9 Times What Equals 351 are a flexible solution for anybody looking to develop professional-quality files promptly and quickly. Whether you need custom-made invitations, returns to, planners, or calling card, these design templates enable you to customize material effortlessly. Merely download and install the theme, modify it to match your needs, and publish it in your home or at a printing shop.

These design templates save money and time, using a cost-efficient alternative to employing a developer. With a wide range of designs and styles available, you can discover the ideal layout to match your personal or organization needs, all while preserving a sleek, professional look.

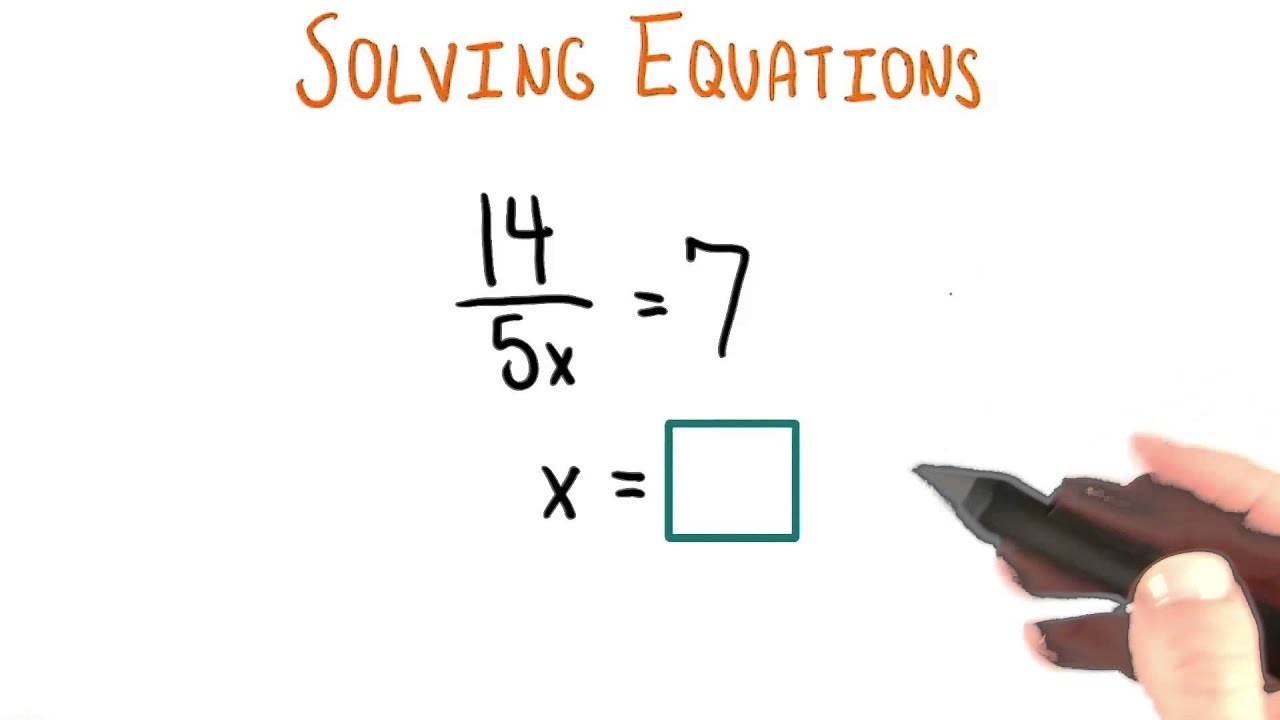

9 Times What Equals 351

9 Times What Equals 351

We offer DIY templates with custom options for fonts colors stickers photos and so much more We specialize in online editable wedding invitation cards Find your perfect Printable Wedding Invitation Card and Suite Template. Customize and print elegant designs for your special day. Start personalizing now!

