170 Divided By 30 Percent are a versatile option for anybody aiming to develop professional-quality records rapidly and quickly. Whether you require personalized invites, resumes, planners, or business cards, these themes allow you to individualize content with ease. Merely download and install the design template, modify it to fit your demands, and print it in your home or at a print shop.

These design templates save money and time, supplying a cost-effective option to hiring a developer. With a vast array of styles and styles readily available, you can find the perfect design to match your personal or service demands, all while preserving a refined, professional appearance.

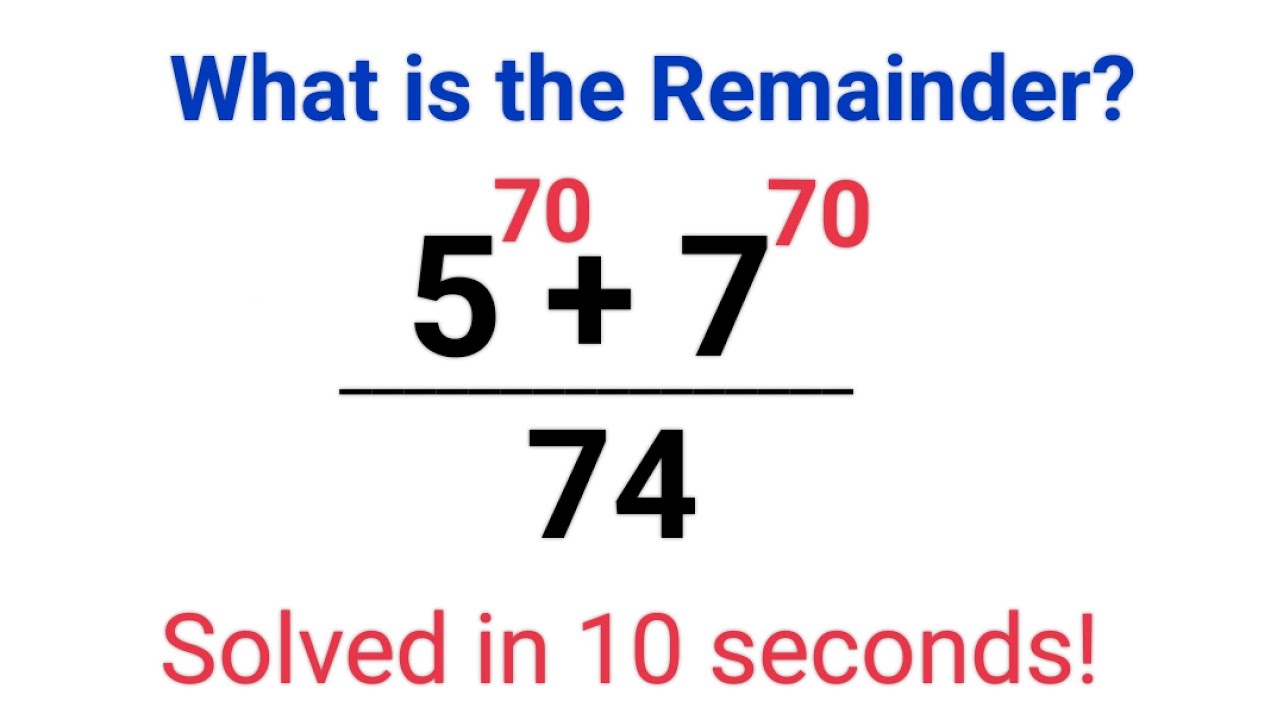

170 Divided By 30 Percent

170 Divided By 30 Percent

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number IRS Form W-9 (rev March 2024). W-9 Form. ©2024 Washington University in St. Louis. Notifications.

