8 15 Of 5 As A Improper Fraction are a functional option for anyone looking to create professional-quality documents promptly and easily. Whether you require customized invites, returns to, organizers, or business cards, these layouts allow you to individualize web content easily. Merely download and install the design template, modify it to fit your needs, and publish it in the house or at a printing shop.

These layouts save money and time, offering a cost-efficient option to hiring a developer. With a wide variety of styles and styles offered, you can discover the excellent design to match your individual or business demands, all while preserving a refined, specialist look.

8 15 Of 5 As A Improper Fraction

8 15 Of 5 As A Improper Fraction

We provide free printable single double and triple elimination tournament brackets along with 3 game guarantee and round robin formats for any sport game Download or print this printable tournament bracket for your 9-team double elimination tournament! Download Editable PDF

Free Cornhole Tournament Printable Brackets Triangle Lawn Games

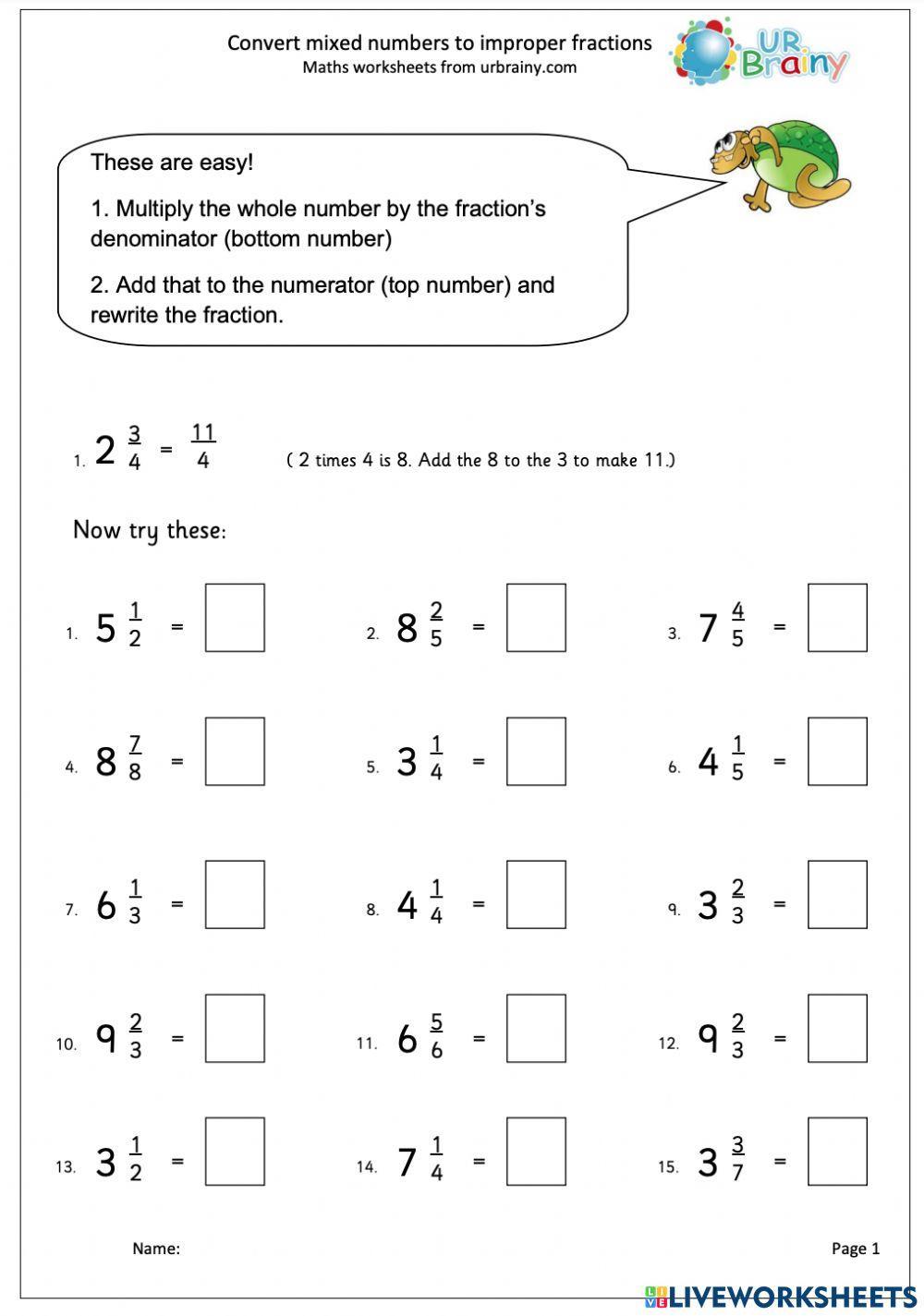

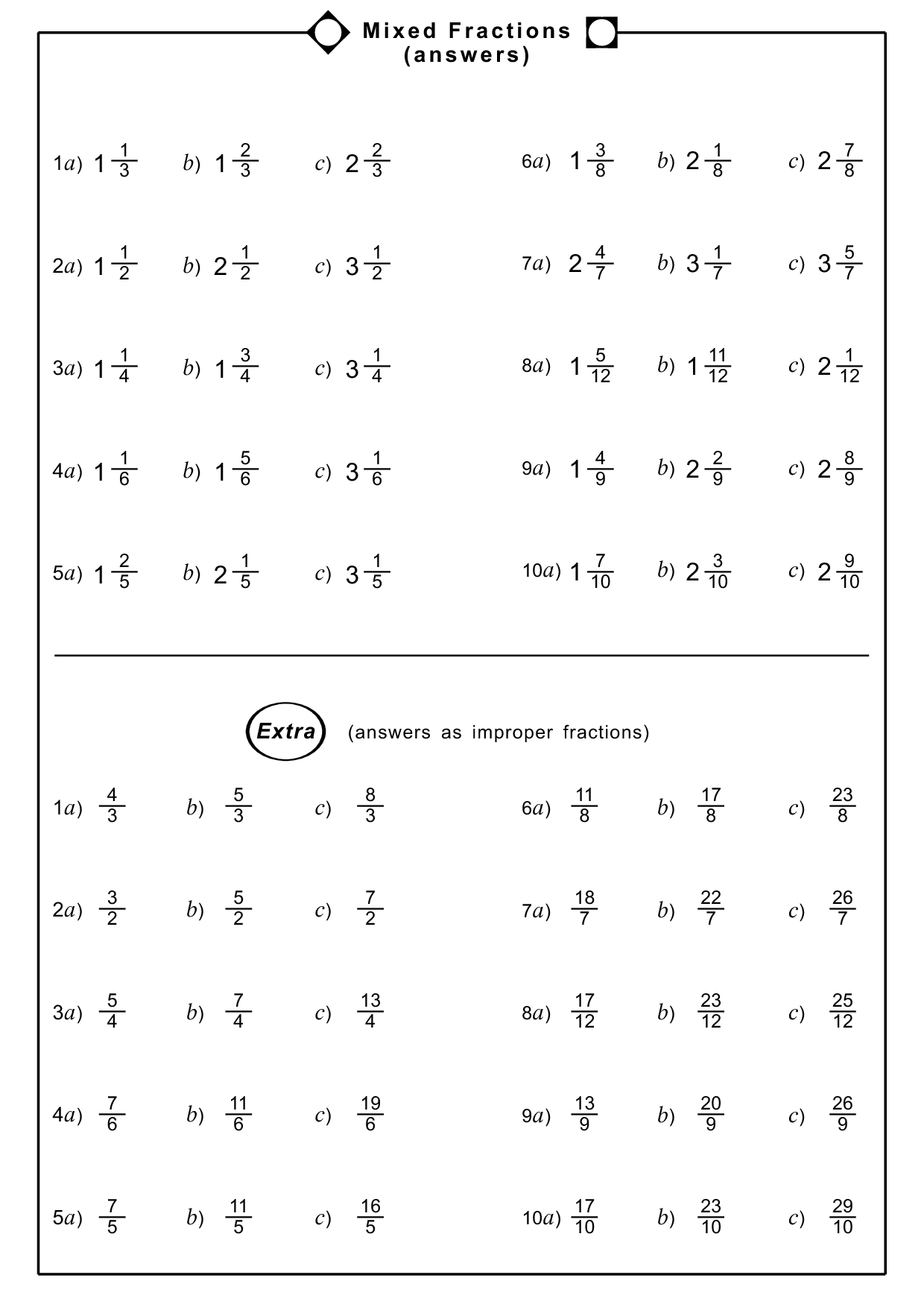

Converting Mixed Number To Improper Interactive Worksheet

8 15 Of 5 As A Improper FractionView the Printable Tournament Brackets for Double Elimination in our extensive collection of PDFs and resources. Access the Printable Tournament Brackets ... Double Elimination Brackets PDF Excel 3 Team3 Team4 Team4 Team5 Team5 Team6 Team6 Team7 Team7 Team8 Team8 Team9 Team9

