3am Est To Gmt 4 are a functional remedy for anyone aiming to create professional-quality records quickly and easily. Whether you need personalized invitations, resumes, coordinators, or calling card, these layouts enable you to personalize material easily. Simply download and install the template, modify it to match your requirements, and publish it in your home or at a print shop.

These templates conserve money and time, using a cost-effective alternative to working with a designer. With a wide range of styles and layouts offered, you can locate the ideal style to match your individual or business requirements, all while preserving a polished, specialist look.

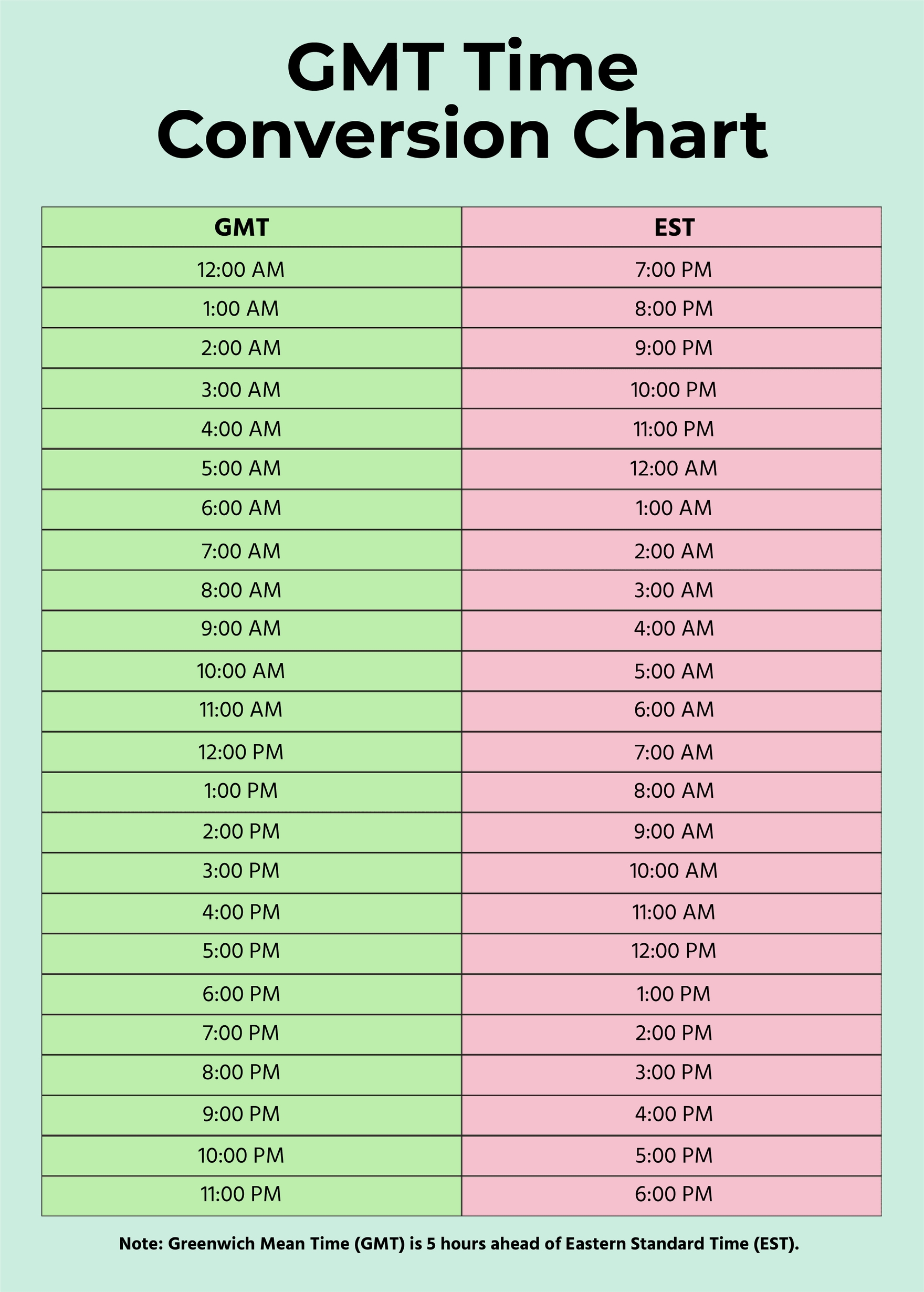

3am Est To Gmt 4

3am Est To Gmt 4

Our detailed wedding checklist maps out your journey from the moment you get engaged to the six month mark and through to the day after Stay organized and on-budget with Truly Engaging's free wedding planning checklist. We have all of your important wedding details covered for 12+ months!

The Ultimate Wedding Planning Checklist and Timeline Brides

8pm Pst To Ist Craigslist Ann Arbor Hub

3am Est To Gmt 4Engaged? Start planning with our free wedding printables! From wedding checklists and timelines to worksheets and questionnaires, ... COMPILE YOUR PRELIMINARY GUEST LIST You ll need that guest count CHOOSE YOUR WEDDING PARTY Who do you want by your side at the altar Ask them now to

With our comprehensive wedding checklists that, by the way, can easily be downloaded or printed, whatever floats your boat, your wedding planning will be a ... [img_title-17] [img_title-16]

Free Wedding Planning Checklist Printable Timeline Guide

[img_title-3]

Free wedding planning checklist that you can edit before you print Available in fillable PDF Excel Word Google Docs Sheets [img_title-11]

We ve listed out 12 months of to dos so you can rest easy knowing you ve got it all written out Scroll down to view it and don t forget to download your [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]