2 2 24 Wordle are a flexible solution for anybody wanting to create professional-quality records swiftly and conveniently. Whether you require personalized invites, resumes, planners, or calling card, these design templates allow you to individualize content with ease. Merely download and install the layout, edit it to suit your demands, and print it in the house or at a printing shop.

These design templates conserve time and money, using a cost-effective option to employing a designer. With a variety of styles and styles available, you can discover the excellent layout to match your personal or organization requirements, all while keeping a sleek, specialist look.

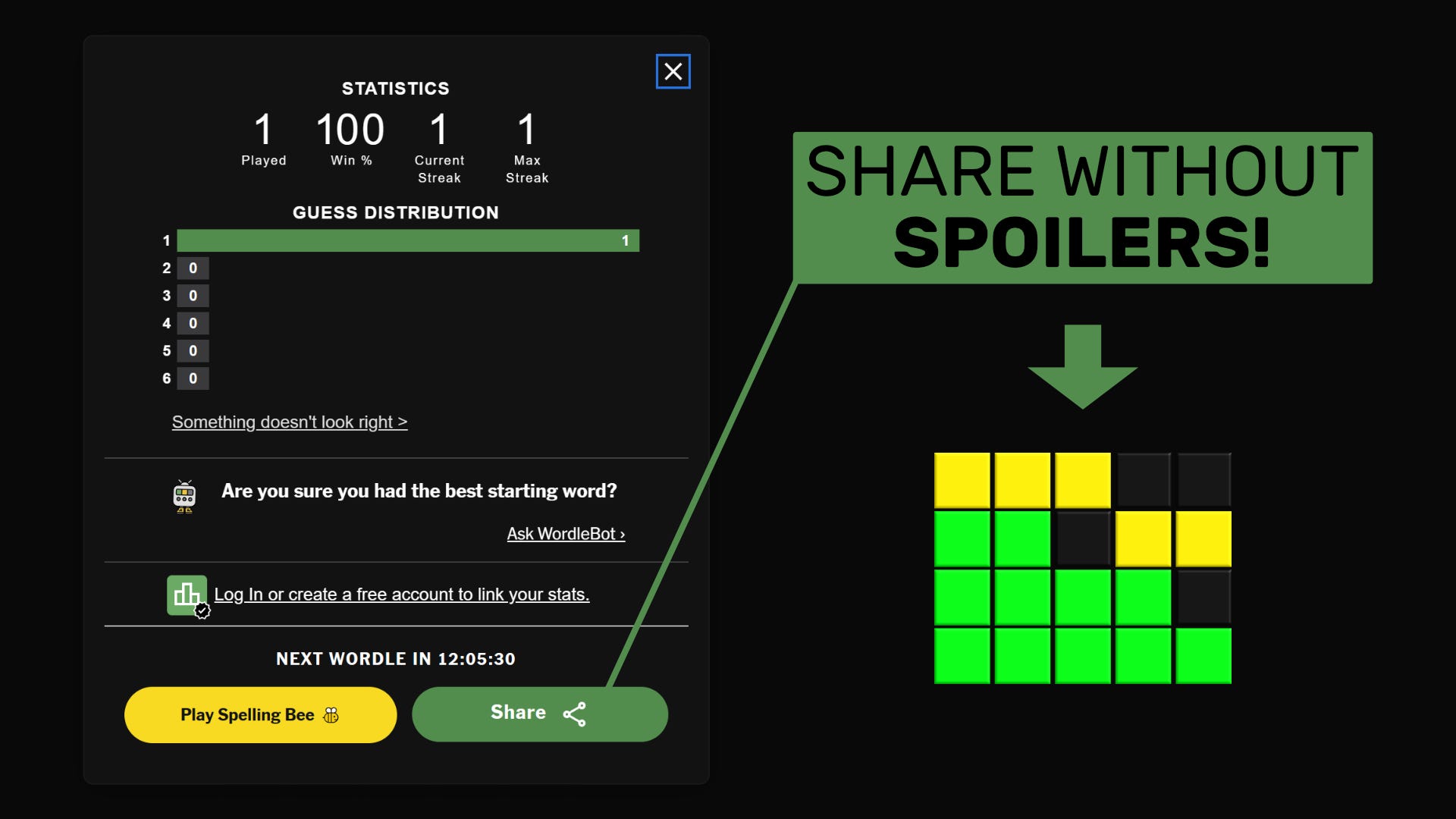

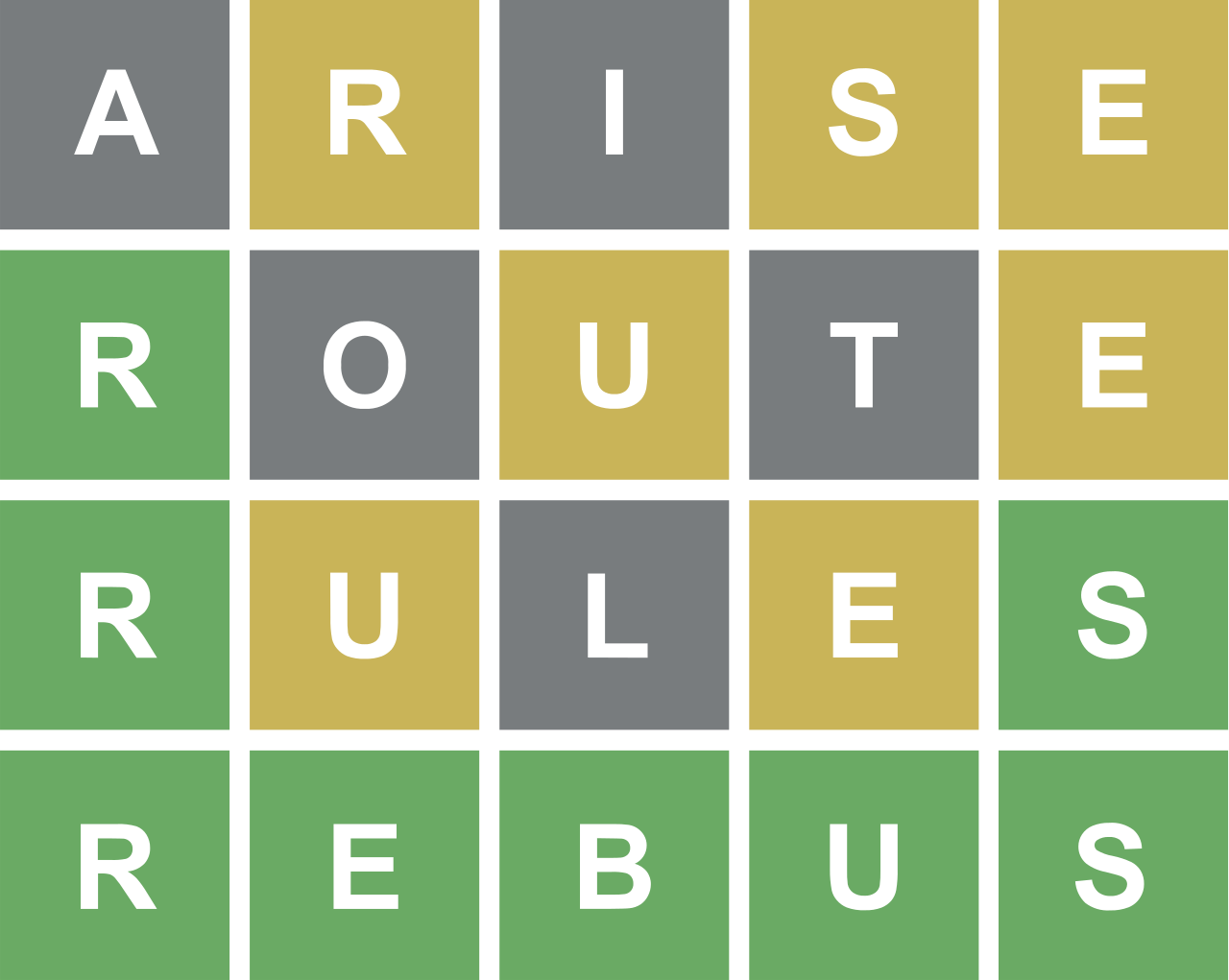

2 2 24 Wordle

2 2 24 Wordle

These prints are great for the classroom for a party or program or just pick your favorite and frame it I have created a couple of printables to help bring out the kid in each of us. Enjoy! Click HERE for the chalkboard print.

Dr Seuss Free Printable Serendipity And Spice Pinterest

Wordle For November 1 2025 Gayla Cherianne

2 2 24 WordleModern gorgeous FREE printable Dr. Seuss Quotes for you to download, print, and frame. These quotes look great in a nursery, room, ... 10 fun Dr Seuss Quotes Great for Dr Seuss themed classroom or bulletin display Quotes included Today was good Today was fun Tomorrow is another one

In this curated collection, we'll handpick quotes that encapsulate Dr. Seuss's wisdom, humor, and boundless imagination. From insightful ... [img_title-17] [img_title-16]

Dr Seuss Printables Craft Lightning My Craftily Ever After

Wordle Hint And Answer For Wednesday January 3 Rock Paper Shotgun

Dr Seuss Quote printable wall art is an INSTANT DIGITAL DOWNLOAD and no physical print will be mailed to you However you can print it out as many times as [img_title-11]

21 Incredible Dr Seuss Quotes with images This set of Dr Seuss quotes come in a printable format for you to print and use as decor too [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]