After Tax Interest Rate are a versatile solution for any person seeking to develop professional-quality records promptly and easily. Whether you need custom-made invitations, returns to, planners, or business cards, these themes enable you to personalize material easily. Merely download and install the template, edit it to fit your demands, and print it in the house or at a printing shop.

These themes save money and time, supplying an economical option to hiring a designer. With a wide range of styles and layouts available, you can discover the perfect style to match your individual or service demands, all while keeping a refined, expert appearance.

After Tax Interest Rate

After Tax Interest Rate

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number The IRS has created a page on IRS.gov for information about Form W-9, at www.irs.gov/w9. Information about any future developments affecting Form W-9 (such ...

Form W 9 Rev November 2017 IRS

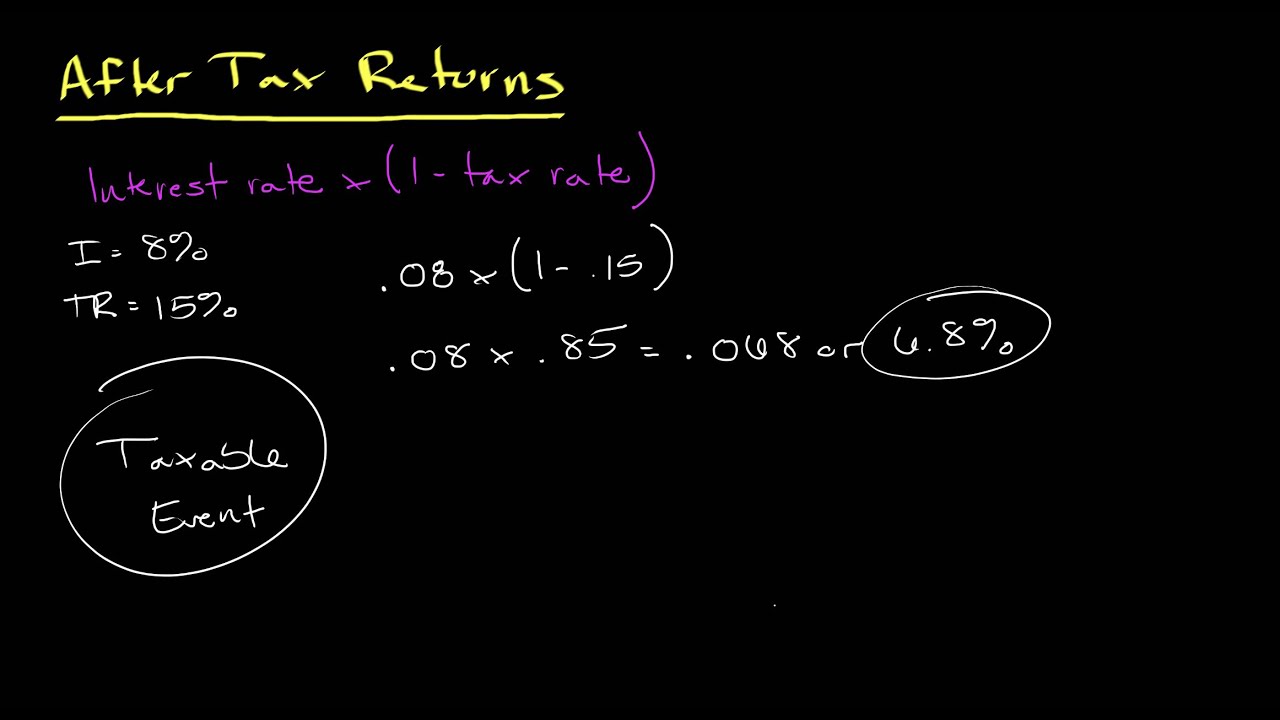

Calculating After Tax Returns Personal Finance Series YouTube

After Tax Interest RateW-9 (blank IRS Form). IRS Form W-9 (rev March 2024). W-9 Form. ©2024 Washington University in St. Louis. Notifications. Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Una persona o entidad (solicitante del Formulario W-9) a quien se le requiera presentar una declaración informativa ante el IRS le está dando este formulario ... Cost Of Debt Financing Plan Projections TVM Formula Archives Double Entry Bookkeeping

