8750 Brutto In Netto Steuerklasse 1 are a functional option for anybody seeking to develop professional-quality papers promptly and easily. Whether you require personalized invites, returns to, coordinators, or calling card, these templates enable you to individualize material with ease. Simply download the design template, edit it to fit your demands, and publish it in your home or at a printing shop.

These design templates conserve money and time, offering an economical alternative to employing a designer. With a vast array of designs and formats available, you can find the best layout to match your individual or business requirements, all while preserving a polished, expert look.

8750 Brutto In Netto Steuerklasse 1

8750 Brutto In Netto Steuerklasse 1

Below we have 129 pages of printable Easter egg templates coloring pages and even some eggs that are fully colored and ready to print and use On this page, you will find 30 all new Easter Egg coloring pages that are completely free to download and print.

Easter Eggs Coloring Pages Coloring ws

GitHub YordanovDnA qchart Qchart Is Reusable Chart Component

8750 Brutto In Netto Steuerklasse 1From blank egg templates ready to be decorated with your own unique style, to patterned Easter egg printables waiting for a splash of color, and some fun ... Free templates of Easter Eggs for children Coloring pages to make Easter decoration develop fine motor skills and creativity Print free on WUNDERKIDDY

The Real Egg is modeled after a real egg using Fusion 360. All its derivatives were created either in Fusion 360 or in Meshmixer. Tesla Model Y Kofferraum Hund Beste Autos Blog Was Ist Brutto Gehalt Qualityinspire

30 Easter Egg Coloring Pages 100 Free Printables

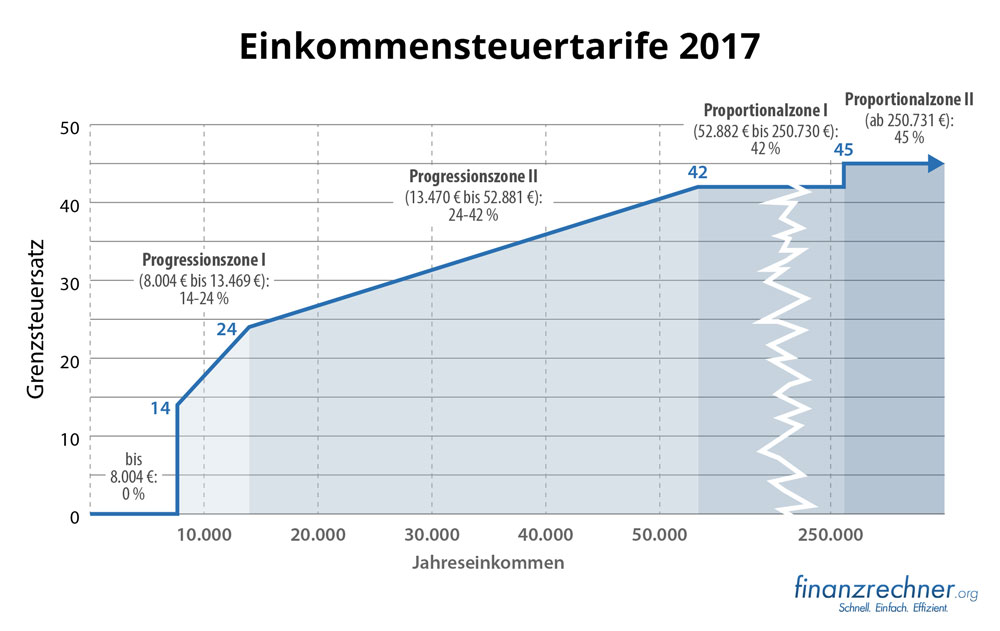

Brutto Netto Rechner 2023 Und 2024 Image To U

We have a giant Easter egg coloring page made of 6 printed sheets Simply print all 6 pages tile them together to create one big Easter egg Steuerklasse 6 Berechnen Www inf inet

Fourteen free printable Easter egg sets of various sizes to color decorate and use for various crafts and fun Easter activities Brutto Netto Gehalt Ermittlung Des Individuellen Finanzbedarfs My Abrechnung Brutto Netto Bez ge Vorlage Erstaunlich Gehaltsabrechnung