W9 form ei sig pdf

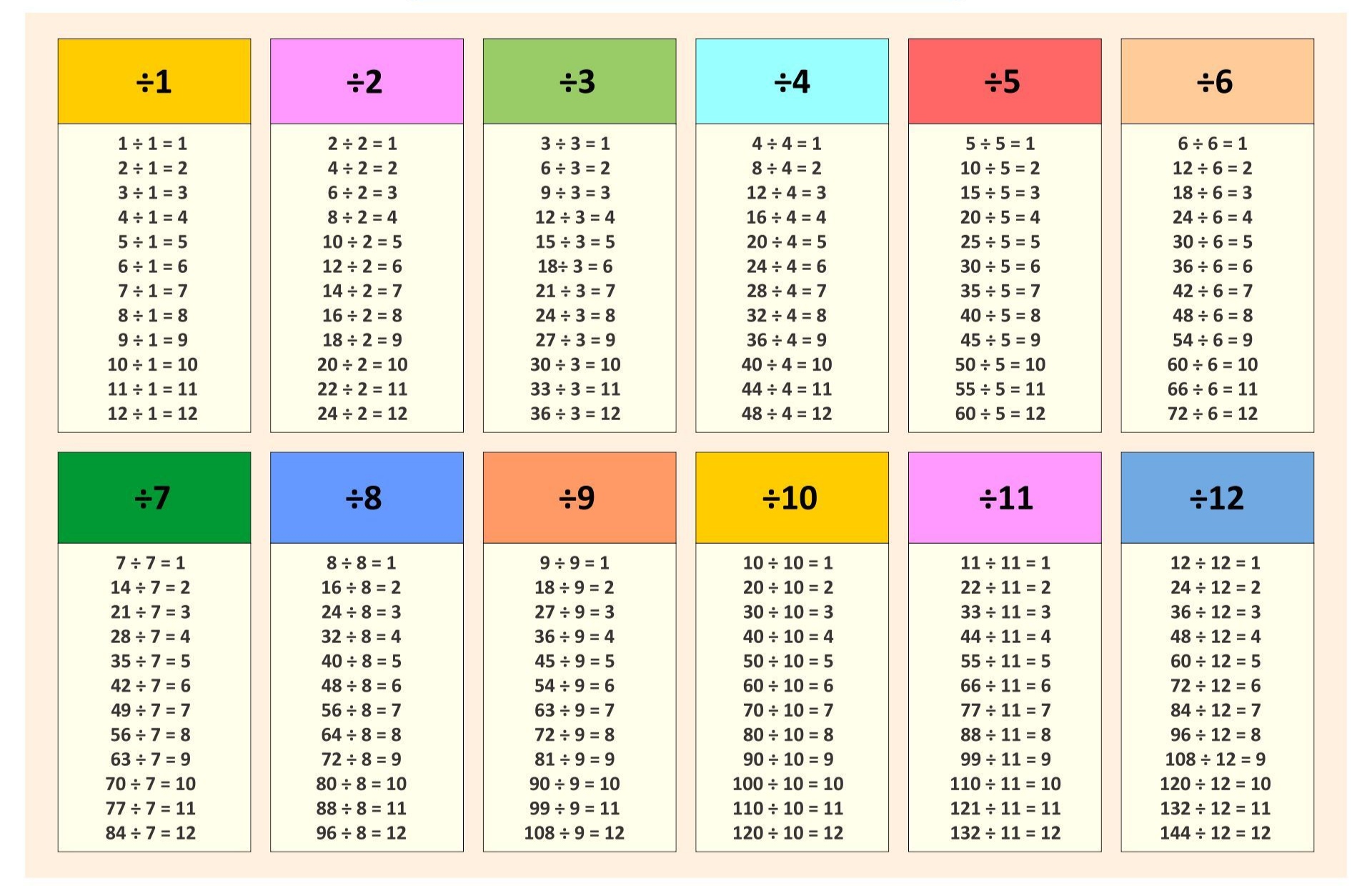

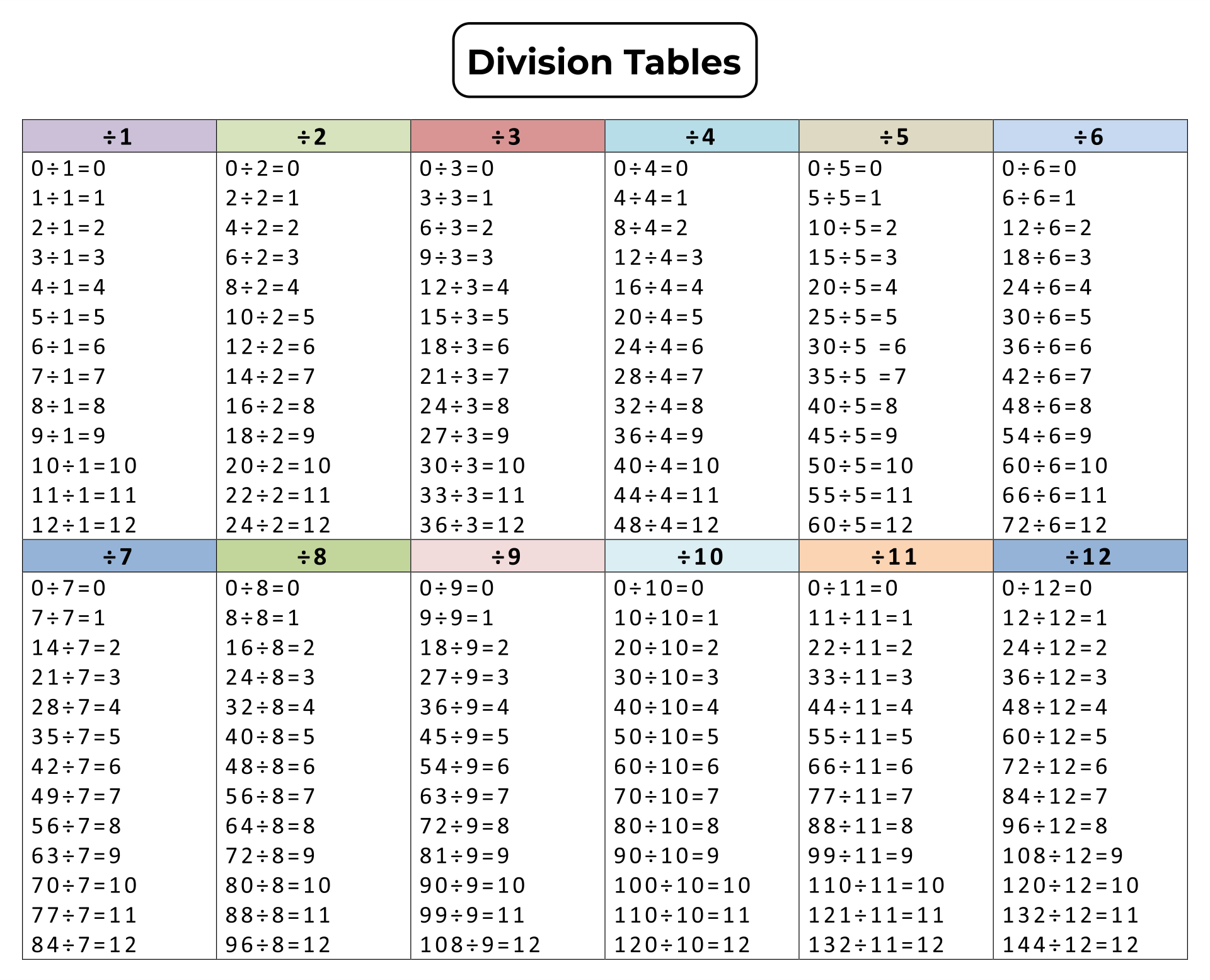

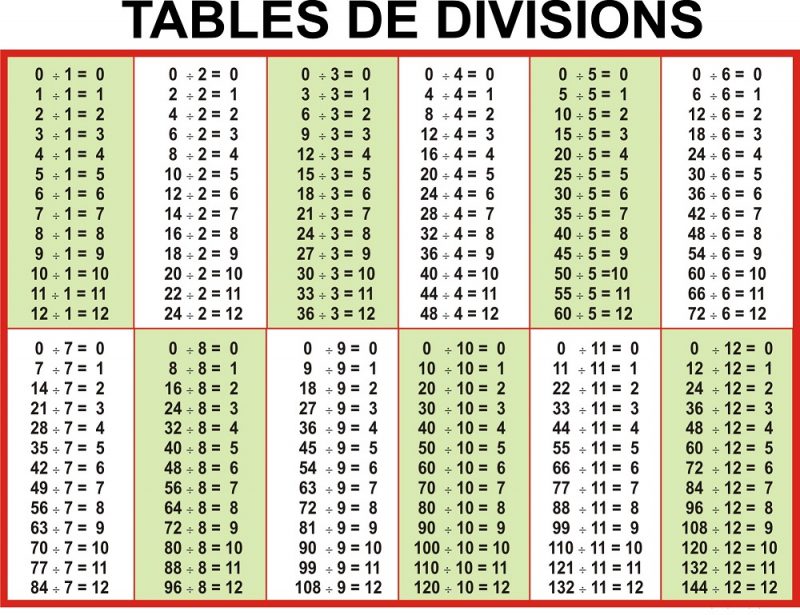