W9 form ei sig pdf

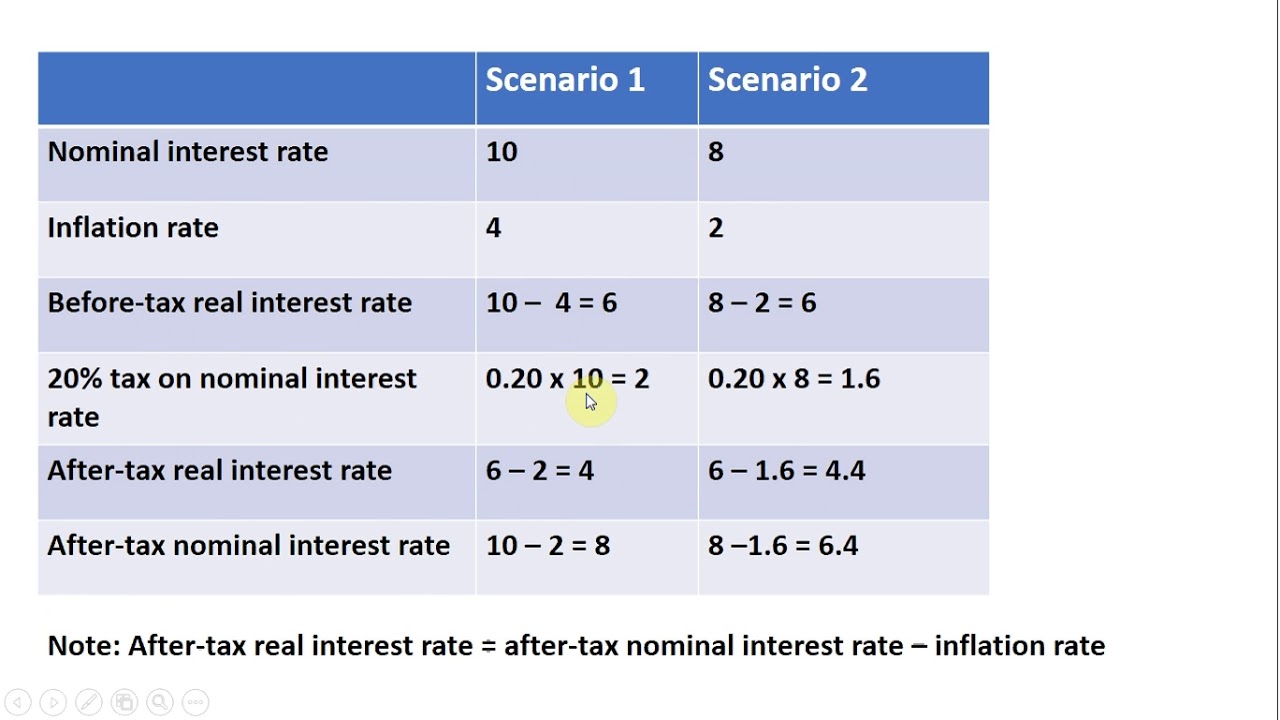

Calculating Before Tax And After Tax Real And Nominal Interest Rates

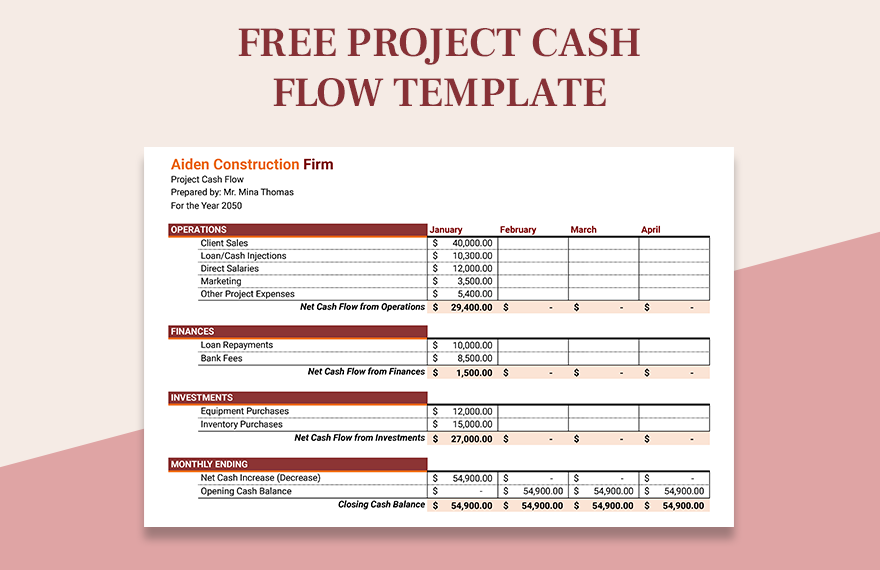

The information from a W9 form is most commonly used to create a 1099 form which contains income received by a worker and tax payments made by a company Free Project Cash Flow Template Google Sheets Excel Template

