4 Percent Increase Of 50000 are a functional service for any person wanting to develop professional-quality files promptly and quickly. Whether you require custom-made invites, returns to, coordinators, or business cards, these design templates allow you to individualize content with ease. Just download the theme, modify it to fit your needs, and publish it in the house or at a print shop.

These templates conserve time and money, offering a cost-effective choice to hiring a designer. With a vast array of styles and styles readily available, you can locate the perfect design to match your personal or organization demands, all while preserving a sleek, specialist appearance.

4 Percent Increase Of 50000

4 Percent Increase Of 50000

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

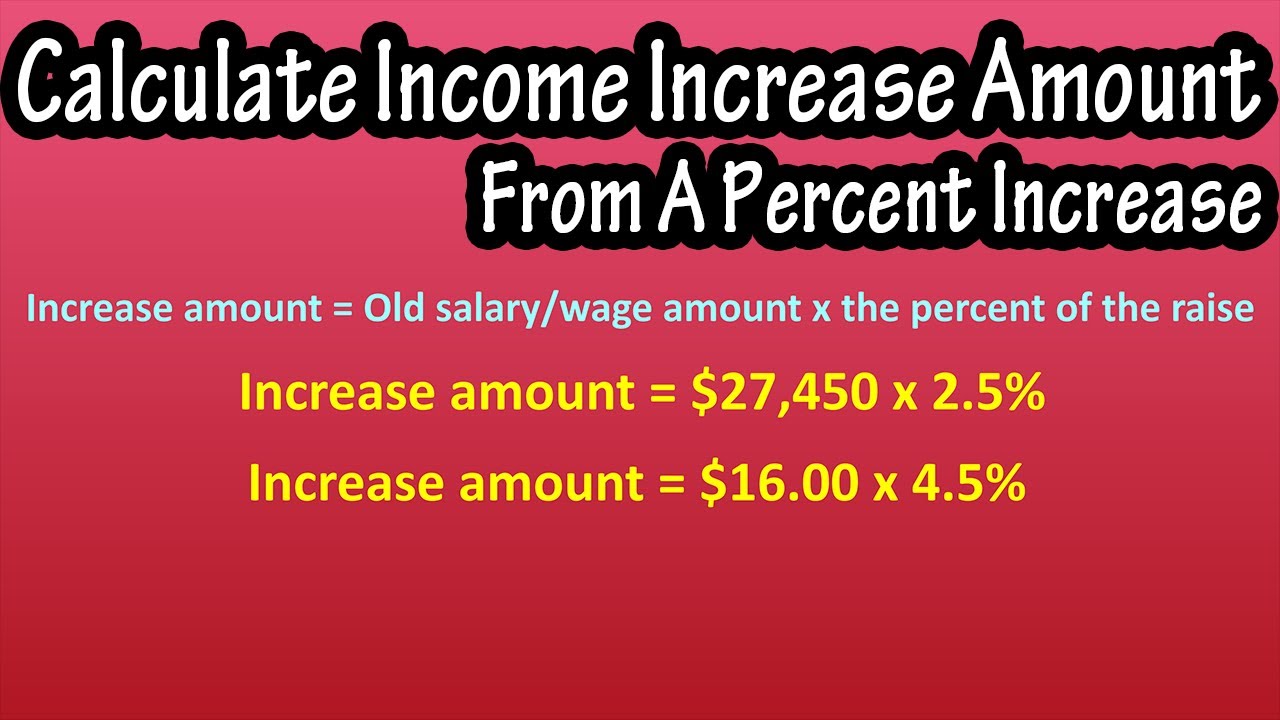

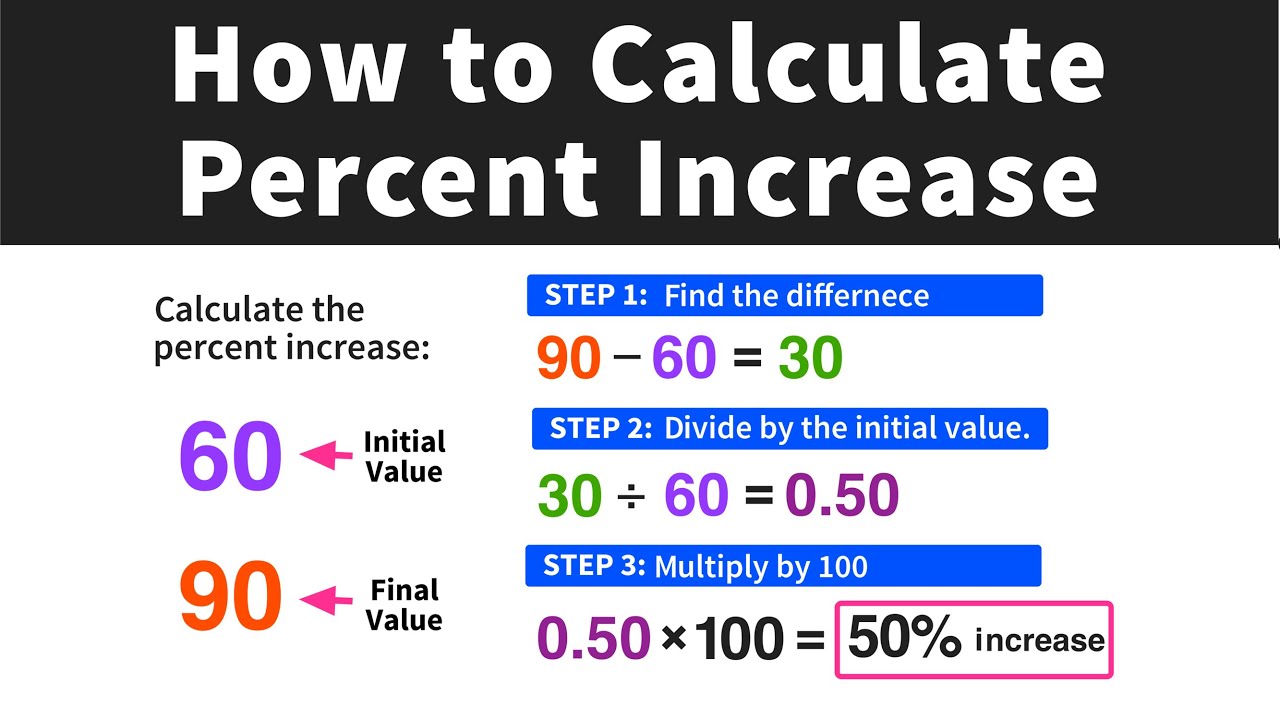

