480 Divided By 1 8 are a versatile remedy for any person aiming to create professional-quality files quickly and quickly. Whether you need custom-made invitations, returns to, organizers, or calling card, these templates permit you to personalize material with ease. Simply download and install the template, modify it to fit your requirements, and publish it in your home or at a print shop.

These design templates save money and time, supplying a cost-efficient option to hiring a designer. With a wide range of styles and formats offered, you can discover the perfect layout to match your personal or service needs, all while keeping a refined, specialist look.

480 Divided By 1 8

480 Divided By 1 8

Check out our cat pumpkin stencil selection for the very best in unique or custom handmade pieces from our stencils templates shops 15 Cat Pumpkin Stencils. Five lit pumpkins with different cat designs carved into them. The pumpkins are on a black background.

Cat Free Pumpkin Stencil Jack o lantern stencil r PumpkinStencils

1 Divided By 4 YouTube

480 Divided By 1 8We're sharing the best pumpkin carving ideas with easy-to-follow templates. Print one of these pumpkin carving stencils for free this ... We found 67 adorable cute cat pumpkin carving patterns that are free to download Step up your porch decor with a beautifully carved pumpkin

Download any of our construction pumpkin carving designs or show your Cat® pride with a stencil of our logo this Halloween! Cat Logo. 7 Ways To Master Division With A Division Chart Bar Diagram Fractions

Printable Cat Pumpkin Carving Stancils Set Kids Halloween Crafting

Dividing Fractions 1 2 Divided By 3 YouTube

Happy Halloween r cats Pumpkin carving of my cat from a homemade stencil Happy Halloween 10 Divided By 1 3 Ten Divided By One Third YouTube

These patterns are offered free of charge for personal use to our pumpkin loving community You are welcome to carve these designs into your pumpkins and 10 Divided By 1 4 Ten Divided By One Fourth YouTube 6 1 2 7 8 Divided By 5 11 16 Brainly

1 Divided By 4 1 4 YouTube

6 Divided By 8 6 8 YouTube

8 Divided By 1 2 Eight Divided By One Half YouTube

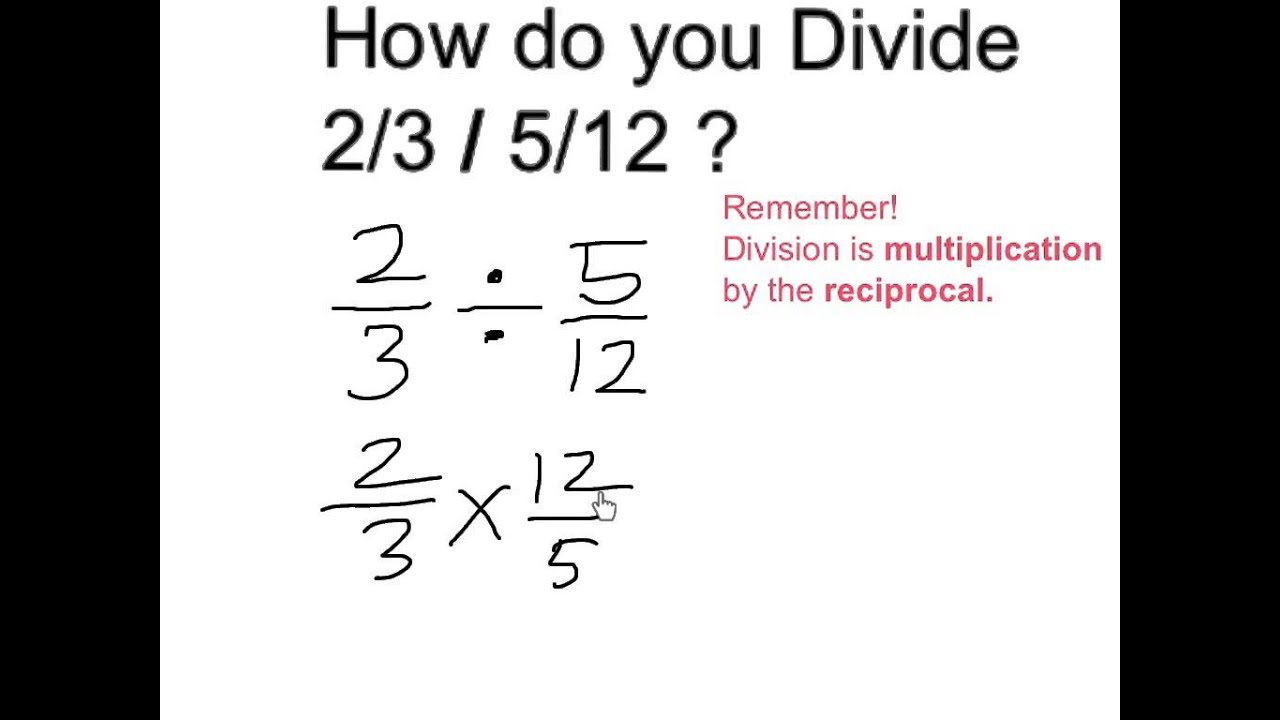

Divide 2 3 5 12 YouTube

6 Divided By 1 3 Six Divided By One Third YouTube

12 Divided By 1 3 Twelve Divided By One Third YouTube

15 Divided By 1 3 Fifteen Divided By One Third YouTube

10 Divided By 1 3 Ten Divided By One Third YouTube

If 4 3 Divided By 1 6 p Then The Value Of P Is Between Which Of The

24 012 Divided By 6 9 Divided By 2 43 4 Divided 15231654 23 05 2023