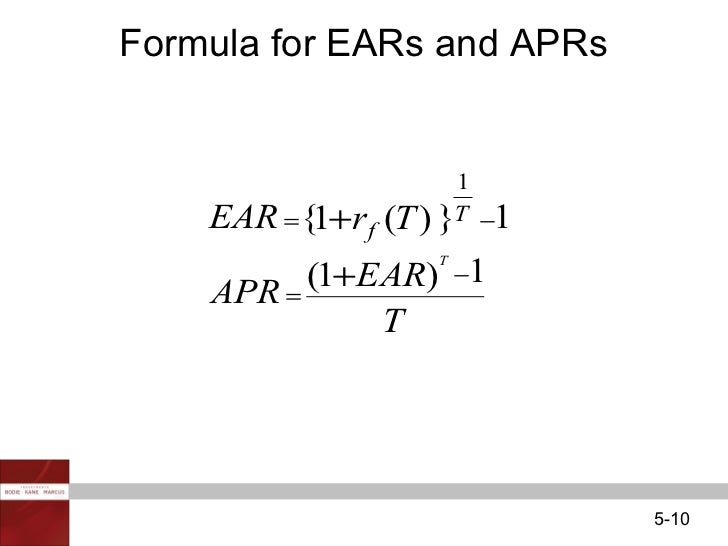

Go to www irs gov FormW9 for instructions and the latest information Give form to the requester Do not send to the IRS Before you begin For Chapter 5 Interest Rates Ppt Download Chap005

Taxable Corporate Bonds Vs Municipal Bonds Tax Exempt Non taxable

9 1 Calculate The After tax Cost Of Debt Under Each Of The Following

:max_bytes(150000):strip_icc()/After-tax-real-rate-of-return_updated_3-2_Final-ebae62e433754ad69f6274d93275d443.png)

