21 Divided By 36 As A Fraction are a functional service for any person wanting to create professional-quality files quickly and easily. Whether you need personalized invites, returns to, organizers, or calling card, these themes enable you to customize material with ease. Merely download and install the design template, modify it to fit your needs, and print it at home or at a print shop.

These templates conserve time and money, offering a cost-efficient choice to hiring a designer. With a wide range of designs and formats offered, you can discover the excellent style to match your individual or service demands, all while keeping a refined, professional look.

21 Divided By 36 As A Fraction

21 Divided By 36 As A Fraction

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Give form to the requester. Do not send to the IRS. Before you begin. For guidance related to the purpose of Form W-9, see Purpose of Form, below. Print or type ...

W9 form ei sig pdf

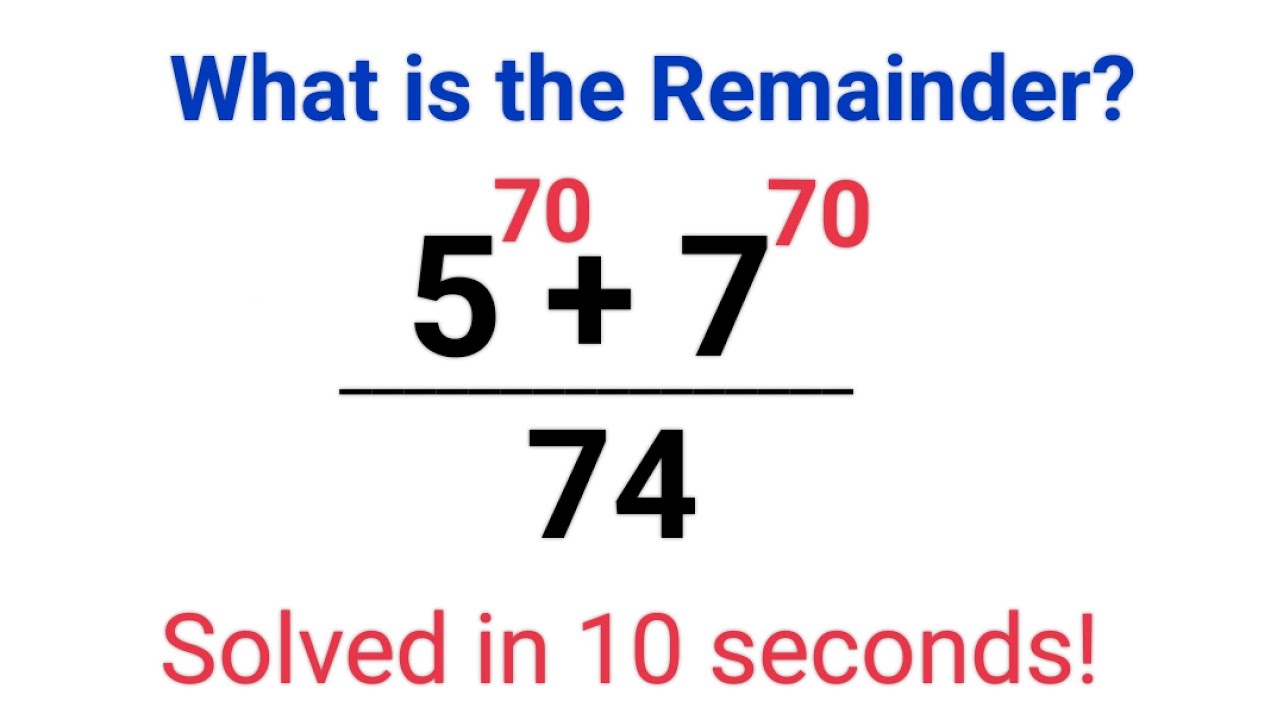

How To Find Remainder Of A Number With Power fastandeasymaths math

21 Divided By 36 As A FractionFormsOffices and ContactsInstitutional DataStudent Accounts. More. Open Search. W-9 (blank IRS Form). IRS Form W-9 (rev March 2024). W-9 Form. ©2024 ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