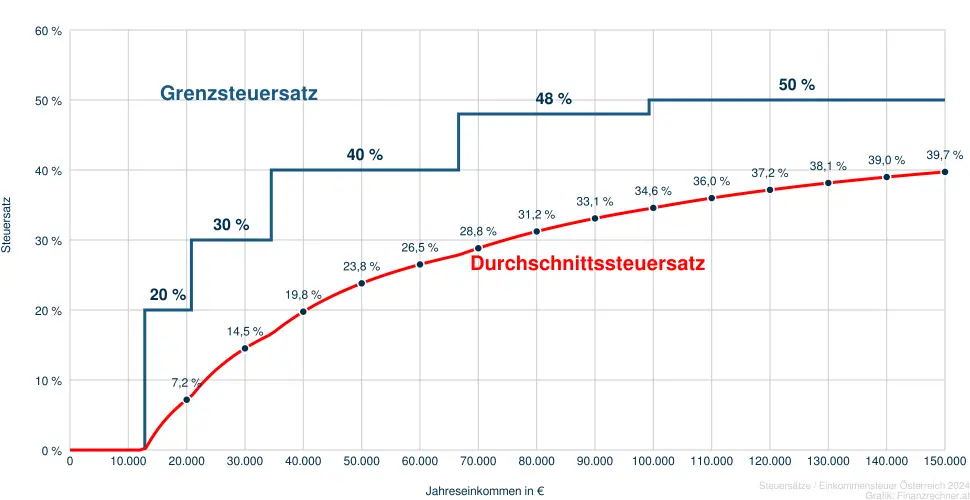

40 000 Brutto In Netto Einkommensteuer

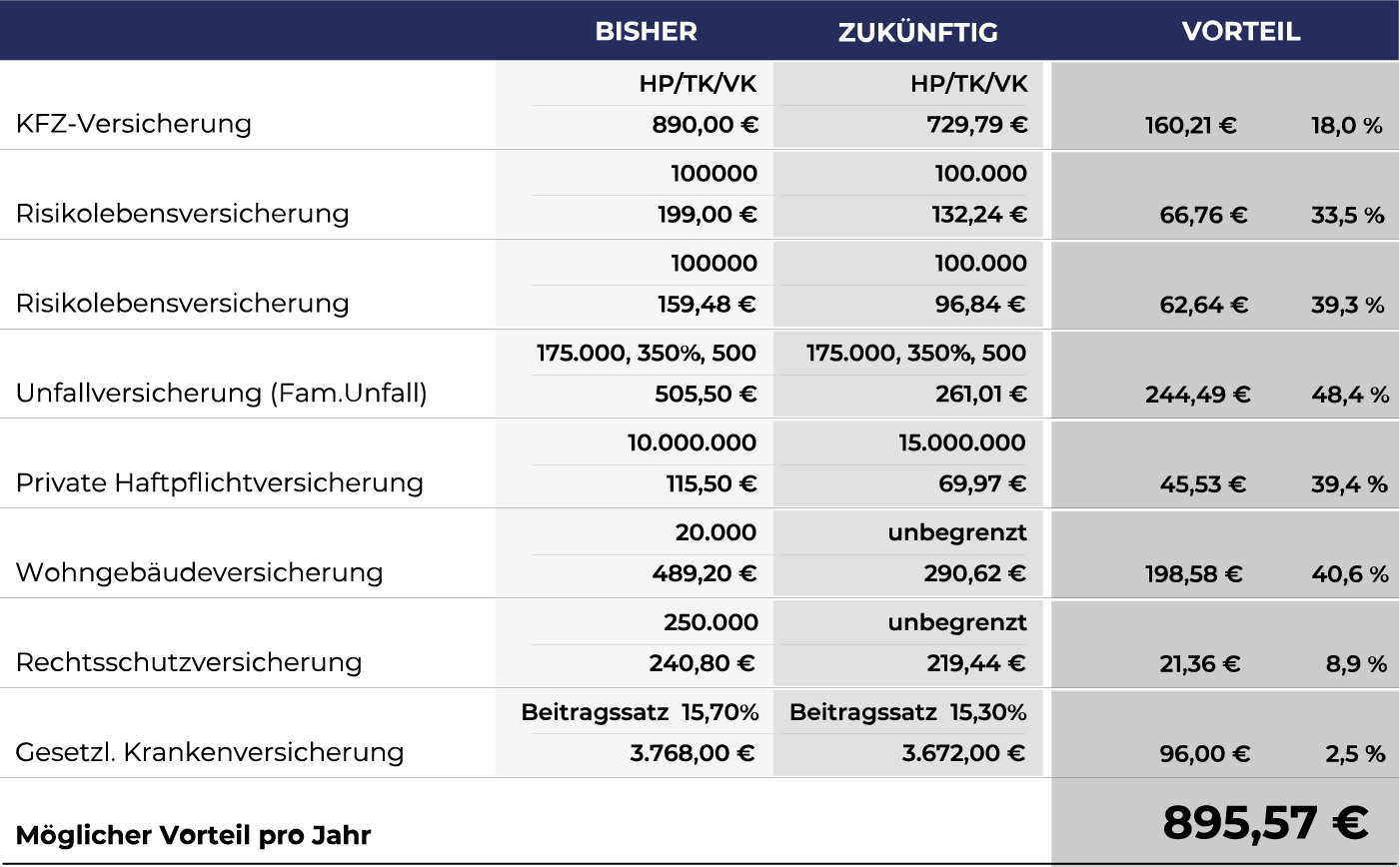

Netto Brutto Optimierung Finanzkanzlei Bremen Jetzt Mehr Rausholen

Files Blog Einkommensteuer 2015 Berechnen

