73 13 16 Divided By 2 are a versatile service for any individual aiming to produce professional-quality documents swiftly and quickly. Whether you need customized invites, returns to, planners, or calling card, these layouts enable you to personalize material with ease. Merely download and install the design template, modify it to match your requirements, and publish it at home or at a printing shop.

These themes save time and money, using an affordable alternative to employing a designer. With a large range of designs and layouts offered, you can locate the ideal style to match your personal or company requirements, all while maintaining a sleek, specialist look.

73 13 16 Divided By 2

73 13 16 Divided By 2

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Una persona o entidad (solicitante del Formulario W-9) a quien se le requiera presentar una declaración informativa ante el IRS le está dando este formulario ...

W 9 blank IRS Form Financial Services Washington University

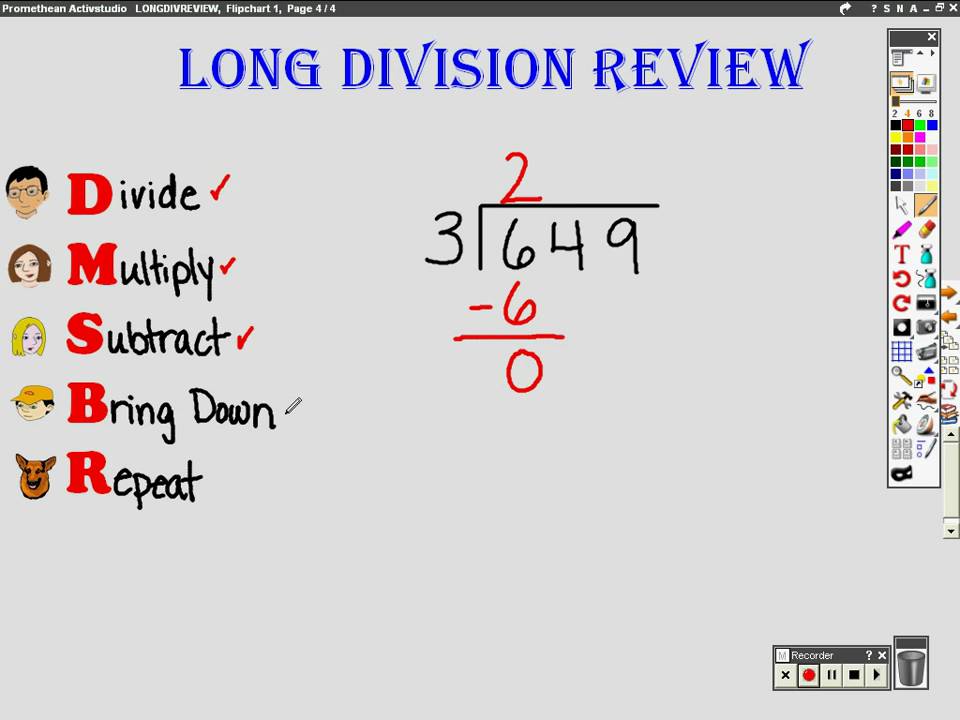

Long Division Video Corbettmaths

73 13 16 Divided By 2A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) to report, for example, income ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