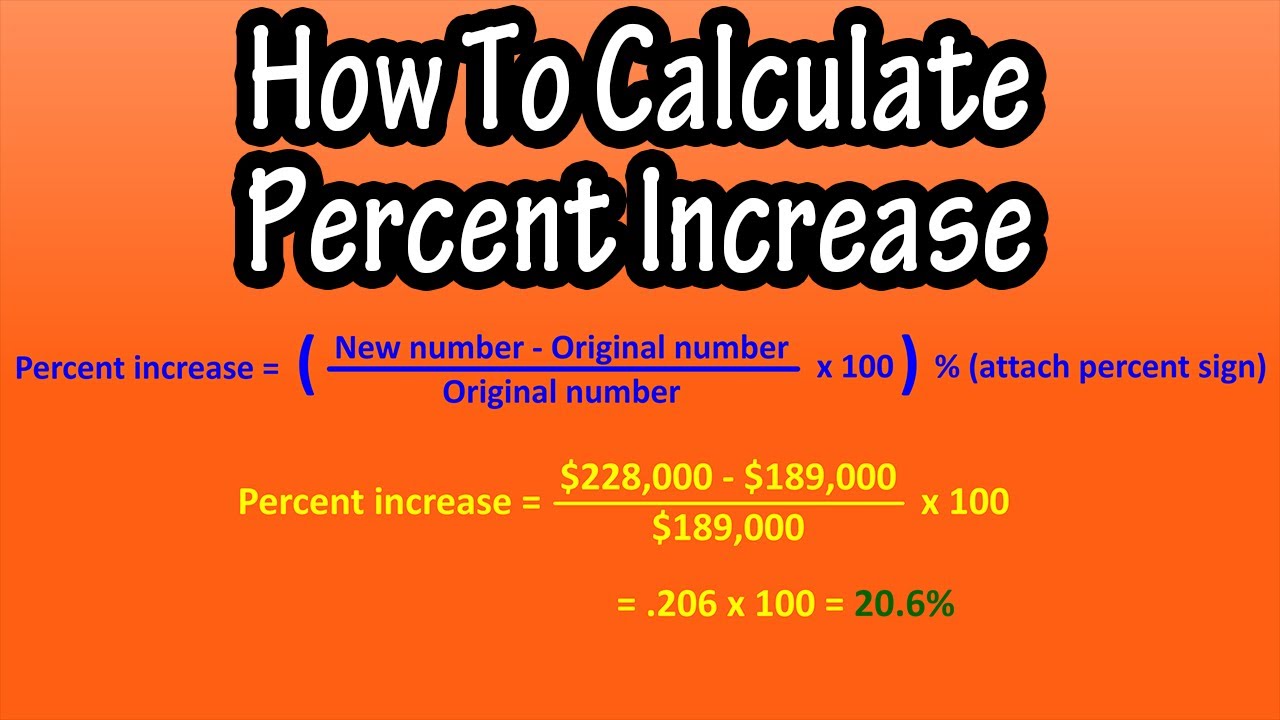

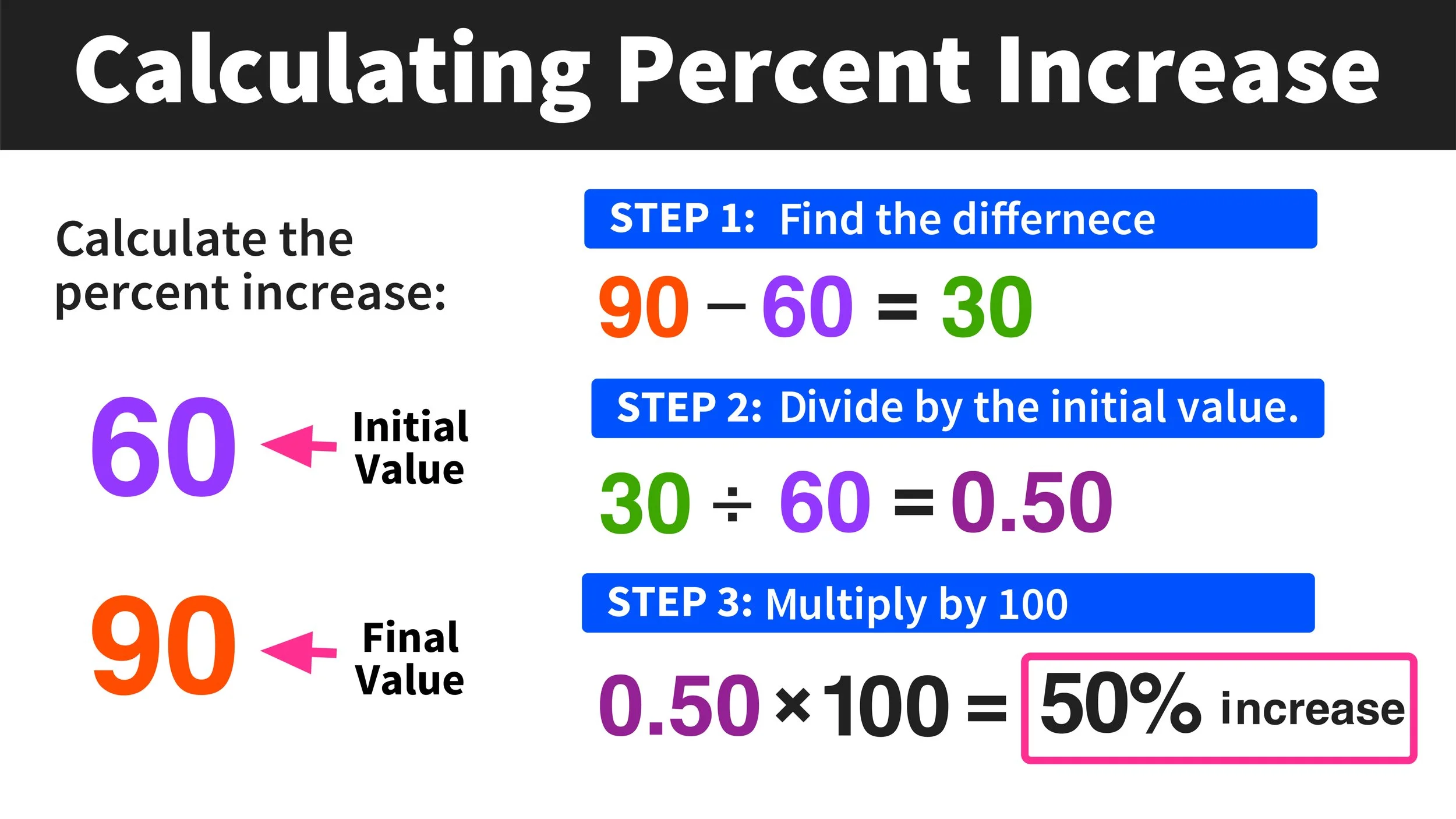

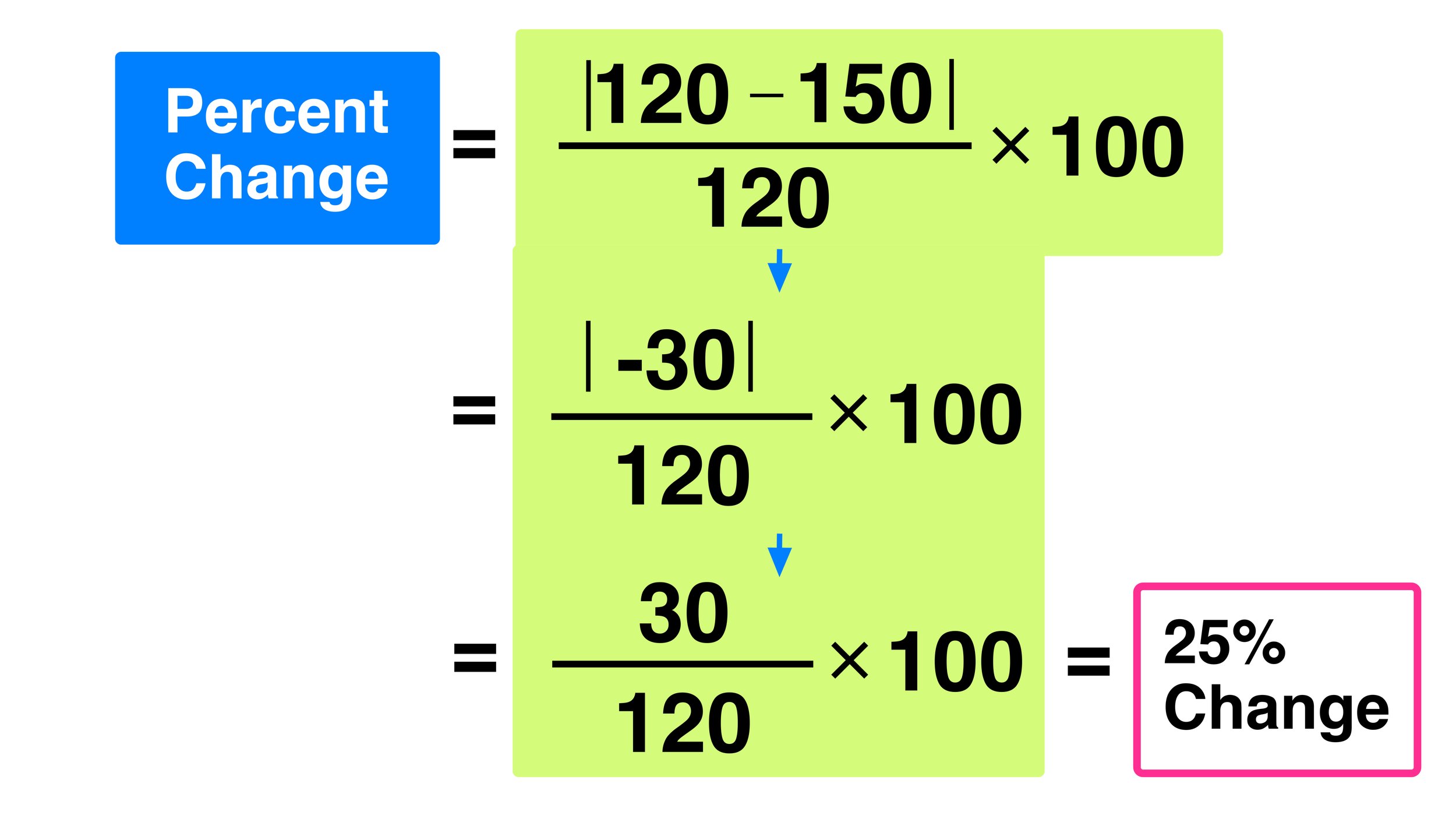

Calculating Percent Increase In 3 Easy Steps YouTube

4 Percent Increase Of 50000You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

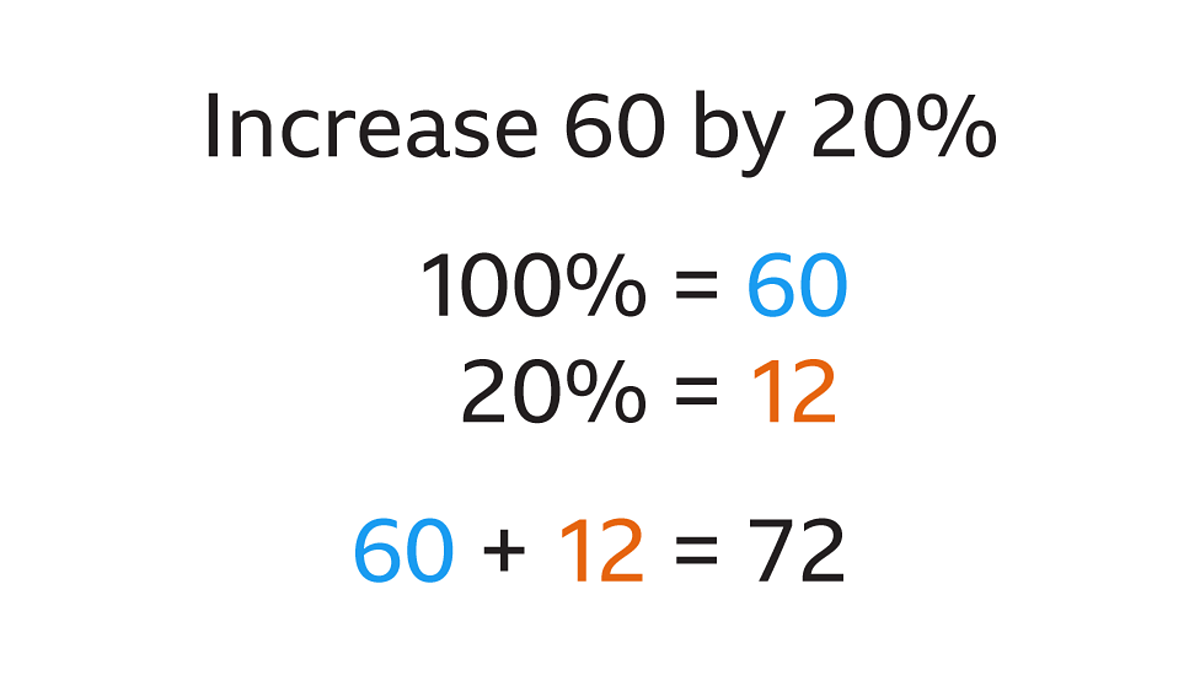