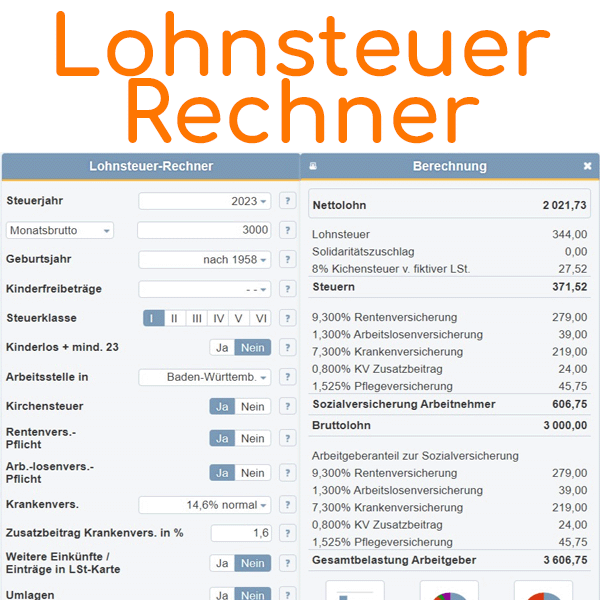

3 000 Brutto In Netto Gehalt Berechnen

Lohnsteuer Definition Klassen Freelancer Wiki

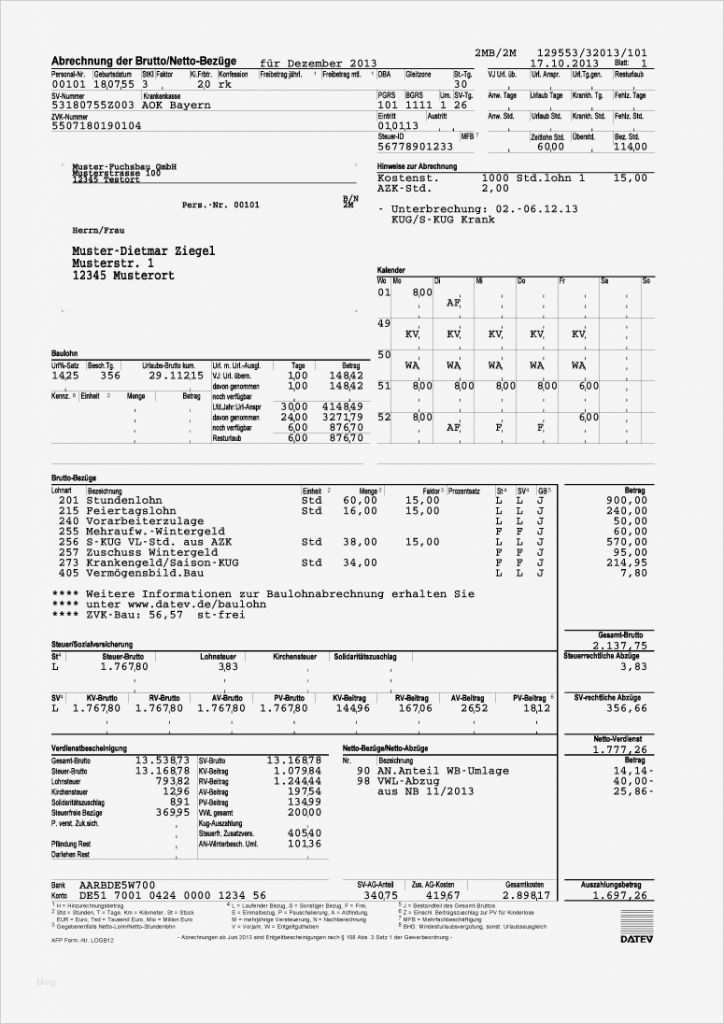

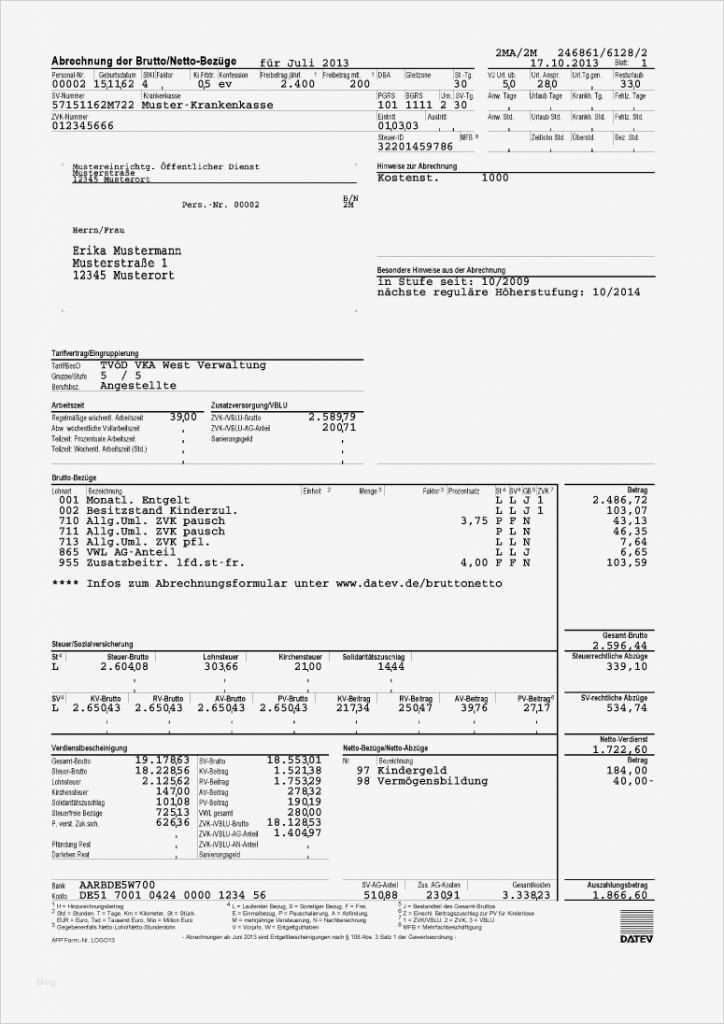

Abrechnung Brutto Netto Bez ge Vorlage Erstaunlich Datev Vorlage Ideen