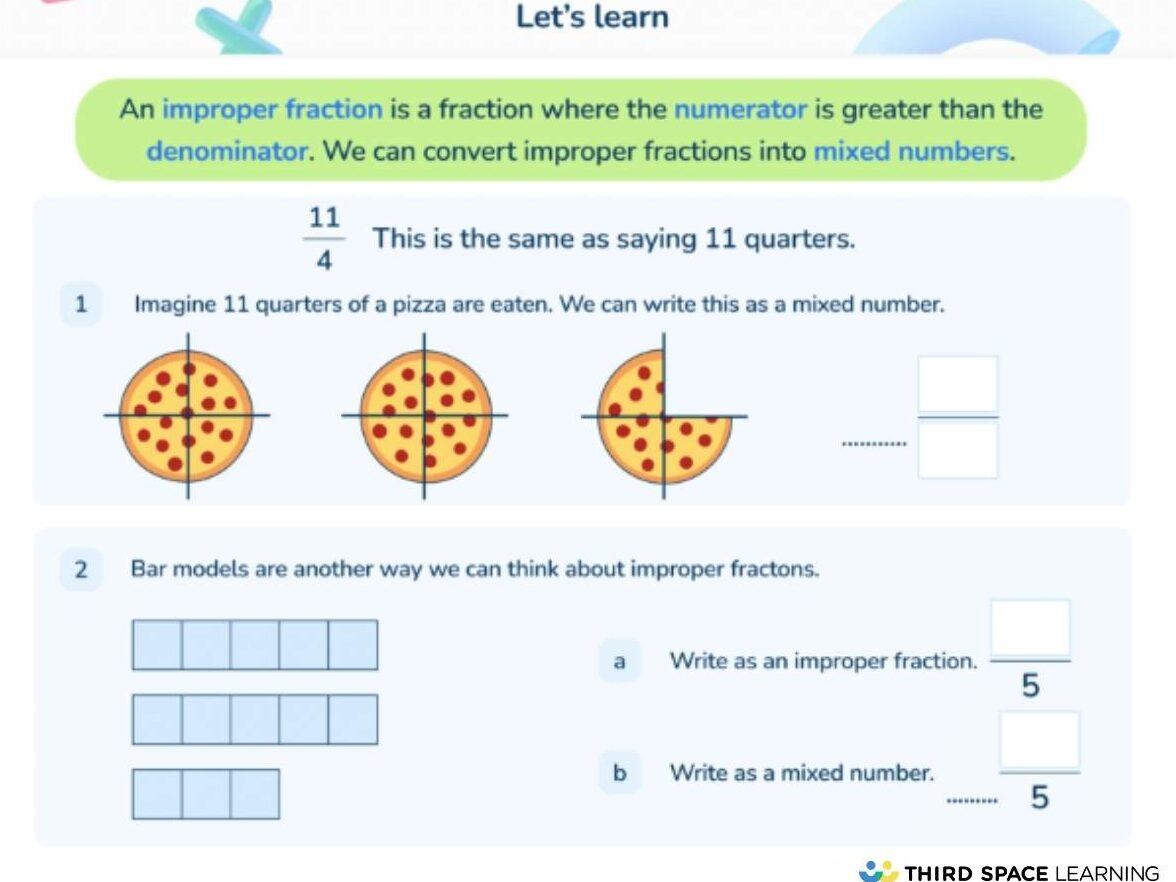

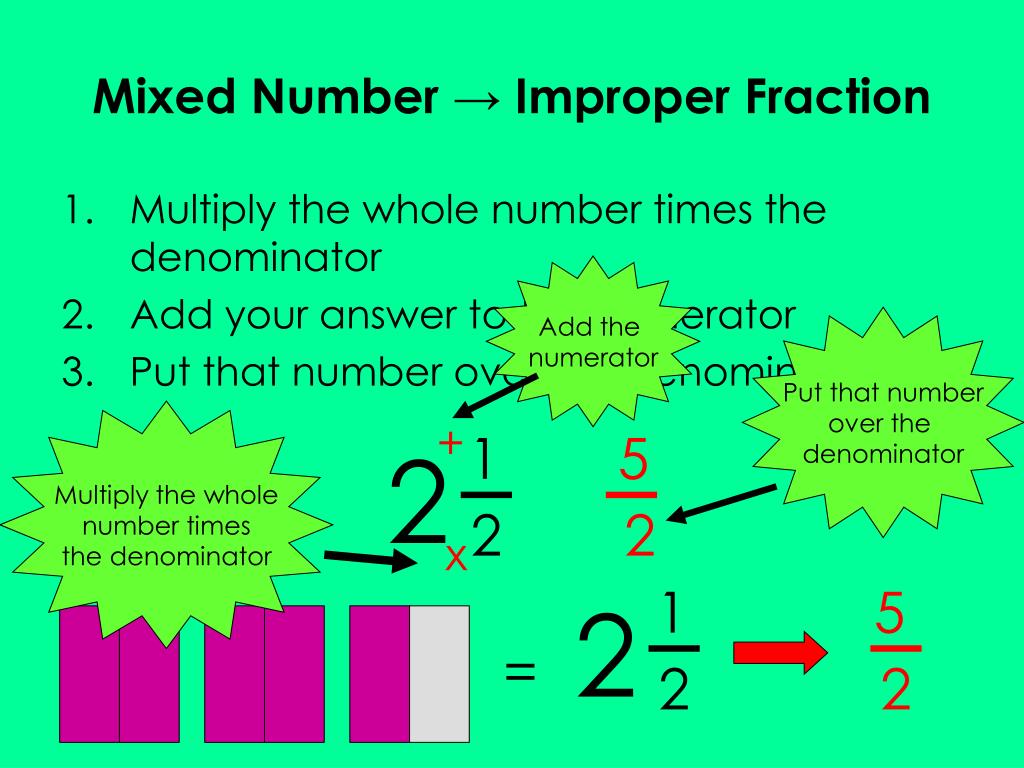

Double Elimination Brackets. Click any printable tournament bracket to see a larger version and download it. 4 Team Double Elimination Bracket. 1 4 As A Improper Fraction Solve Improper Fraction

9 Team Double Elimination Bracket Printable Diamond Scheduler

Free Improper Fraction Mixed Number Worksheet Download Free Improper

Easily organize single or double elimination tournaments for sports games or competitions Customize and print these editable brackets for a stress free Explain Improper Fractions

Printable double elimination tournament brackets for your sports league or office pool Your double elimination bracket is fully customizable Number Line Fractions Calculator Converting Improper Fractions

