19 800 Divided By 9 are a versatile service for anybody seeking to create professional-quality documents promptly and conveniently. Whether you require custom-made invitations, returns to, planners, or business cards, these templates permit you to individualize material effortlessly. Just download the template, modify it to match your requirements, and publish it in the house or at a print shop.

These templates conserve money and time, using an economical choice to hiring a developer. With a vast array of designs and layouts offered, you can locate the perfect style to match your personal or service demands, all while keeping a polished, professional look.

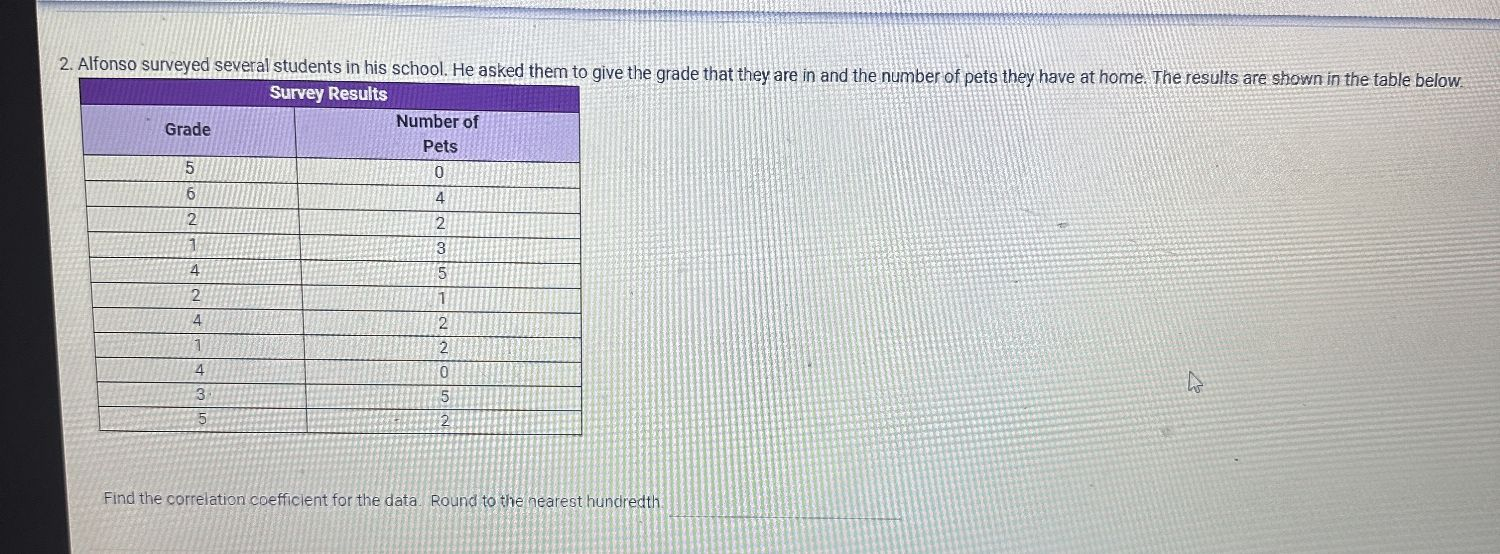

19 800 Divided By 9

19 800 Divided By 9

You can print out a donation receipt template pdf and issue handwritten receipts at events or customize a donation receipt template doc with your logo and This free template instantly generates a PDF receipt that can be downloaded, printed for your records, or automatically emailed to donors for their tax returns.