Abrechnung Brutto Netto Bez ge Vorlage Luxus Datev Vorlage Ideen

Steuerklasse 6 Berechnen Www inf inet

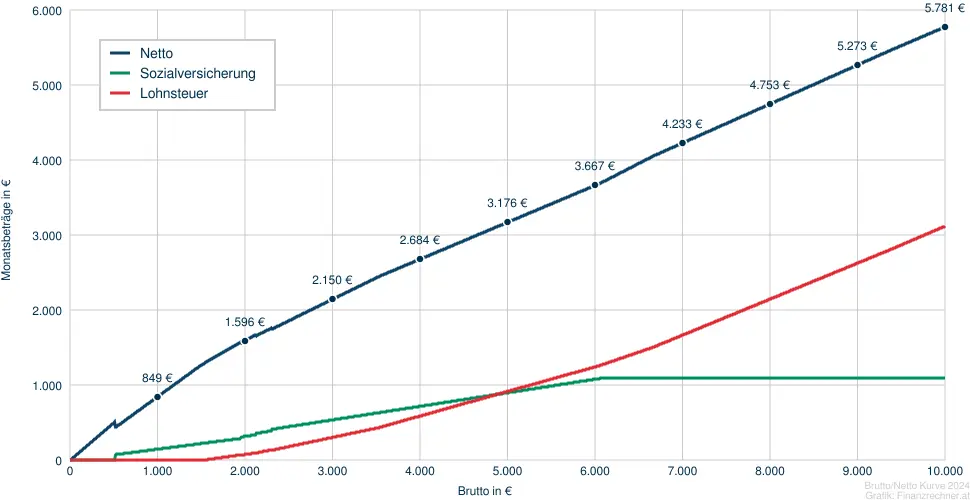

Brutto Netto Rechner 2025 Netto Gehalt Berechnen

Brutto Netto Rechner Gehaltsrechner 2025