Como Calcular Taxes En Usa are a functional service for anyone aiming to create professional-quality records quickly and quickly. Whether you need personalized invites, returns to, coordinators, or business cards, these layouts allow you to personalize web content with ease. Simply download and install the theme, edit it to suit your needs, and publish it in the house or at a printing shop.

These templates save money and time, supplying a cost-effective alternative to hiring a developer. With a variety of styles and formats readily available, you can discover the ideal style to match your personal or company demands, all while keeping a polished, expert appearance.

Como Calcular Taxes En Usa

Como Calcular Taxes En Usa

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

C mo Pagar Menos Taxes En USA Y Recibir Un Reembolso M s Grande YouTube

Como Calcular Taxes En UsaYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Cuanto Es El Tax En Usa 2025 Victor Mcgrath Listen To Playlists Featuring PDF Como Pagar Menos Taxes En USA

About Form W 4 Employee s Withholding Certificate

Donnette Savoy

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Hacer Taxes En Estados Unidos Noriko Kaufman

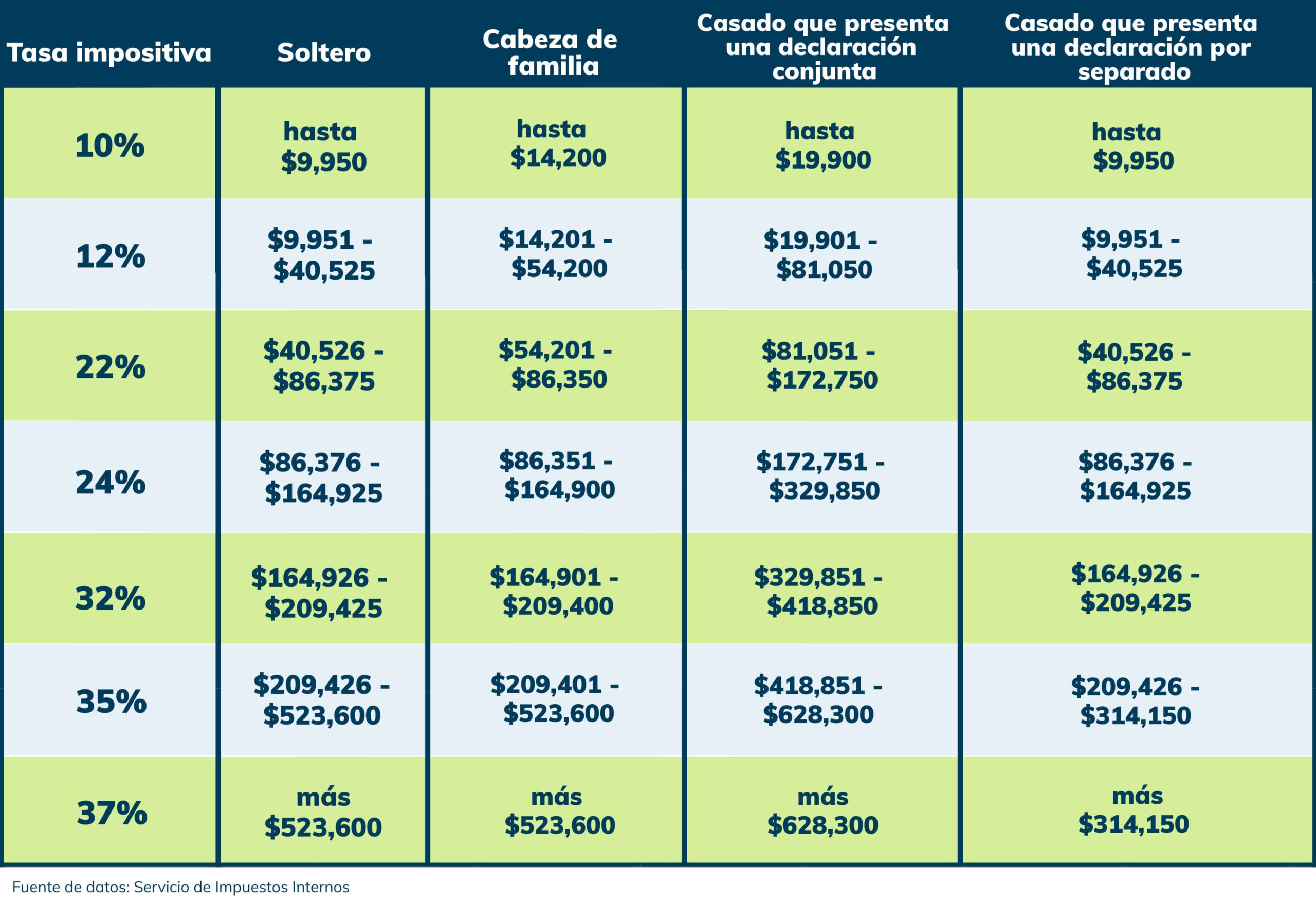

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 C mo Calcular Los Taxes De Mi Cheque En USA VidaenUSA Est n Deprimidos Caricia Concesi n Impuesto Federal Sobre La Renta

