Citibank Roth Ira Rates are a versatile remedy for anybody wanting to produce professional-quality documents promptly and conveniently. Whether you need personalized invites, resumes, organizers, or calling card, these design templates enable you to individualize content easily. Simply download and install the design template, modify it to fit your requirements, and publish it in your home or at a printing shop.

These themes save time and money, providing a cost-efficient option to employing a developer. With a variety of designs and formats available, you can find the best layout to match your personal or business demands, all while maintaining a sleek, specialist look.

Citibank Roth Ira Rates

Citibank Roth Ira Rates

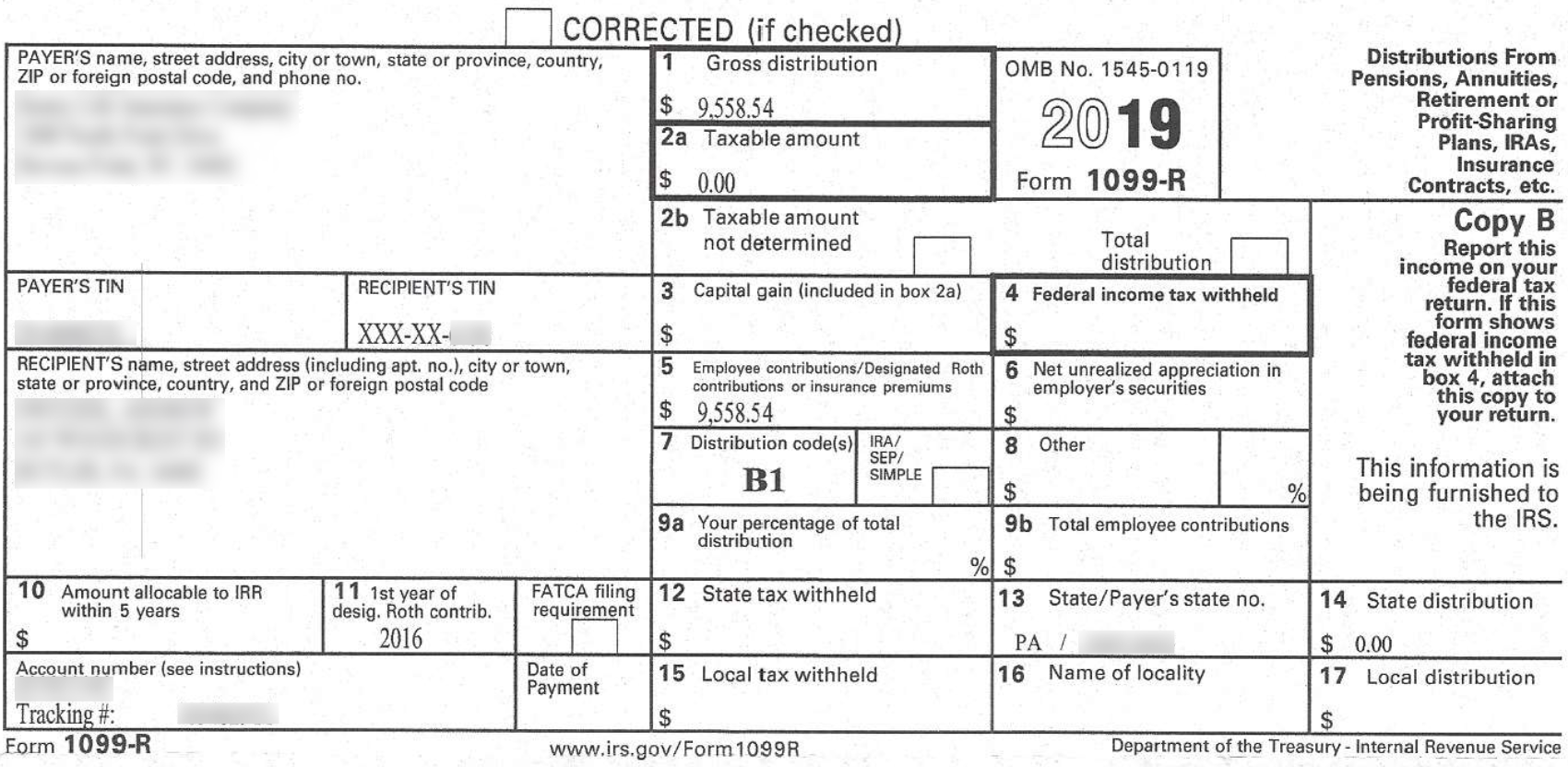

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

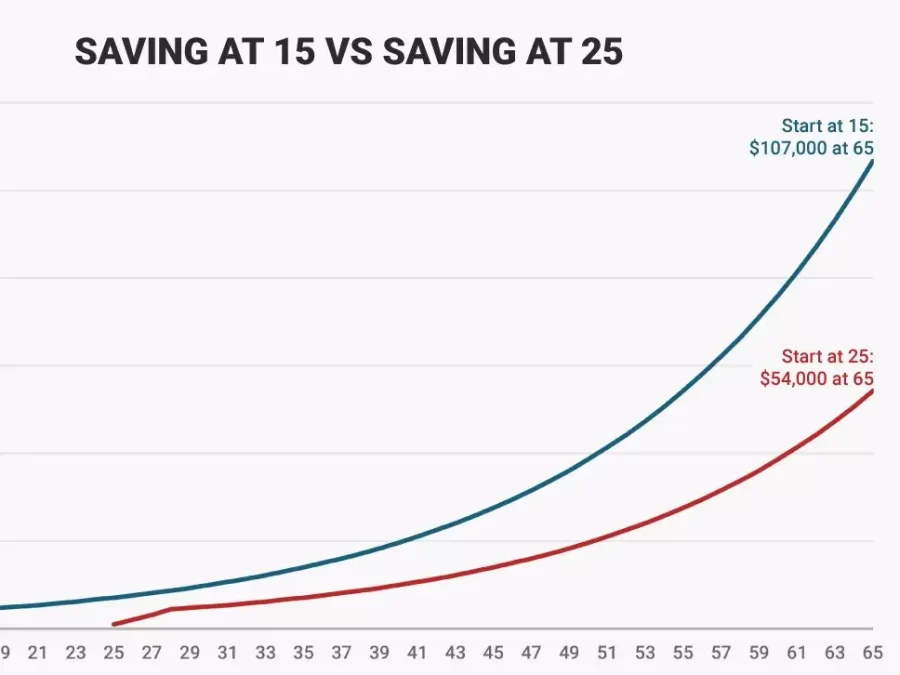

5000 Roth Ira Chart

