529 Plan Rules And Regulations are a functional remedy for any person looking to create professional-quality papers quickly and conveniently. Whether you need custom-made invitations, returns to, organizers, or business cards, these templates enable you to customize web content easily. Simply download the design template, edit it to fit your demands, and publish it at home or at a printing shop.

These themes conserve money and time, supplying an economical option to hiring a designer. With a variety of designs and formats readily available, you can discover the ideal layout to match your individual or service needs, all while preserving a refined, professional appearance.

529 Plan Rules And Regulations

529 Plan Rules And Regulations

Does your name match the name on your social security card If not to ensure you get credit for your earnings contact SSA at 800 772 1213 Download and print blank W-4 Withholding Forms so that your employer can withhold the correct federal and/or state income tax from your pay.

Form IL W 4 Employee s and other Payee s Illinois Withholding

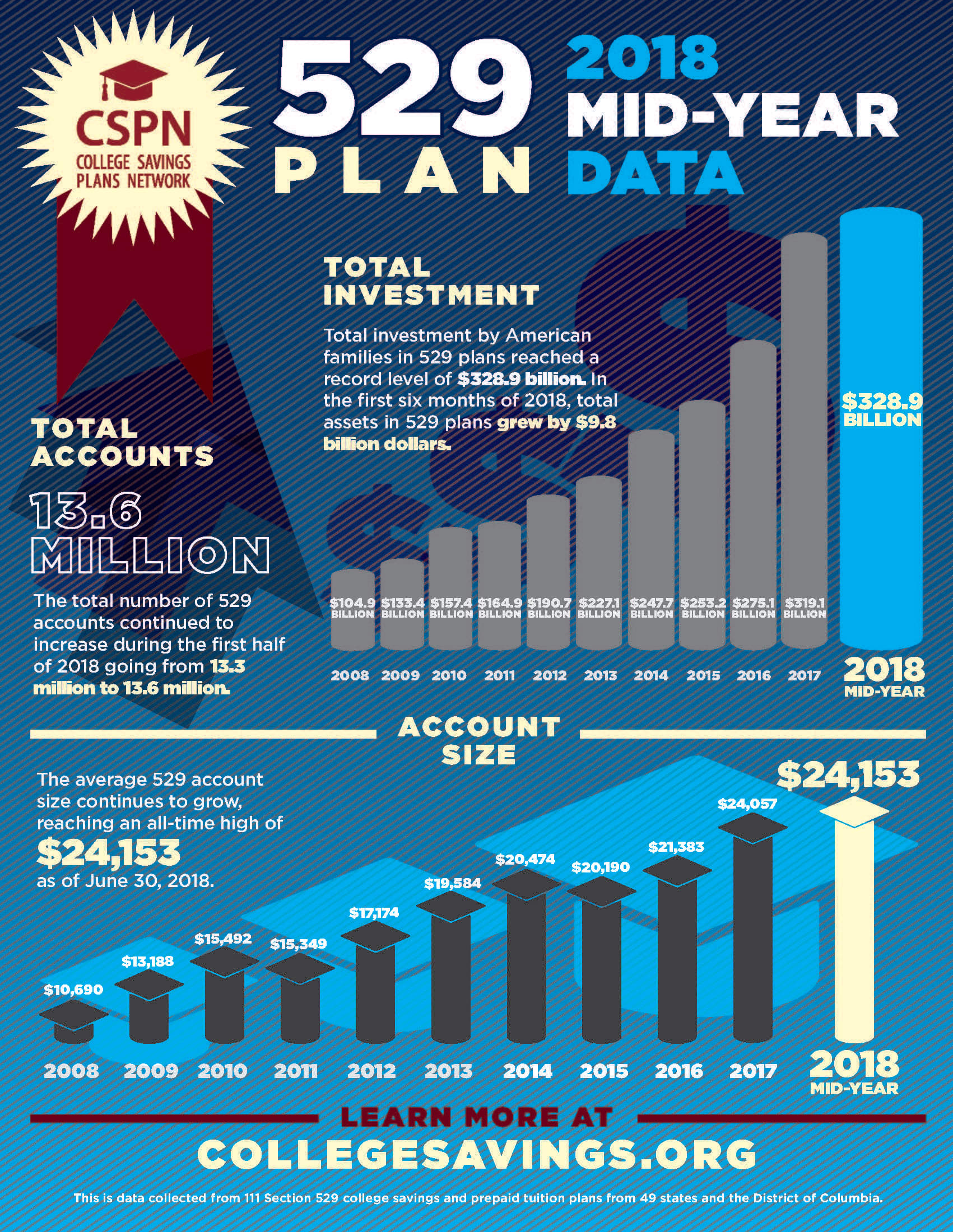

Ny 529 Contribution Limit 2025 Kyla Monmore

529 Plan Rules And RegulationsComplete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 PDF. Form 1040-ES. Estimated Tax ... Information about Form W 4 Employee s Withholding Certificate including recent updates related forms and instructions on how to file

This certificate is for income tax withholding and child support enforcement purposes only. Type or print. Notice to Employer: Within 20 days of hiring a new ... [img_title-17] [img_title-16]

