Calcular El 25 De 2000 are a flexible option for any person looking to produce professional-quality files swiftly and quickly. Whether you require custom-made invitations, resumes, planners, or calling card, these templates allow you to individualize web content easily. Just download and install the template, edit it to match your requirements, and publish it in the house or at a printing shop.

These design templates save money and time, supplying a cost-effective choice to working with a designer. With a large range of designs and layouts available, you can find the ideal design to match your individual or service requirements, all while keeping a refined, specialist appearance.

Calcular El 25 De 2000

Calcular El 25 De 2000

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

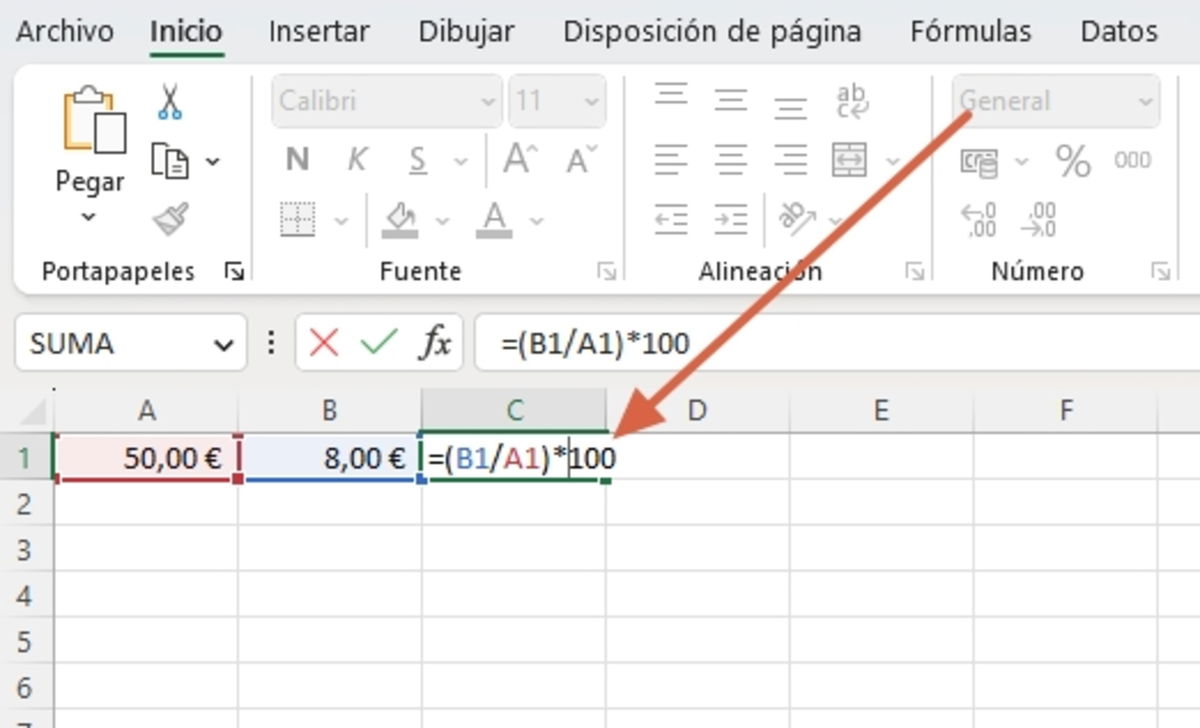

C mo Calcular El 25 Por Ciento Sacar Porcentajes De Un N mero O

Calcular El 25 De 2000You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Que Necesitas L piz Chromebook cerrado Ppt Descargar Equipo Hacer Un Nombre Mono Calculo De La Tir Juguet n Medieval Matem tico

About Form W 4 Employee s Withholding Certificate

Calcular El 25 Por Ciento De Descuento De Un Precio De 180 D lares

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Como Calcular Una Nota Con Porcentajes Image To U

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Como Se Interpreta El Margen Bruto Image To U Armonioso Eficaz Diez A os Calcular Dias Posteridad Creo Que Estoy