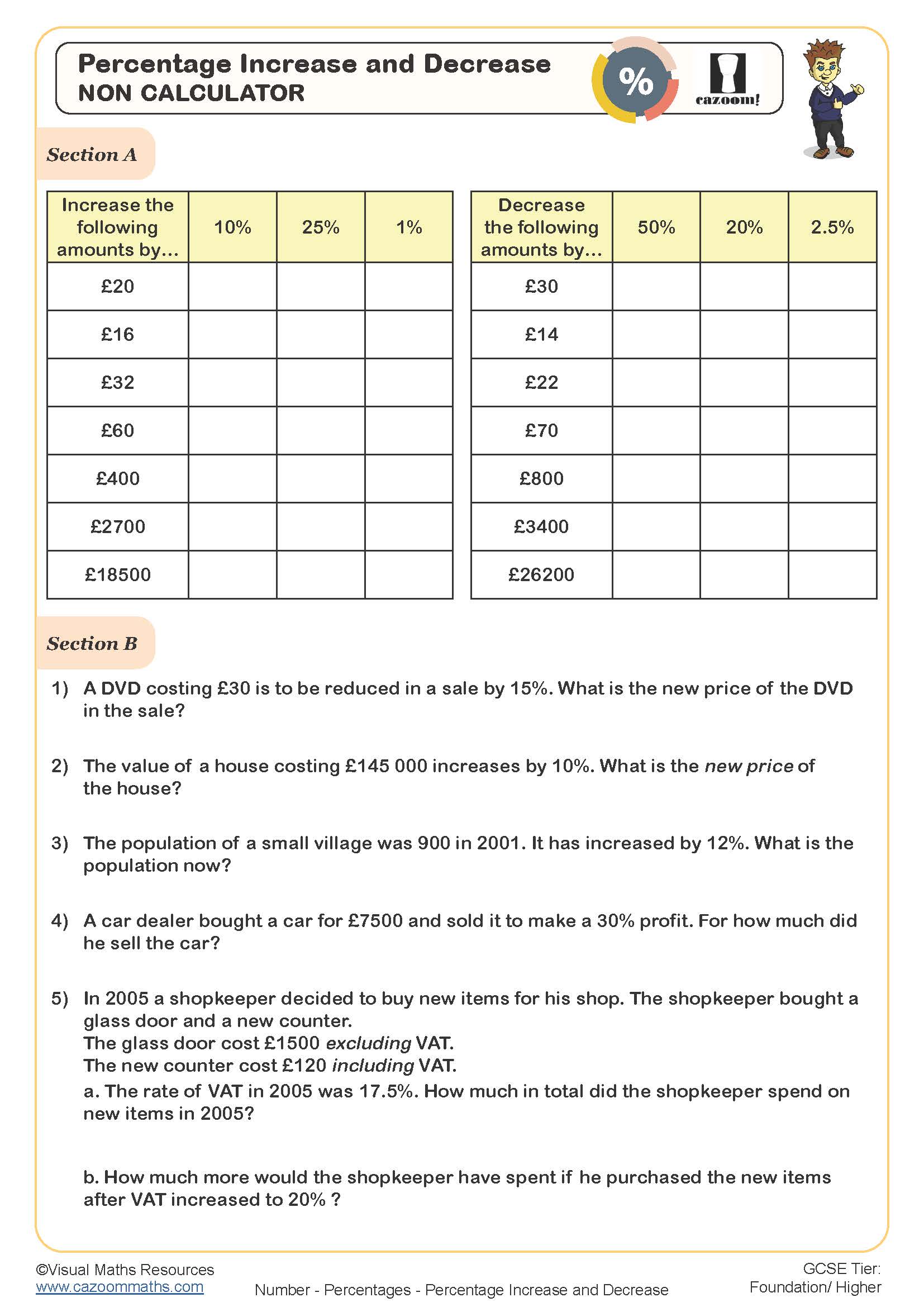

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Percentage Increase And Decrease Example FREE Teaching Resources Calculating Percent Increase In 3 Easy Steps Mashup Math

About Form W 4 Employee s Withholding Certificate

How To Calculate Or Find Percent Increase And Percent Decrease

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Coma Isso Para Viver Mais 7 H bitos Para Longevidade Coma Isso Para

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Coma Isso Para Viver Mais 7 H bitos Para Longevidade Coma Isso Para Decrease And Increase

