5 Percent Of 20000 Calculator are a versatile service for any individual seeking to develop professional-quality records swiftly and easily. Whether you need customized invitations, resumes, organizers, or calling card, these templates enable you to individualize web content effortlessly. Just download the template, modify it to suit your needs, and publish it in the house or at a printing shop.

These design templates conserve money and time, offering a cost-efficient alternative to hiring a developer. With a wide variety of styles and formats available, you can discover the ideal style to match your individual or organization demands, all while preserving a polished, specialist appearance.

5 Percent Of 20000 Calculator

5 Percent Of 20000 Calculator

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

Decimals Percentages Fractions B R E A K

5 Percent Of 20000 CalculatorYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... What Is 20 Percent Of 1500 Solution With Free Steps What Is 5 Percent Of 20000 In Depth Explanation The Next Gen Business

About Form W 4 Employee s Withholding Certificate

Find The Amount And Compound Interest On Rupees 20000 For 1 1 2year At

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Percent Volume Calculator Guluhouseof

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 What Times What Equals 66 How To Calculate Percentage Vrogue co

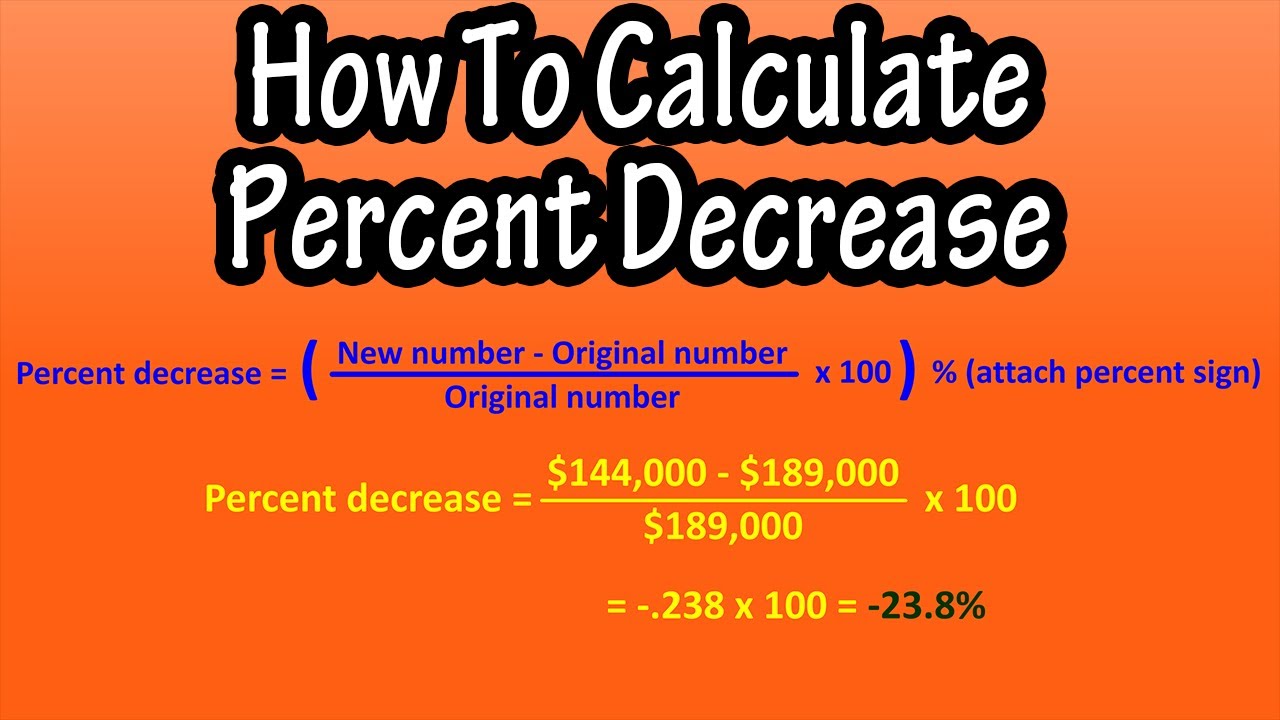

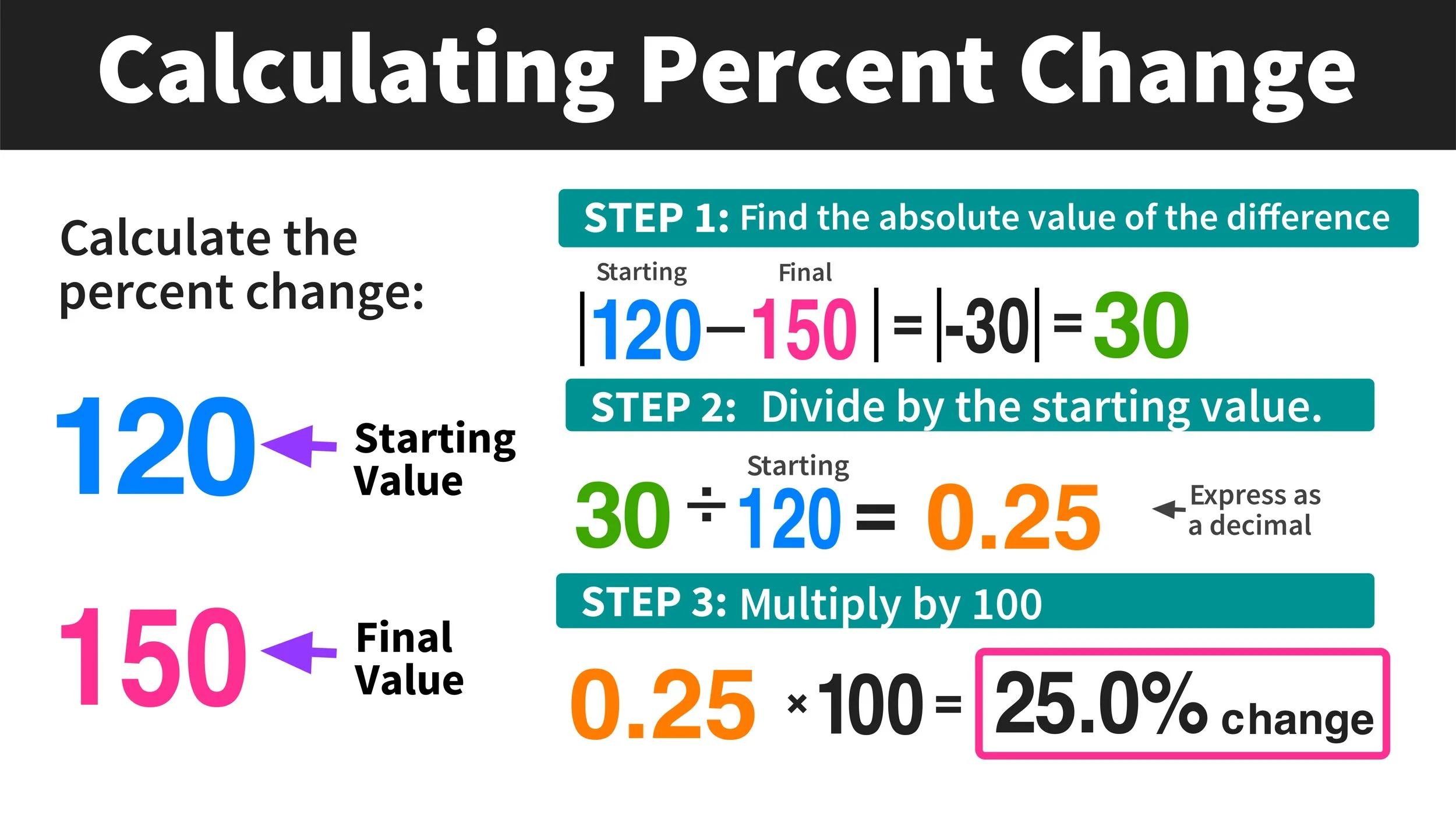

Percent Change Calculator Mashup Math

Who Redshirts

What Is 3 Percent Of 20000 Calculatio

10th Ward Archives Block Club Chicago

Virginia Political Map 2024 Chad Meghan

Hungary s Minimum Wage Among The Lowest In The EU See How It Measures

Who Are The Proles

Percent Volume Calculator Guluhouseof

What Is 0 5 Percent Of 20000 Calculatio

What Times What Equals 66