Citibank Roth Ira RatesYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... [img_title-17] [img_title-16]

About Form W 4 Employee s Withholding Certificate

Max Ira Roth Contribution 2025 Dorey Georgia

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Can I Withdraw My Contributions From A Roth IRA Without A Penalty

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 [img_title-12] [img_title-13]

2025 Income Limits For Ira Hugo Landon

Iowa 529 Tax Deduction Limit 2025 Images References Zayn Raya

401k Contribution Limits 2025 Chart For Married Couples Carina Sascha

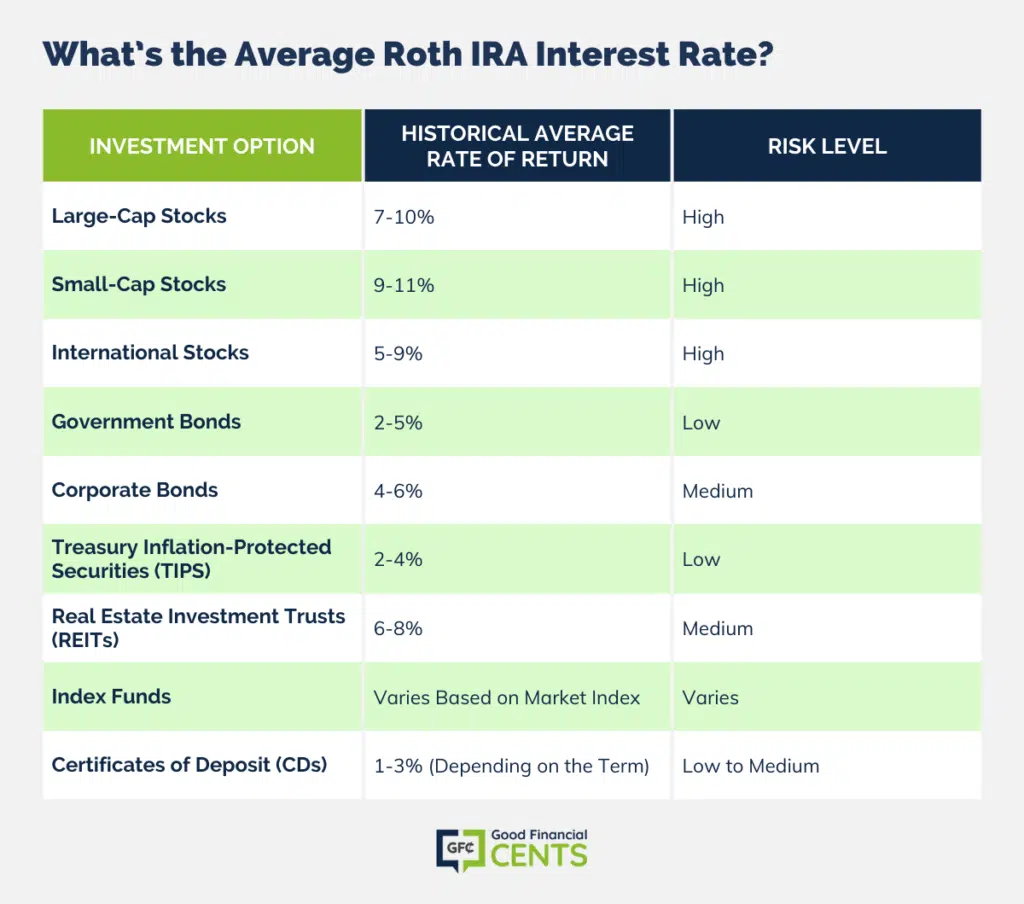

Best Roth Ira Rates 2024 Myrah Tiphany

2024 Roth Ira Limits 2024 Date Dyanna Devinne

Contribution Limits 2024 Multiple Ira Limits Wren Salsabil

Donna GayleenKacy SallieTrude HorPippa Ferguson Luna Anisa

Can I Withdraw My Contributions From A Roth IRA Without A Penalty

[img_title-14]

[img_title-15]