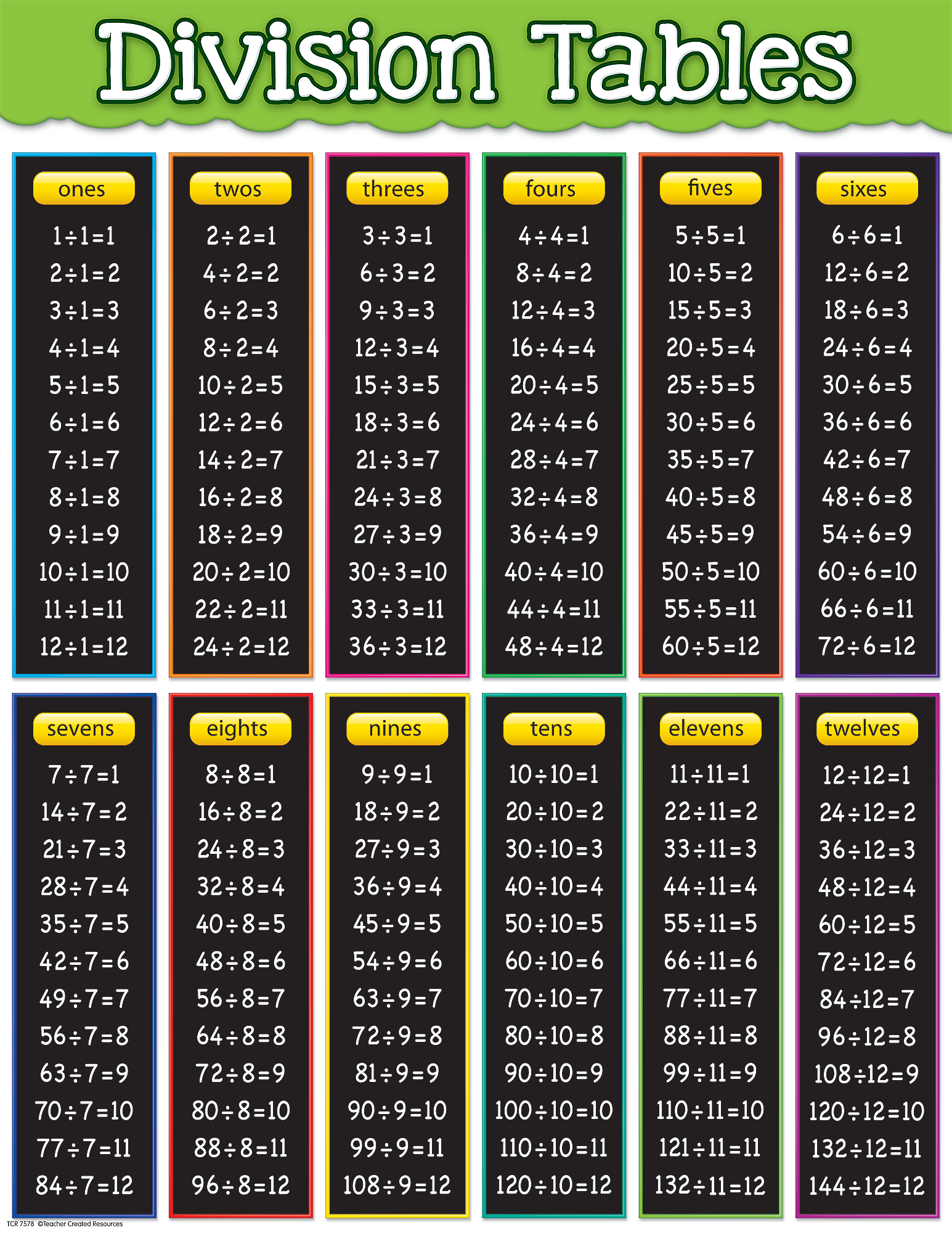

Tabla De Division Del 1 Al 12

170 Divided By 30 PercentAny payee/vendor who wishes to do business with New York State must complete the. Substitute Form W-9. Substitute Form W-9 is the only acceptable documentation. Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

