3 4 1 4 Simplified are a flexible solution for any individual seeking to develop professional-quality documents promptly and easily. Whether you require custom-made invites, returns to, coordinators, or business cards, these templates permit you to individualize material effortlessly. Merely download and install the design template, edit it to fit your demands, and publish it in your home or at a print shop.

These templates save money and time, using a cost-efficient alternative to hiring a designer. With a wide variety of styles and styles offered, you can find the ideal design to match your personal or company requirements, all while preserving a refined, specialist appearance.

3 4 1 4 Simplified

3 4 1 4 Simplified

All the wedding cards below are free and can be printed right from your home computer Custom text and even photos can be added before or after you ve printed Choose from dozens of online free Wedding Card template ideas from Adobe Express to help you easily create your own free Wedding Card.

Congratulations Wedding Card Images Free Download on Freepik

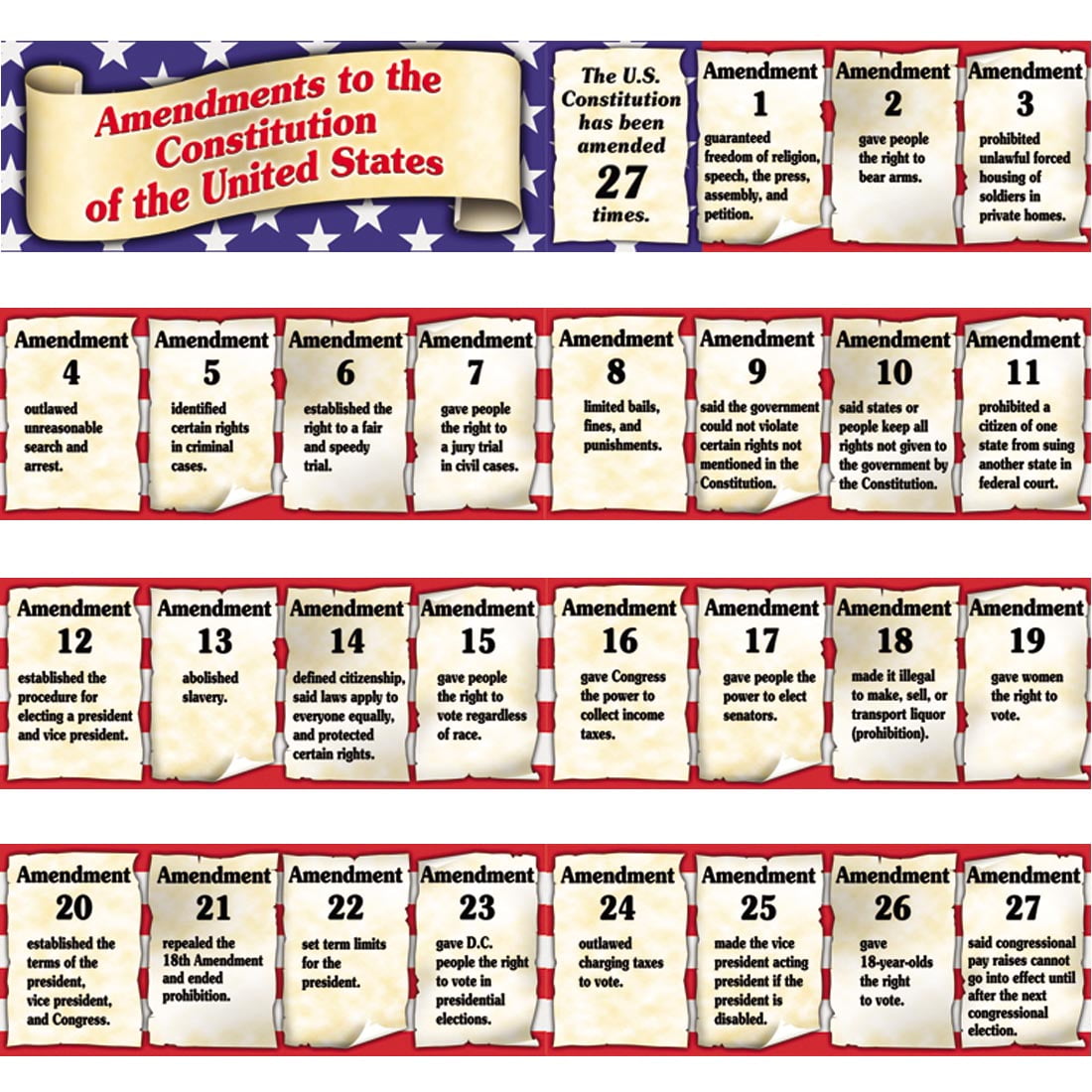

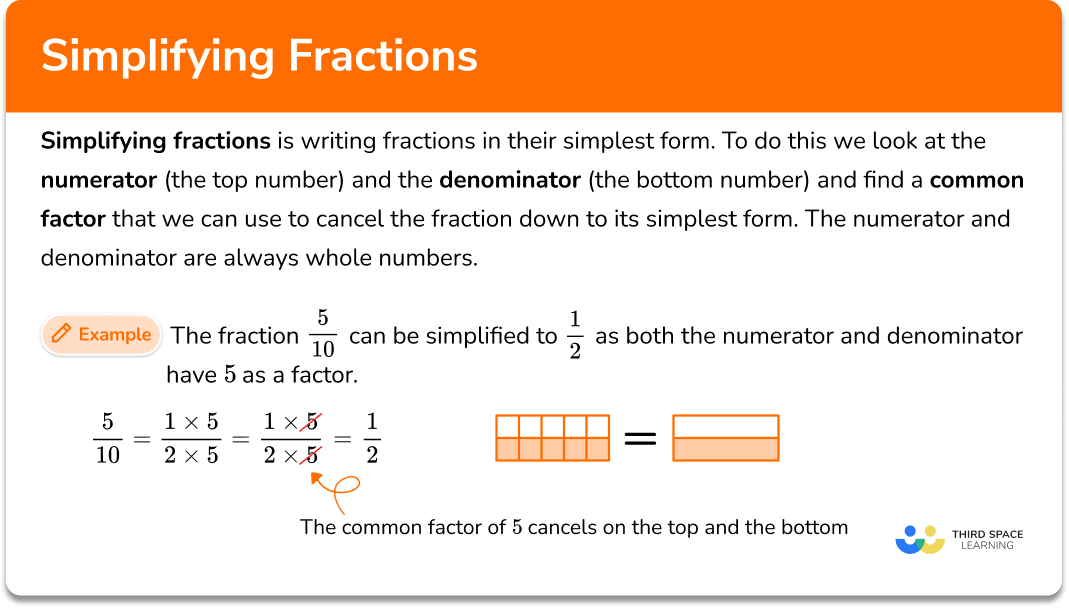

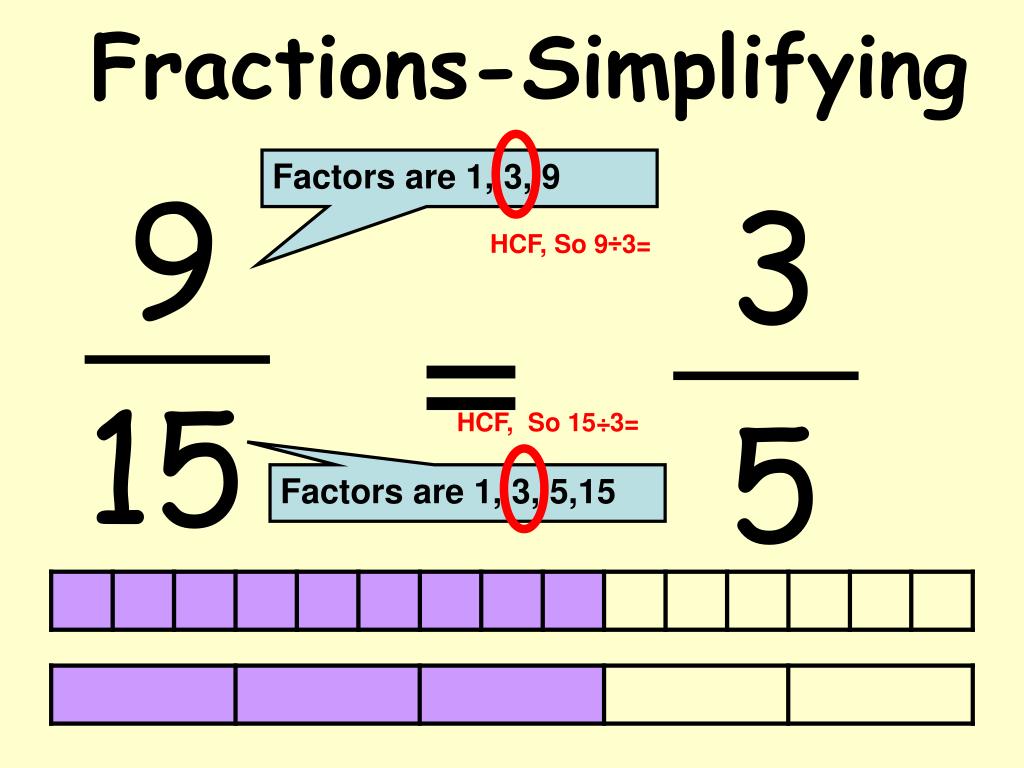

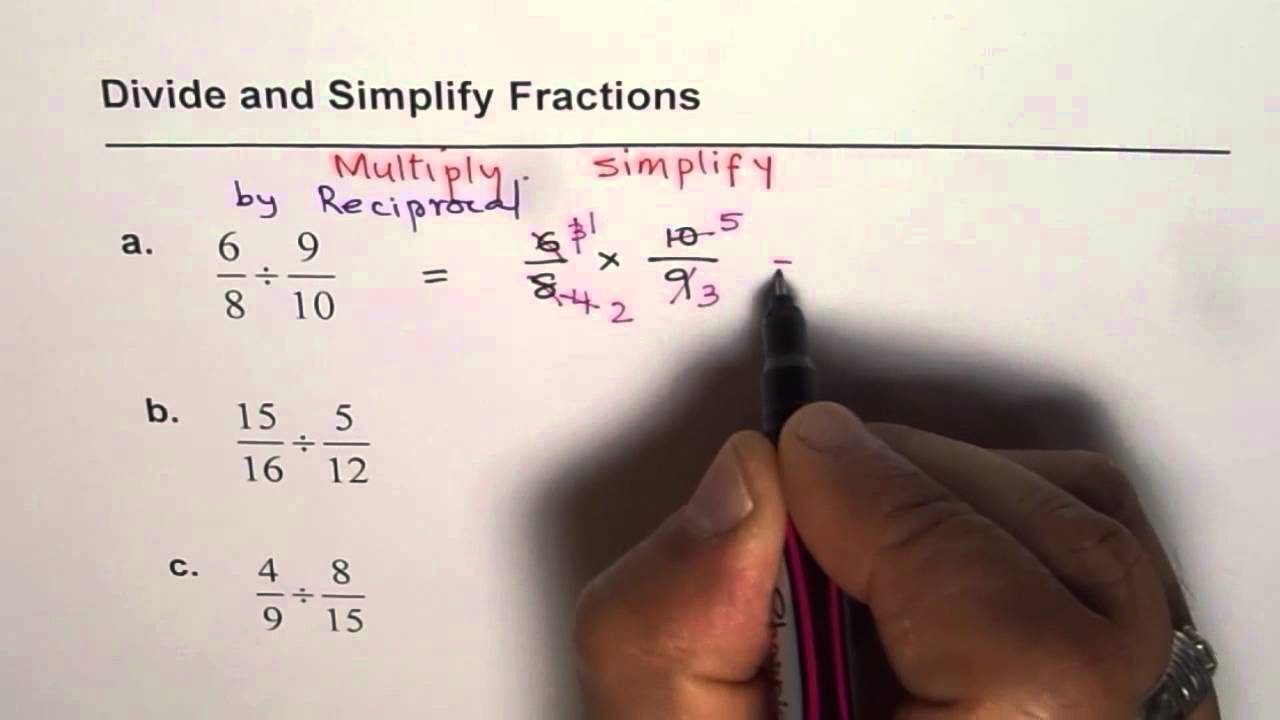

Fraction In The Simplest Form

3 4 1 4 SimplifiedFree printable greeting cards. DIY congratulations greeting cards for graduation, baby shower, bridal shower, or wedding. Jumpstart your wedding plans from a save the date to a post celebration greeting with free wedding card templates you can customize and print from Canva