Real Interest Rate Definition Formula And Example 47 OFF

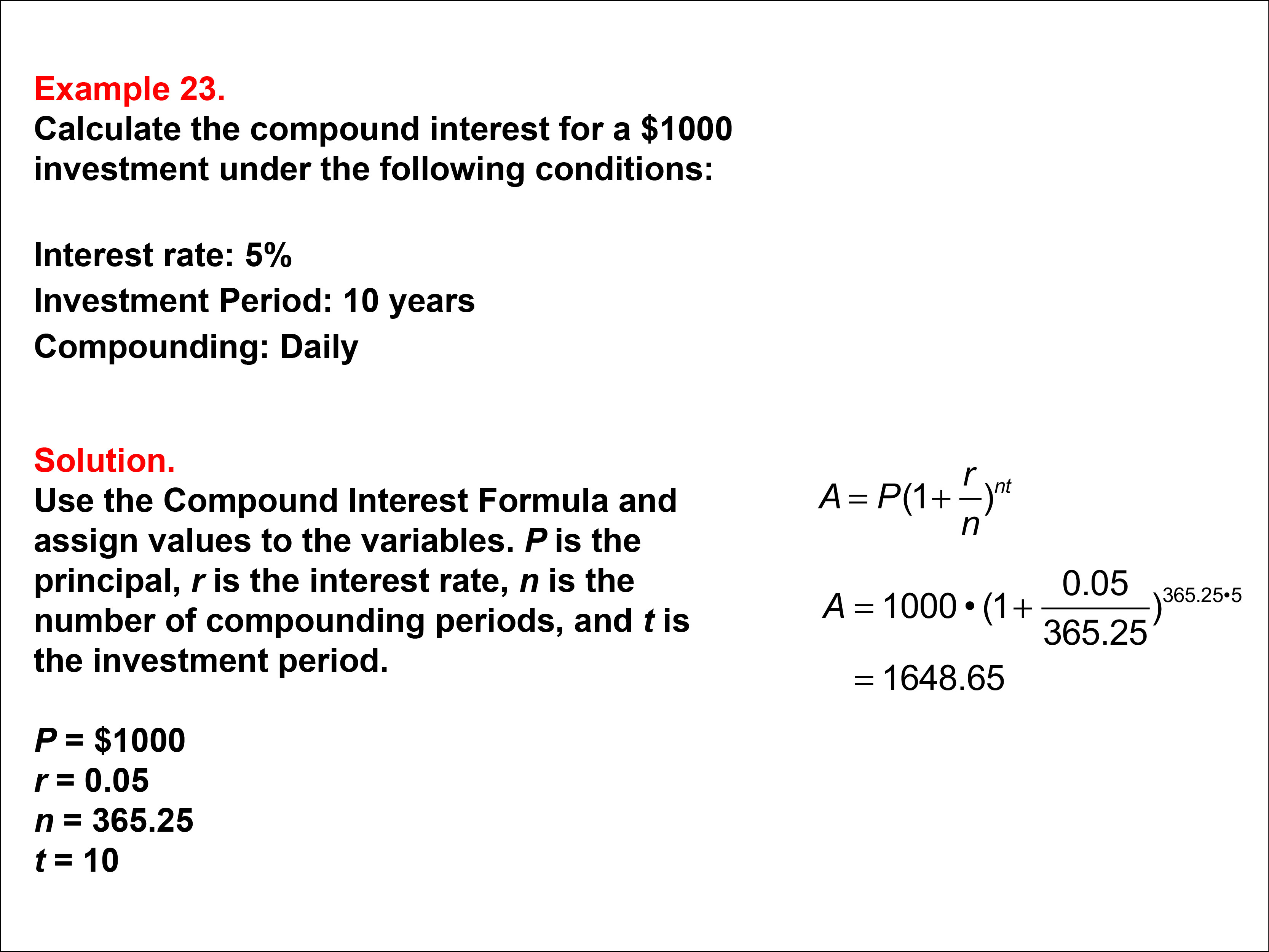

Student Tutorial Compound Interest Media4Math

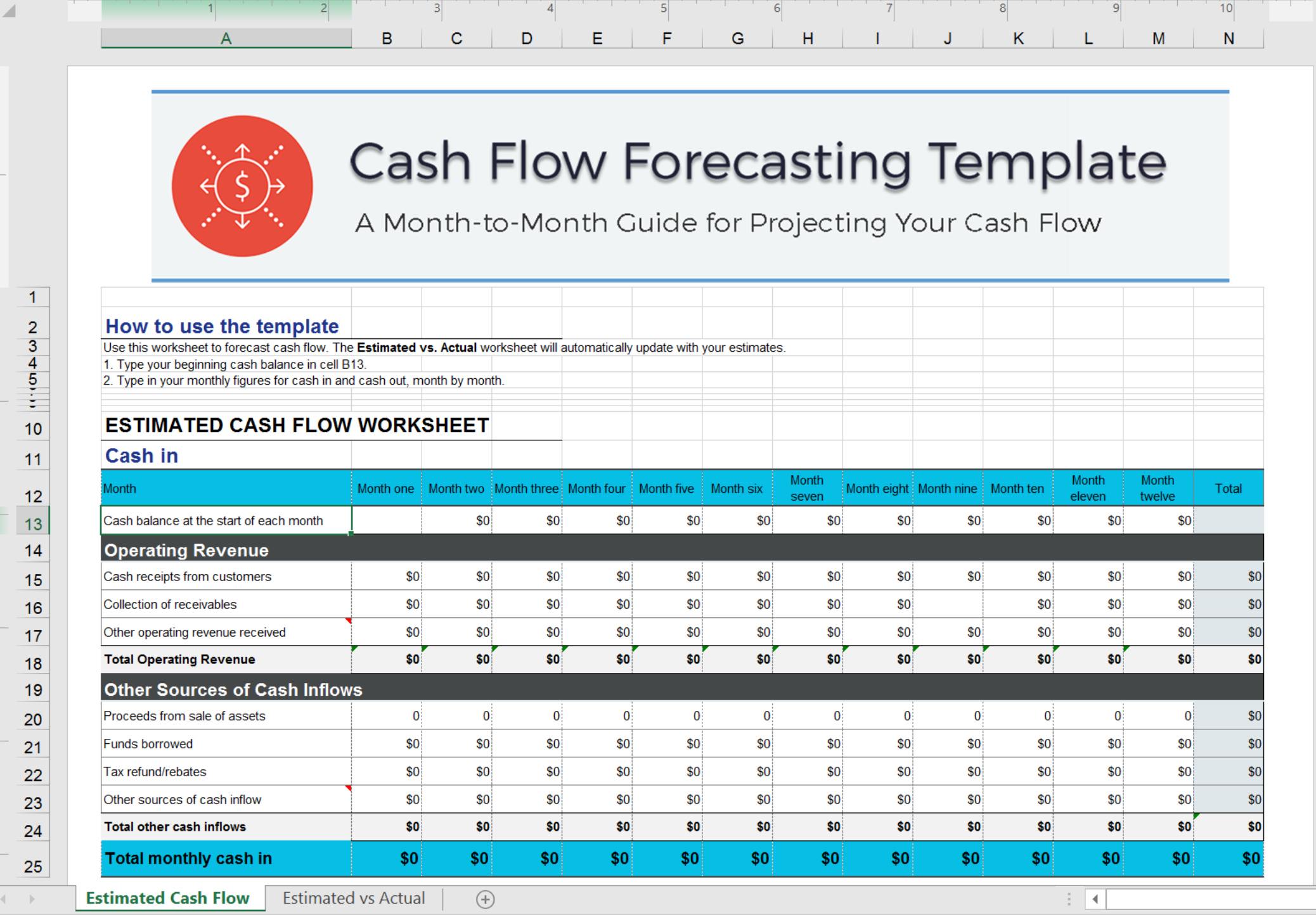

Cash Flow Excel Template Forecast Your Cash Flow

Amortization Table Excel Template Elcho Table

How To Calculate The After tax Cost Of Your Mortgage

Free Project Cash Flow Template Google Sheets Excel Template

Chap005

Antonio Receives A Portion Of His Income From His Holdings Of Interest