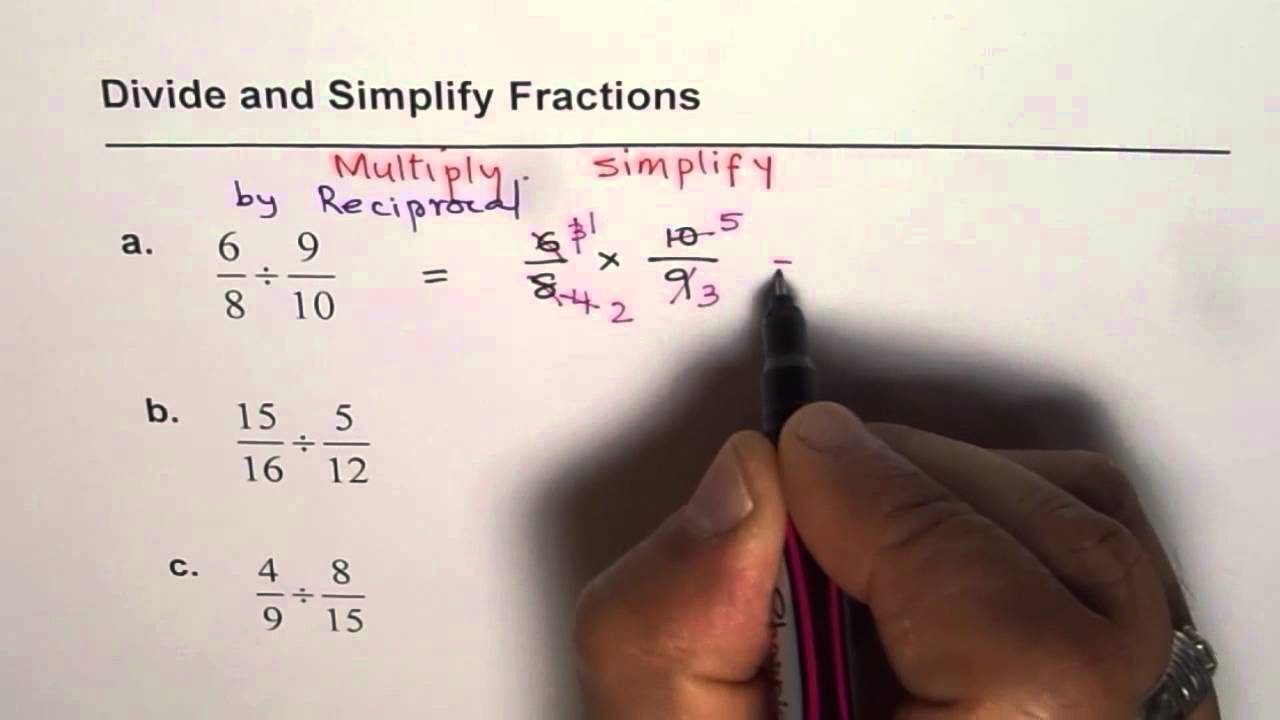

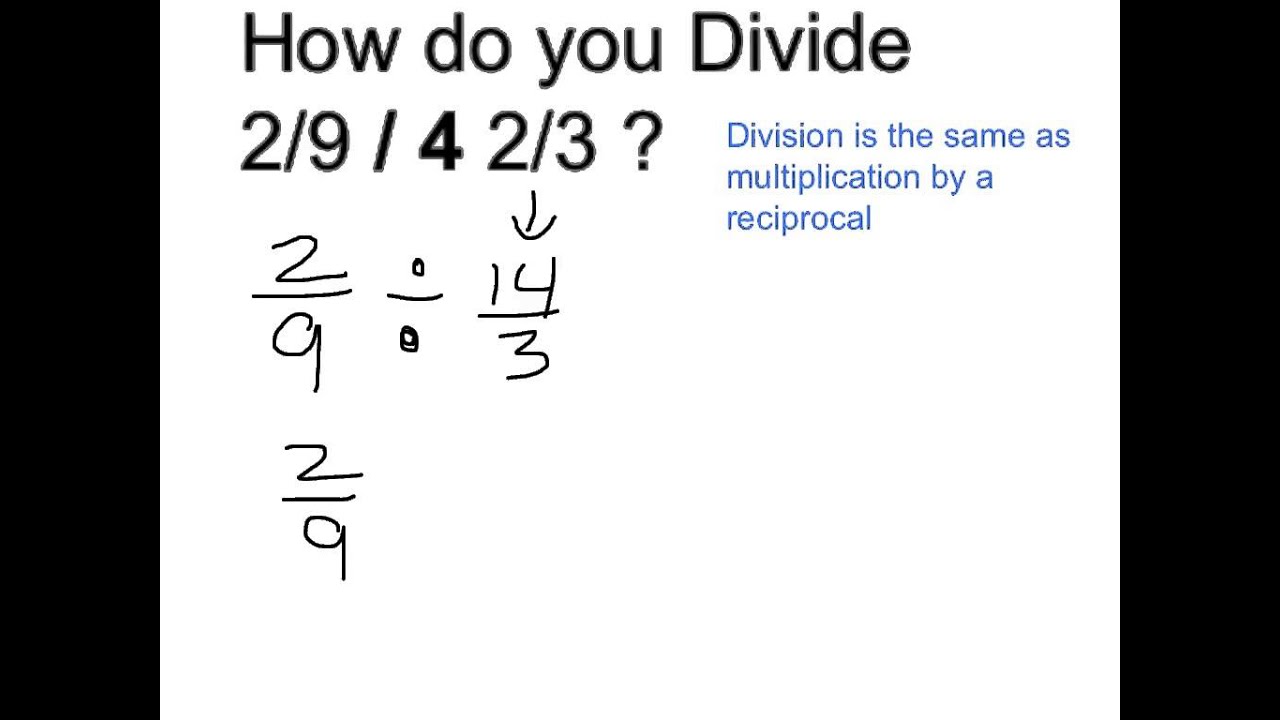

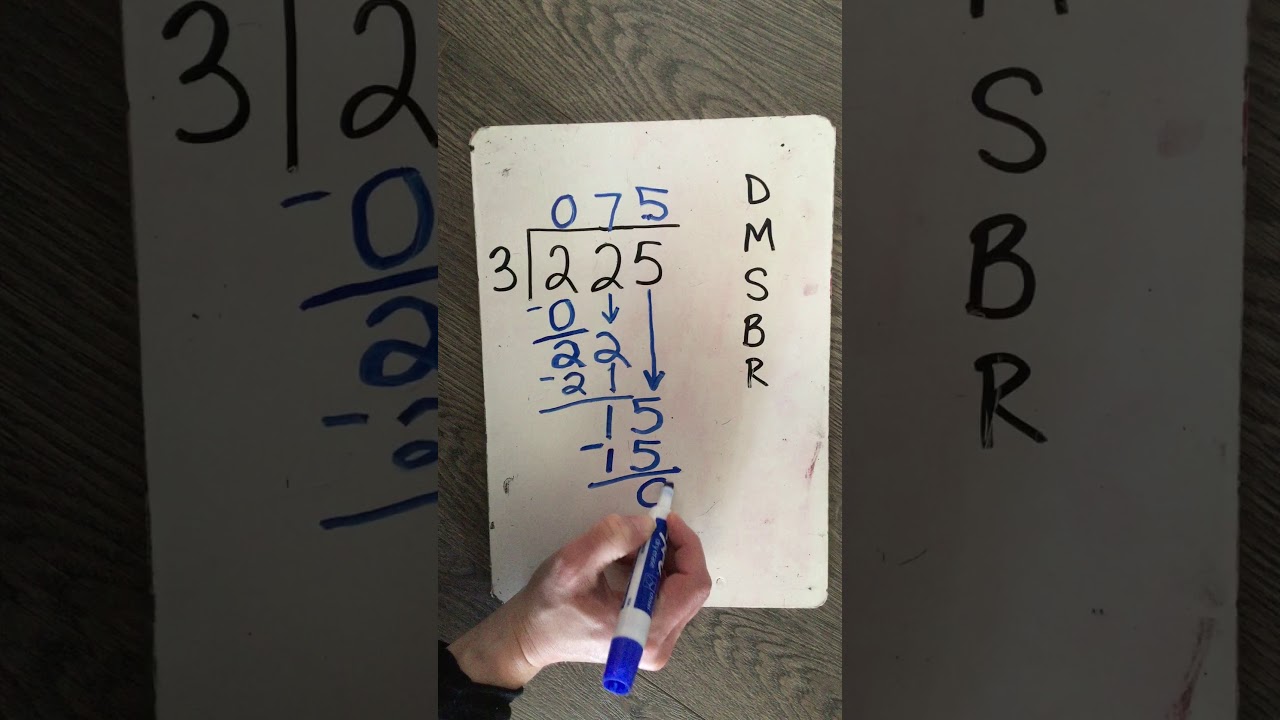

The W9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won't be ... 1 4 Divided By 2 Divide Numbers By Fractions