How To Find Or Calculate Percent Percentage Increase Formula For

Lecturas De S labas Palabras Y Oraciones Materiales 51 OFF

AD ER Kapilmuni News

Percent Increase Odapo

Percent Change Calculator Mashup Math

Increase

Percentage Increase And Decrease Worksheet Cazoom Maths Worksheets

Coma Isso Para Viver Mais 7 H bitos Para Longevidade Coma Isso Para

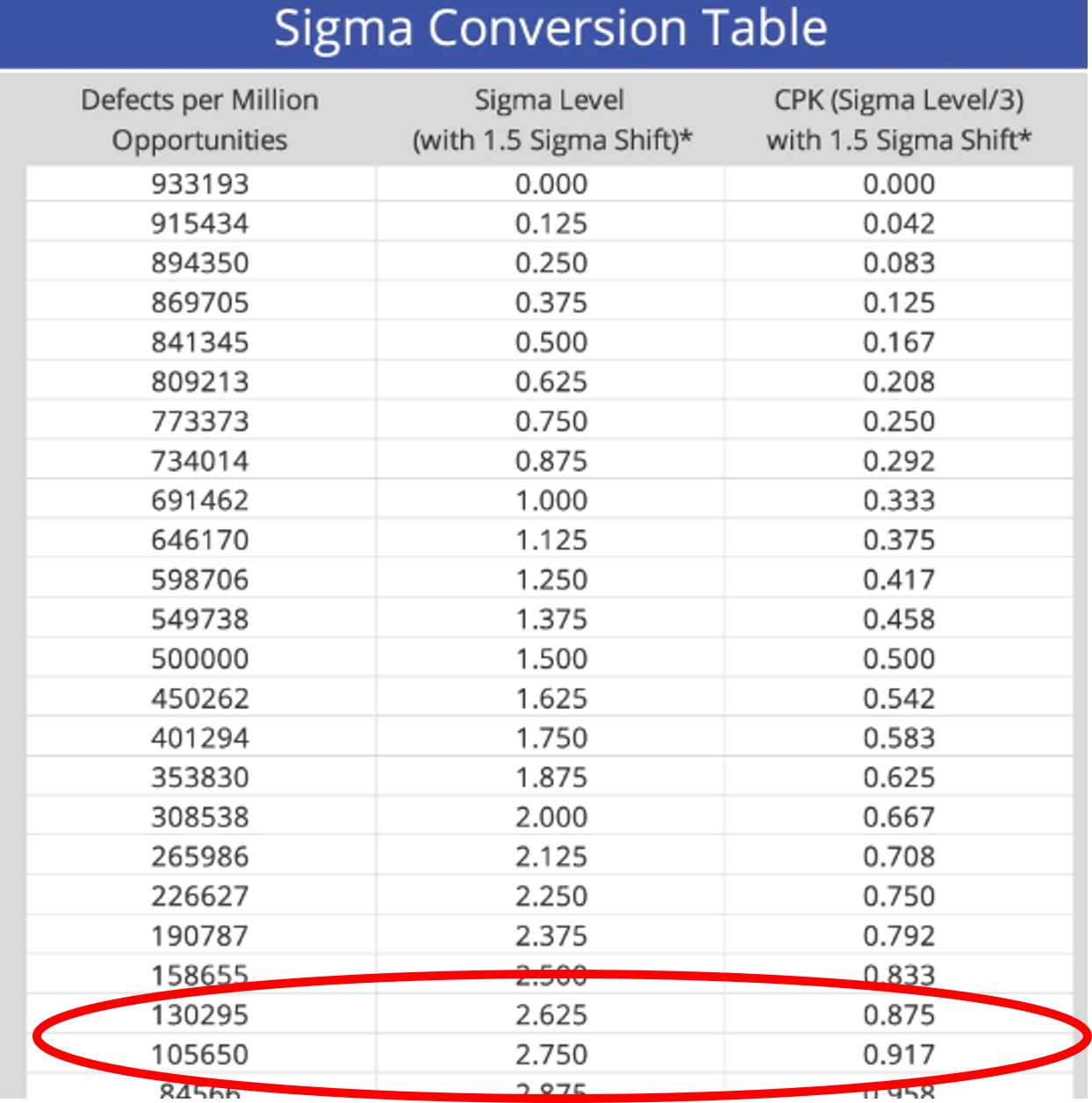

Cpk To Ppm Conversion Table Hot Sex Picture

Example 20 Anita Takes A Loan Of Rs 5 000 At 15 Per Year As Rate Of