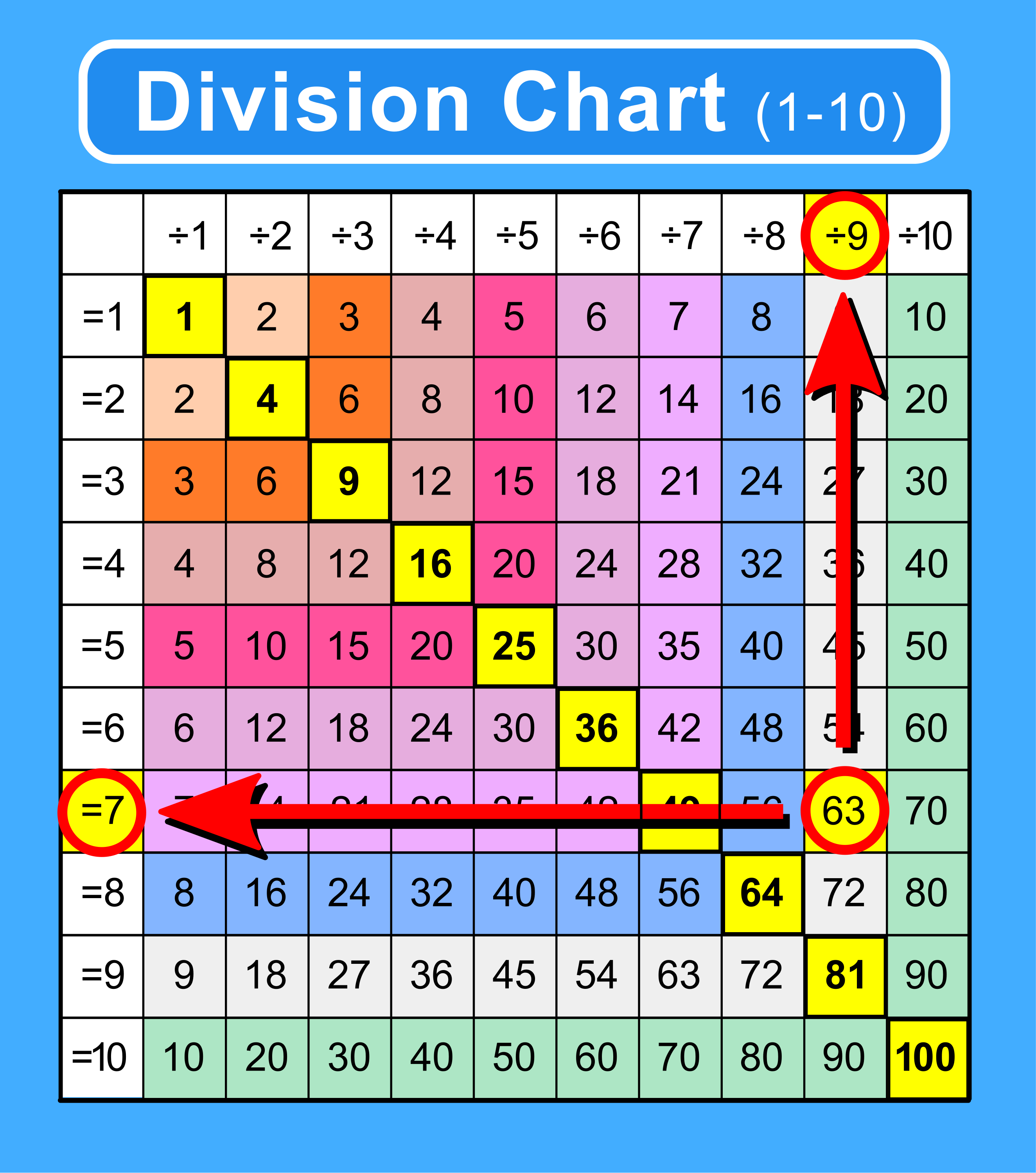

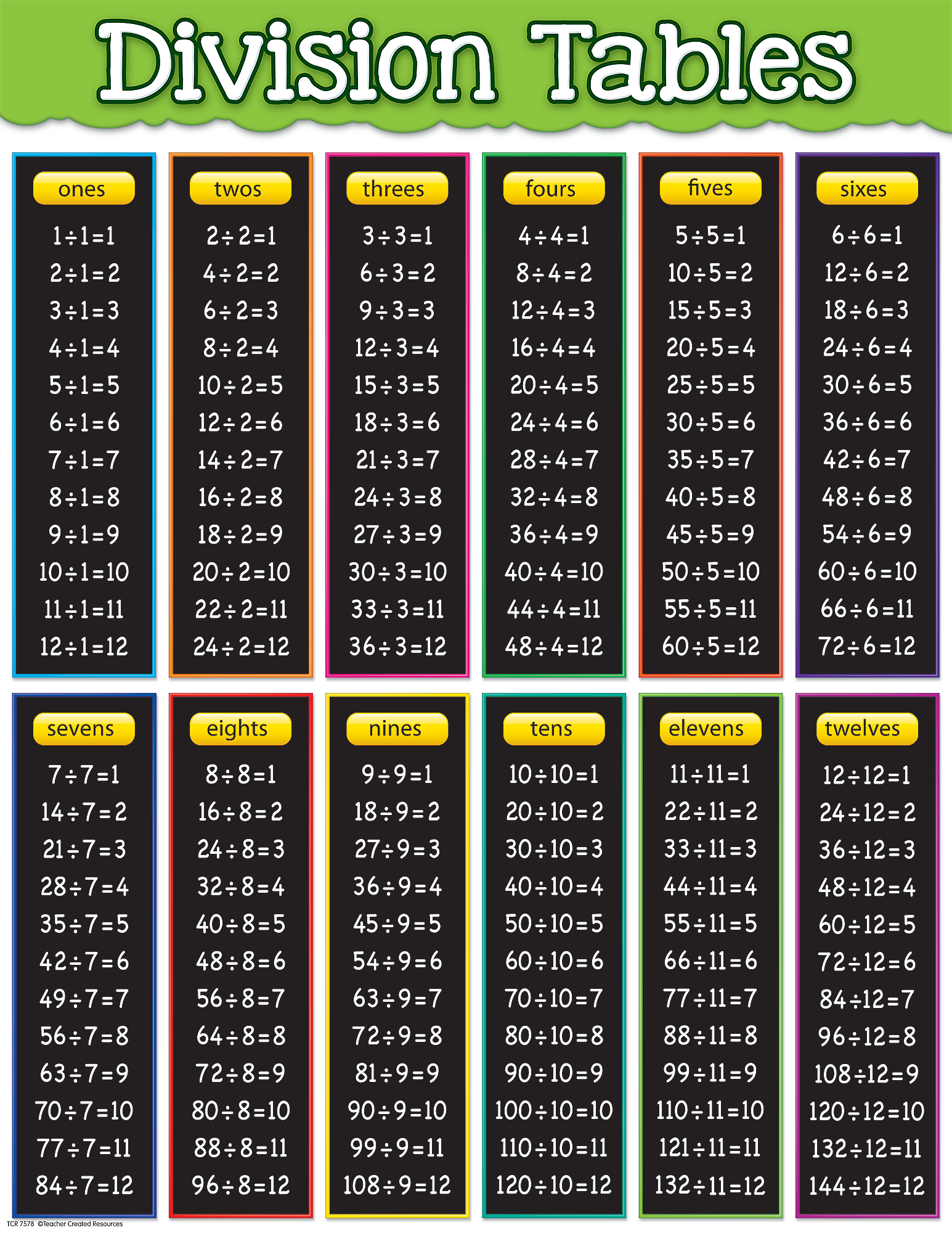

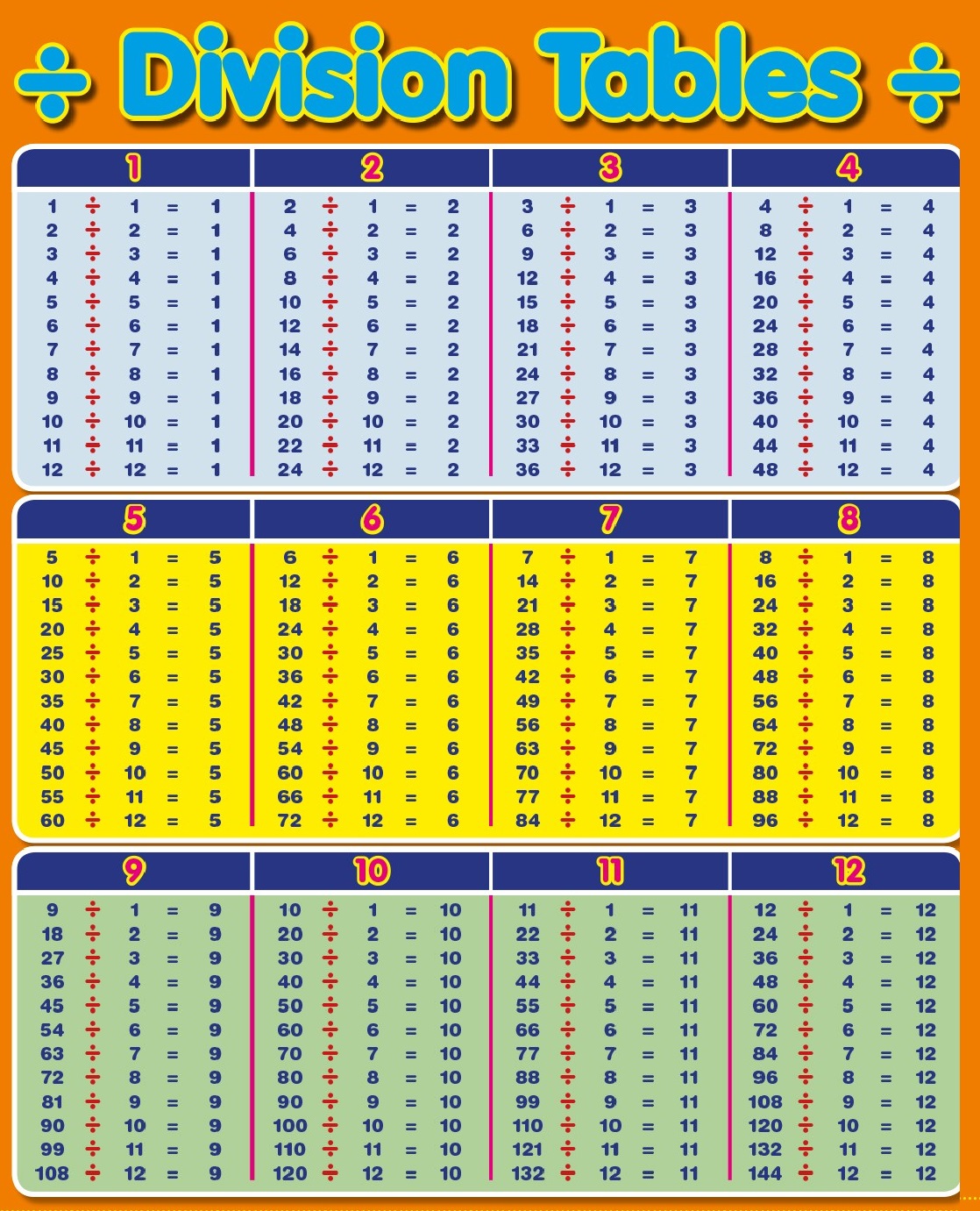

Complete your W-9 online with our fillable form W-9 solution. Quickly fill out, e-sign, and securely submit or download the W-9 form for your tax needs. Blank Division Chart 10 Division Tables

Form W 9 sp Rev March 2024 IRS

Tabla De Division Del 1 Al 12

Form MA W 9 Rev April 2009 Print Form Page 2 What Name and Number to Give the Requester For this type of account Give name and SSN of 1 Individual 500 Divided By 15