DONATION RECEIPT Download Print Complete

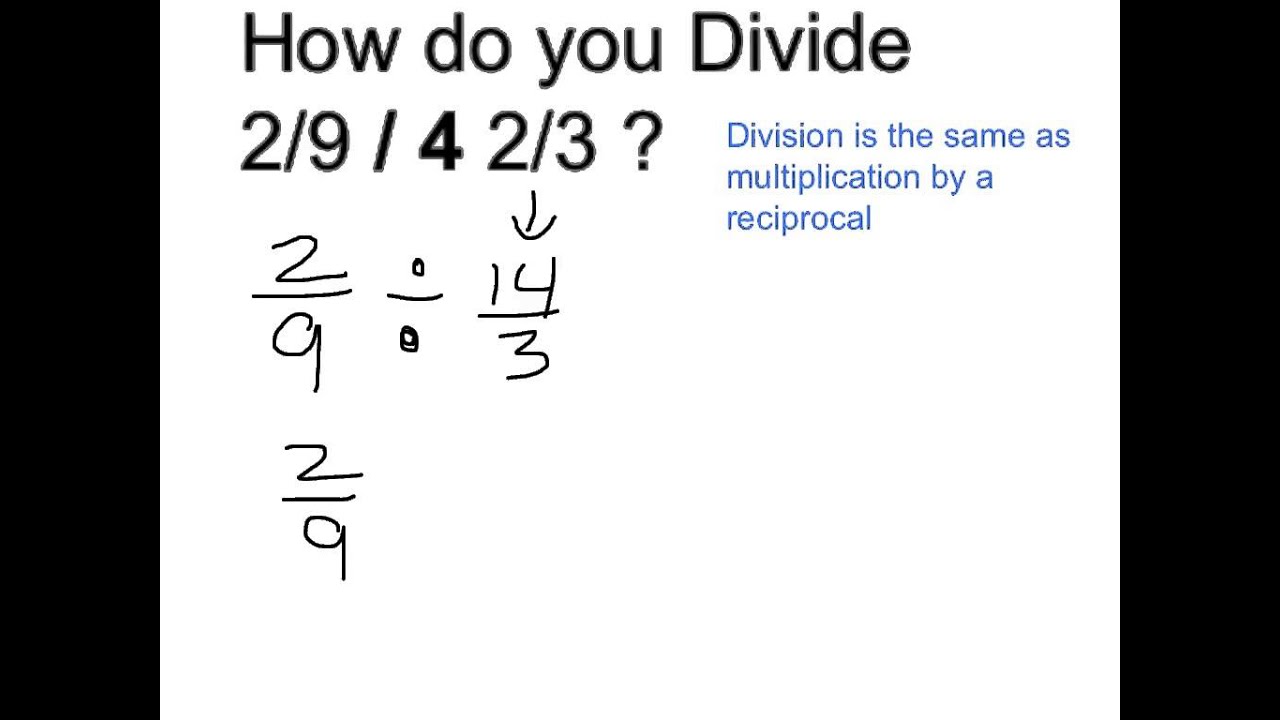

9 To The Power Of 7 Divided By 9 Brainly in

19 800 Divided By 9The purpose of this donation receipt is to formally acknowledge donations made to nonprofit organizations. ... Free Printable Receipt Template for Businesses. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual business or organization

The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information. [img_title-17] [img_title-16]

