3680 Brutto In Netto Steuerklasse 2 are a versatile solution for anyone seeking to develop professional-quality records rapidly and easily. Whether you need personalized invites, returns to, organizers, or business cards, these layouts permit you to personalize material easily. Merely download the design template, modify it to suit your needs, and publish it in the house or at a print shop.

These design templates save time and money, providing an economical alternative to working with a designer. With a variety of styles and formats offered, you can discover the perfect layout to match your personal or organization requirements, all while maintaining a polished, specialist look.

3680 Brutto In Netto Steuerklasse 2

3680 Brutto In Netto Steuerklasse 2

The 2024 NFL Weekly Schedule shows matchups and scores for each game of the week Use the printer icon to download a printable version We provide free weekly NFL Pick'em sheets and college pick'em sheets for you to print. You can access the full NFL schedule or college football schedule for ...

NFL Schedule Week 2 Dec 17 Dec 17 2024 ESPN

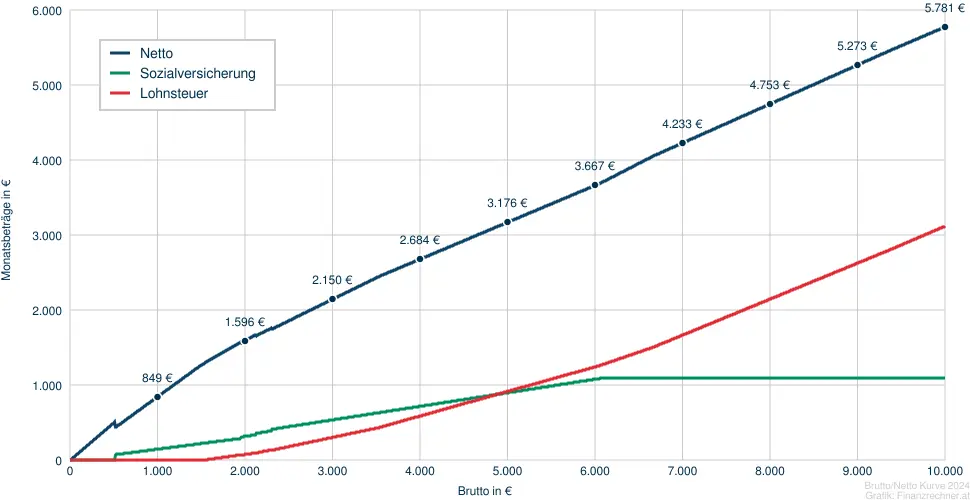

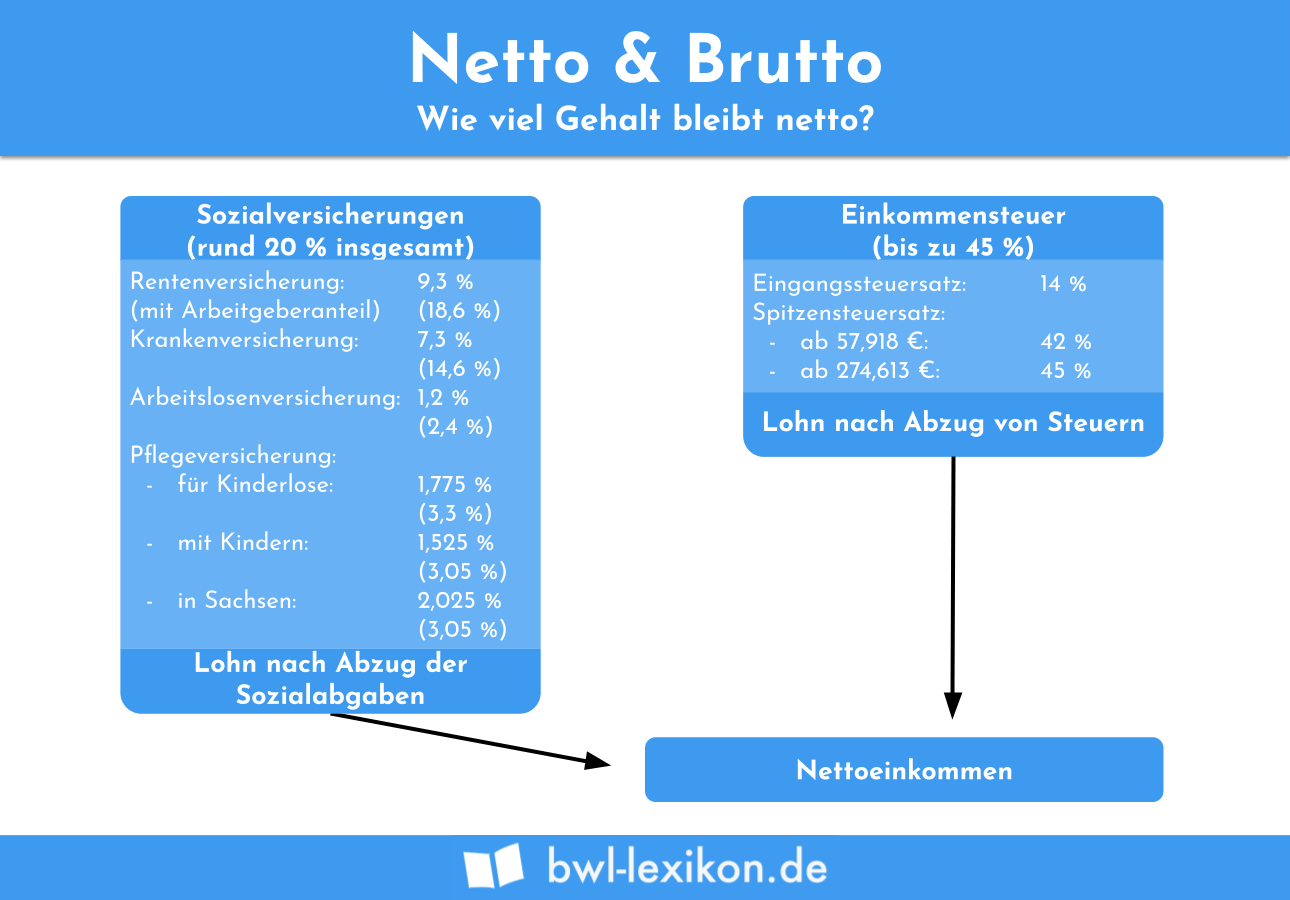

8340 Brutto In Netto Bruttonettorechner at

3680 Brutto In Netto Steuerklasse 2Print Week 2 NFL Pick'em Office Pool Sheets in .PDF Format. NFL Football Week Two Picks and Schedules. National Football League Match ups. Thursday Sep 12 TIME ET Buffalo at Miami 8 15 pm Sunday Sep 15 Las Vegas at Baltimore 1 00 pm LA Chargers at Carolina 1 00 pm

Get the 2024 Monday Night Football Schedule. See which teams are playing this Monday or plan your Football Mondays for the entire NFL season. Brutto Netto Rechner 2020 Ihr Gehaltsrechner Brutto Netto Rechner 2025 Netto Gehalt Berechnen

