19 2 5 Divided By 2 3 4 are a functional solution for anyone looking to produce professional-quality records promptly and quickly. Whether you need custom invites, returns to, planners, or calling card, these templates enable you to individualize content effortlessly. Just download and install the template, edit it to fit your needs, and publish it at home or at a print shop.

These layouts save time and money, offering an economical option to working with a designer. With a vast array of designs and formats offered, you can locate the excellent design to match your personal or organization requirements, all while maintaining a refined, specialist appearance.

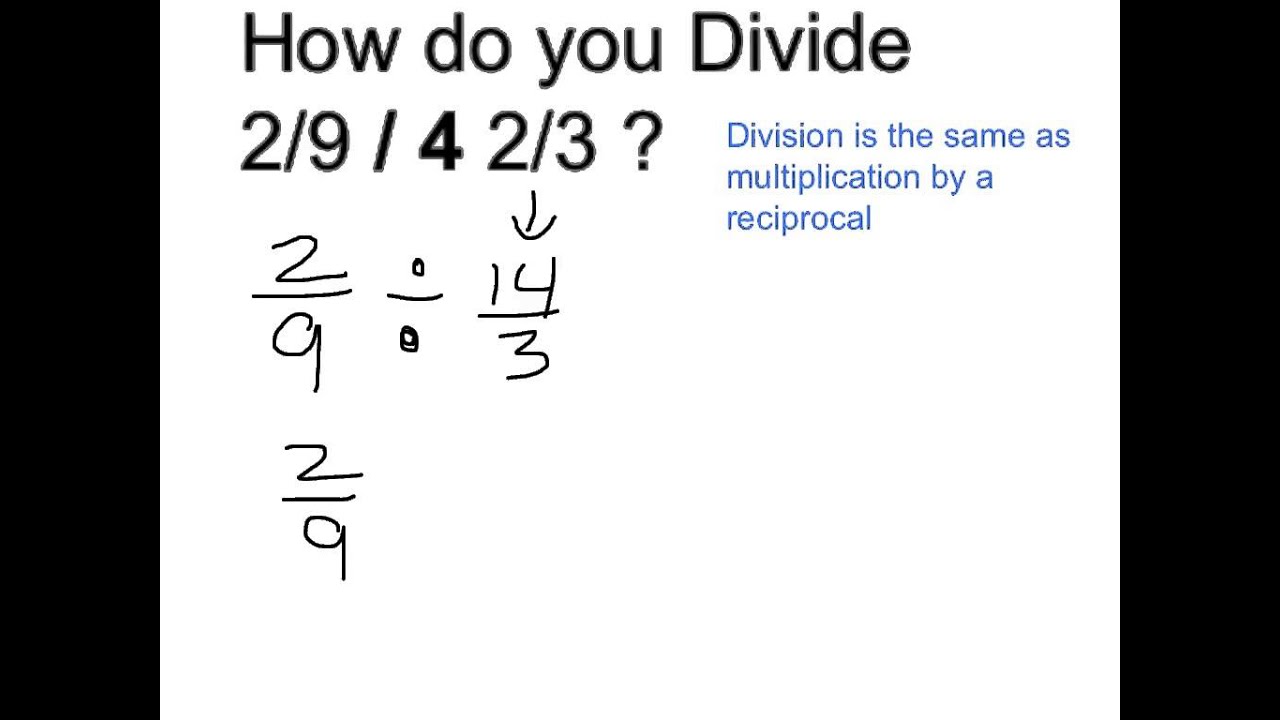

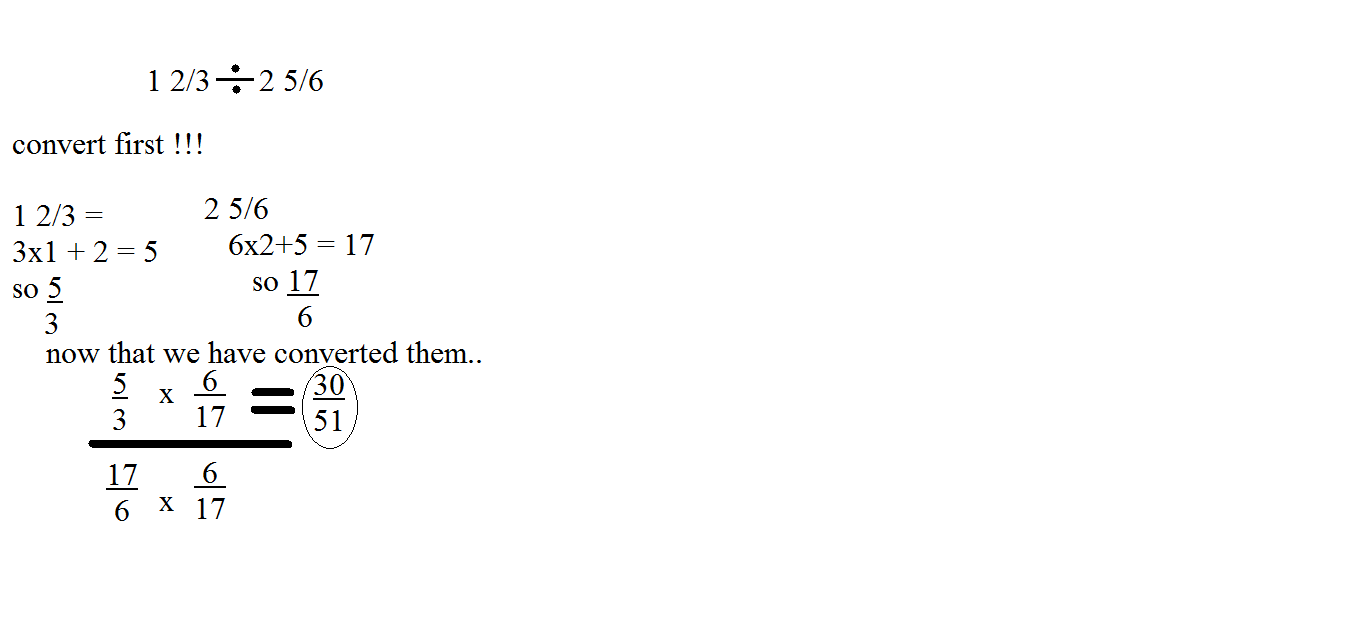

19 2 5 Divided By 2 3 4

19 2 5 Divided By 2 3 4

