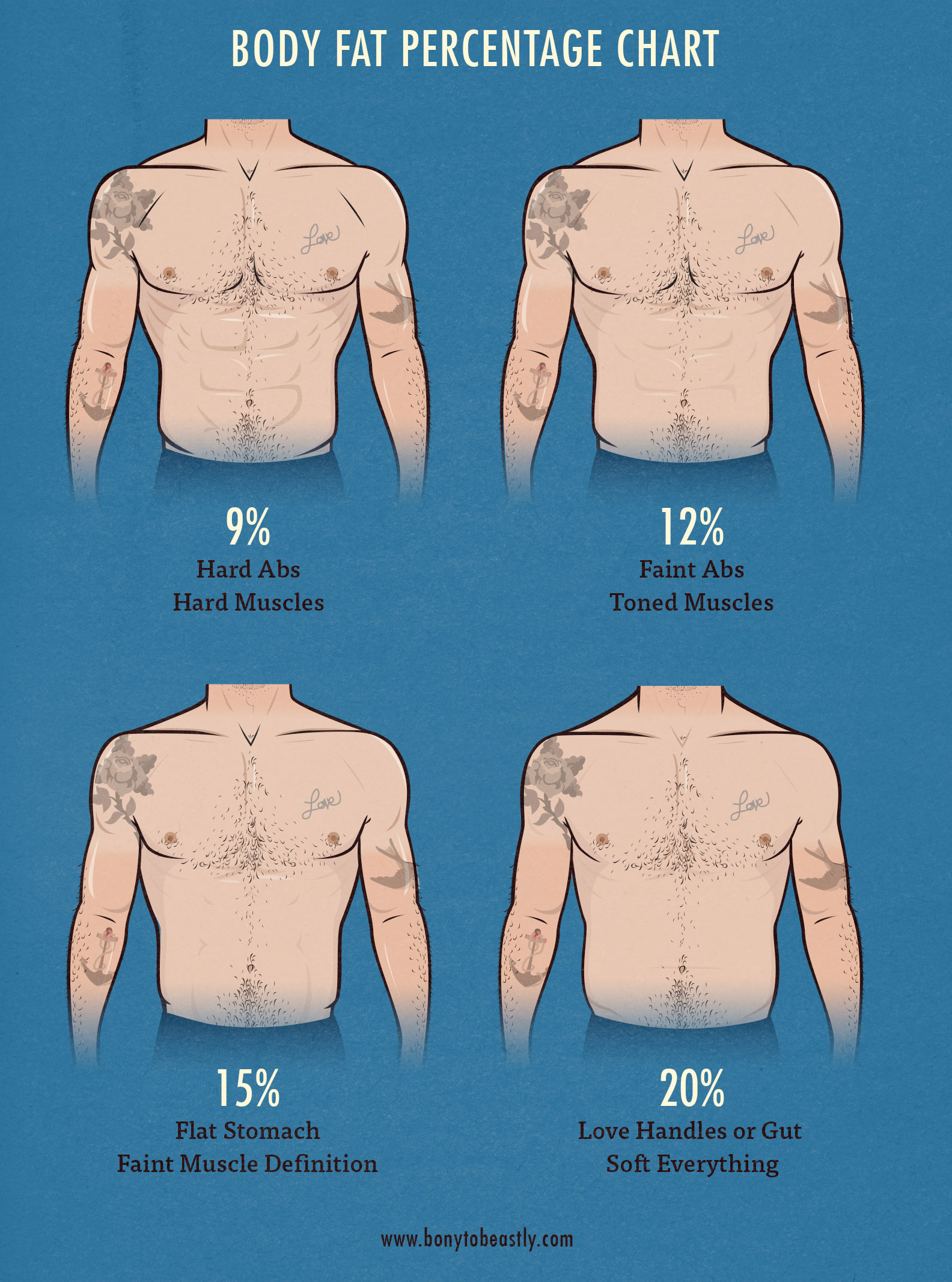

Anyone Got Dexa Scan And Successfully Improved Results Page 2

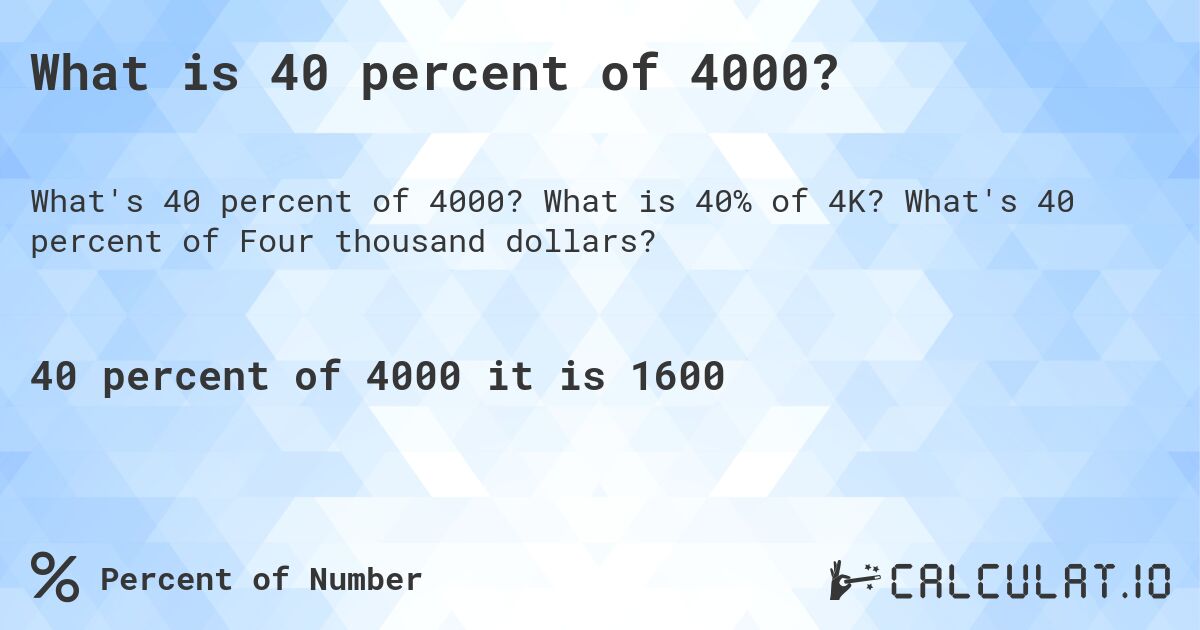

What Is 40 Percent Of 4000 Calculatio

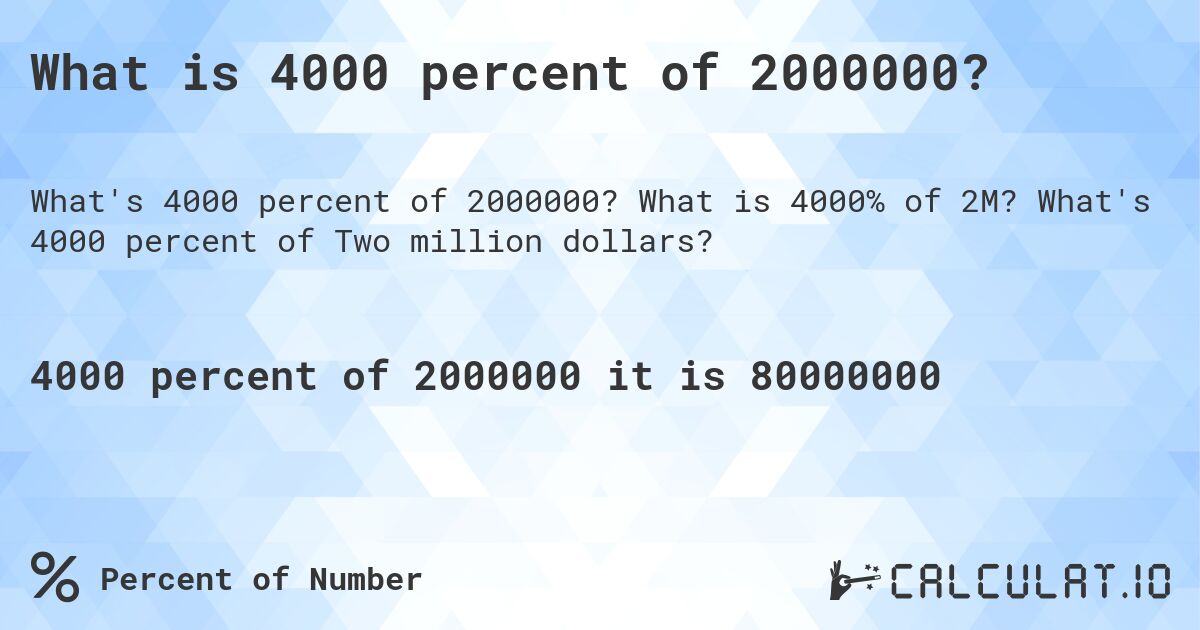