Printable Weekly FOOTBALL Pick em Sheets OfficePoolStop

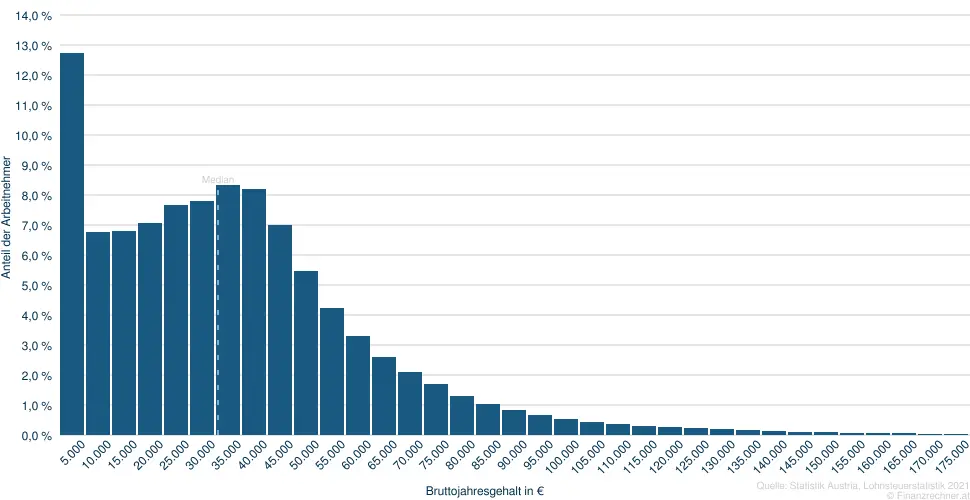

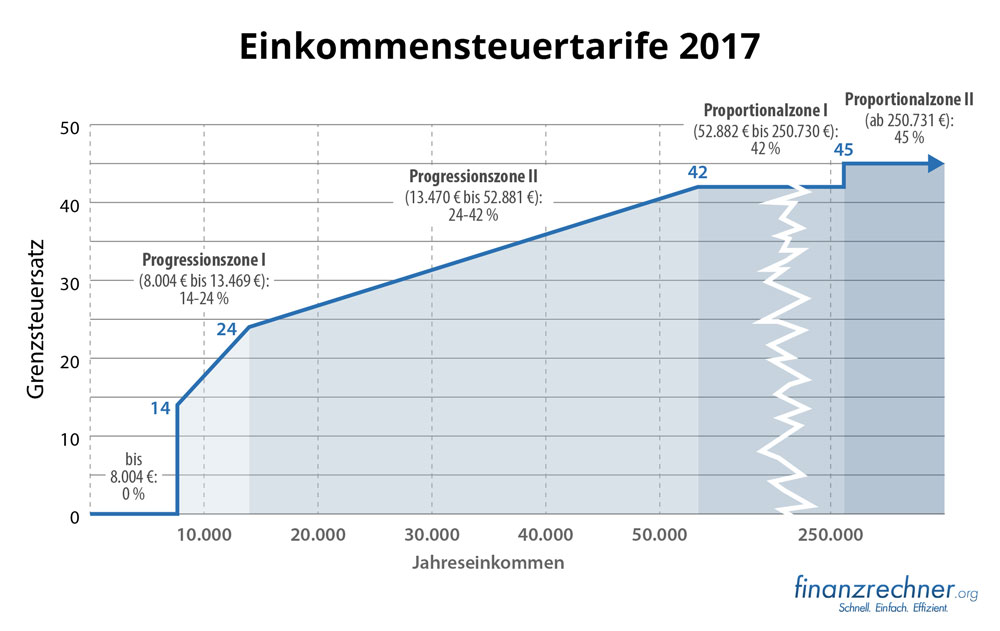

Einkommensverteilung sterreich Einkommenspyramide

Includes every weekly NFL matchup game times and TV networks Space to write in game projections and results Prints on letter size paper Steuerklasse 6 Berechnen Www inf inet

Sunday September 15th Raiders logo LV Raiders 2 11 Ravens logo Chargers logo LAC Chargers 8 5 Panthers logo Saints logo NO Saints 5 8 Cowboys Steuertabelle IMACC Brutto Netto Gehalt Ermittlung Des Individuellen Finanzbedarfs My

