Are Business Casualty Losses Deductible are a functional solution for any individual aiming to create professional-quality documents promptly and easily. Whether you require customized invites, returns to, organizers, or calling card, these templates permit you to personalize web content effortlessly. Merely download and install the template, modify it to fit your demands, and publish it in the house or at a printing shop.

These templates conserve money and time, providing an economical alternative to hiring a developer. With a variety of designs and layouts offered, you can find the excellent layout to match your individual or business needs, all while preserving a sleek, expert appearance.

Are Business Casualty Losses Deductible

Are Business Casualty Losses Deductible

Inform others about restricted areas with these printable do not enter signs Clear and empty rooms easily marked with these signs Create free no entry sign flyers, posters, social media graphics and videos in minutes. Choose from 250+ eye-catching templates to wow your audience.

No Entry Signs Printable Templates Free PDF Downloads

IRS Form 4684 Walkthrough Casualty Theft Losses YouTube

Are Business Casualty Losses DeductibleFree printable construction site do not enter danger sign template in PDF format. Choose from 15 unique printable do not enter signs perfect for home or business use All signs can be printed from a personal printer and

Click any sign to see a larger version and add it to your cart. Stop. Do Not Enter. Testing - Do Not Disturb. How To Report Lost Or Stolen Crypto BitcoinTaxes System Table

255 Free Templates for No entry sign PosterMyWall

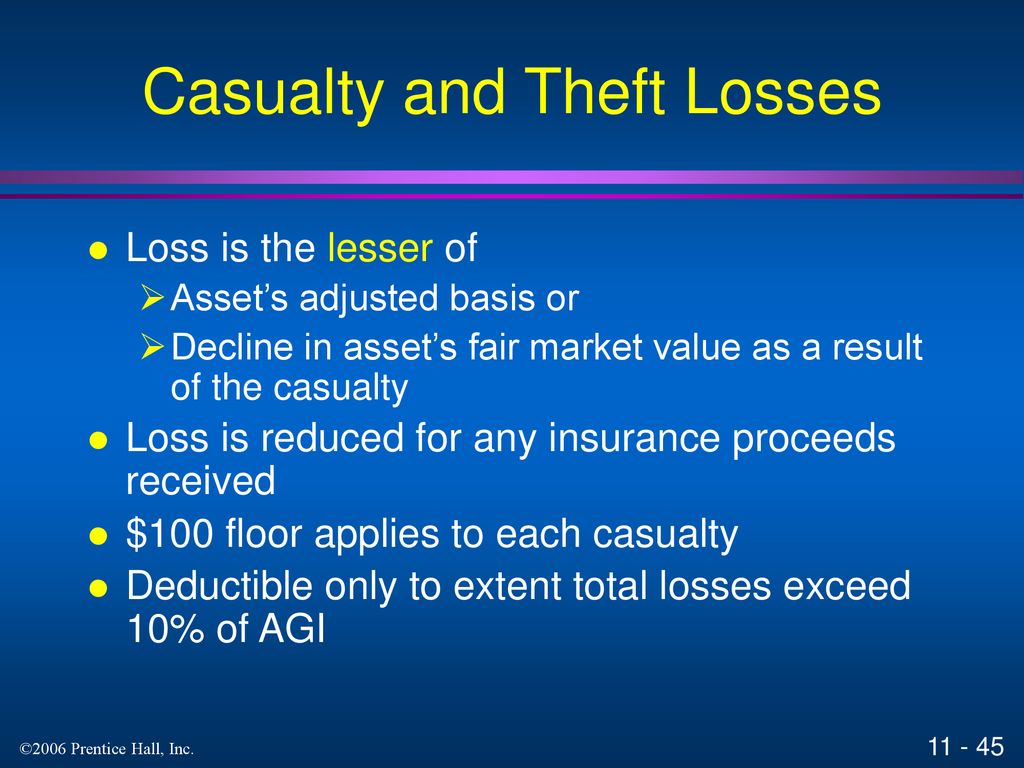

Income Tax Accounting Fall 2023 Chapter 5 LO 5 5 Deductible

Print free osha DANGER signs all free no need to log in The largest selection of free signs in pdf format for you to print and use Are Theft Losses Deductible In 2025 Yoshi Marcella

Choose from 15 unique printable do not enter signs perfect for home or business use All signs can be printed from a personal printer and are FREE A Guide To Casualty Loss Rules For Those Impacted By Hurricane Ian Military And Civilian Casualties Of Ukraine In Russian Ukrainian War