Blank W 4 withholding forms Symmetry Software

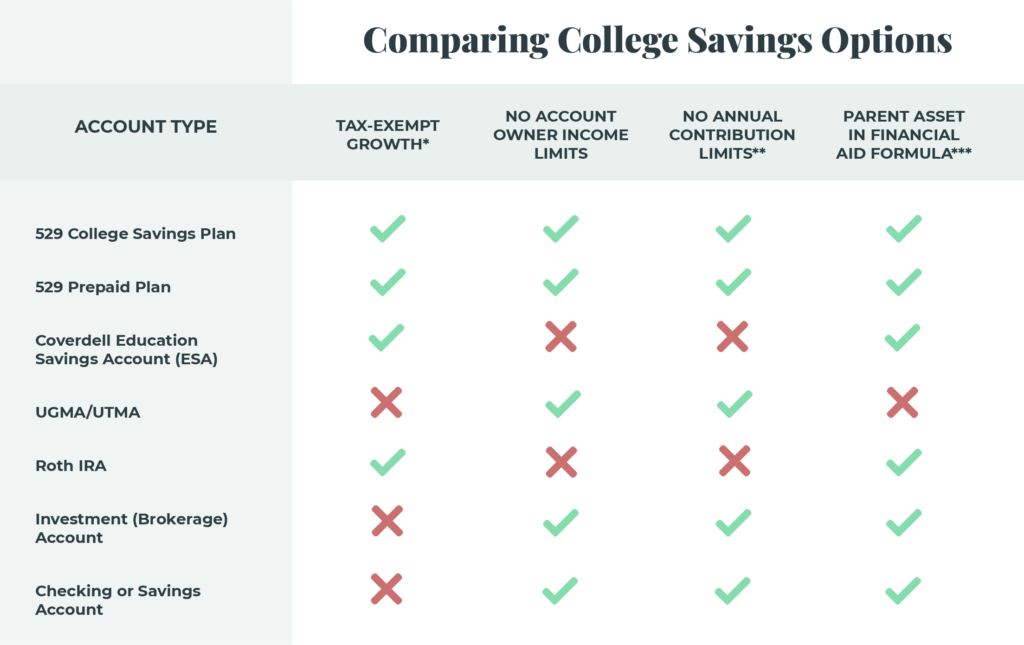

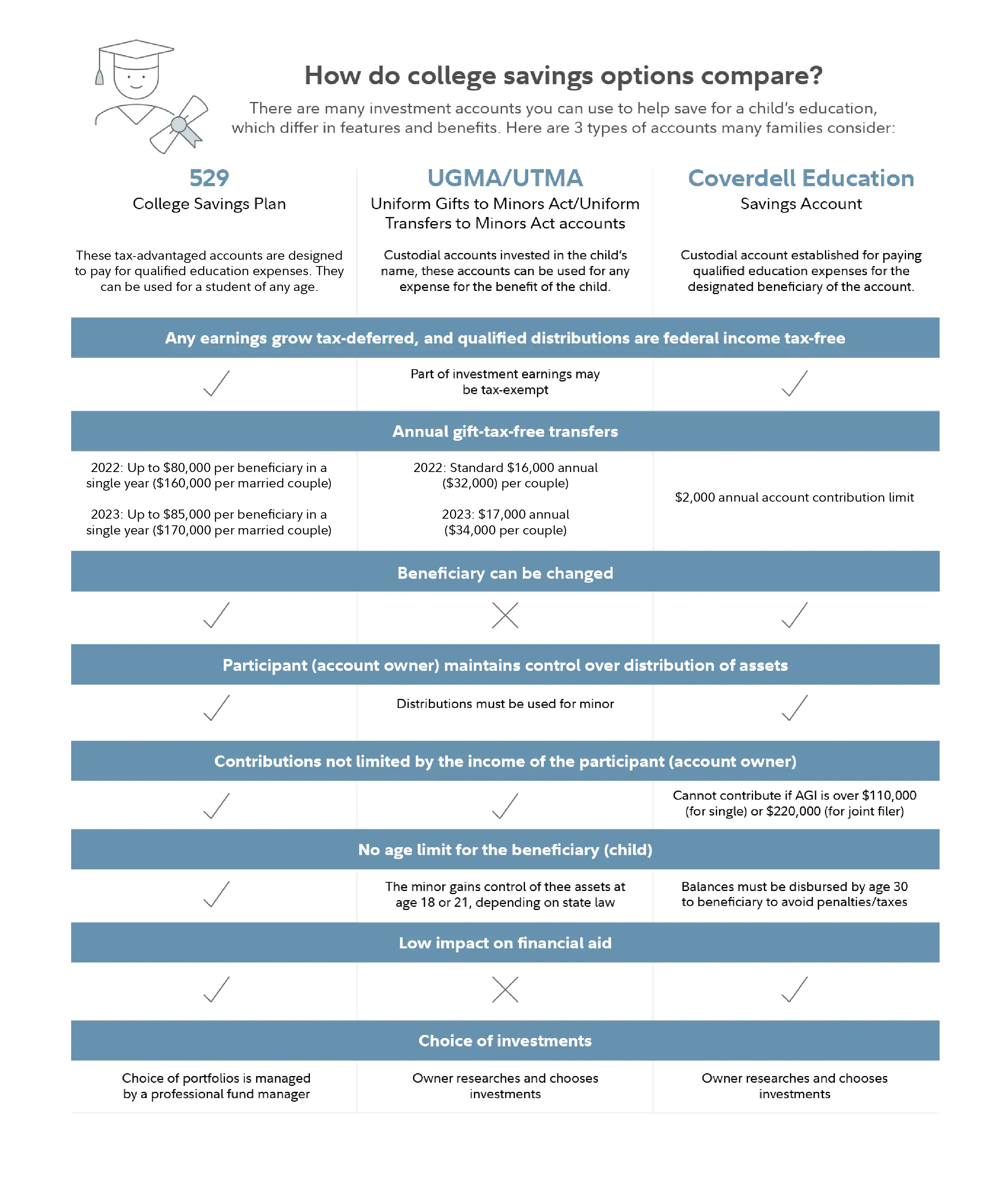

529 Vs Roth IRA The Annuity Expert

Employee Give this form to your employer and keep a copy for your records Remember to review this form once a year and update it if needed Note Single Roth Ira Rules 2024 Rollover Windy Bernadine

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when Simple Ira Roth 2024 Secure Act Linet Phaedra UTMA Vs 529 Which Plan Should I Choose

