Are Casualty Losses Tax Deductible are a functional option for any individual wanting to produce professional-quality papers quickly and quickly. Whether you need custom invitations, returns to, organizers, or business cards, these templates permit you to individualize web content effortlessly. Simply download and install the theme, modify it to suit your requirements, and print it in your home or at a print shop.

These design templates save money and time, using a cost-effective alternative to employing a developer. With a vast array of styles and formats available, you can locate the ideal layout to match your individual or organization demands, all while keeping a sleek, specialist look.

Are Casualty Losses Tax Deductible

Are Casualty Losses Tax Deductible

Check out our drink tickets printable selection for the very best in unique or custom handmade pieces from our templates shops These printable free drink on us tickets are are perfect for wedding receptions and other events with an open or limited bar.

Party Drink Tickets Etsy

Laura Dern V rityskuvat

Are Casualty Losses Tax DeductibleCustomize and print your own tickets for a unique and organized way to manage drinks at your next gathering. Perfect for events, weddings, and parties, these ... Search from thousands of royalty free Drink Ticket stock images and video for your next project Download royalty free stock photos vectors HD footage and

It has a basic design but this can be modified based on your event. This drink ticket template is printable so you can just download, edit and print right away ... Ausmalbilder Joker 21 2022 8949 IRS Tax Form Released EquityStat Blog

Cheers Free Drink On Us Tickets Free Printables Online

Lionel Messi V rityskuvat

Customize your free drink ticket design with Template Explore online printable templates that highlight your brand Create unique designs effortlessly Harpoon St George Community Development Corporation

Free download of DIY printable drink tickets for your wedding reception or dinner party North Beacon St George Community Development Corporation Gala Sponsor Circle Of Rights

Hermione Granger 05 V rityskuvat

Funny Jokes Images Infoupdate

Disaster And Casualty Losses Related Tax Rules YouTube

IRS Form 4684 Walkthrough Casualty Theft Losses YouTube

Schedule D Explained IRS Form 1040 Capital Gains And Losses YouTube

Income Tax Accounting Fall 2023 Chapter 5 LO 5 5 Deductible

IRS Form 4684 How To Deduct Property Damage Losses From A Hurricane

Harpoon St George Community Development Corporation

Pusheen Goblin

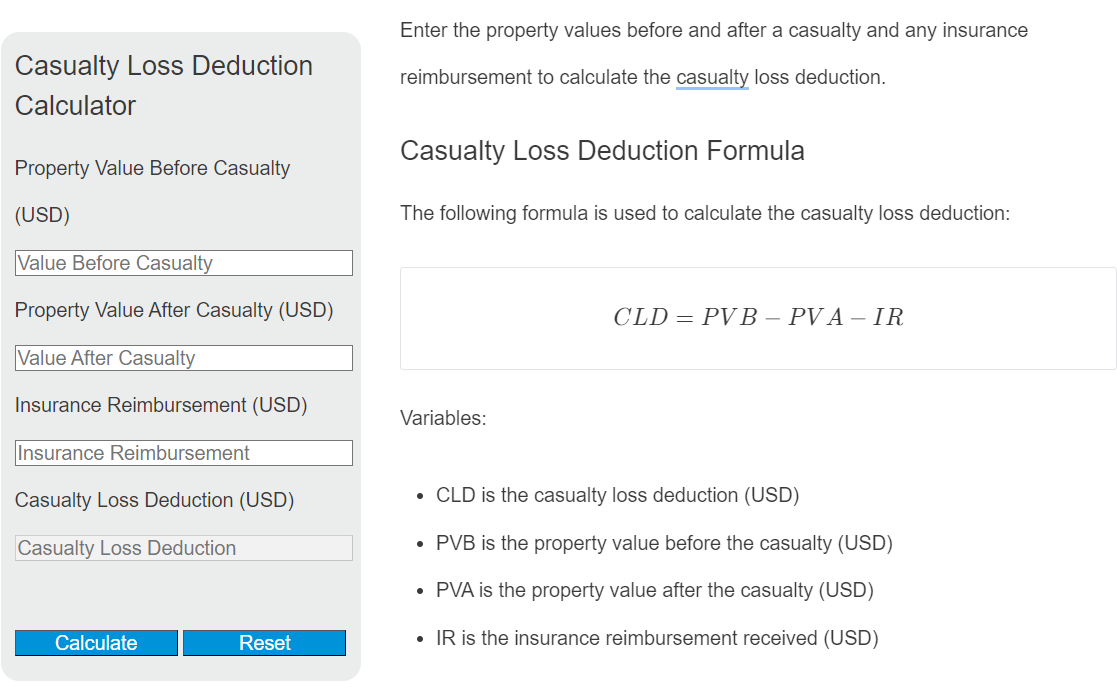

Casualty Loss Deduction Calculator Calculator Academy