Conglomerate Sri Lanka About McLarens Group

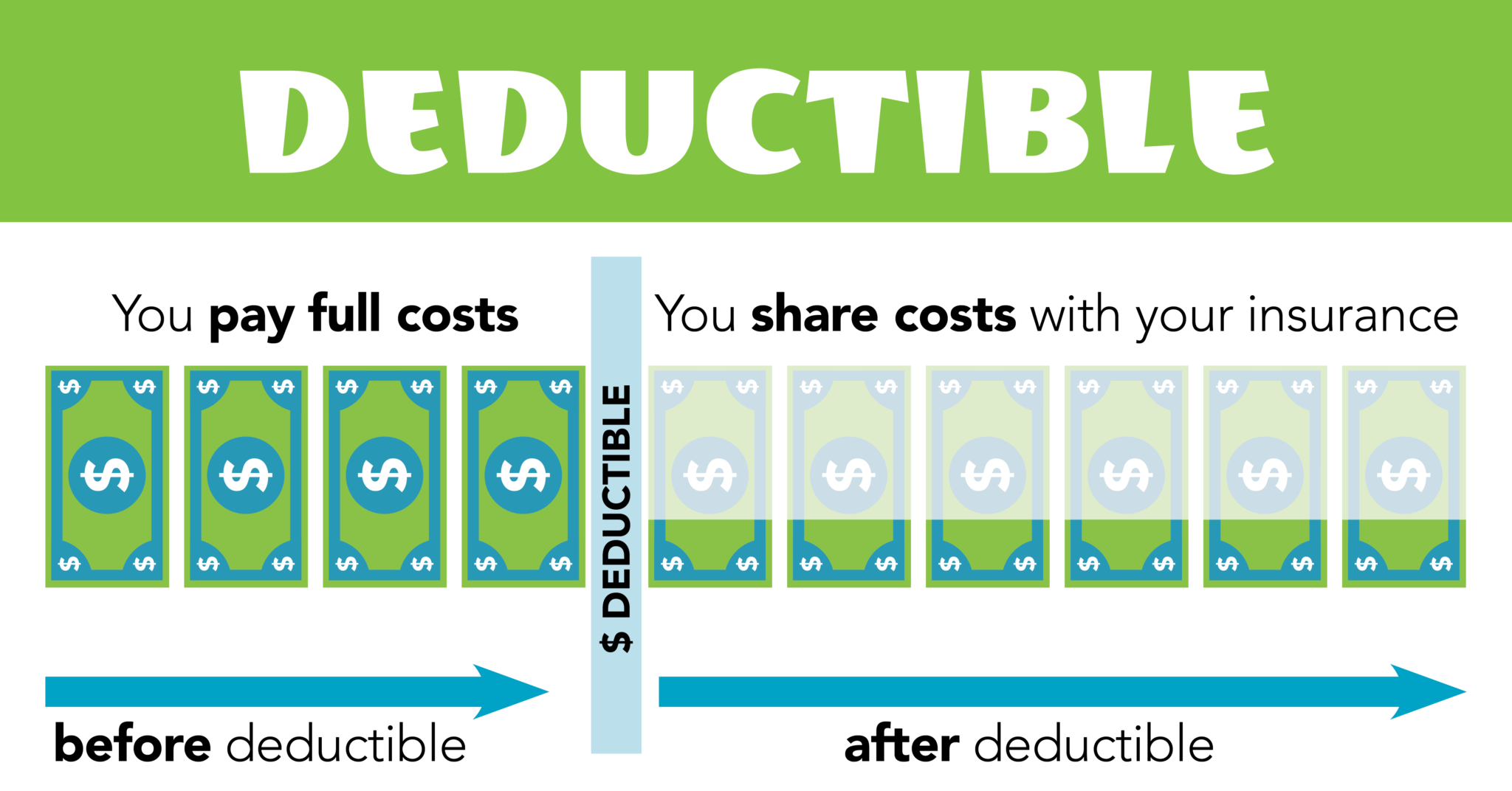

Deductibles Explained ETrustedAdvisor

Show Me The Money

List Of Itemized Ded Elmer K McConnell

Luca Tan Dopple ai

Spotlight On Transfer Pricing Risk

Casualty Loss Deduction 2024 Amity Beverie