W rde Euch Der Betrag Reichen Es Ist Das Brutto Krankengeld Davon

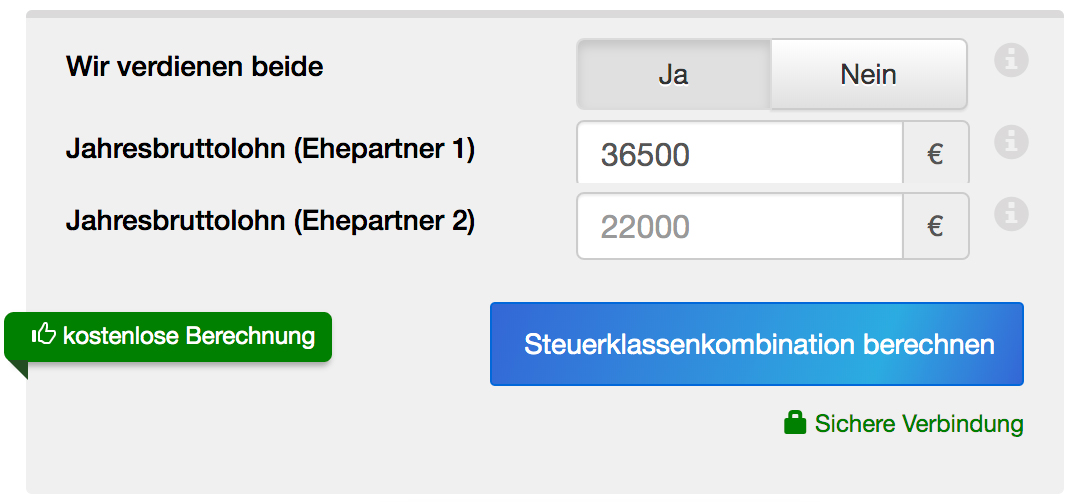

Steuerklassenkombination Mehr Geld Durch Steuerklassenwechsel

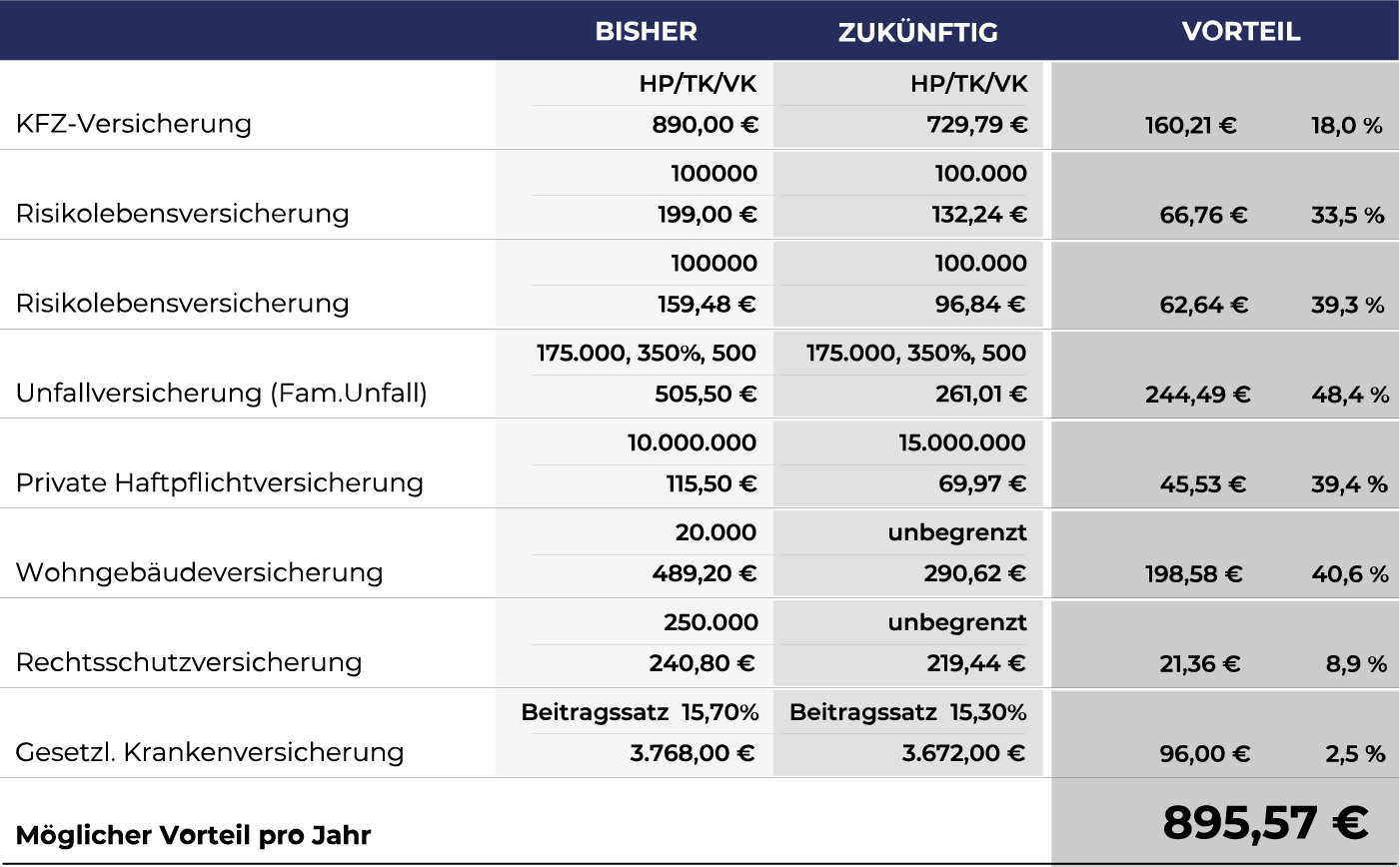

Netto Brutto Optimierung Finanzkanzlei Bremen Jetzt Mehr Rausholen

Lohnsteuer Definition Klassen Freelancer Wiki

Brutto Netto 2025 Velma Jeanette