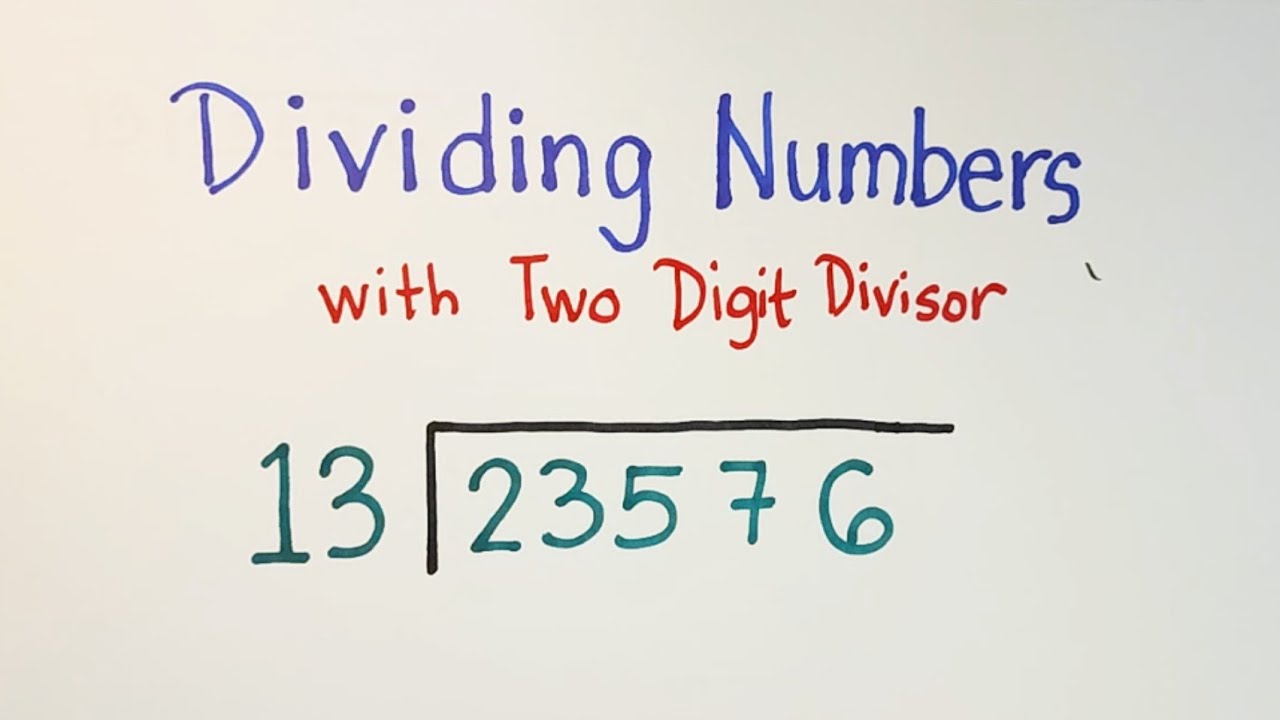

Go to www.irs.gov/Forms to view, download, or print Form. W-7 and/or Form SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and have Form W-7 ... Long Division Decimals And Remainders Times Table And Division