Free Wedding Invitation Templates Adobe Express

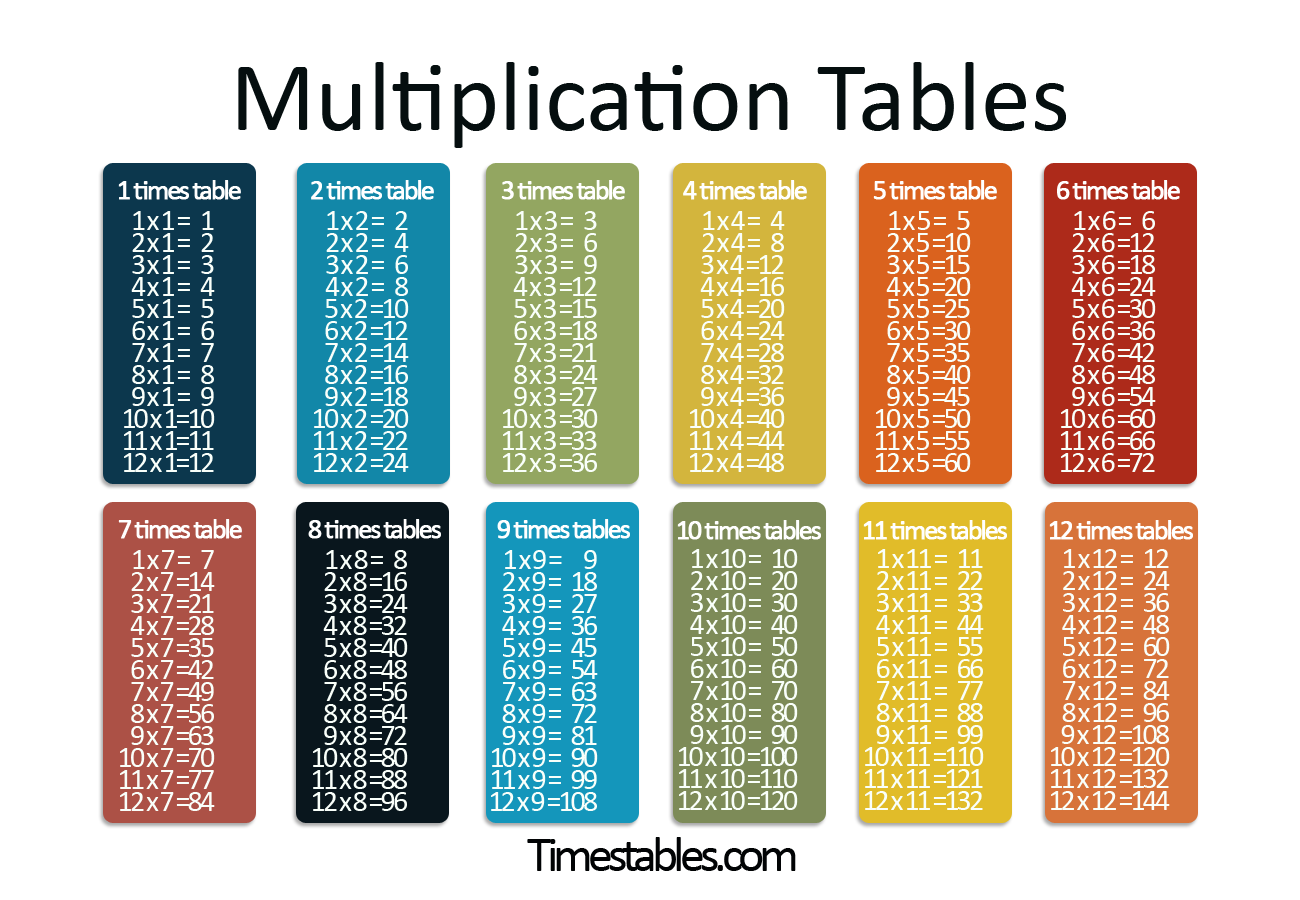

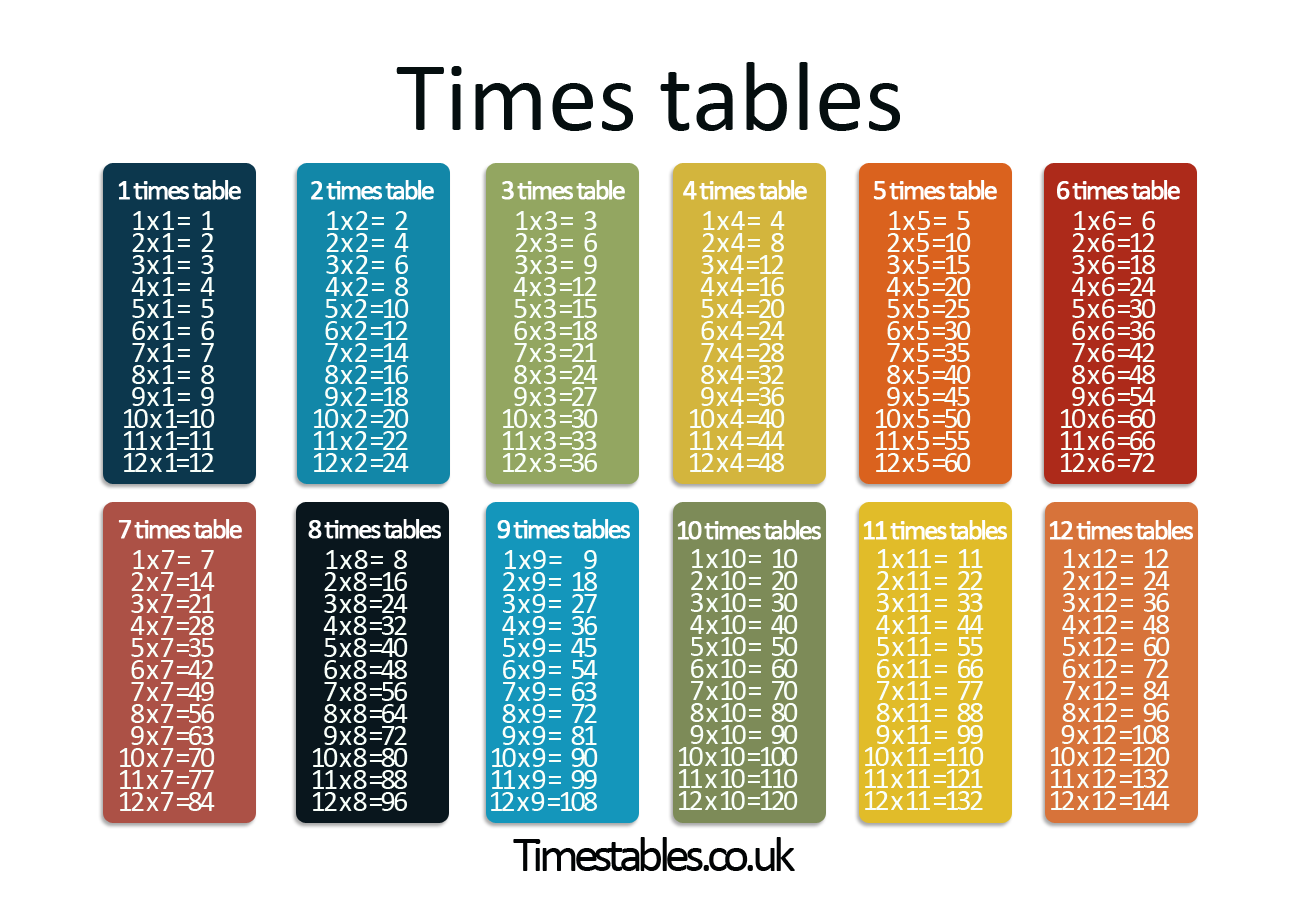

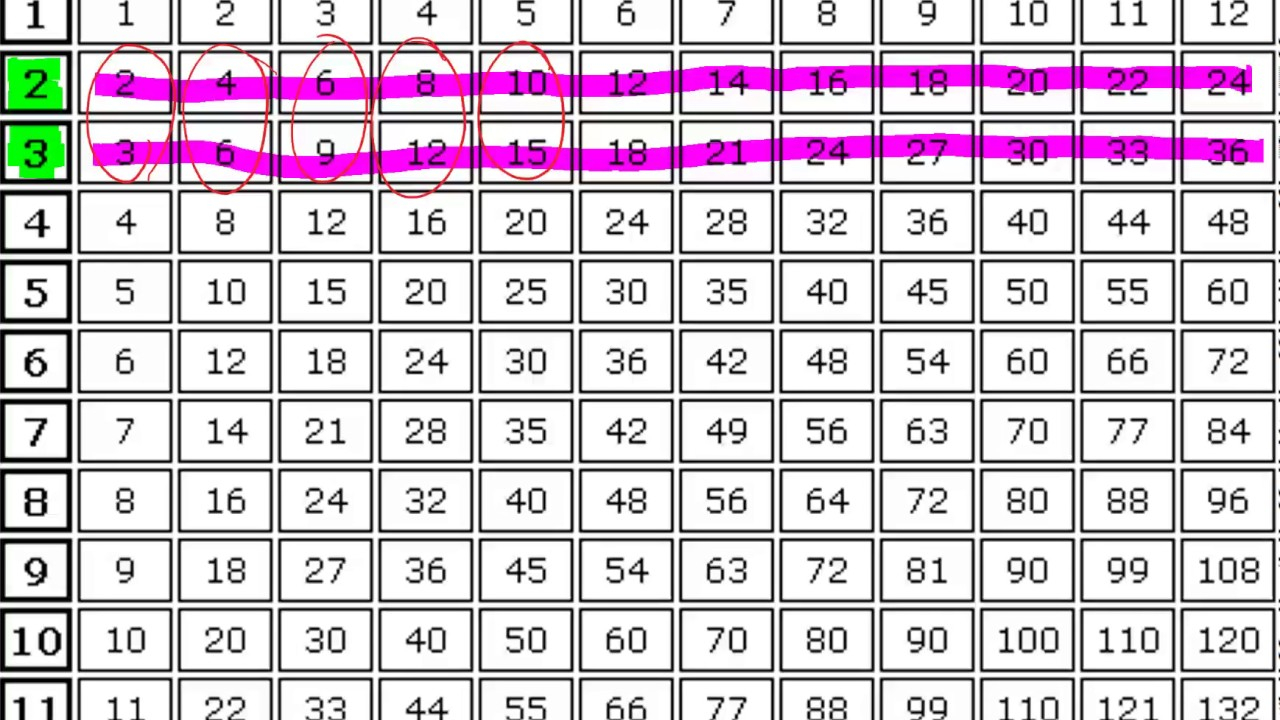

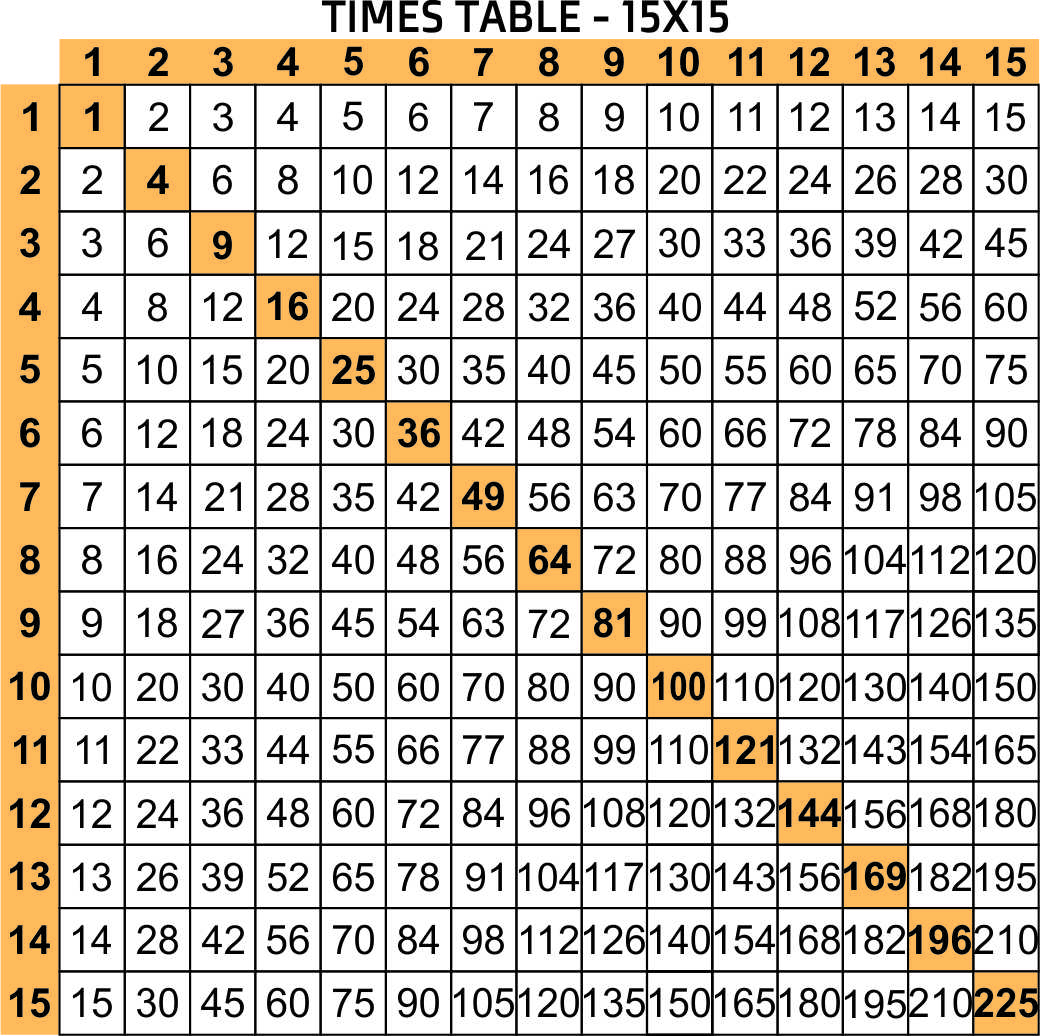

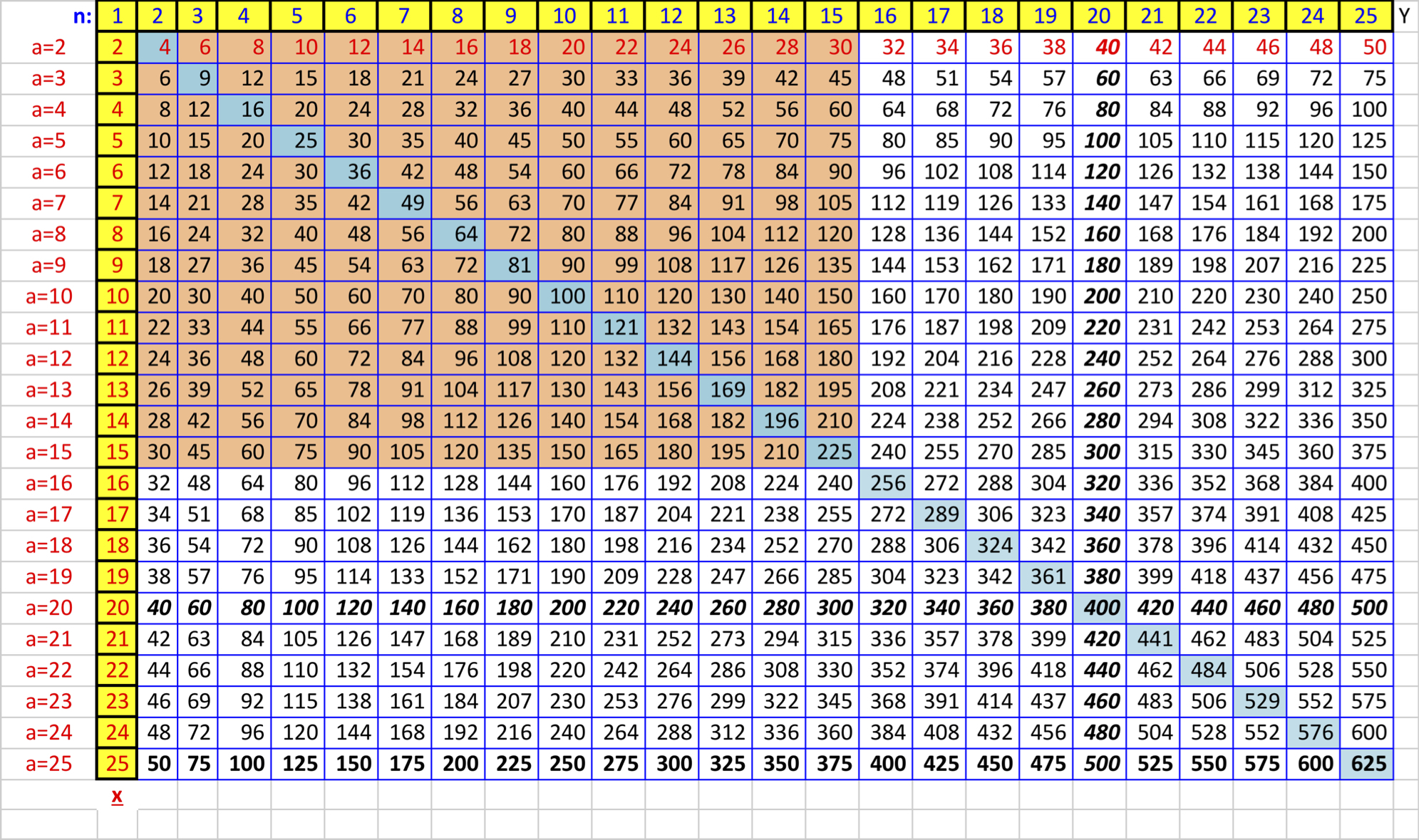

