28 Divided By 8 1 2 are a flexible remedy for anybody looking to produce professional-quality documents swiftly and conveniently. Whether you require custom invitations, resumes, organizers, or calling card, these design templates enable you to individualize content easily. Simply download and install the template, modify it to fit your demands, and print it in your home or at a print shop.

These templates save money and time, using a cost-efficient alternative to working with a developer. With a large range of designs and formats readily available, you can locate the best design to match your personal or organization demands, all while keeping a refined, expert appearance.

28 Divided By 8 1 2

28 Divided By 8 1 2

DIY custom wedding invitations Add your wedding details and customize colors online Download a print ready file then print unlimited copies at home Find your perfect Printable Wedding Invitation Card and Suite Template. Customize and print elegant designs for your special day. Start personalizing now!

Downloadable Wedding Invitation Etsy

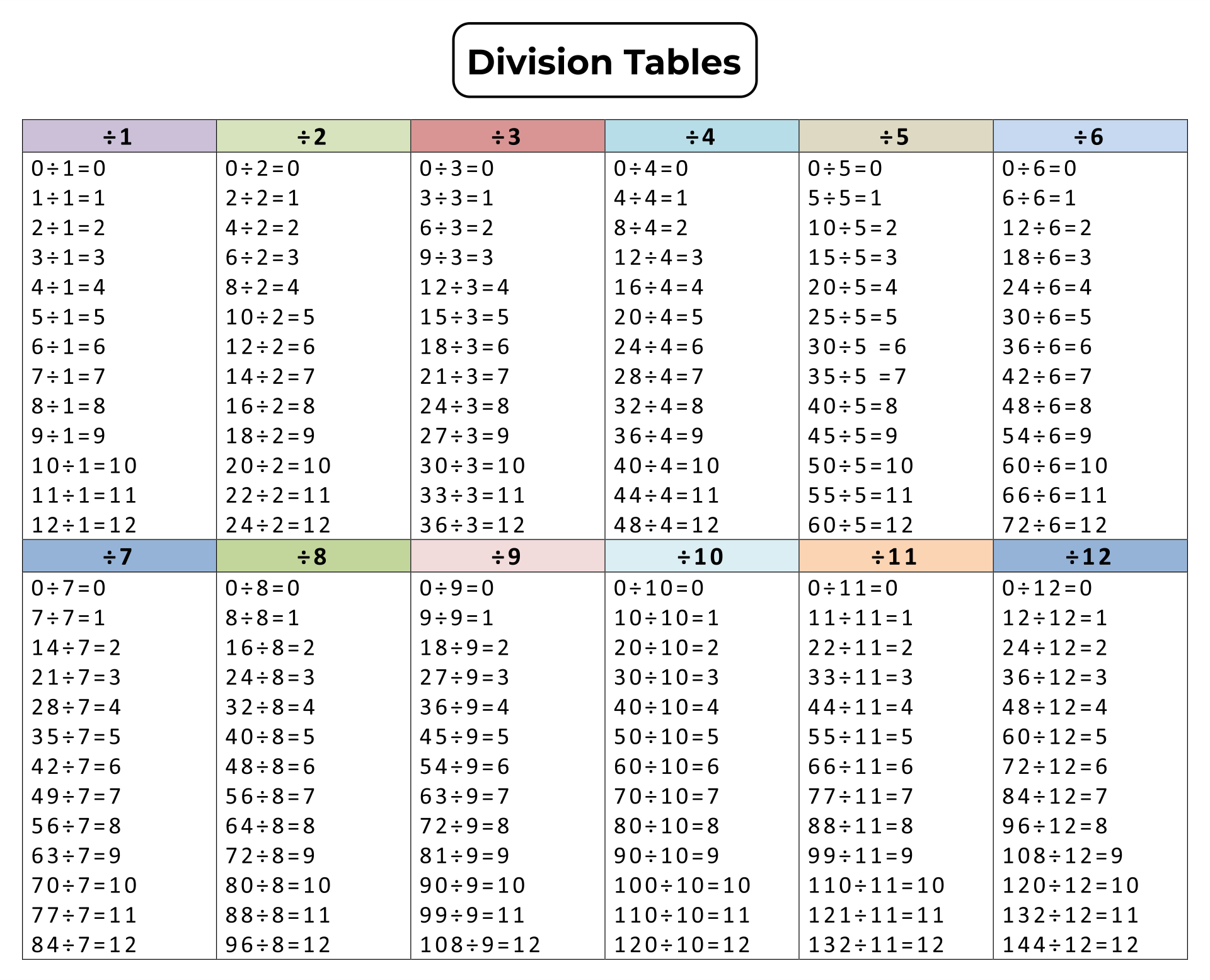

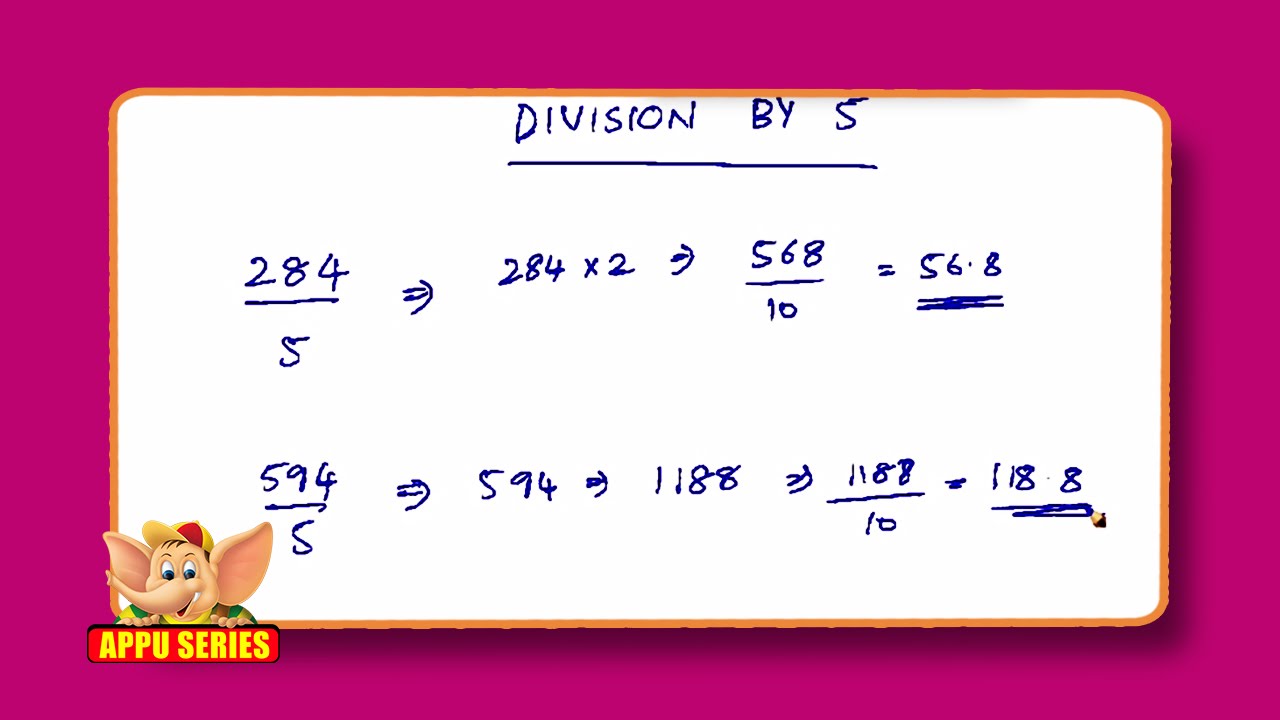

12 Division Charts For Making Maths Fun Kitty Baby Love

28 Divided By 8 1 2Boho Simple Vintage Flowers wedding Invitations Set Template, Instant Download Printable Invites Home Printing, Simple Wedding Cards. ( 227/template/z ). We offer great designs that you can customize download and print at home for free Enjoy these designs and have fun making your own unique wedding invitation