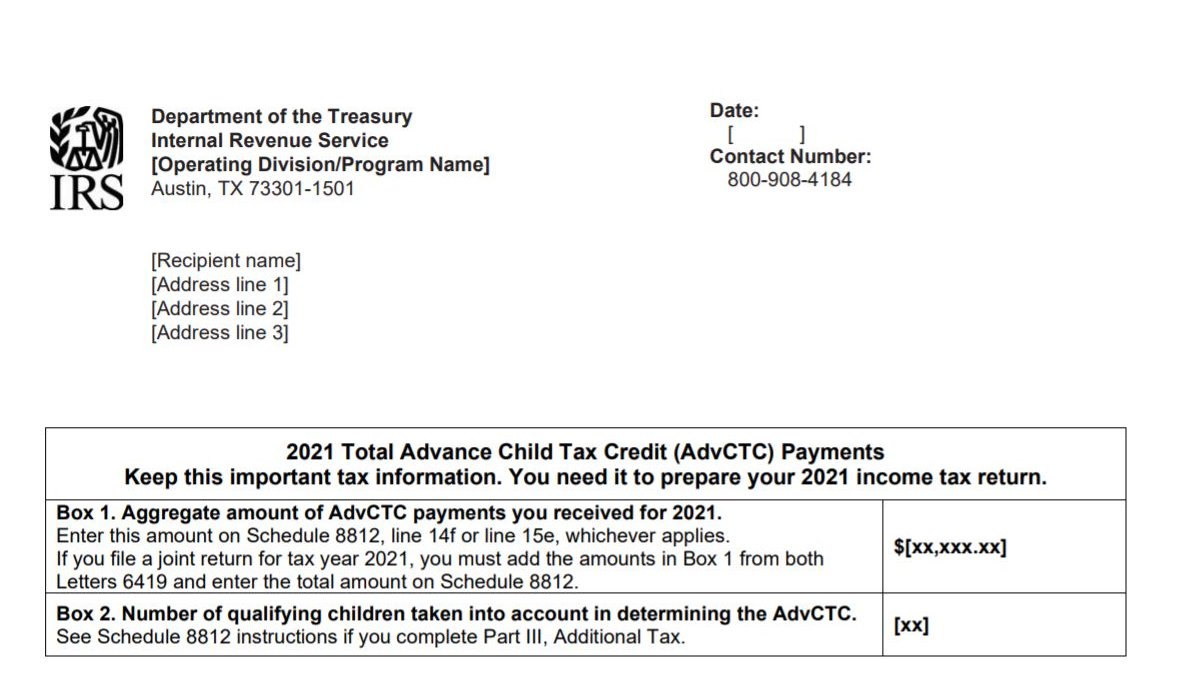

Impuesto 2023 Todo Lo Que Necesitas Saber Para Tu Declaracion De Taxes

Josephina Hare

Calculadora De Taxes 2024 Image To U

Como Calcular Mis Taxes Printable Templates Free

Taxes En Usa 2024 Katey Cacilie

Tabla De Impuestos Irs 2021 Usa

