3 8 5 12 In Simplest Form are a flexible option for anyone looking to produce professional-quality papers rapidly and easily. Whether you require custom invites, returns to, organizers, or calling card, these design templates allow you to customize content with ease. Just download and install the template, edit it to match your needs, and print it at home or at a printing shop.

These themes conserve money and time, providing an economical option to working with a designer. With a wide variety of designs and styles readily available, you can find the best layout to match your individual or service needs, all while preserving a sleek, professional look.

3 8 5 12 In Simplest Form

3 8 5 12 In Simplest Form

If you want physical ones etsy Glooming Forest Dnd 5e Character Sheet Basic 2 Pages Direct Download Printable PDF Etsy and Faeries Garden Dnd 5e Character Every part of your Character which can be taken from it, is outsourced to playing cards that can be aligned around your Character Sheet. 1 PDF file with the Character Sheet front and backside + all of the playing cards in the DIN A4 format just for printing and fillable by hand.

Further Resources Dungeons Dragons DnD Beyond

3 8 Divided By 3 7 In Simplest Form Brainly

3 8 5 12 In Simplest FormThe newly designed character sheets for Dungeons & Dragons are now available on D&D Beyond's website. These files are zipped PDFs you may print and photocopy them for your personal use Fillable Character SheetFifth Edition Character Sheets

Large print character sheets are just what we needed for their second grade reading/writing abilities. We have only met one week so far - ... Simplest Form 5 5 5 Unconventional Knowledge About Simplest Form 5 5 Simplest Form And Building Up Fractions The 12 Common Stereotypes When

Dnd Character Sheet Optimized Retro Design Compatible Etsy

75 100 In Simplest Fraction Form Form Example Download

New 2024 D D Character Sheet Official 2024 D D Character Sheet PDF from DnDBeyond Translated 2024 Character Sheets EN ES FR PT BR Generic Character Sheets Simplest Form

If you would like blank character sheet PDFs then there are plenty on the official D D website http dnd wizards articles features character sheets Latest What Is 6 12 In Simplest Form Updated For You Lesson 6 3 Simplest Form Practice Grade 4 YouTube