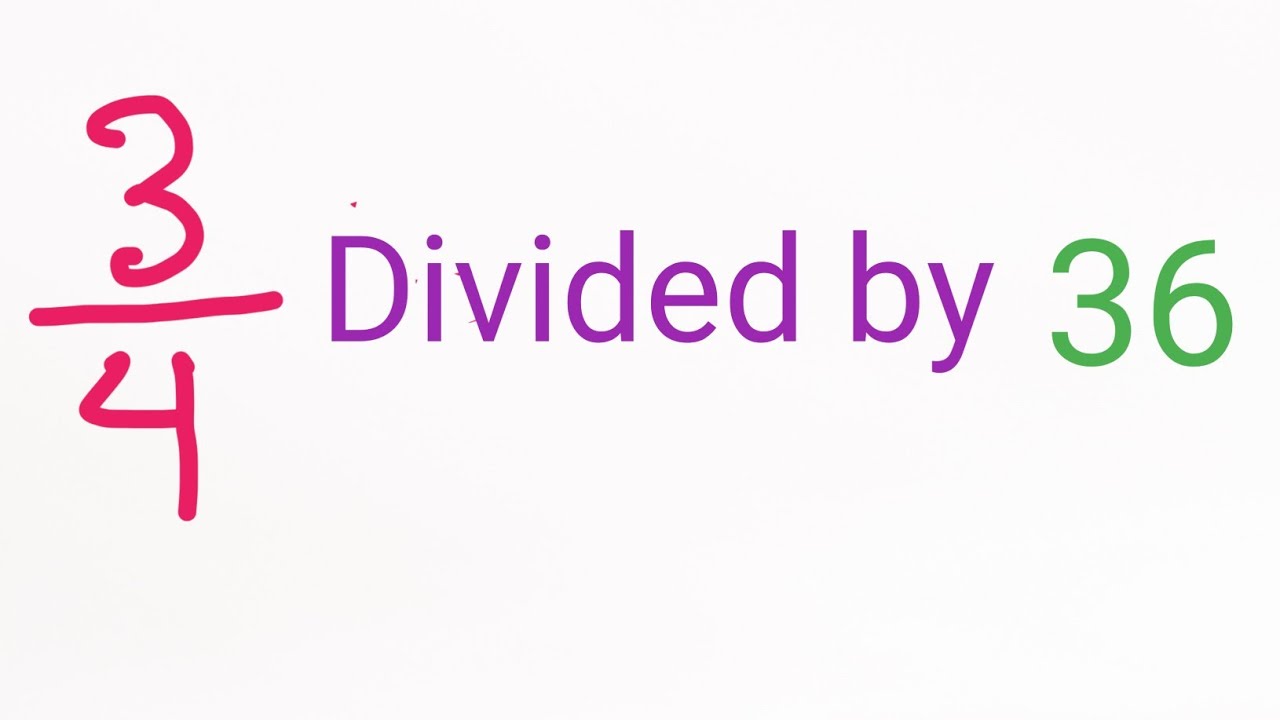

Explore elegant wedding invitations with free recipient addressing. Order FREE samples! Easily customize invites with photos, QR codes & more at Minted. 4 6 Divided By 1 2 10 Divided By 1 2

Printable Wedding Invitation Card Suite Template

10 Division Table

Why hire a designer when you can do it yourself These lovely Wedding Invitations can be customized and printed at home or your local print shop 10 Divided By 17

Our classic print at home invitation kit is a blank canvas for your personal style This smooth heavy weight paper will make a lasting impression 10 Division Table 10 Divided By 1 2