Form W 9 Rev March 2024

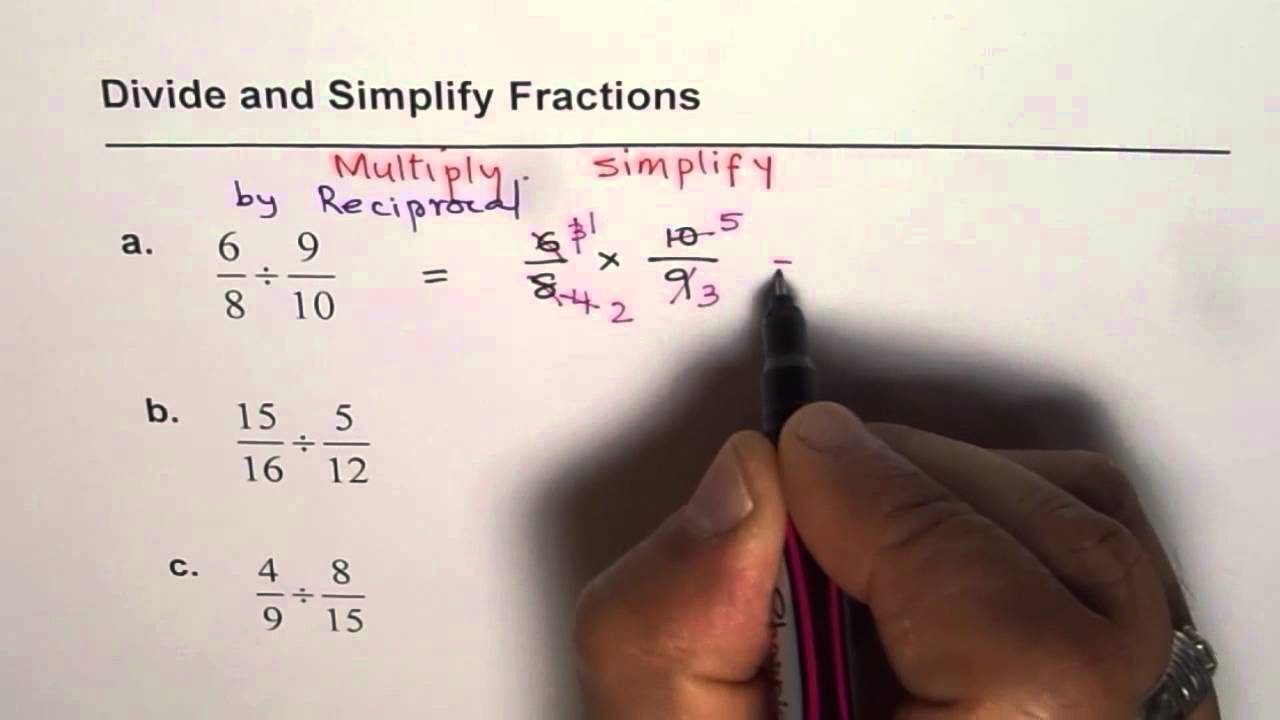

15 As A Fraction Decimal To Fraction

The W9 is a formal request for information about the contractors you pay but more significantly it is an agreement with those contractors that you won t be 28 Divide By 30

Form W 9 Request for Taxpayer Identification Number TIN and Certification Used to request a taxpayer identification number TIN for 500 Divided By 15 8 9 Divided By 8