Are Theft Losses Deductible In 2025 Yoshi Marcella

Are Theft Losses Deductible In 2025 Yoshi Marcella

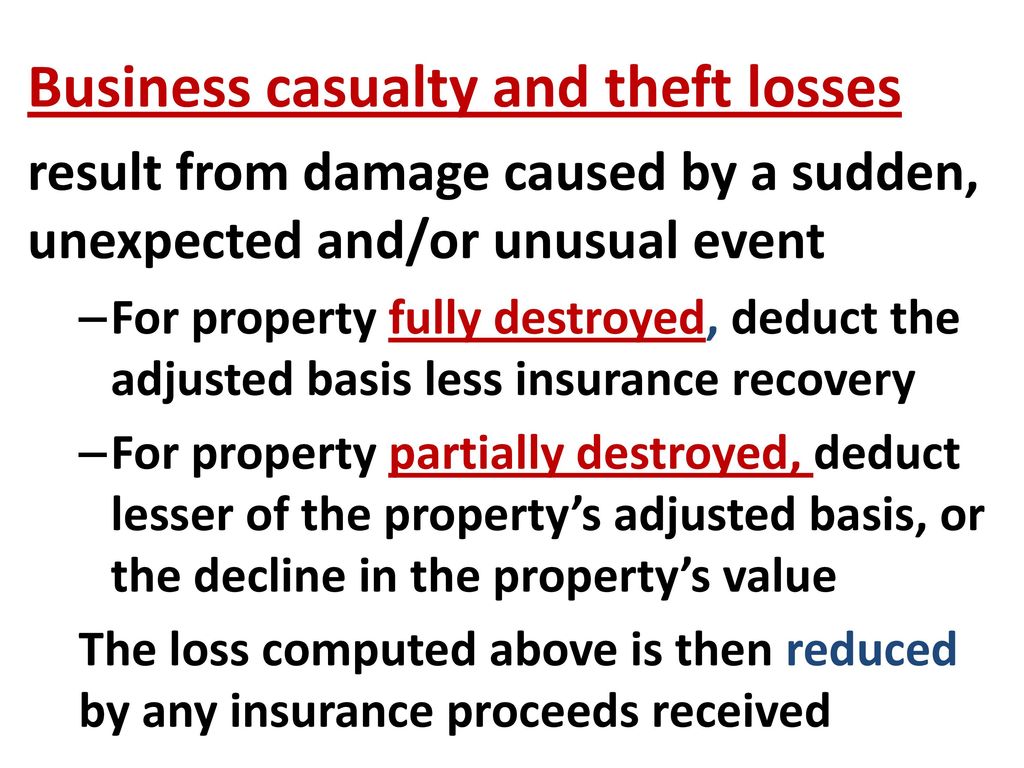

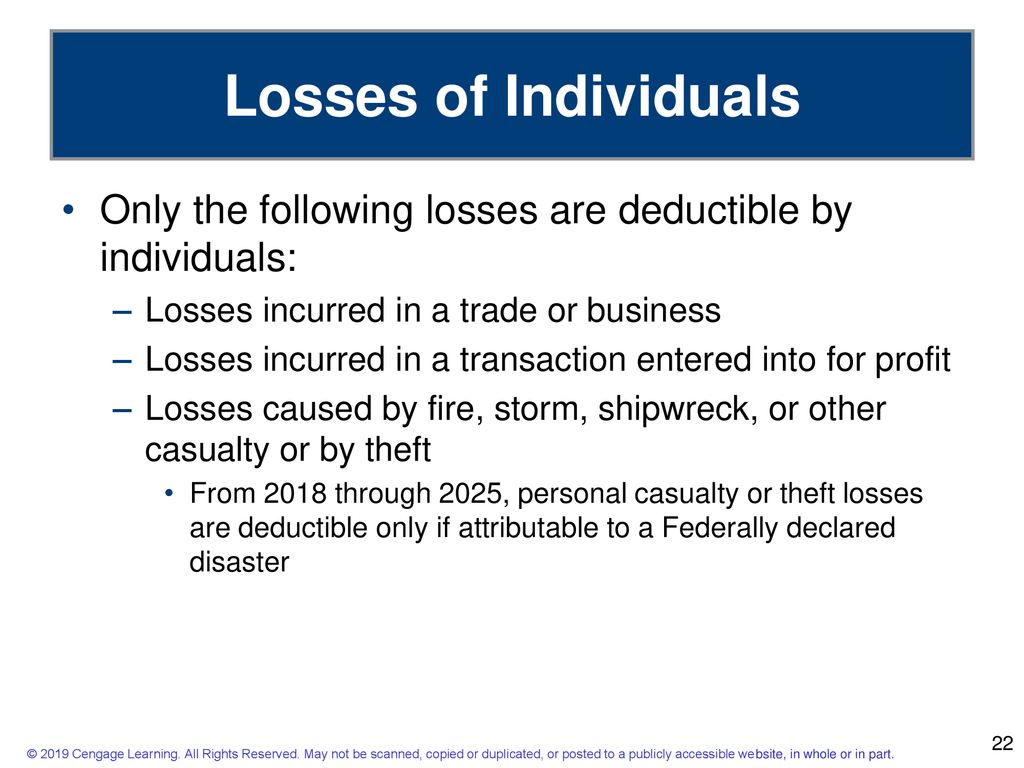

Deductions And Losses Certain Business Expenses And Losses Ppt Download