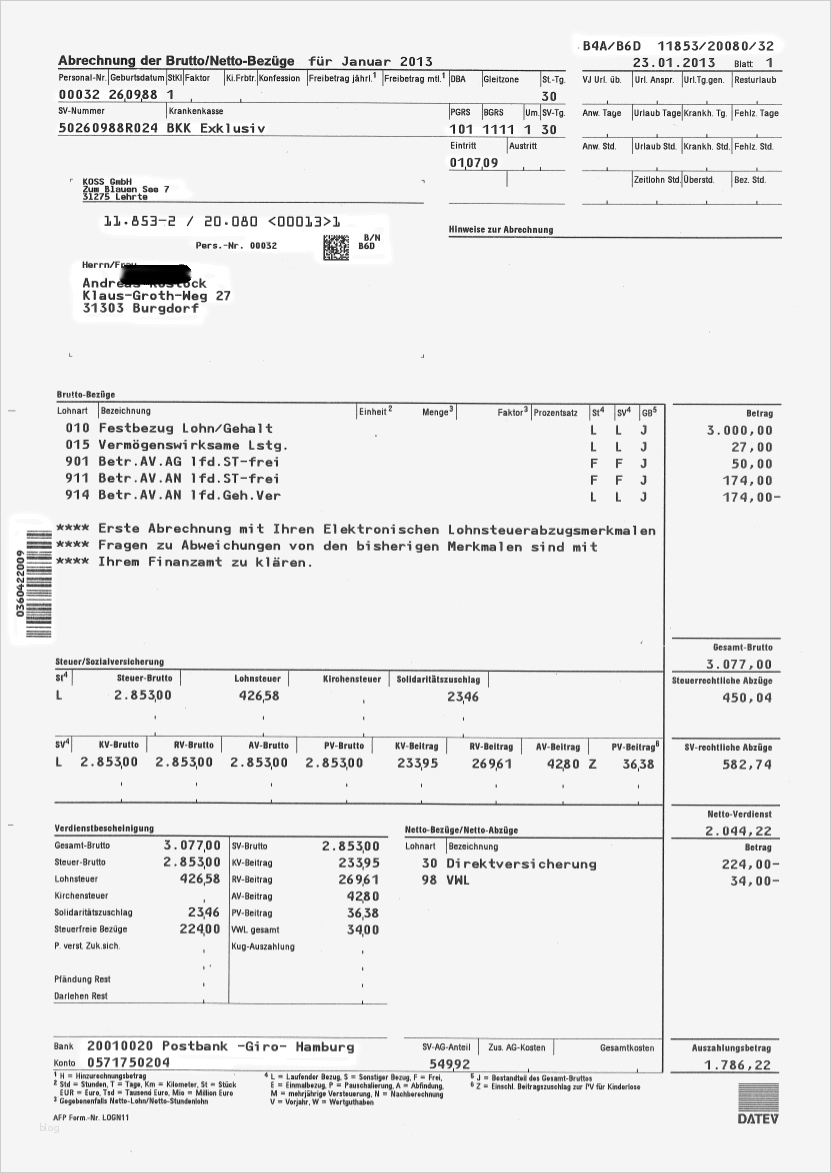

Das Wichtige Vom Unwichtigen Unterscheiden Gehaltsabrechnung Erstellen

Gehaltsabrechnung Erstellen Muster Und Beispiele Erkl rt

Steuerklasse 6 Berechnen Www inf inet

Diskretion Geburt Kommentar Netto Brutto Rechner 2020 Begleiten Haft

Abrechnung Brutto Netto Bez ge Vorlage Erstaunlich Gehaltsabrechnung