What Is 4000 Percent Of 2000000 Calculatio

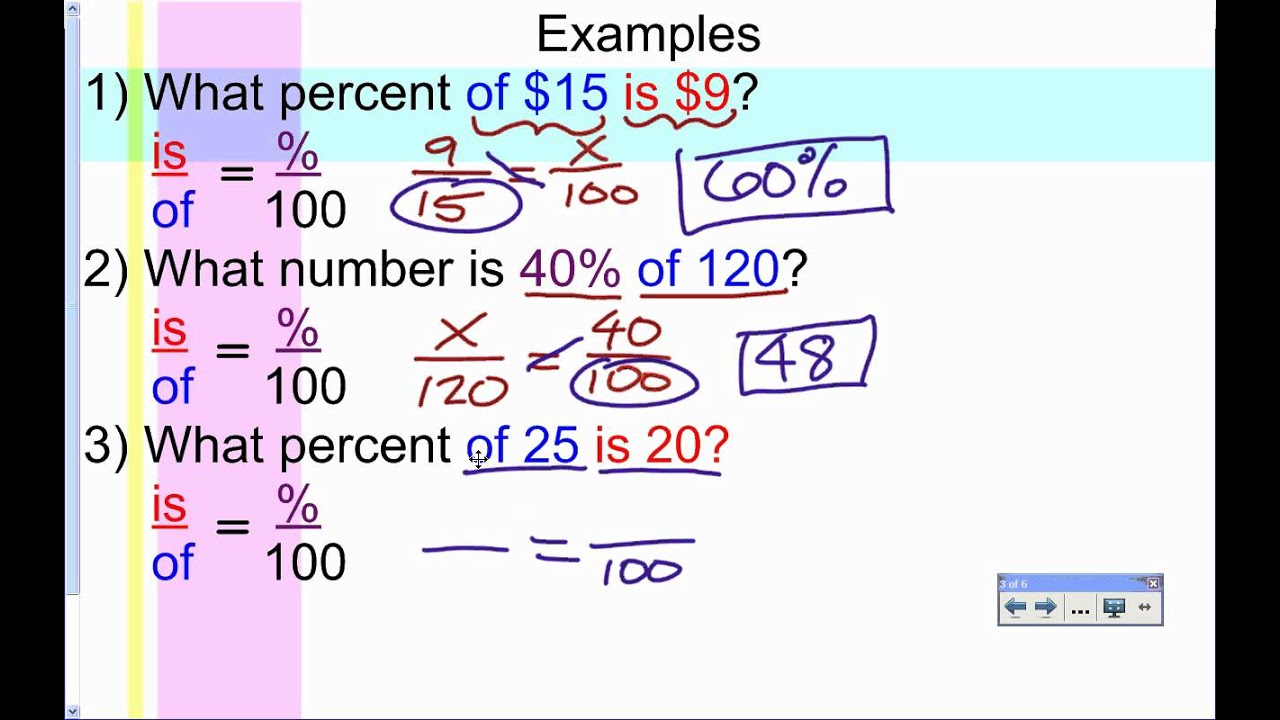

Whats 20 Percent Of 25

Keeping The Government Humming

What Is 18 Percent Of 4000 In Depth Explanation The Next Gen Business

What Is 22 Percent Of 100

What Is 60 Off 4000 Calculatio

Caroline Rhea Came Into Studio With Her Opener CJ RealFunnyFriends

17 March 2023 Black And White Stock Photos Images Alamy