Donation Receipt Template PDF Templates Jotform

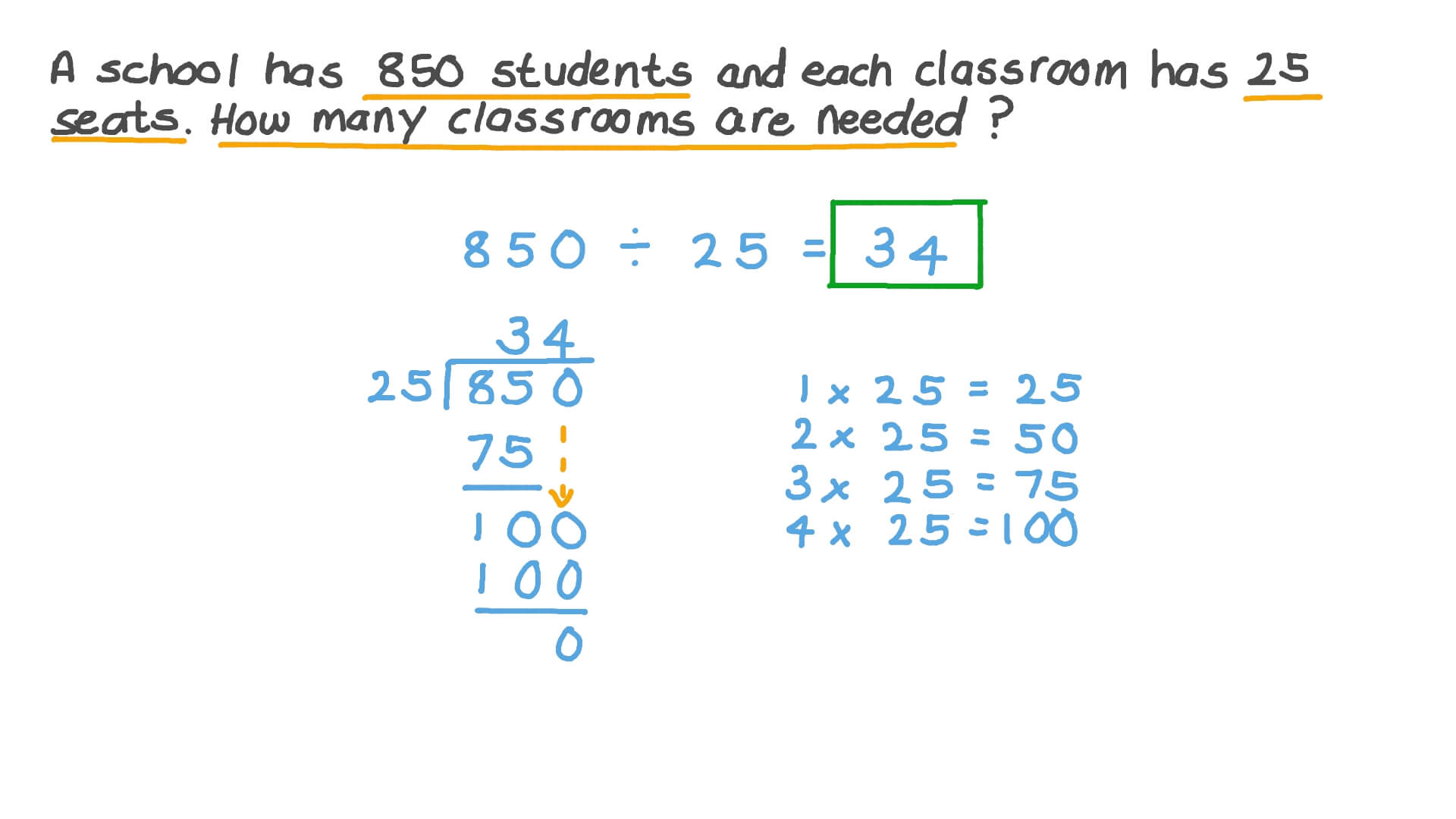

Question Video Solving Word Problems Involving Division Of Numbers Up

This receipt is issued to individuals who have donated cash or payment personal property or a vehicle and seek to claim the donation as a tax deduction [img_title-11]

This receipt is the only record of your tax deductible donation INFORMATION TO BE COMPLETED BY DONOR Name Date Address City [img_title-12] [img_title-13]