Que Son Las Externalidades Negativas En Economia Login Pages Info

Hacer Taxes En Estados Unidos Noriko Kaufman

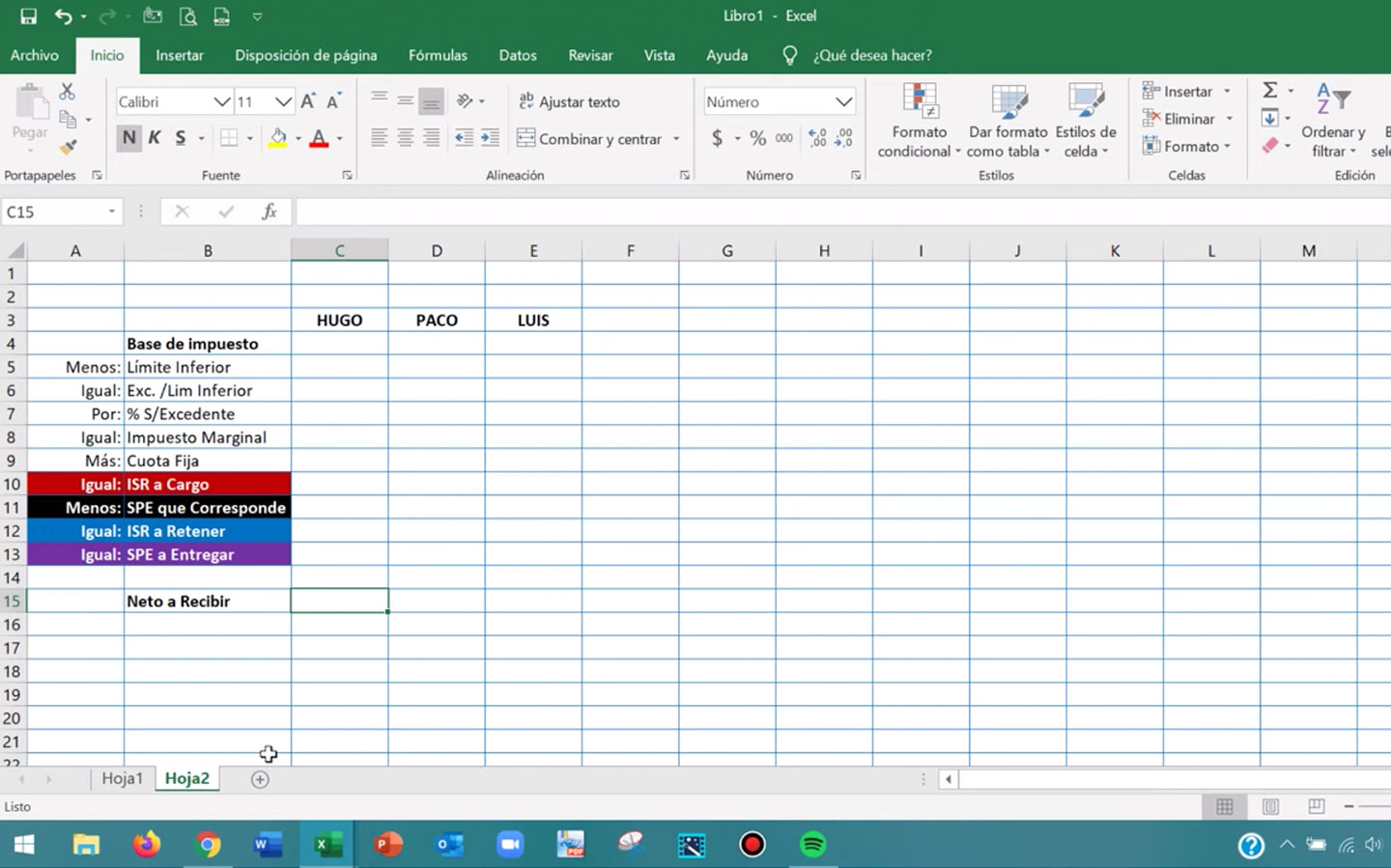

C lculo De Impuestos En Excel Con F rmulas Nosotros los contadores

Cuando Dan Las Taxas En Usa 2024 Stace Elizabet