Check out our wedding cards printable selection for the very best in unique or custom, handmade pieces from our greeting cards shops. [img_title-17] [img_title-16]

Free Wedding Card Templates Adobe Express

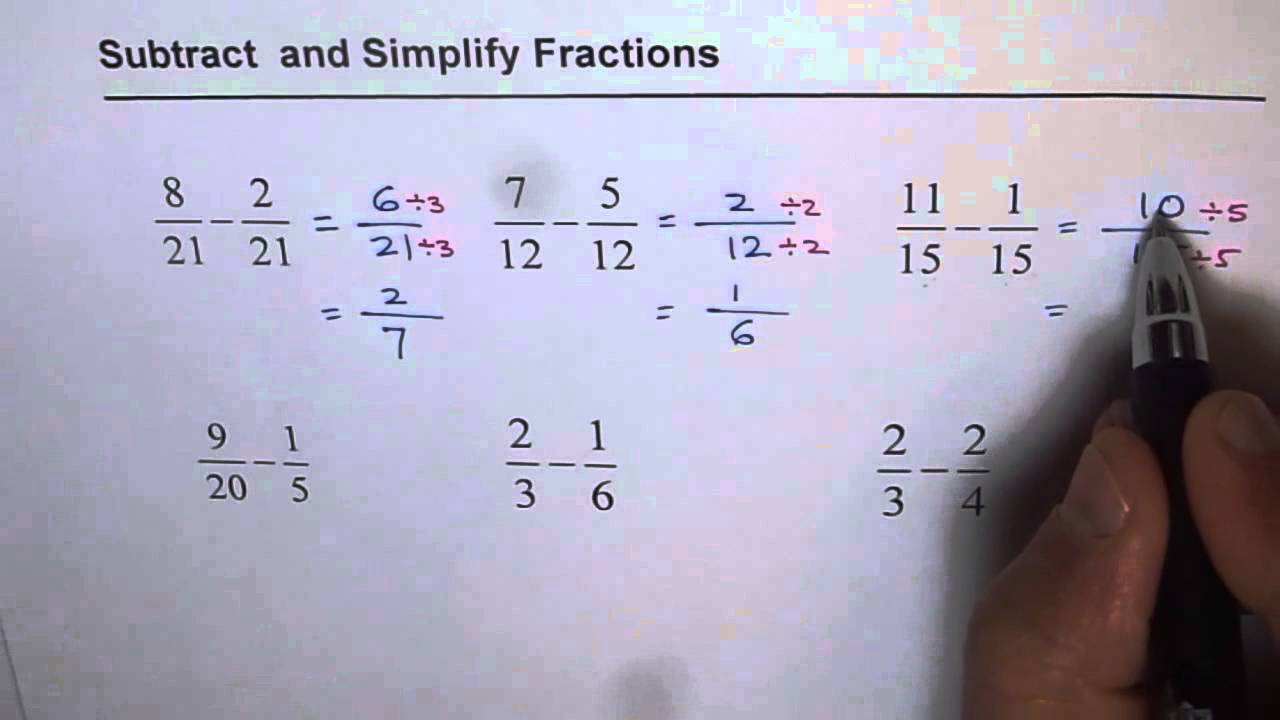

Simplifying Subtracting Fractions

Discover Pinterest s best ideas and inspiration for Wedding cards printable Get inspired and try out new things 140 people searched this [img_title-11]

Instant Downloadable Wedding Card Your files will be available to download once payment is confirmed YOU WILL RECEIVE 3 FILES 1x JPG Greeting Card A6 [img_title-12] [img_title-13]

What Is 1 4 Simplified

Chinese Characters Writing

What Is 4 5 Simplified

Printable Dnd Character Sheets

Fractions With Unlike Denominators Calculator

Can 2 5 Be Simplified

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]