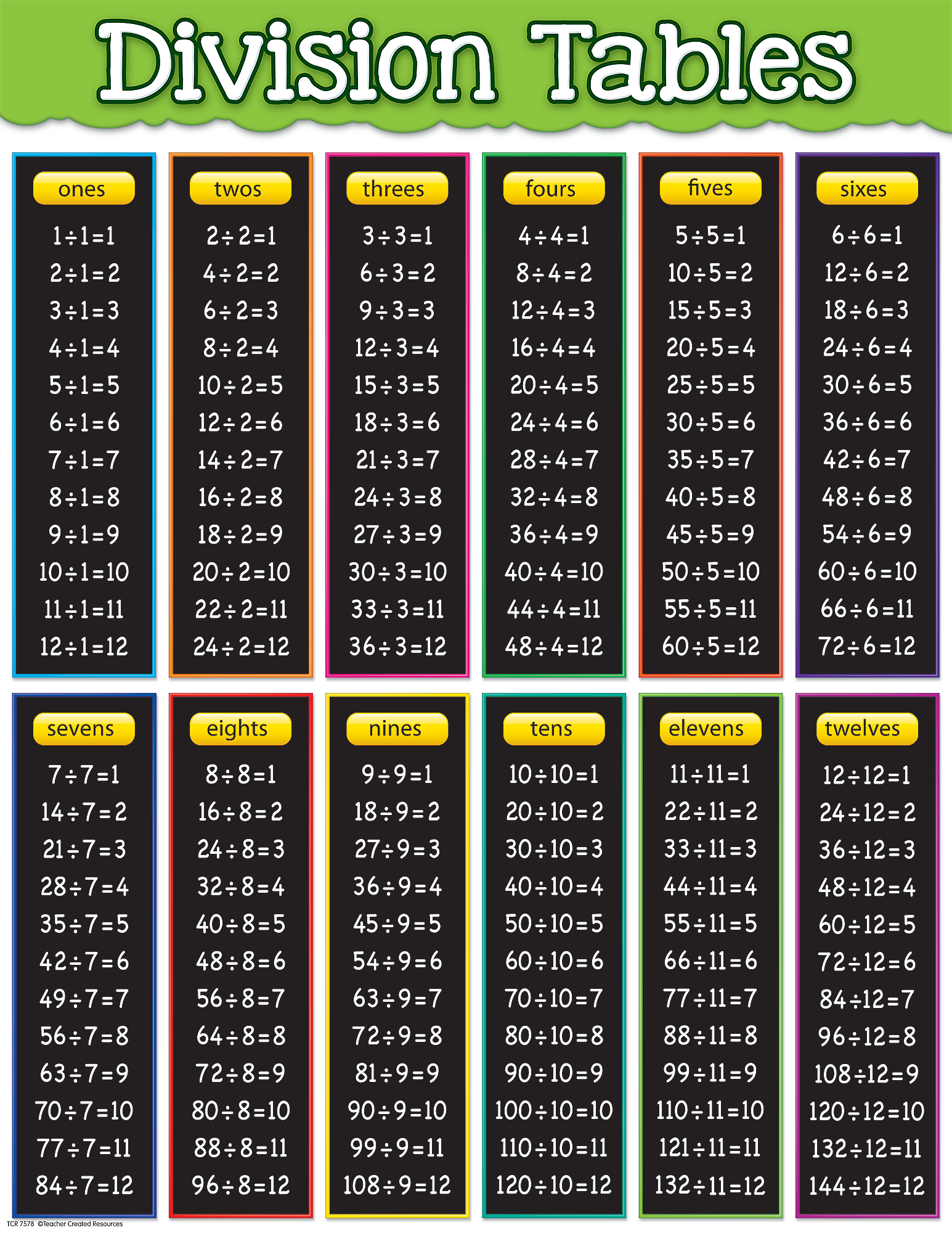

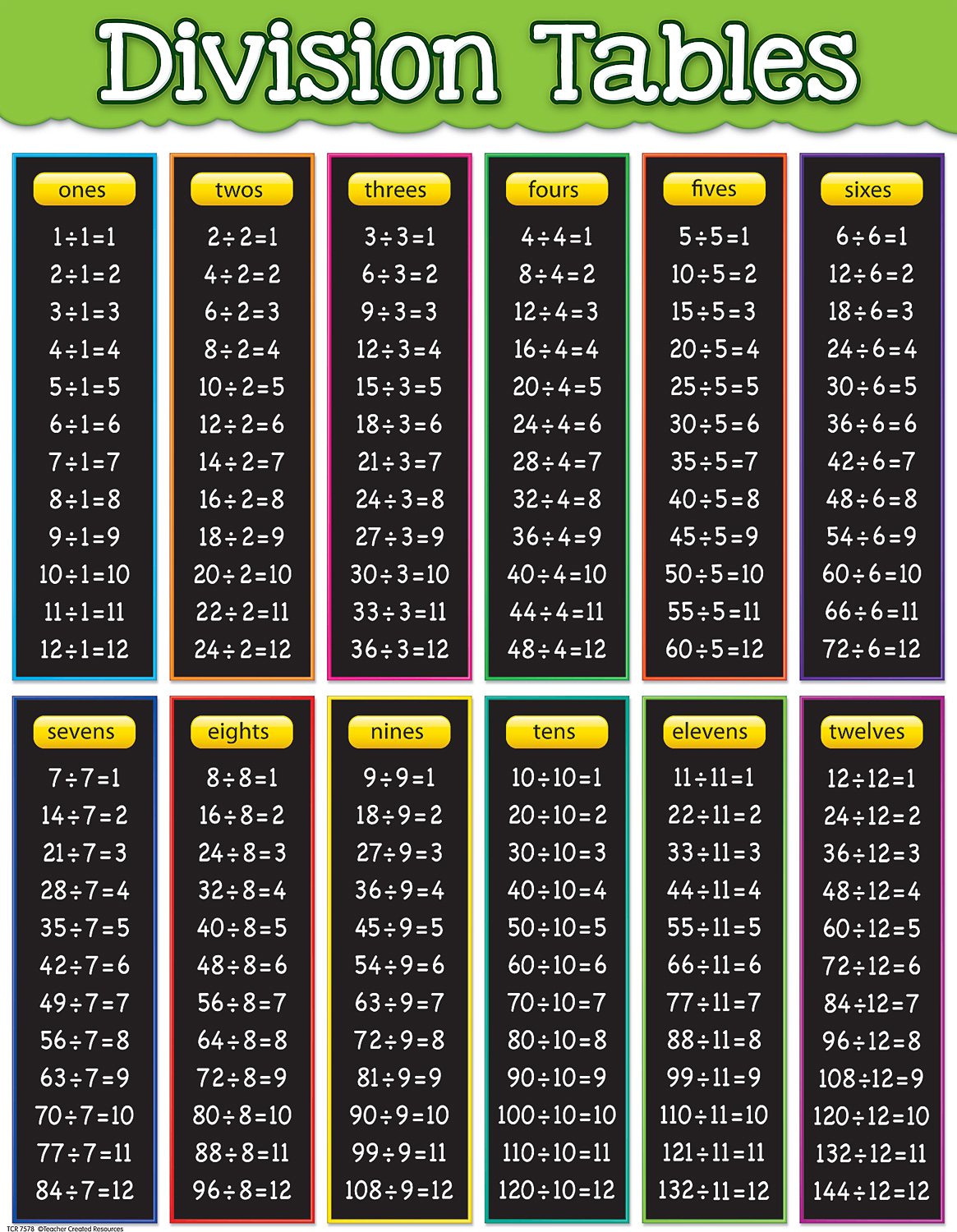

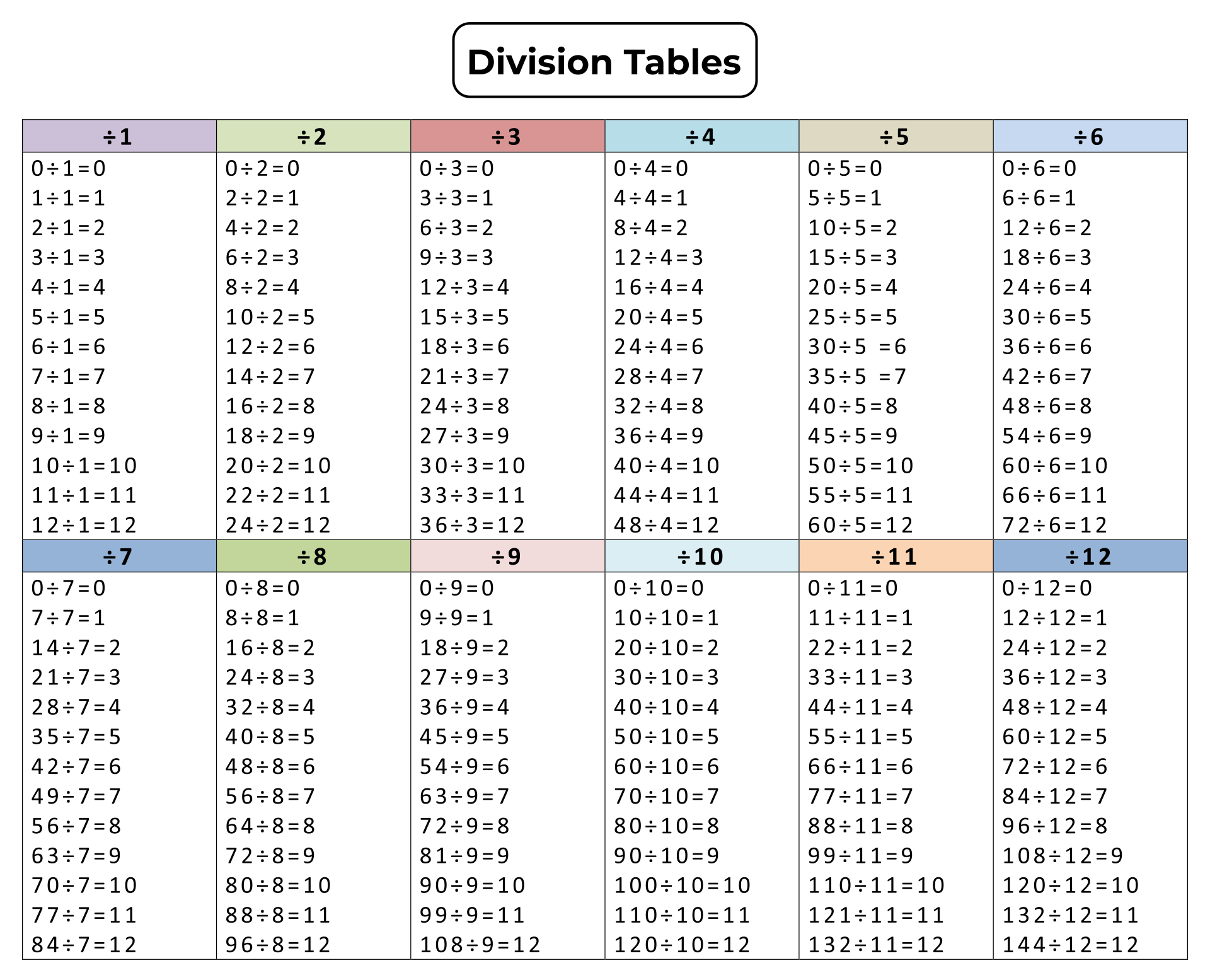

Division 1 12 Chart

19 Divided By 800 68 Divided By 1025 15231582 05 05 2021 13 52

Division Tables Chart From Teacher Created Resources School Crossing

Division By 1

10 Divided By 1000

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]