4 Percent Of 25000 Calculator are a functional option for any individual aiming to produce professional-quality documents rapidly and conveniently. Whether you need custom invitations, returns to, coordinators, or calling card, these layouts permit you to personalize web content with ease. Just download the design template, modify it to match your requirements, and publish it at home or at a print shop.

These layouts conserve money and time, using a cost-effective option to hiring a developer. With a vast array of designs and layouts available, you can find the best layout to match your individual or business needs, all while maintaining a polished, professional look.

4 Percent Of 25000 Calculator

4 Percent Of 25000 Calculator

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, ...

W 9 blank IRS Form Financial Services Washington University

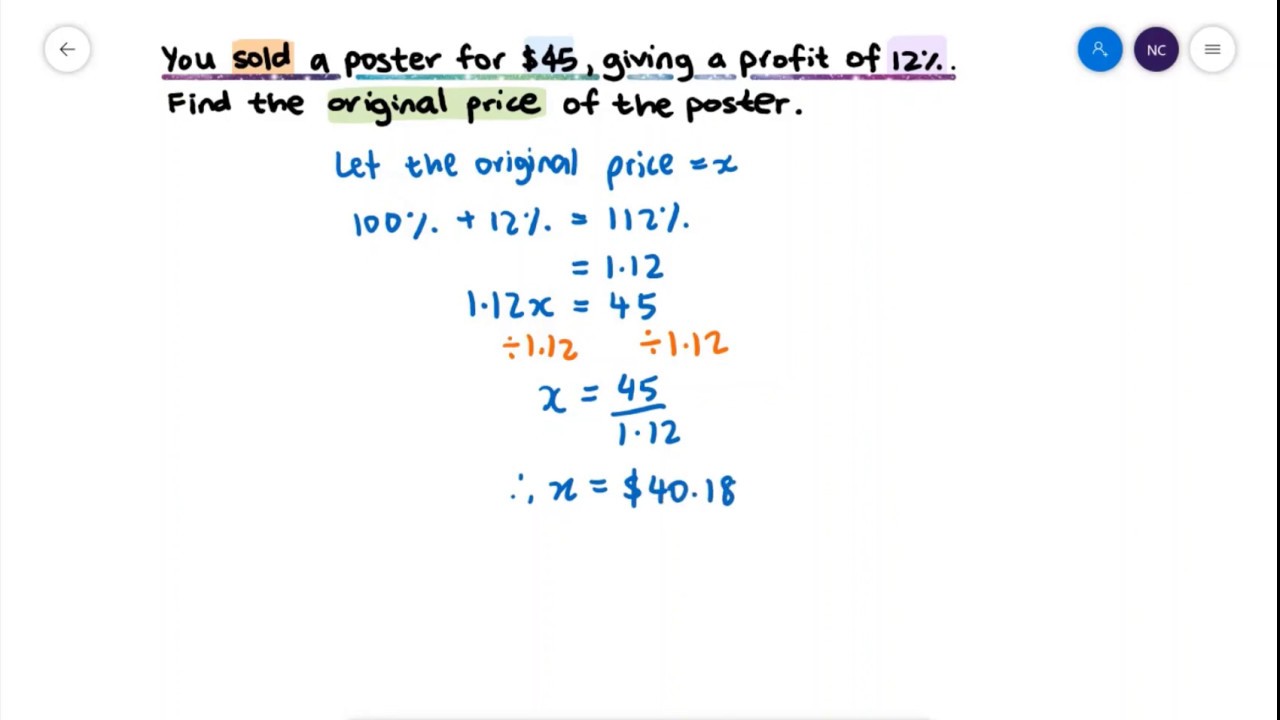

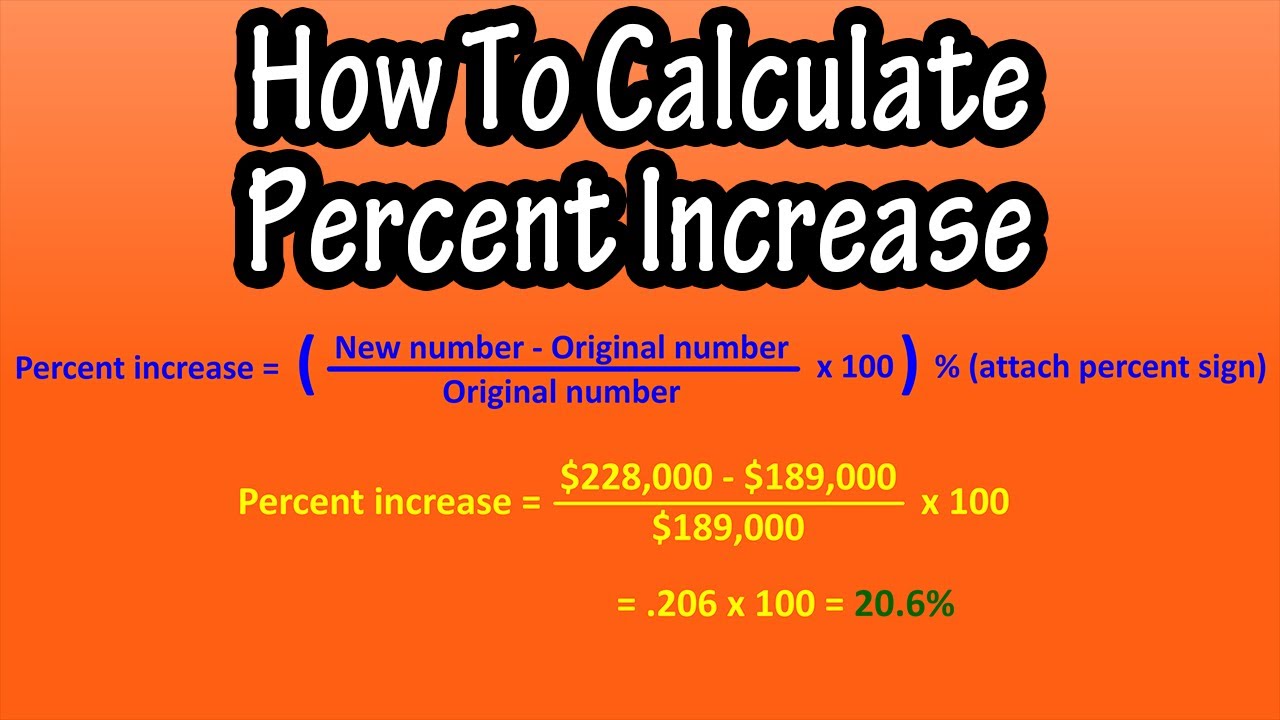

How To Find Or Calculate Percent Percentage Increase Formula For

4 Percent Of 25000 CalculatorForm W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

