8 Divided By 36 Long Division are a versatile solution for anyone looking to create professional-quality files promptly and easily. Whether you require personalized invites, resumes, coordinators, or calling card, these templates allow you to personalize content easily. Simply download and install the layout, modify it to suit your requirements, and publish it in your home or at a print shop.

These templates conserve time and money, offering an economical alternative to employing a designer. With a vast array of designs and layouts offered, you can find the excellent layout to match your individual or organization needs, all while maintaining a refined, expert appearance.

8 Divided By 36 Long Division

8 Divided By 36 Long Division

Learn the history of the Silent Night lyrics Print a beautiful watercolor copy of the lyrics to use this Christmas Christmas Song Silent Night Lyrics: Silent night, holy night, All is calm, all is bright, Round yon Virgin Mother and Child, Holy infant so tender and mild, ...

Christmas Song Lyrics Silent Night Printable FamilyEducation

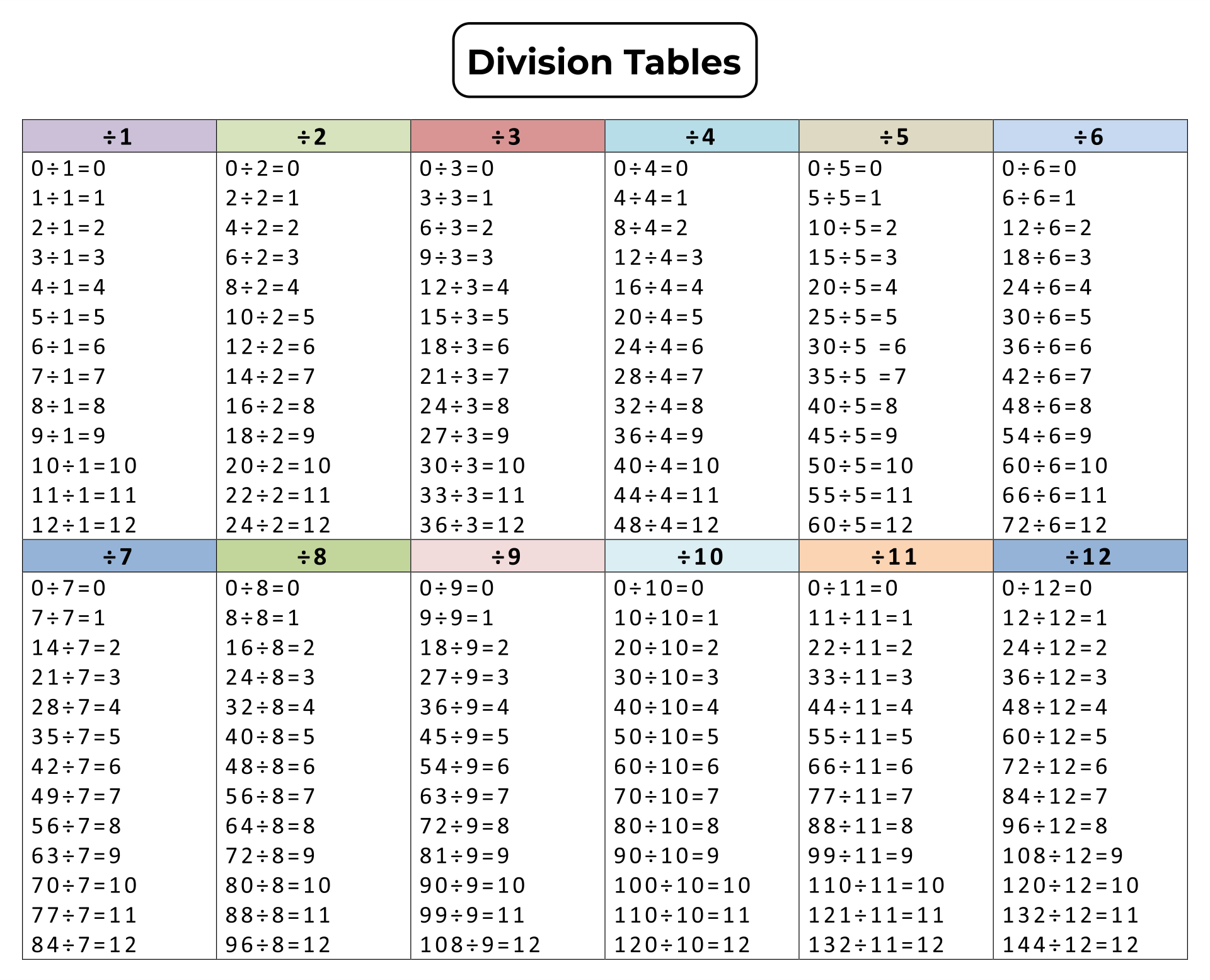

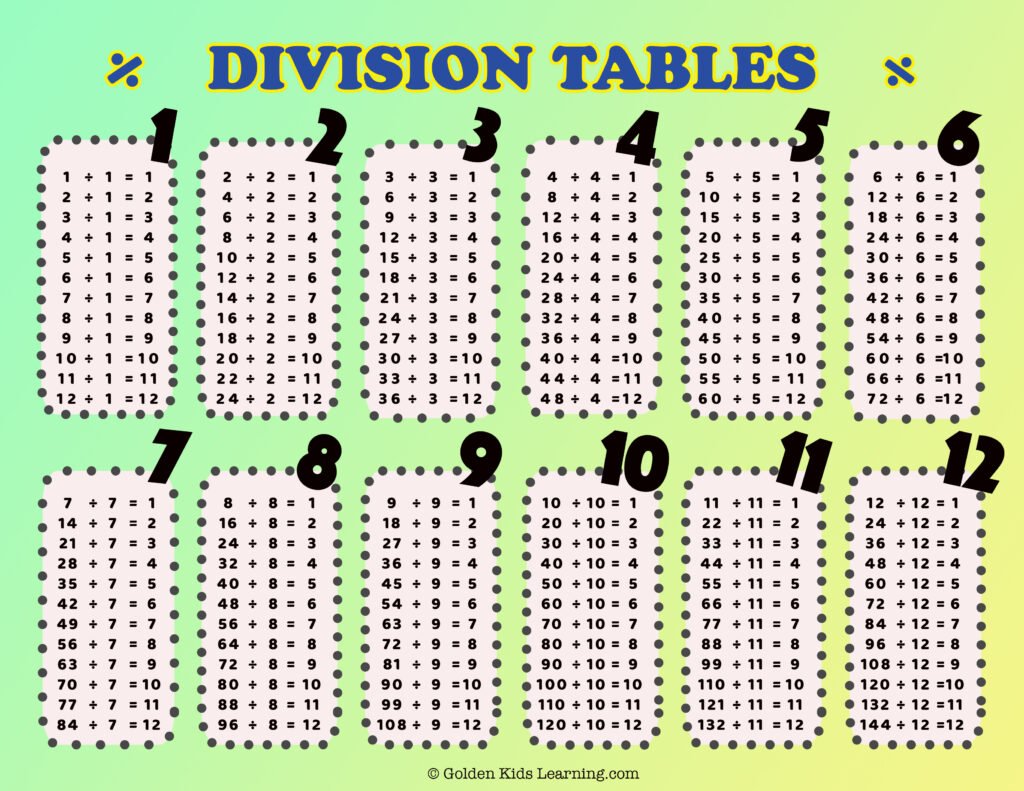

Division Table 1 12 Printable Math Resources

8 Divided By 36 Long DivisionSilent Night Lyrics Printable Large Wall Decor | Farmhouse Decor | Black & White | Christmas Wall Art | Christmas Song Decor Silent night holy night All is calm all is bright Round yon virgin mother and Child Holy Infant so tender and mild Sleep in heavenly peace