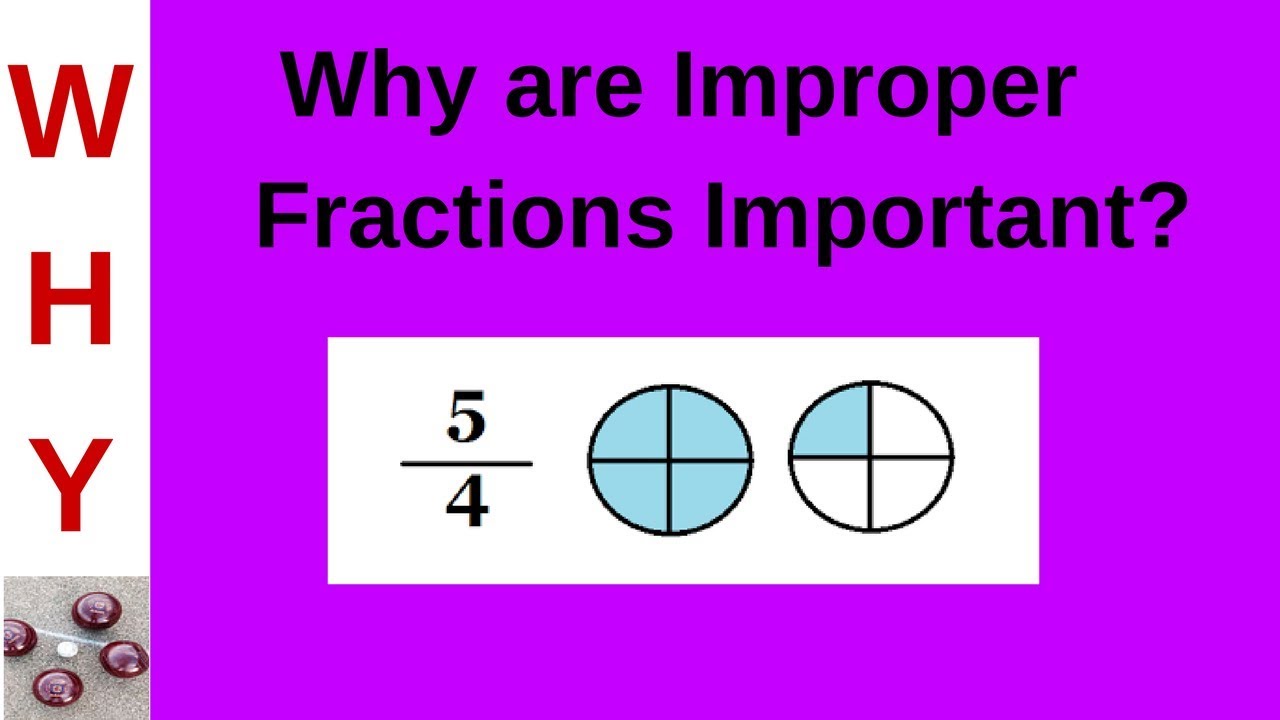

Improper Fractions Definition

Solve Improper Fractions

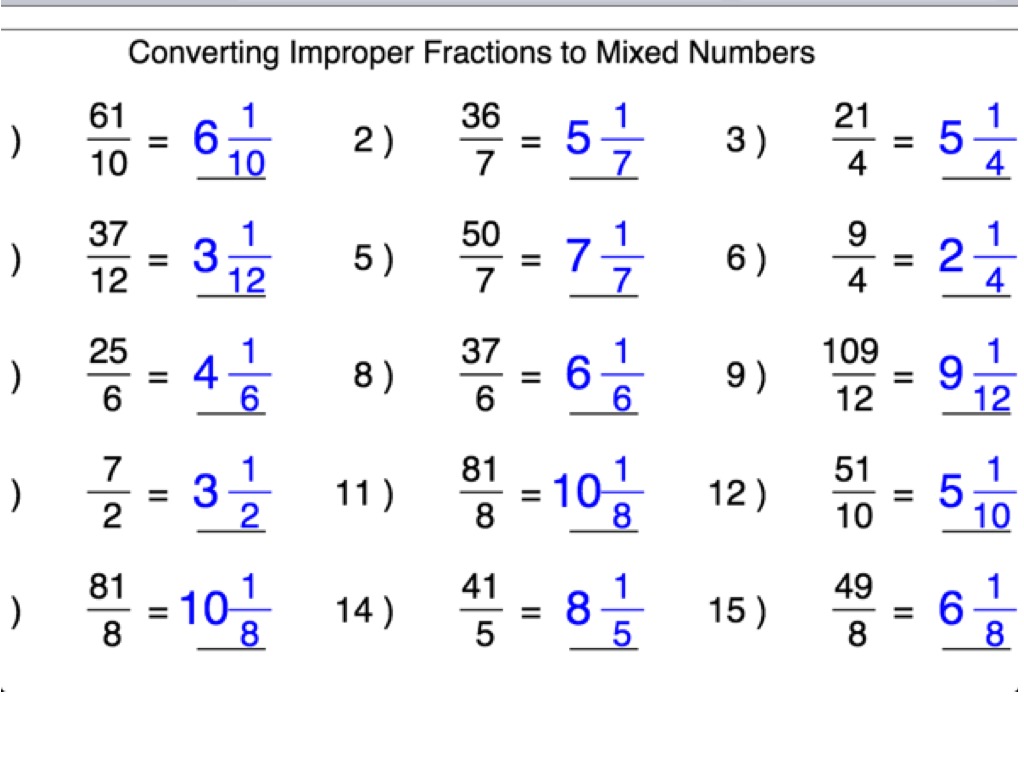

Converting Improper Fractions To Decimals

Comparing Improper Fractions

Adding Three Fractions Calculator

Change Improper Fraction

Add Mix Fractions

Explain Improper Fractions

Converting Improper Fractions

Math Answer Keys Addition Carrying Worksheets Wwwjustmommies