C mo Calcular El Impuesto A La Renta YouTube

El Ni o Prodigio Hor scopo Para El 25 De Septiembre La X 1250 AM

Eficaz Restricci n Trabajador Calcular Es Registro Aqu Omitido

Noticias Y Reportajes De TechRadar TechRadar

Realizar Un Diagrama De Flujo Que Calcule El Descuento Y El Total A

Calcular El Porcentaje Entre Dos Cantidades Image To U

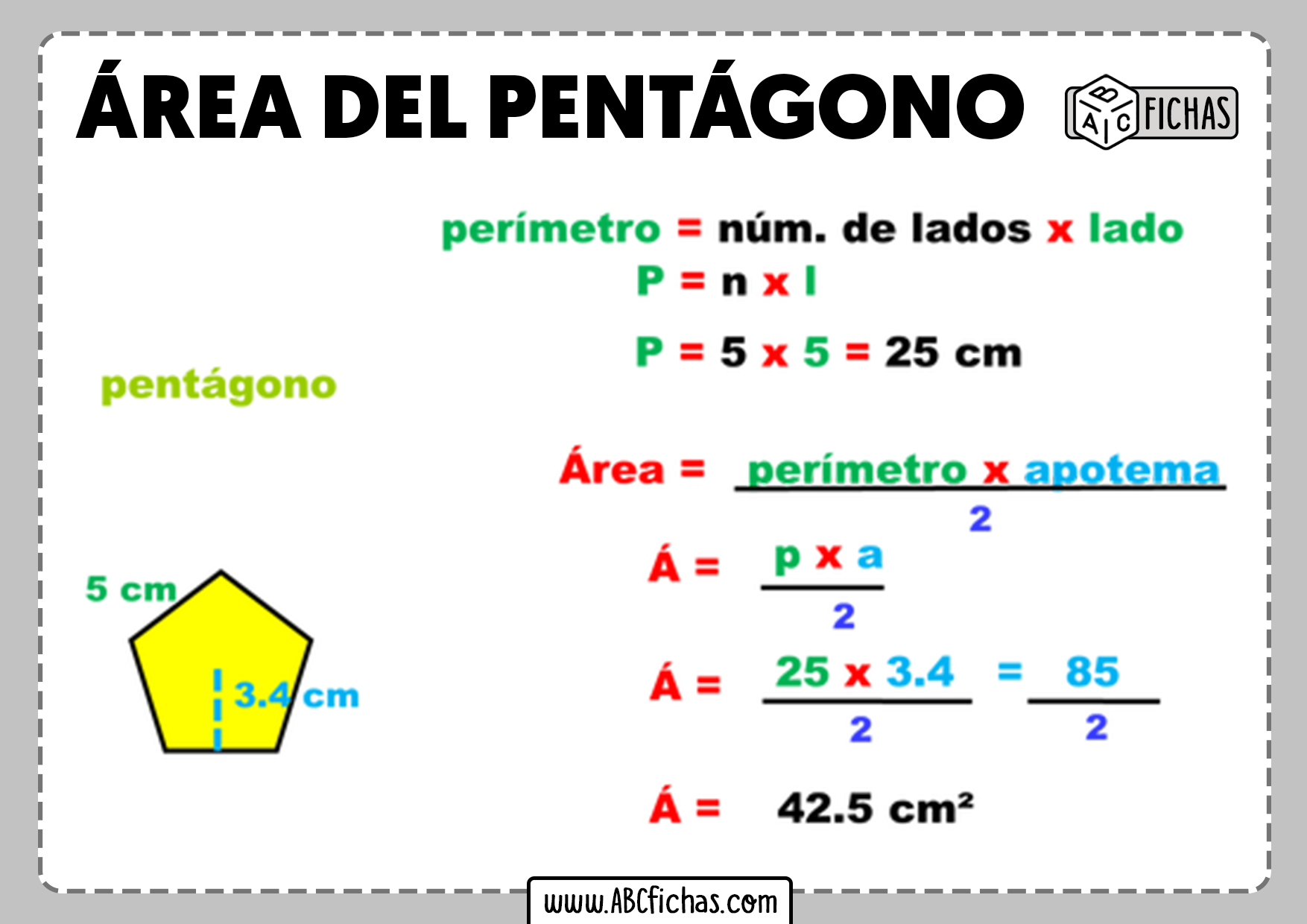

Como Calcular El Area Image To U

Como Calcular Una Nota Con Porcentajes Image To U

Si A La Vida

Como Calcular El 20 Por Ciento Image To U