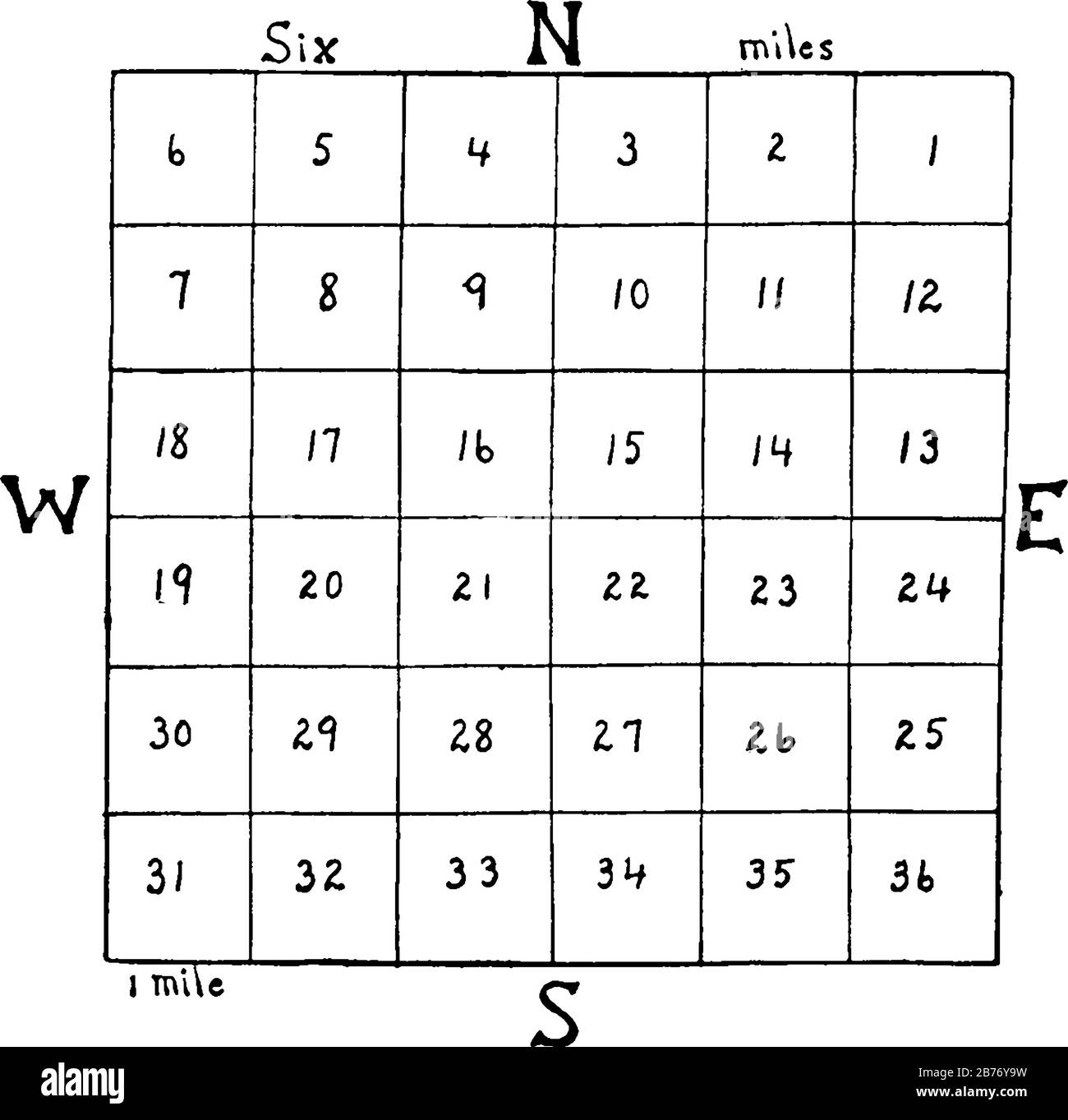

640 Stock Vector Images Alamy

27 15 Simplified Form

28 Divide 400