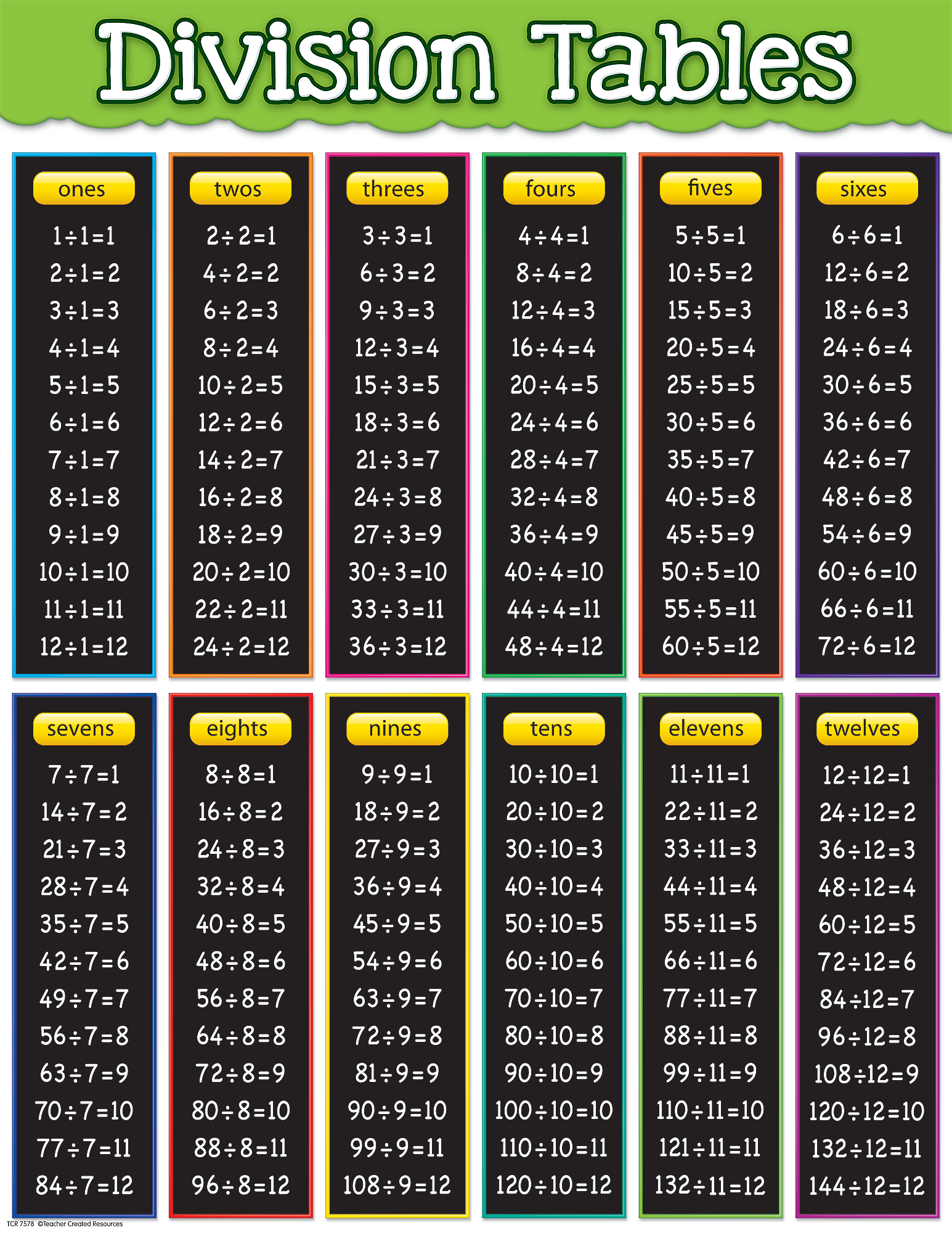

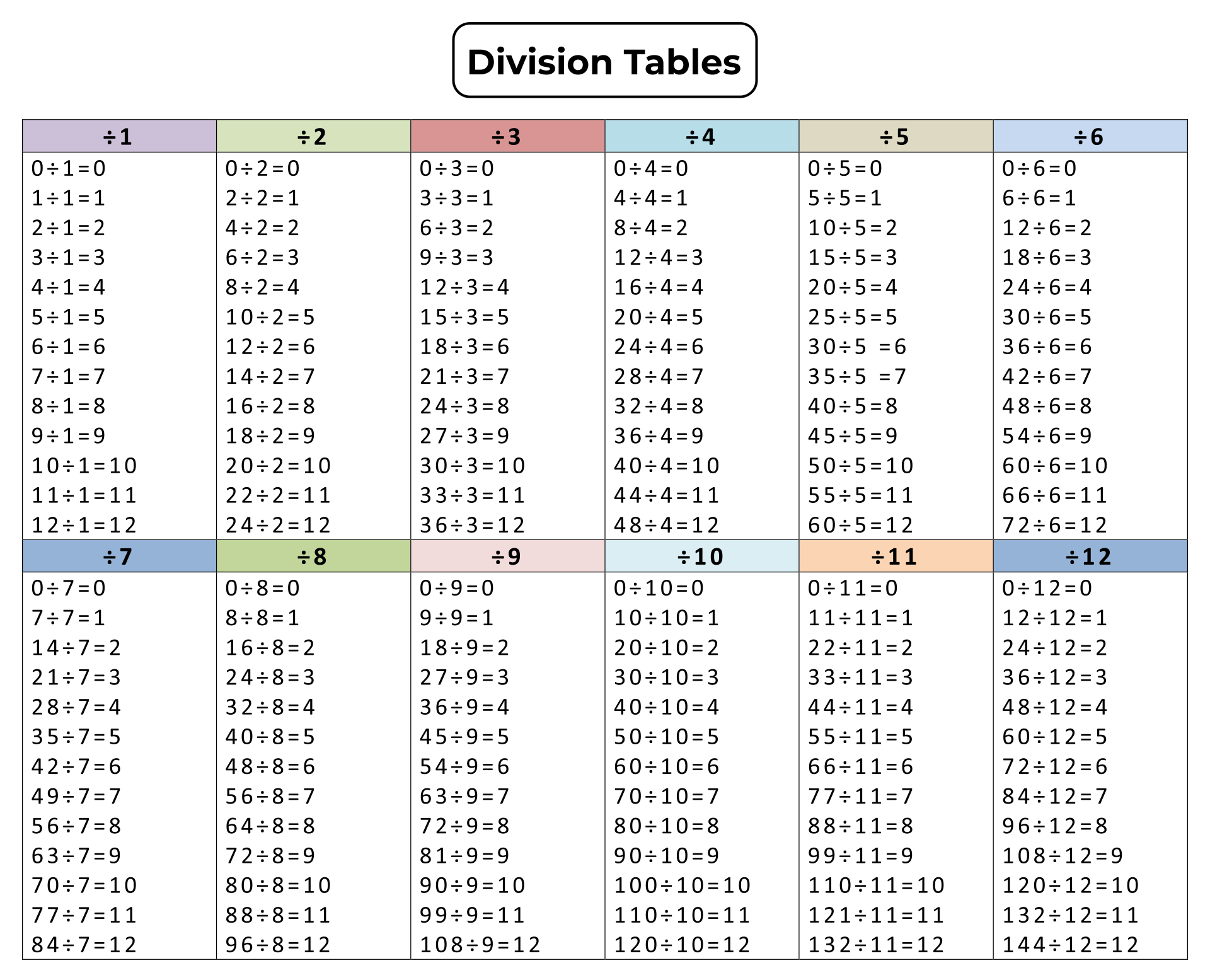

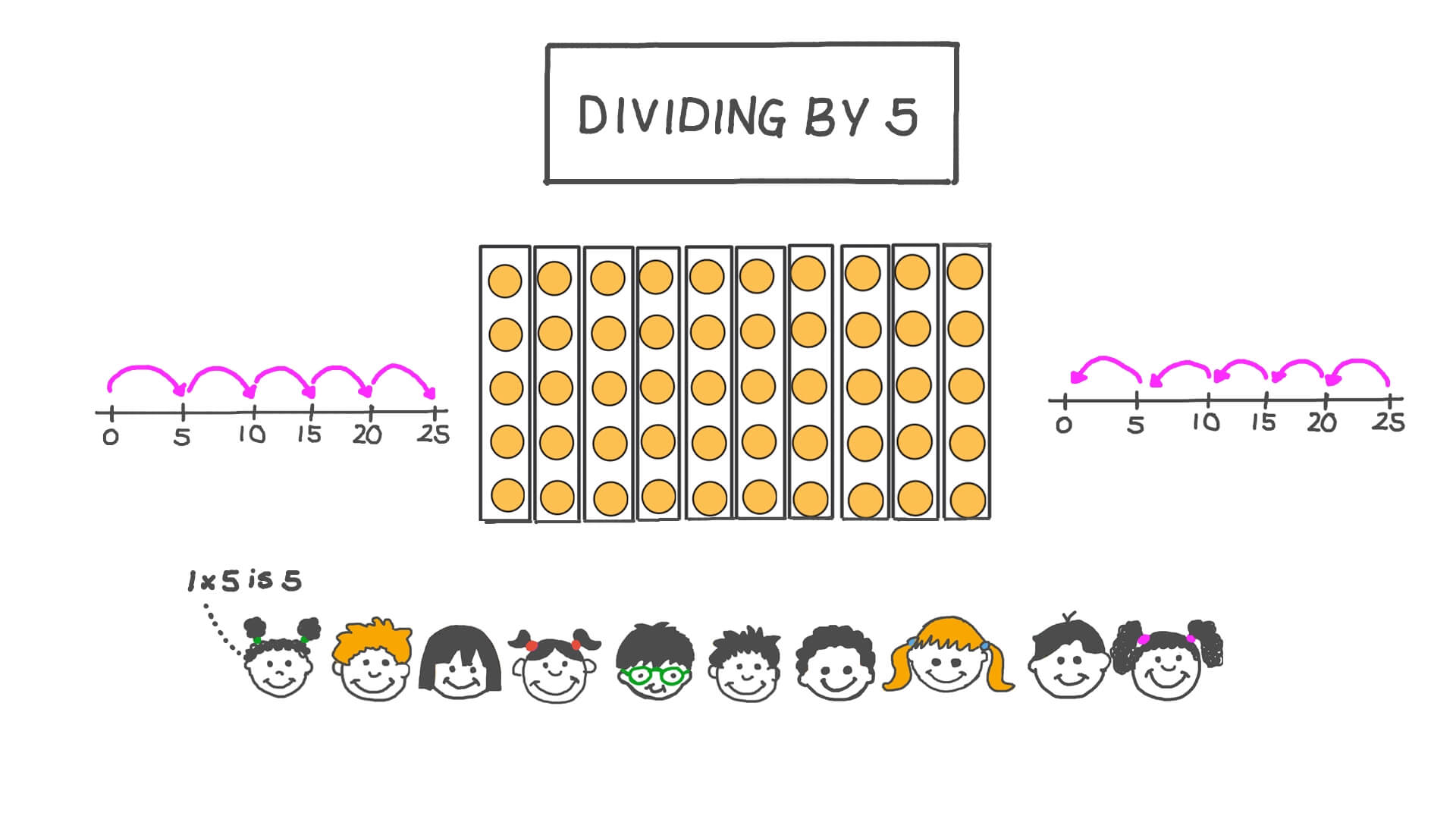

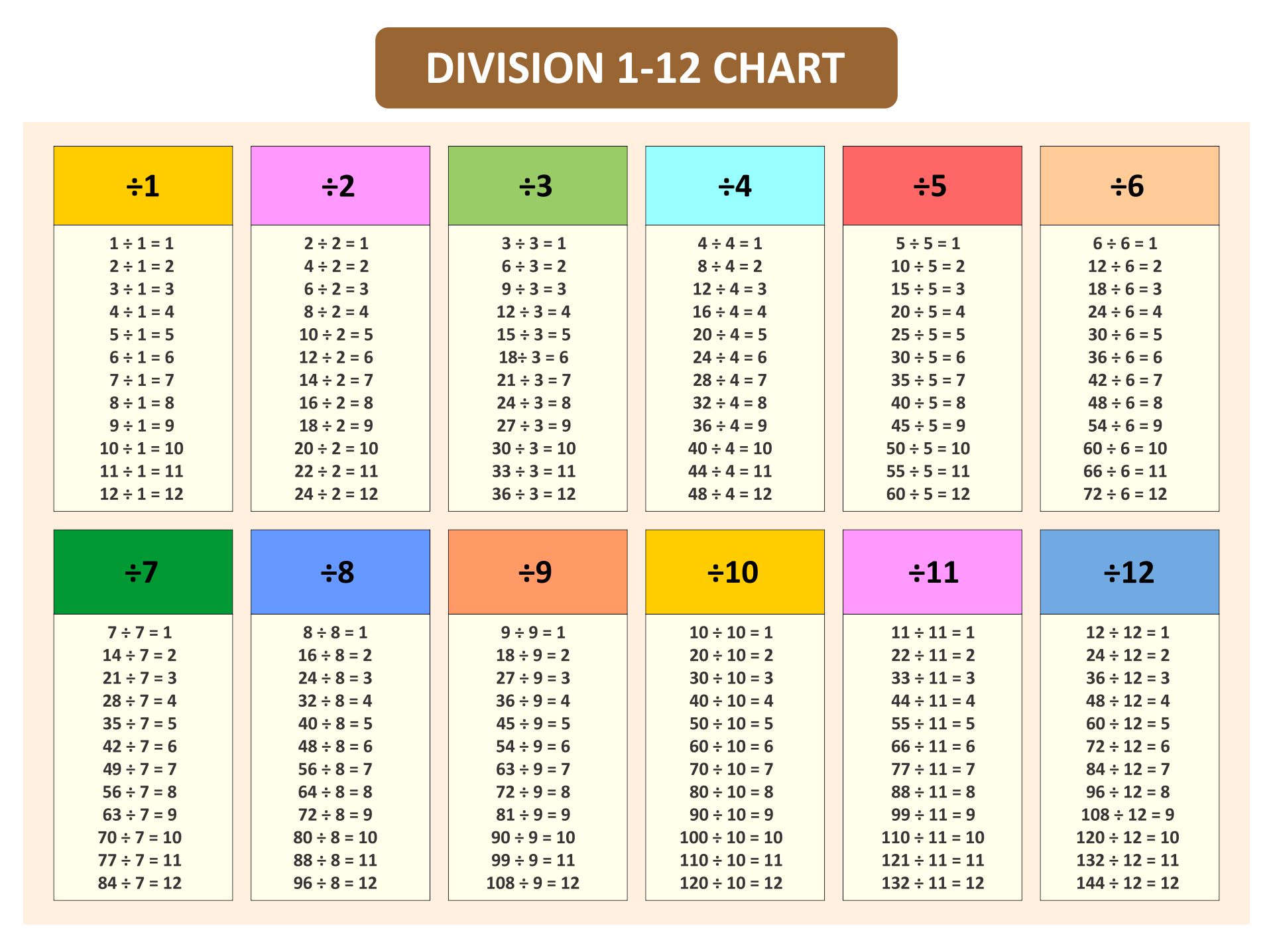

On this page you will find many Division Worksheets including division facts and long division with and without remainders This resource includes 2 Multiplication and Division Charts from 1-12 (color/ black & white). Students can use these reference pages to help them master their ...

Free Printable Division Math Table Worksheet Creative Center

Long Division Video Corbettmaths Primary

19 2 5 Divided By 2 3 4These division facts table are colorful and a great resource for teaching kids their division facts. A complete set of printable division facts for 1 to 12. Free Printable Division Chart a great educational resource to help students learn division at any grade at school or homeschool

We have a variety of chart designs to choose from to hang up on walls or put in the school folders for daily review. What Is 6 Divided By 100 1 5 Divided By 2 6 7

Division chart printable TPT

A4 Division Tables Poster A Fun Bright Visual Aid For Helping To Begin

Free Printable Division Chart 1 20 can be downloaded in PDF PNG and JPG formats Free Printable Black and White Division Table 1 20 5 Divided By 1000

Free PDF Download MULTIPLICATION DIVISION Table Charts 0 12 No signups or login required just download for free What Is 4 5 Simplified What Is 5 Divided By

Three Division Tables

Division By 1

10 Divided By 4 5

Times Table And Division

Division Chart Printable

1 4 Divided By 7

40 Divided By 100

5 Divided By 1000

Times Table And Division

3 5 Divided By 3