W 9 blank IRS Form Financial Services Washington University

10

Form MA W 9 Rev April 2009 Print Form Page 2 What Name and Number to Give the Requester For this type of account Give name and SSN of 1 Individual 500 Divided By 15

Form W 9 Request for Taxpayer Identification Number TIN and Certification Used to request a taxpayer identification number TIN for 100 Divided By 101 26 500 Divided By 12

12 Division Charts For Making Maths Fun Kitty Baby Love

18 Division Table

27 15 Simplified Form

28 Divide 400

10 Division Table

15 Divided By 23

28 Divide By 30

500 Divided By 15

24 Divided By 8 Is As Many As 3 Can Be Represented As

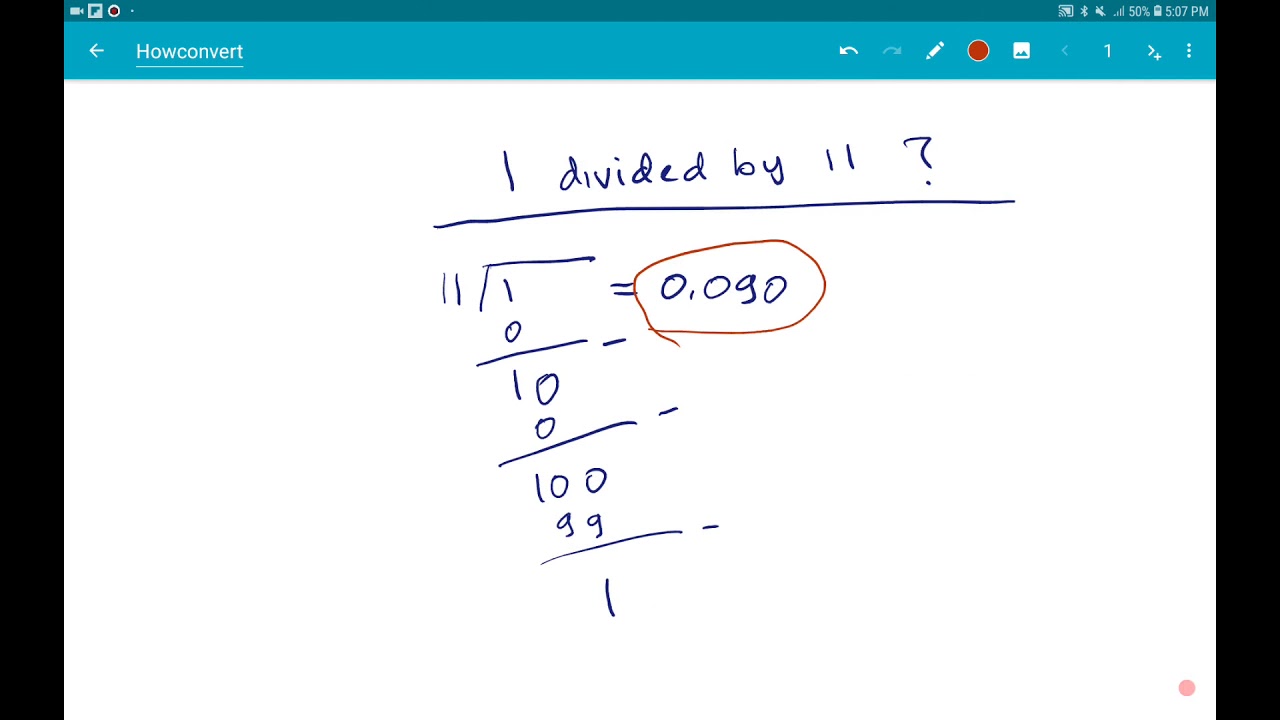

6 Divided By 100