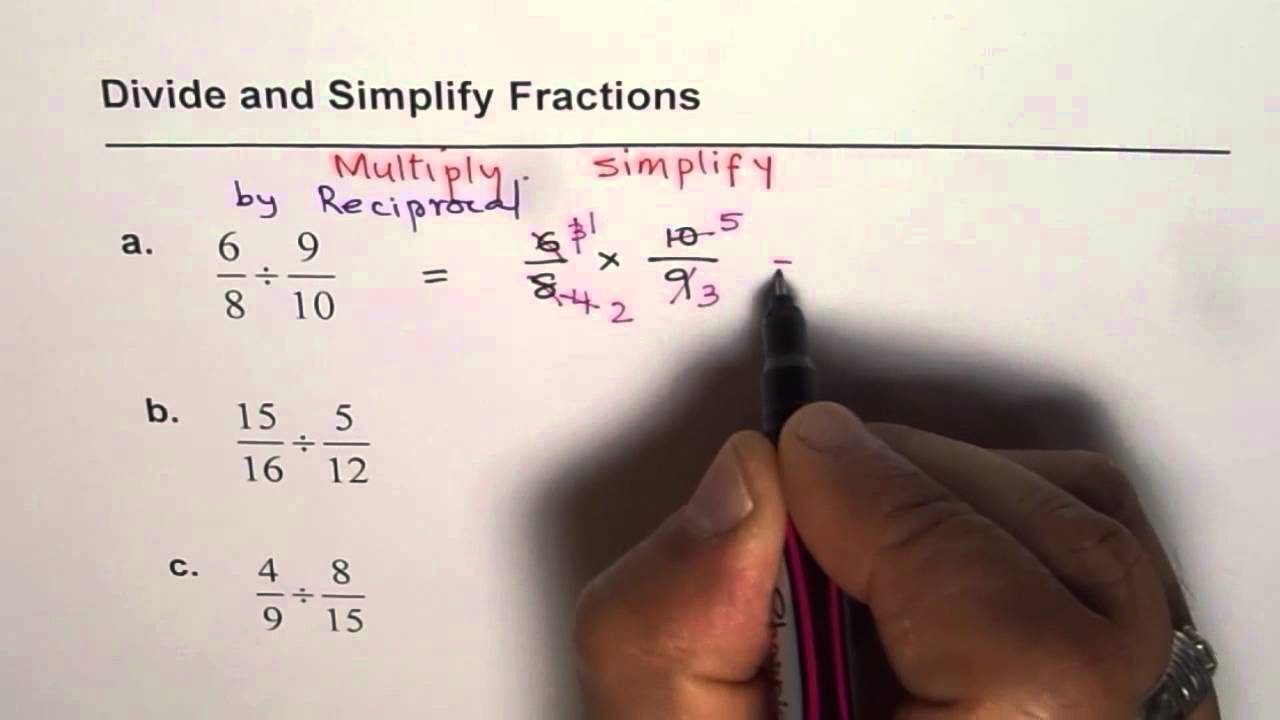

Download free printable lyrics for Silent Night in PDF format. Enjoy singing along to this classic Christmas carol. Math Division Rules Division With Decimal

Silent Night Lyrics Love to Sing

12 Division Charts For Making Maths Fun Kitty Baby Love

Christ the Savior is born Christ the Savior is born Silent night holy night Son of God love s pure light Radiant beams from Thy holy face Division Chart Printable

The English lyrics to Silent Night with links to sheet music for the carol All sheet music and lyrics are available in colorful festive printable PDFs 10 Divided By 17 Bar Diagram Fractions