15 Divided By 23

15 Divided By 23

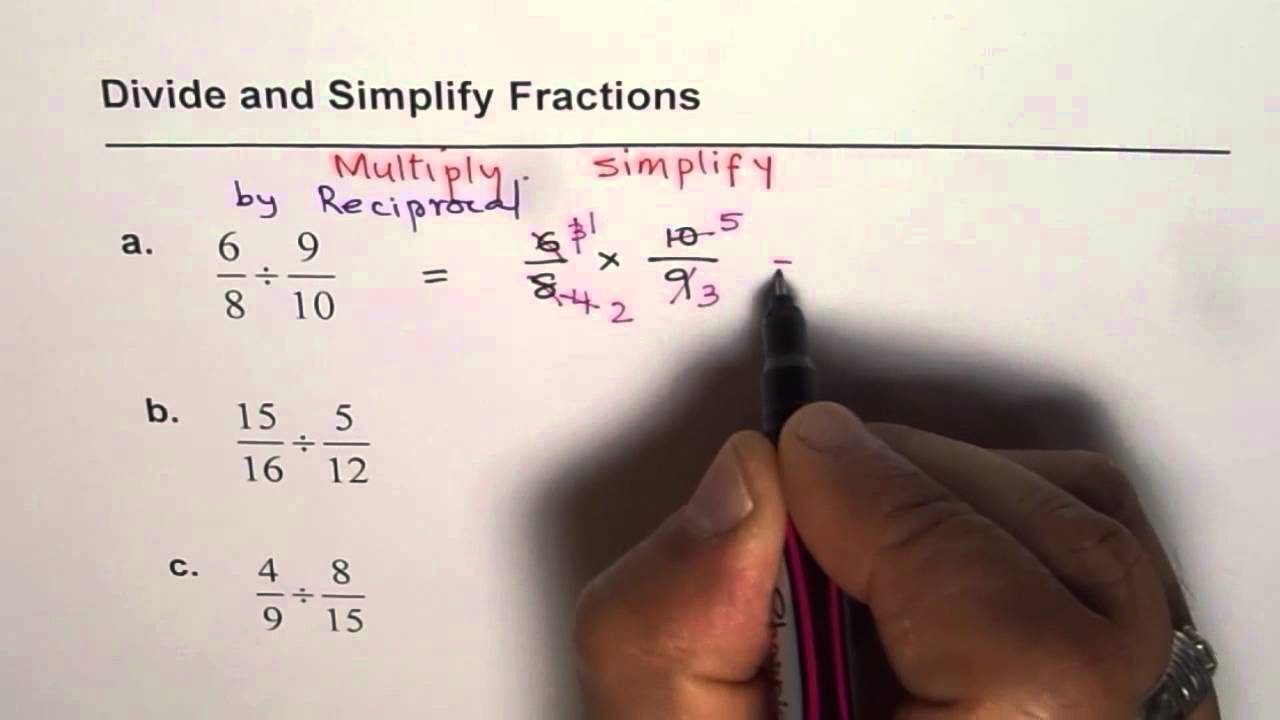

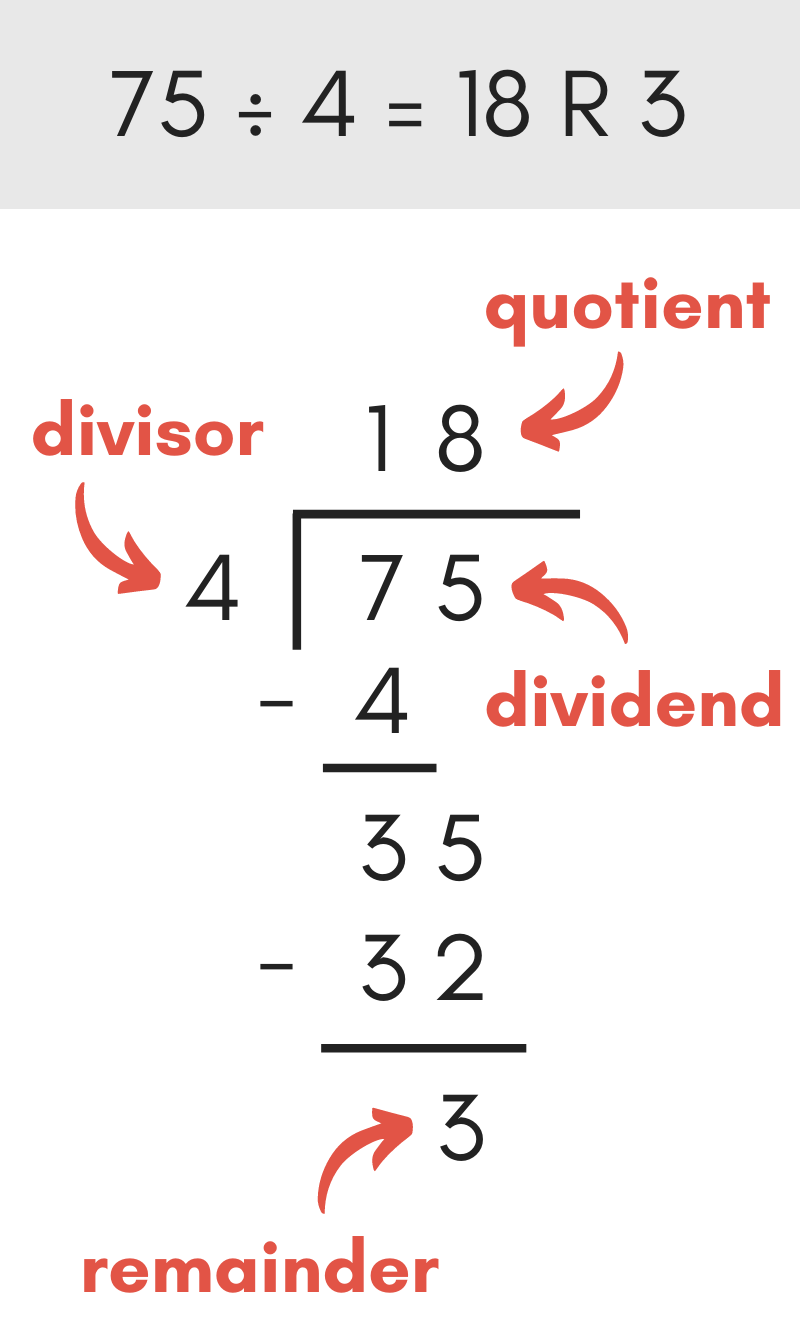

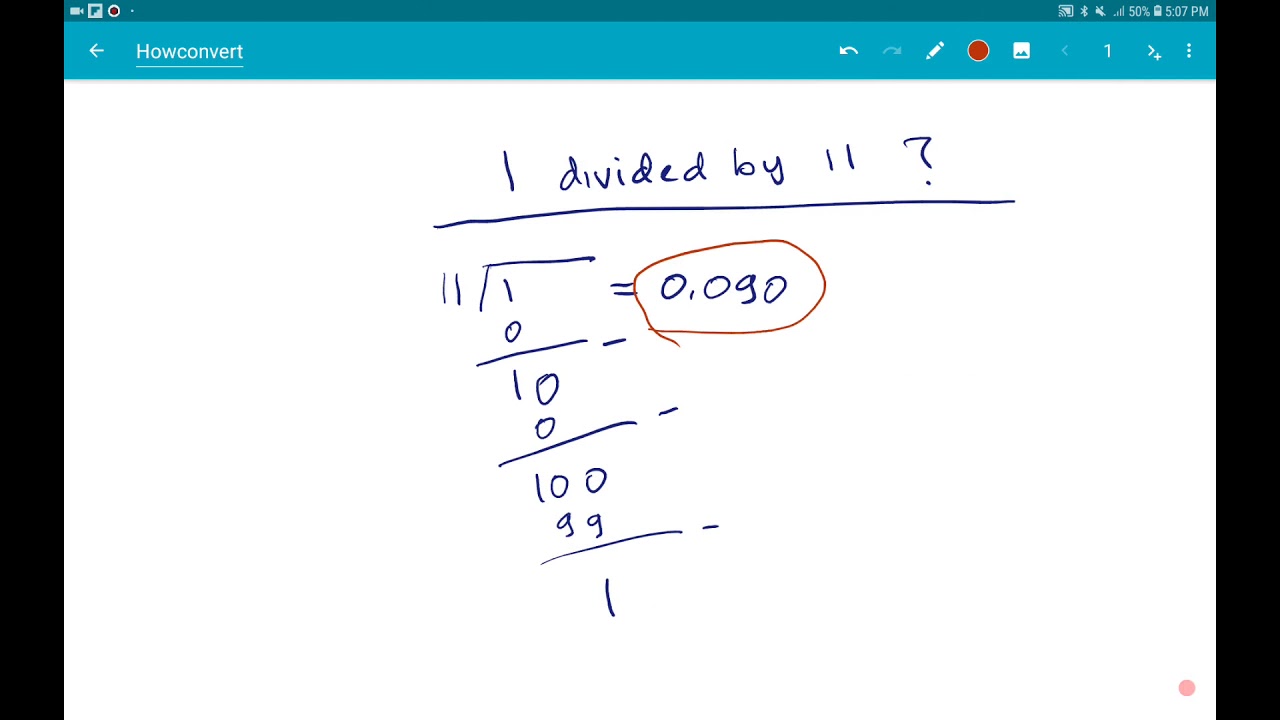

Solving Division

10 Divided By 140

Three Division Tables

Two Division Tables

Division Charts Printable

10 Divided By 17

4 5 Divided By 1 2

4 5 Divided By 1 2