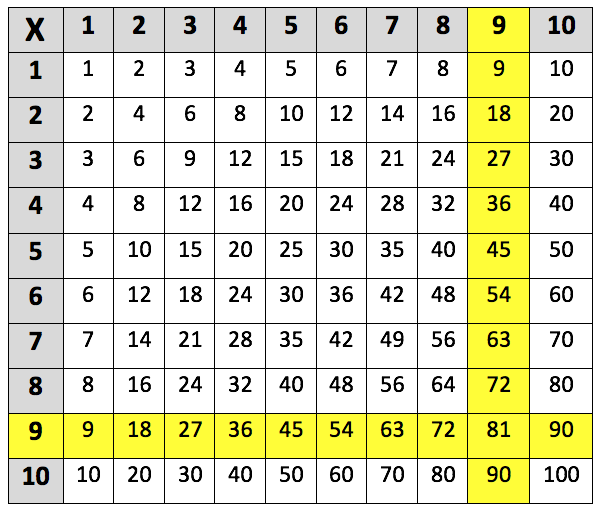

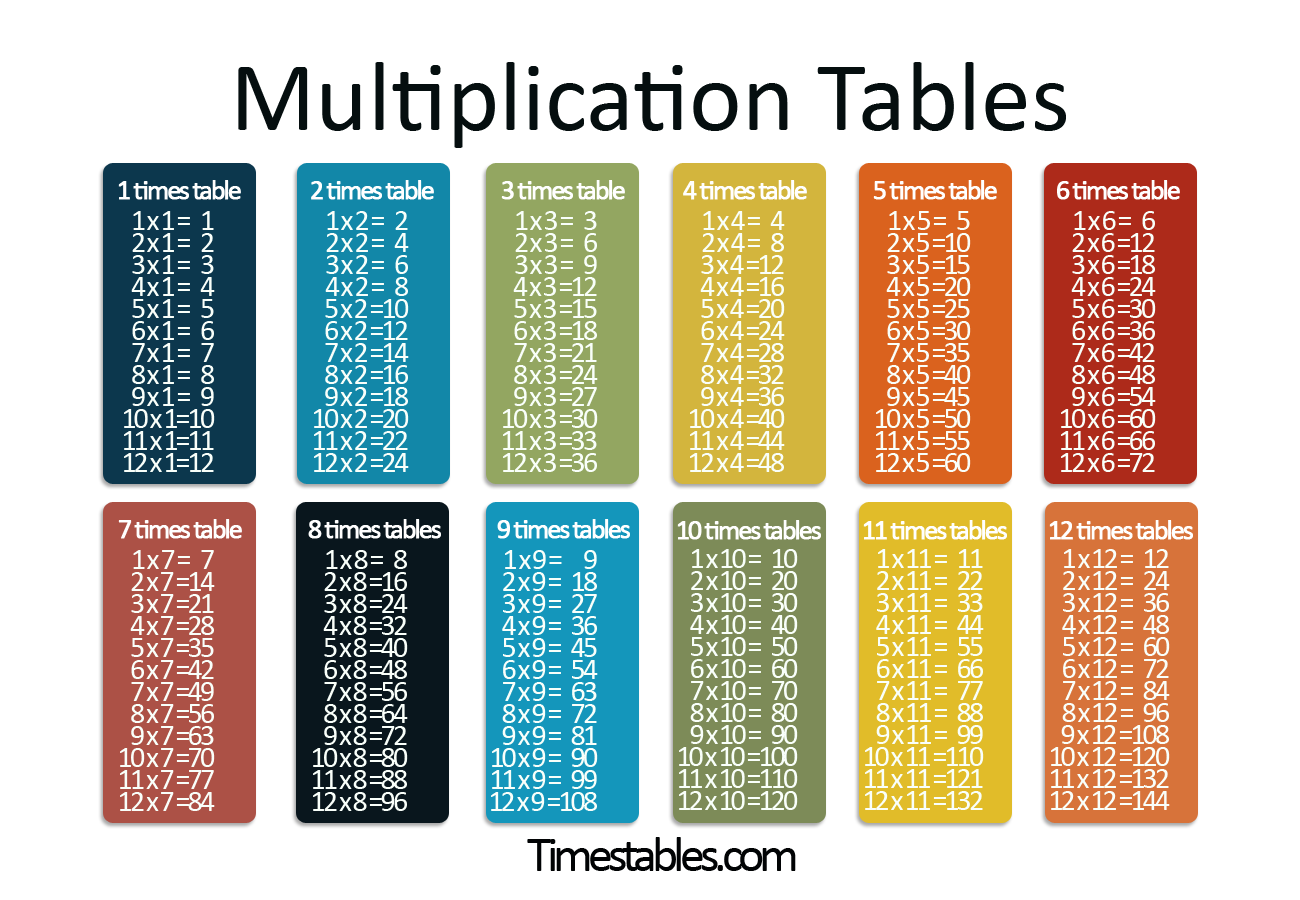

Opdreunen Maar Die Tafels Times Table Chart Multiplication Chart

9 Times What Equals 351Design and print wedding invitations as unique and special as your big day. Start from our selection of beautiful templates, add a personal touch. We offer great designs that you can customize download and print at home for free Enjoy these designs and have fun making your own unique wedding invitation

Why hire a designer when you can do it yourself? These lovely Wedding Invitations can be customized and printed at home or your local print shop. 9 Times What Equals 27 What Times What Equals 196

Printable Wedding Invitation Card Suite Template

4 Times What Equals 1000

Check out our printable wedding invitation selection for the very best in unique or custom handmade pieces from our invitation templates shops Times Table Chart To 120

DIY custom wedding invitations Add your wedding details and customize colors online Download a print ready file then print unlimited copies at home 60 Times What Equals 100 What Times What Equals 250

4 Times What Equals 122

What Times What Equals 80

What Times What 24

What Times What Equals 32

What Times What Equals 57

What Times What Equals 39

What Times What Equals 280

Times Table Chart To 120

What Times What Equals 1080

What Times What Equals 40