For guidance related to the purpose of Form W-9, see Purpose of Form, below. Print or type. See. Specific Instructions on page 3. 1 Name of entity/individual ... Chicago Mayoral Election 2024 Results Denice Mirabella How To Calculate The Percentage Error Pictures And Examples

2021 W 9 Navy SEAL Foundation

Numbers 1 To 25000 N meros De 1 A 25000 1 25000 1 25000

Any payee vendor who wishes to do business with New York State must complete the Substitute Form W 9 Substitute Form W 9 is the only acceptable documentation Who Redshirts

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 and What Is 4 Percent Of 25000 Calculatio What Is 4 Percent Of 25000 Calculatio

Jenya Hitz Swiss Post

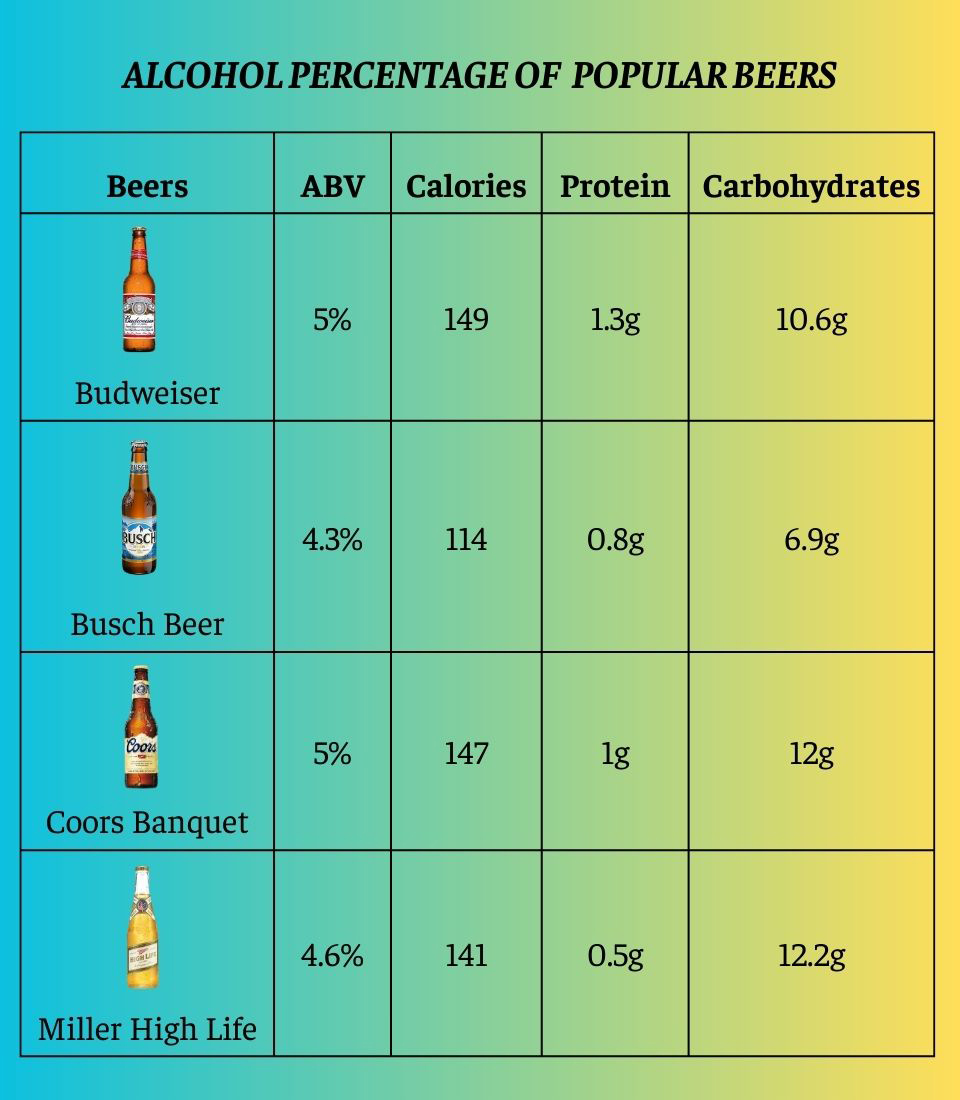

Beer Alcohol Percentage Chart Hot Sex Picture

Class Environment SC School Report Cards

A Sum Of Rs 25000 Becomes Rs 27250 At The End Of 3 Years When

Rhymes With Comedian

Gosloto 6 45

Deltius Soluci n Oral 25 000 UI ITF Labomed Chile

Who Redshirts

Factors Of 25000 Calculatio

Standard Income Tax Deduction 2025 Justin S Leitch