New 529 Rules 2024 Tandy Florence

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

New 529 Plan Rules 2024 Changes Rona Vonnie

New 529 Rules 2024 Adah Linnie

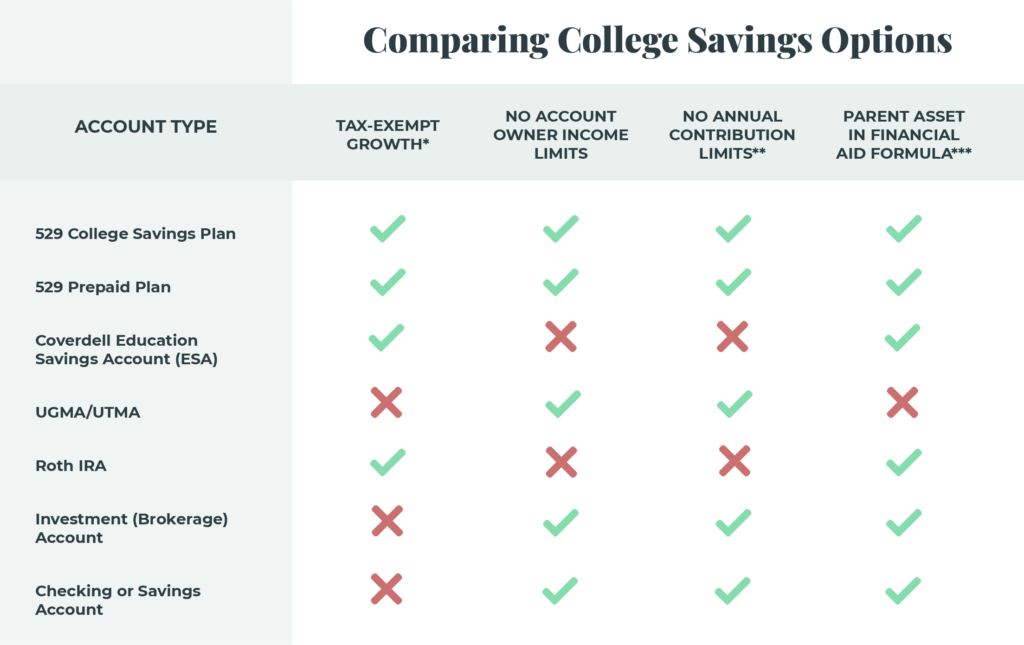

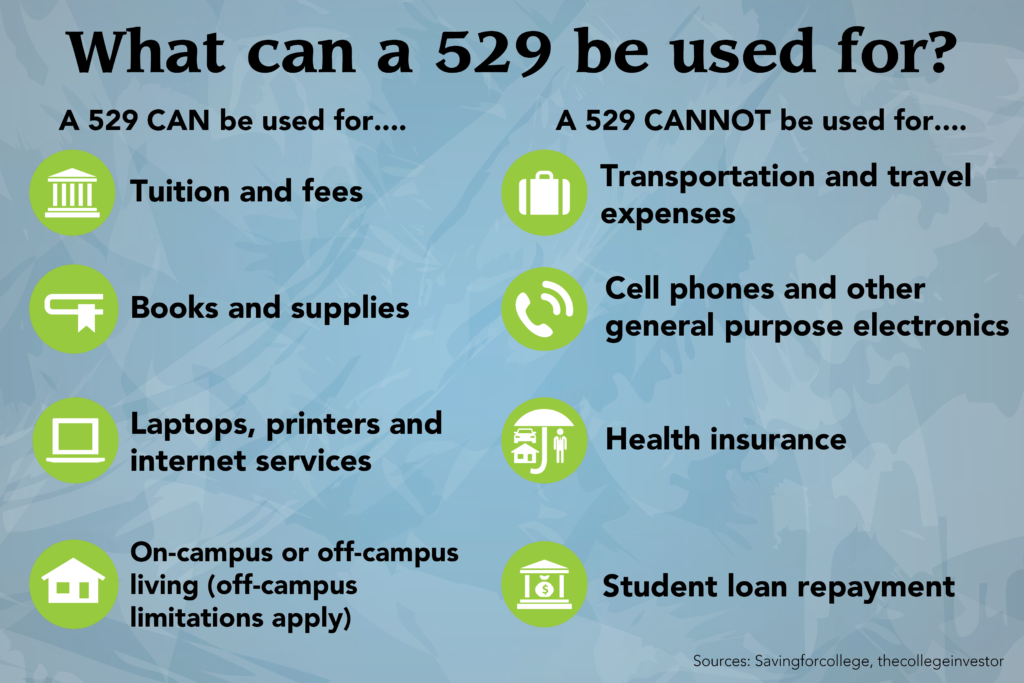

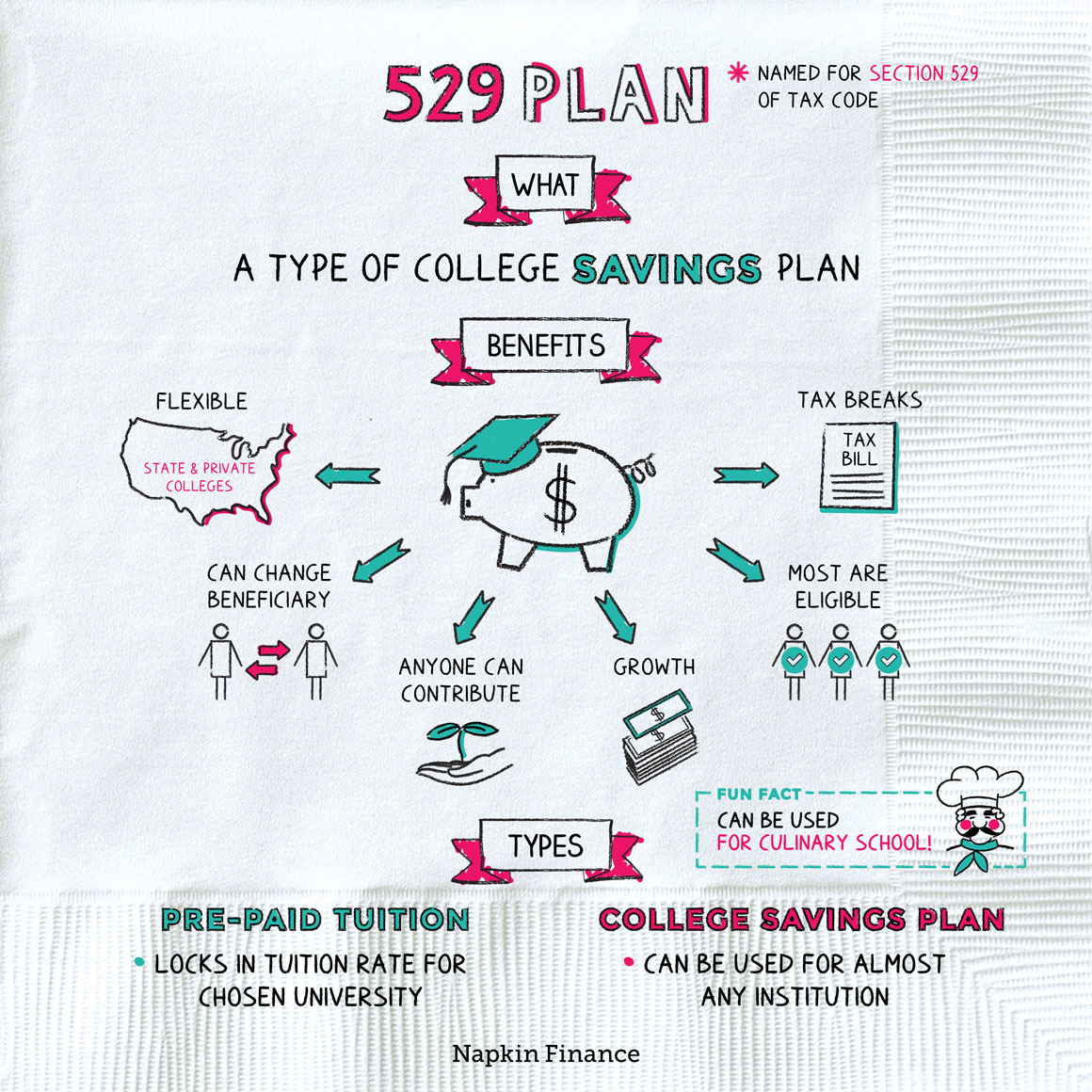

How A 529 Plan Works State Farm

College Access 529 Utah 529 Plan Rules And College Savings Options

Iowa 529 Plan Tax Deduction 2024 Lotti Rhianon

Maximum Contribution To 529 Plan 2025 Stefan A Gruenewald

Roth Ira Rules 2024 Rollover Windy Bernadine

Employer Provided Health Insurance Rules Financial Report

529 Plan Basics Fidelity