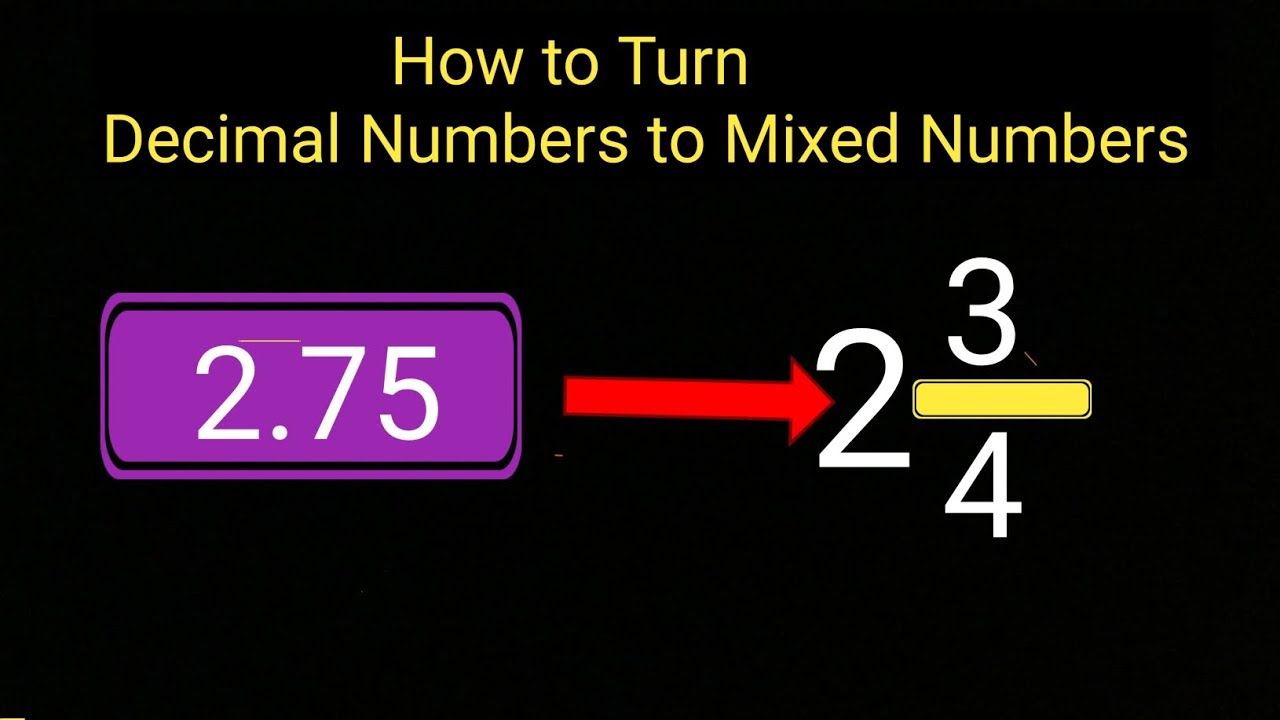

How To Turn A Decimal Into A Mixed Number In Simplest Form YouTube

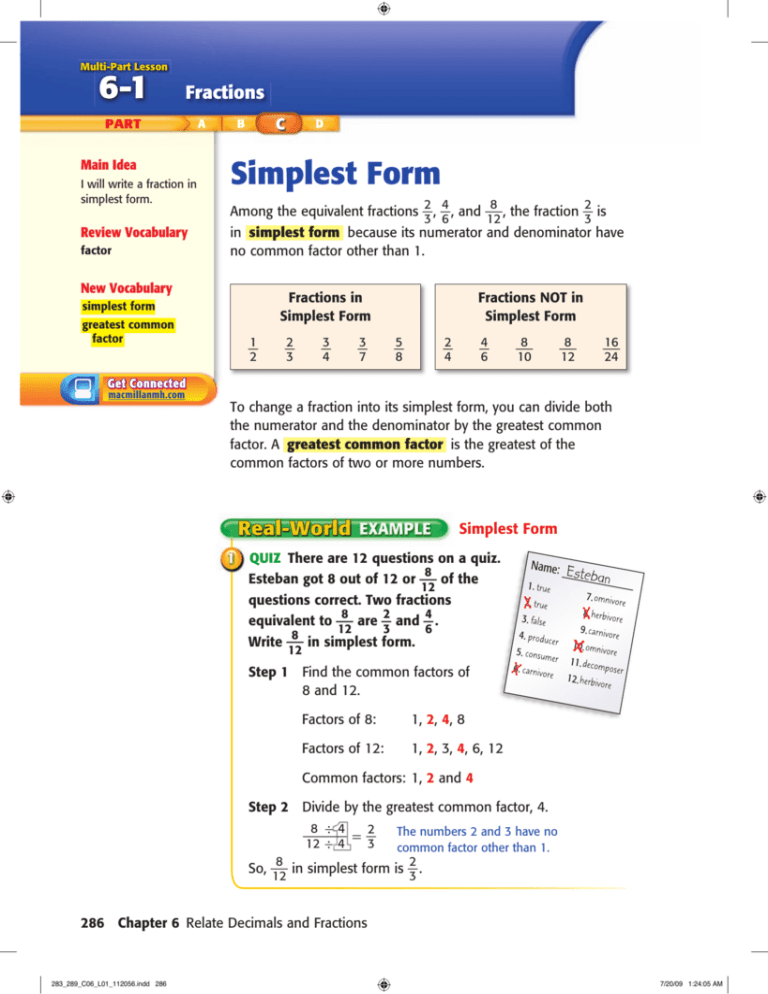

Simplest Form

What Is 15 11 12 In Simplest Form Brainly in

Solved How To Explain 3 5 16 4 7 18 In Simplest Form Course Hero

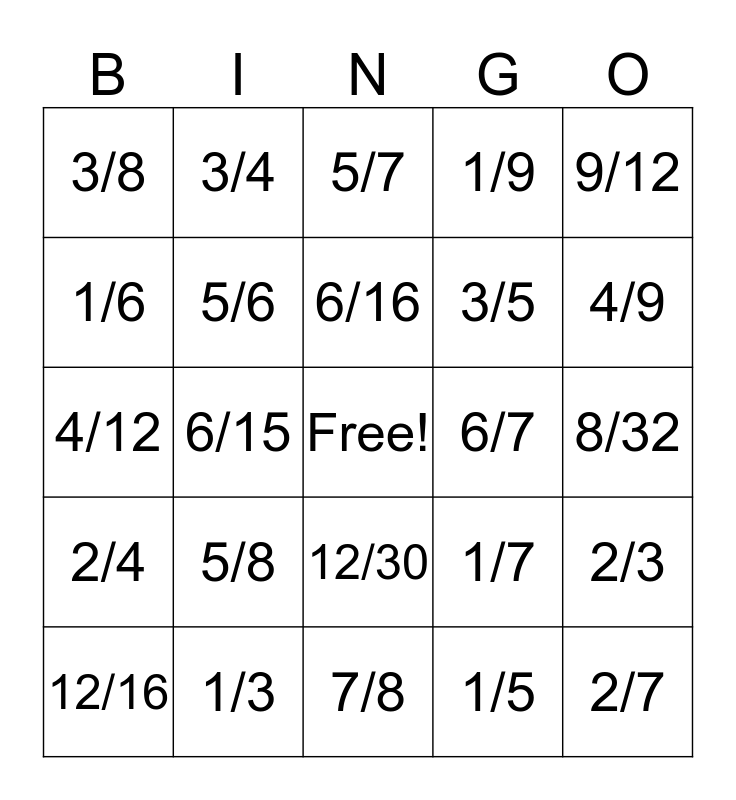

Simplest Form Of Fractions Bingo Card

Simplest Form Of 8 10 Brainly

Lesson 2 4 Multiply Write Each Answer In Simplest Form Math ShowMe

Simplest Form

Simplify Ratios YouTube

Student Tutorial What Is A Fraction In Simplest Form Media4Math