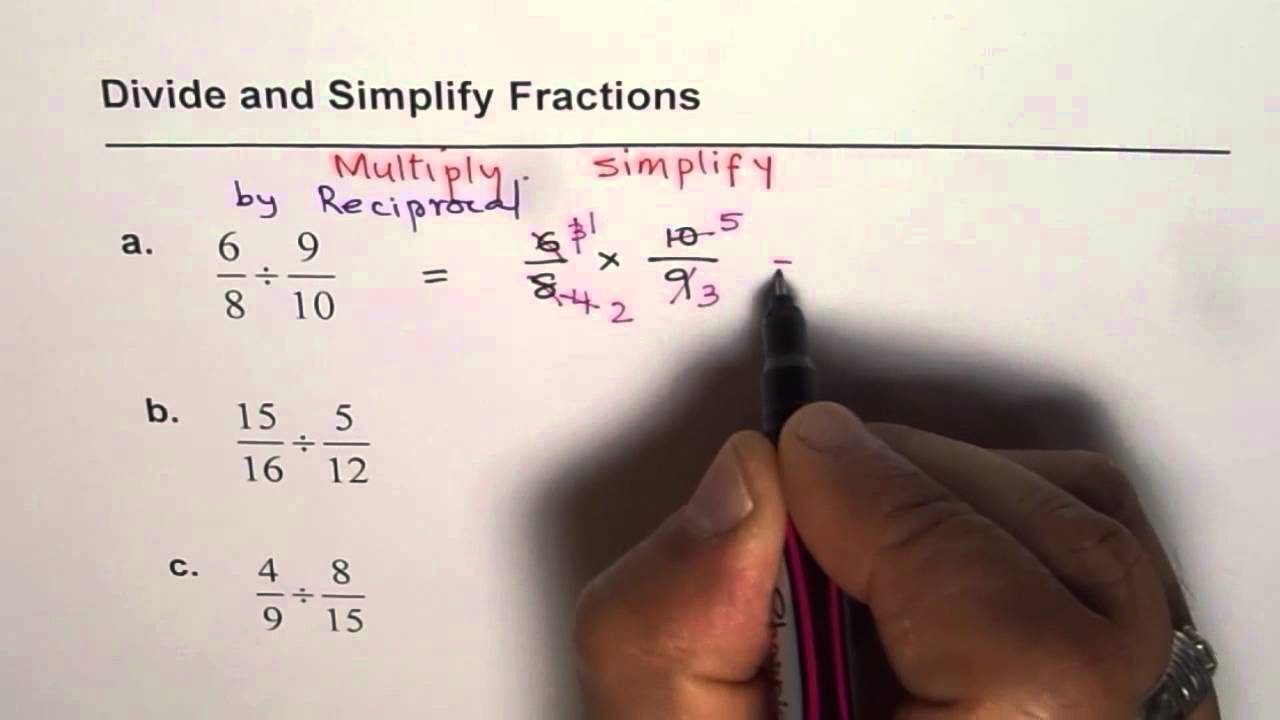

Give form to the requester Do not send to the IRS Before you begin For guidance related to the purpose of Form W 9 see Purpose of Form below Print or type Area With Fractions 28 Divide By 30