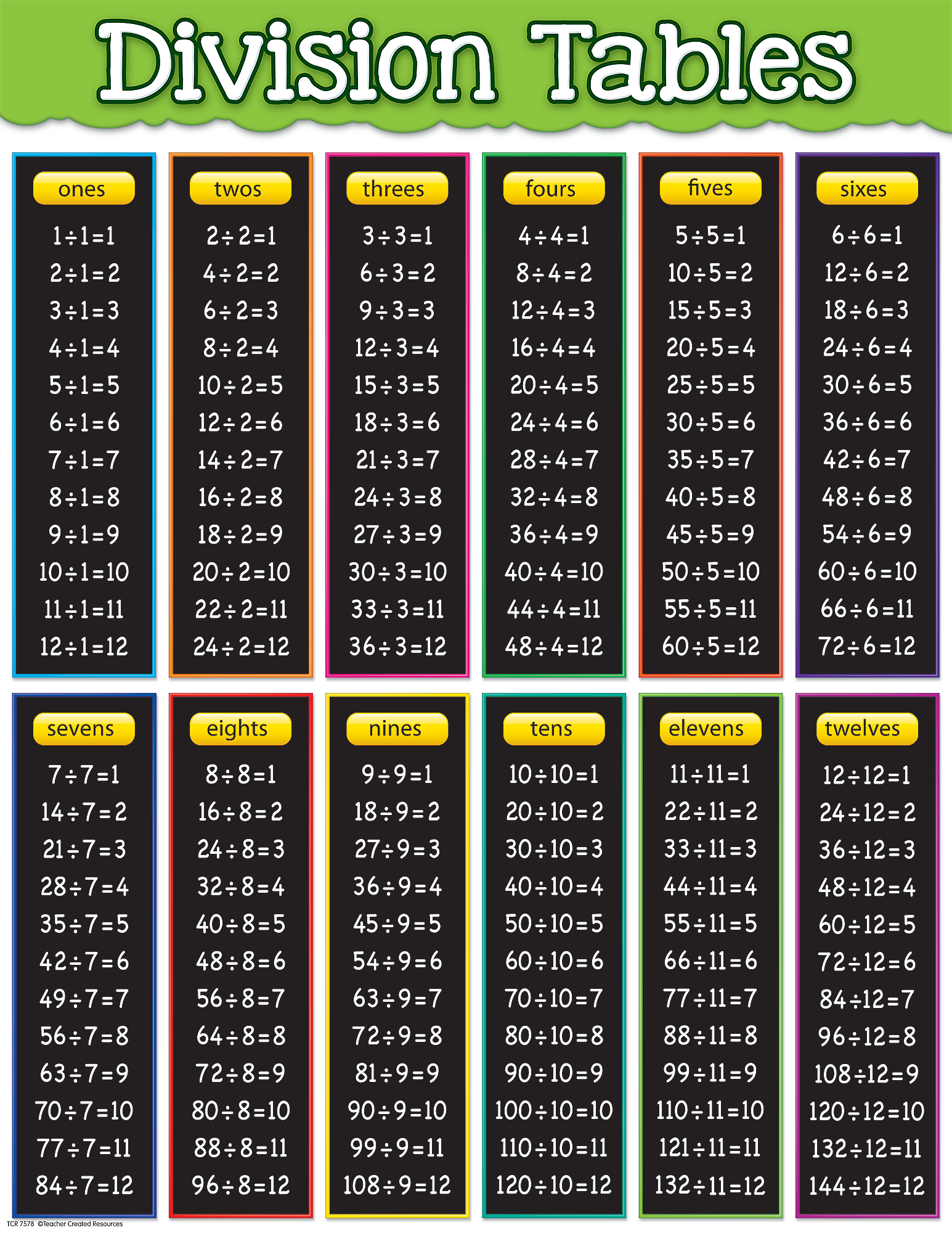

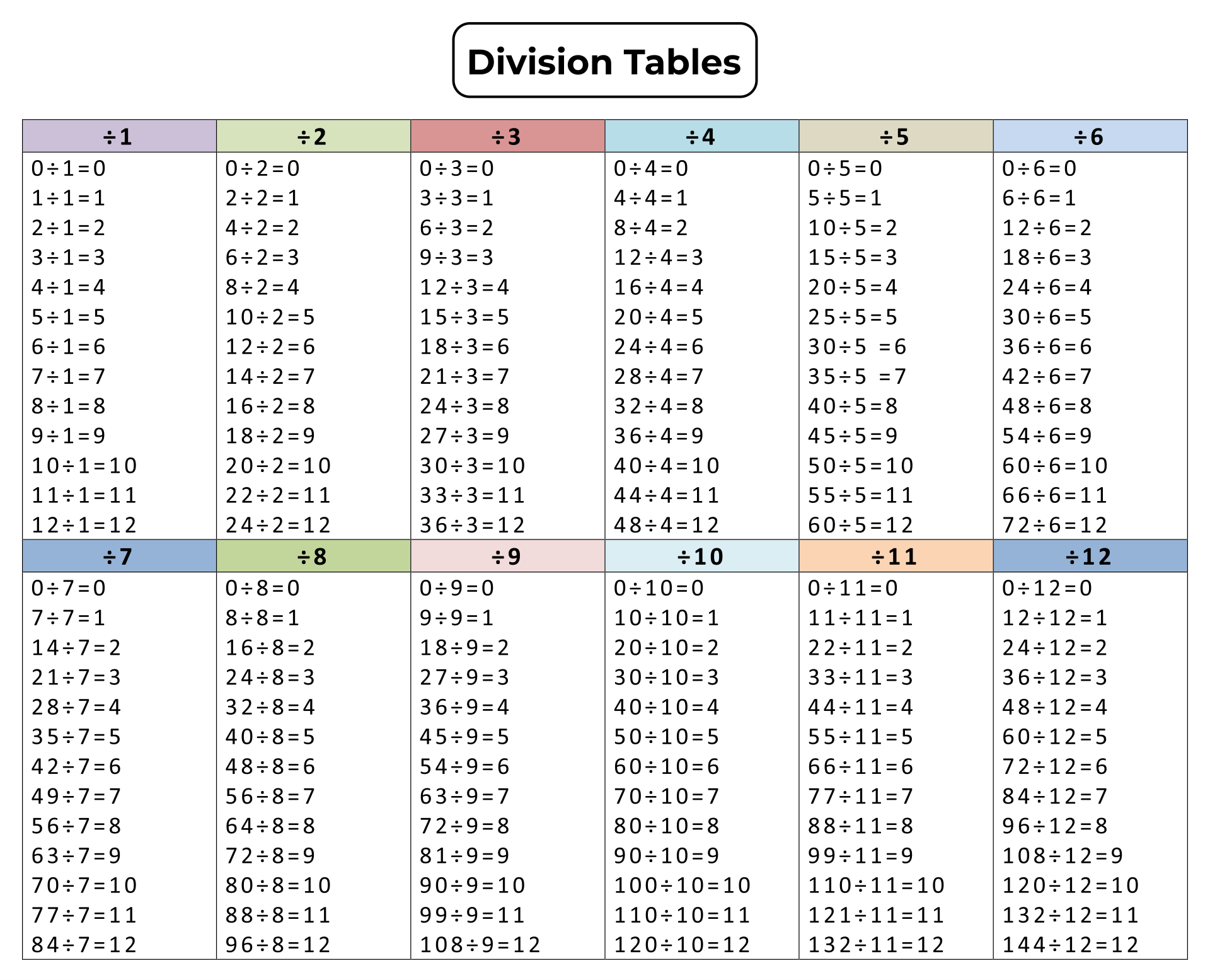

10 Division Table