10 Division Table

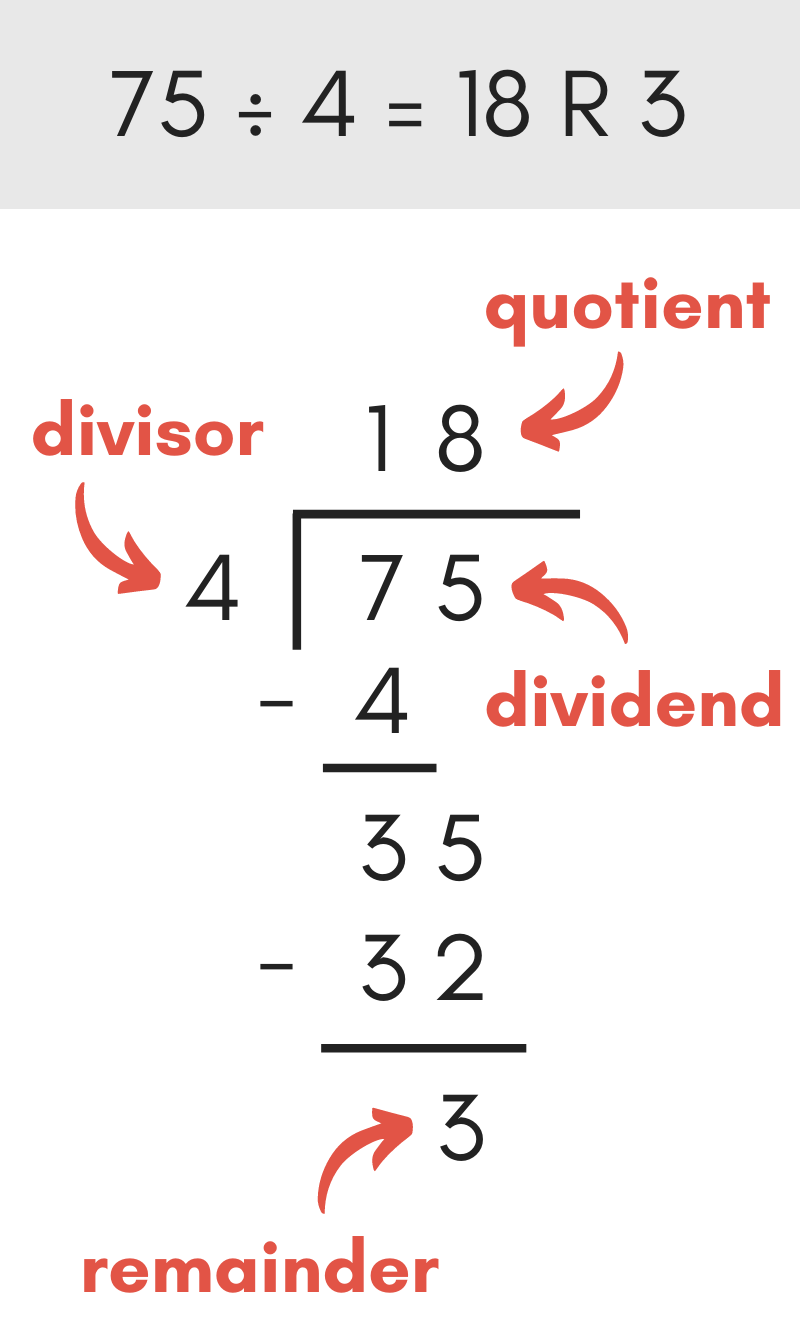

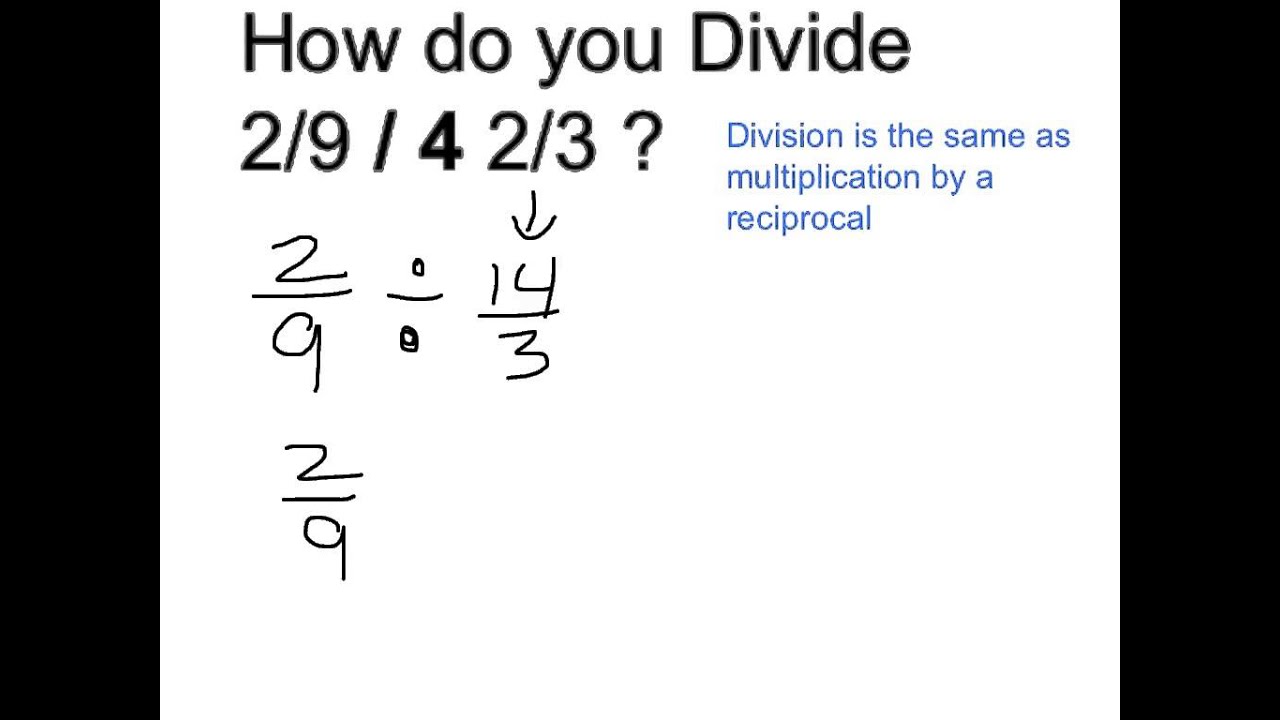

Longhand Division

15 Divided By 23

15 Divided By 23

Solving Division

Divide Table Chart

Division Charts Printable

Division Chart Printable

10 Divided By 1 2

100 Divided By 86