Duplication Division

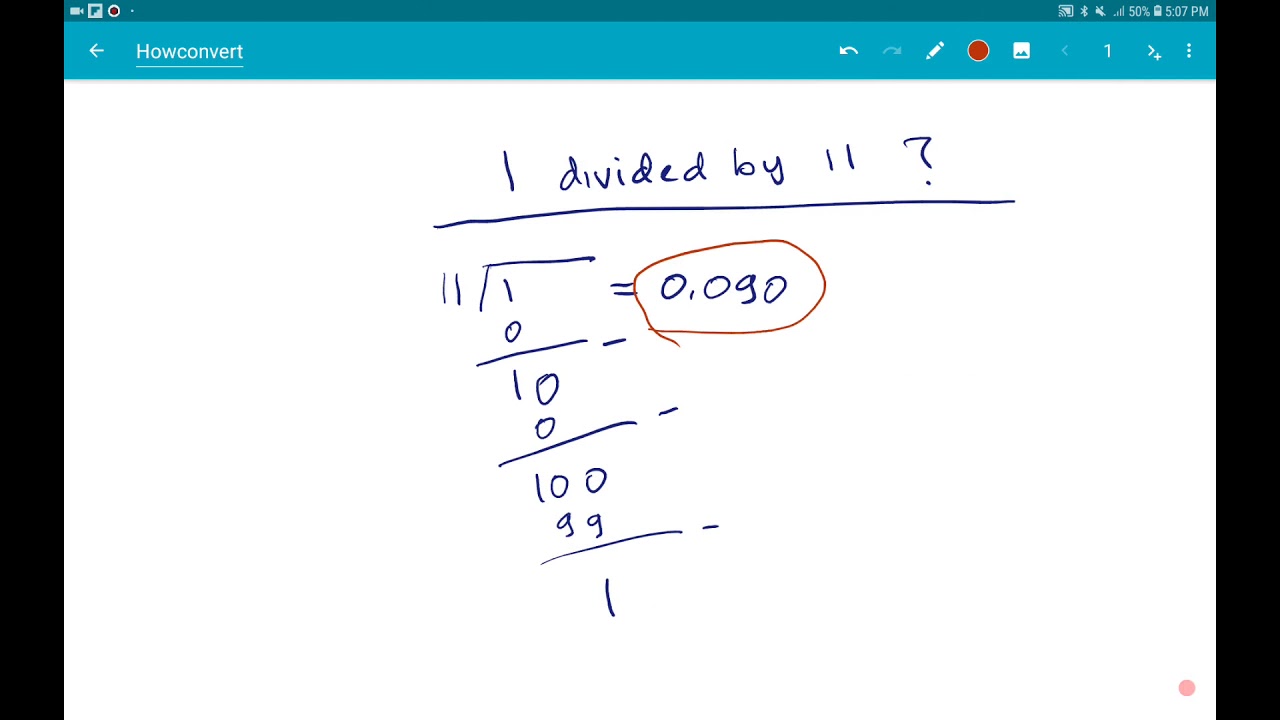

Dividing Decimals

27 15 Simplified Form

28 Divide 400

10 Division Table

28 Divide By 30

28 Divide By 30

500 Divided By 15

26 500 Divided By 12

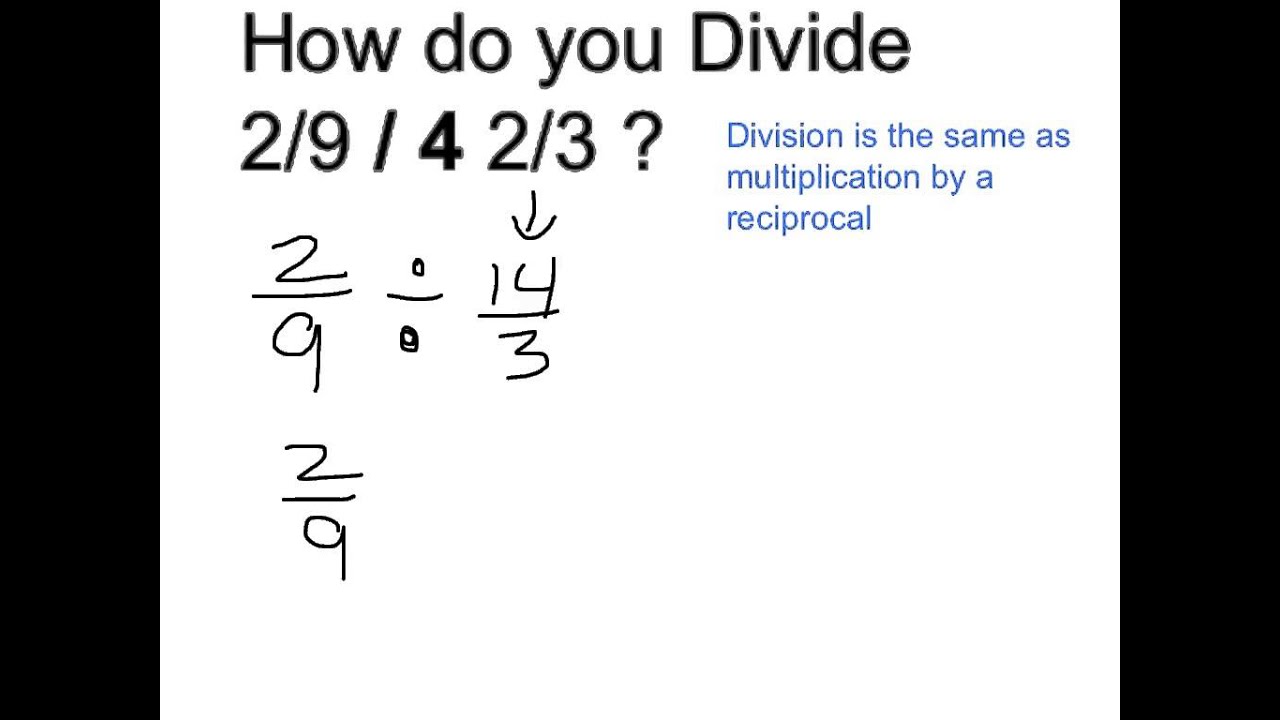

8 9 Divided By 8