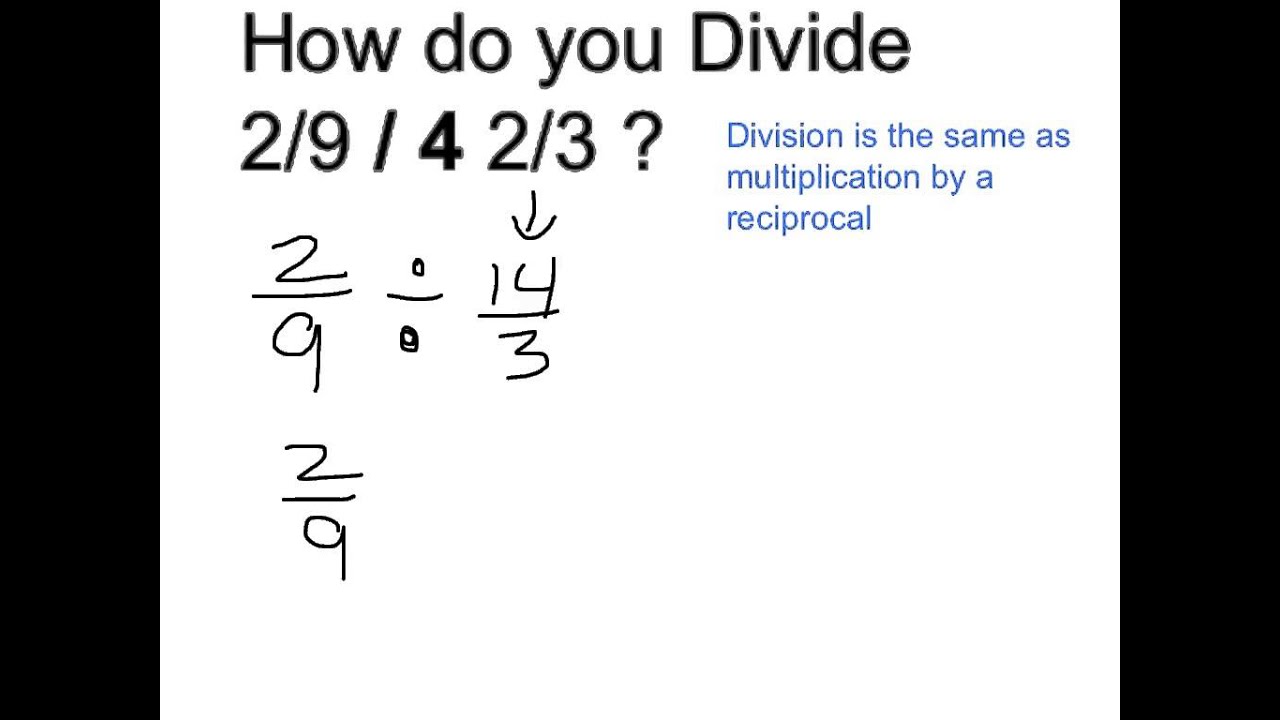

5 6 Divided By 2

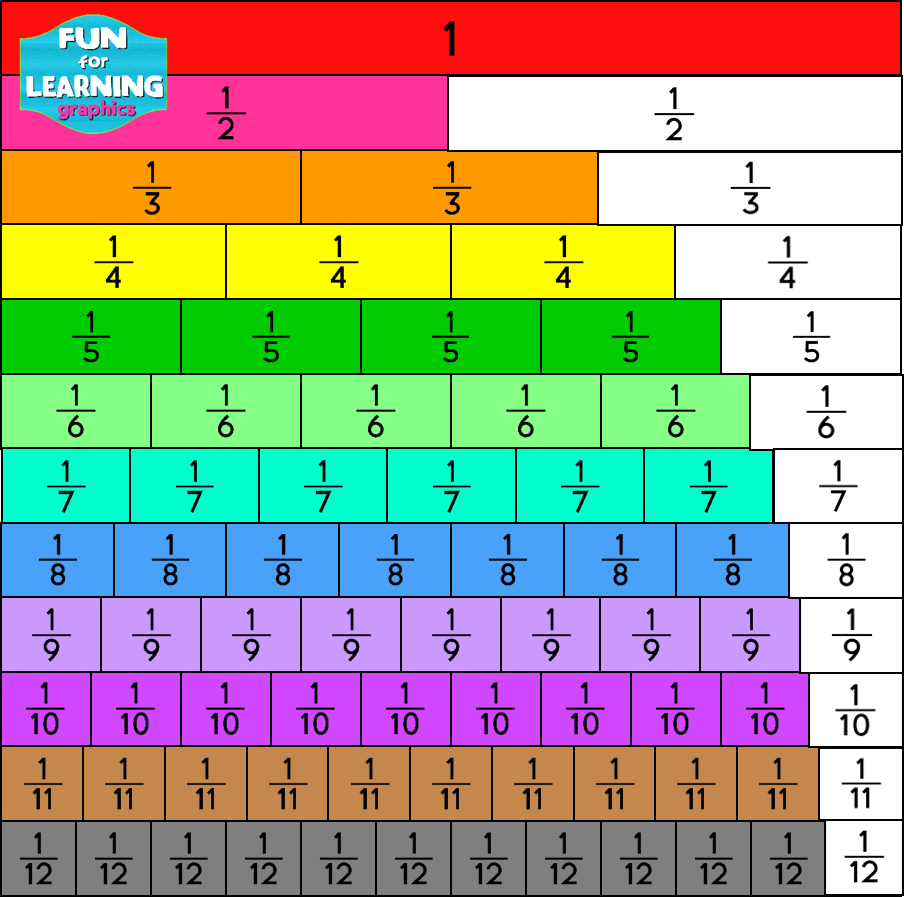

Bar Diagram Fractions

28 Divide By 30

28 Divide By 30

Blank Division Chart

Times Table And Division