Cpt Code 81001 And 81003 are a versatile option for anyone aiming to create professional-quality records quickly and easily. Whether you require customized invitations, resumes, organizers, or calling card, these templates permit you to individualize content easily. Just download and install the template, modify it to fit your needs, and print it at home or at a print shop.

These layouts save money and time, supplying a cost-effective option to hiring a designer. With a wide range of styles and layouts readily available, you can locate the perfect layout to match your personal or company needs, all while preserving a refined, specialist look.

Cpt Code 81001 And 81003

Cpt Code 81001 And 81003

You can use it for articulation language and vocabulary target words Just fill in your own words Print or use online as PDF Dots and boxes printable game can be played by the whole family. All you need is some pens and out dot and boxes template.

Printable Dot Game Sheets

How To Use CPT Code 99308

Cpt Code 81001 And 81003How to Play: 1. Print the template above, OR make your own game board, using a blank sheet of paper and fill a section of it (or ... Dots to boxes is a classic pencil and paper game a perfect travel game for the whole family Download now

Dot Game Template. To save you time drawing a grid of dots yourself, I created a collection of free printable dots game templates in six ... [img_title-17] [img_title-16]

Free Dots And Boxes Printable Game Template Just Family Fun

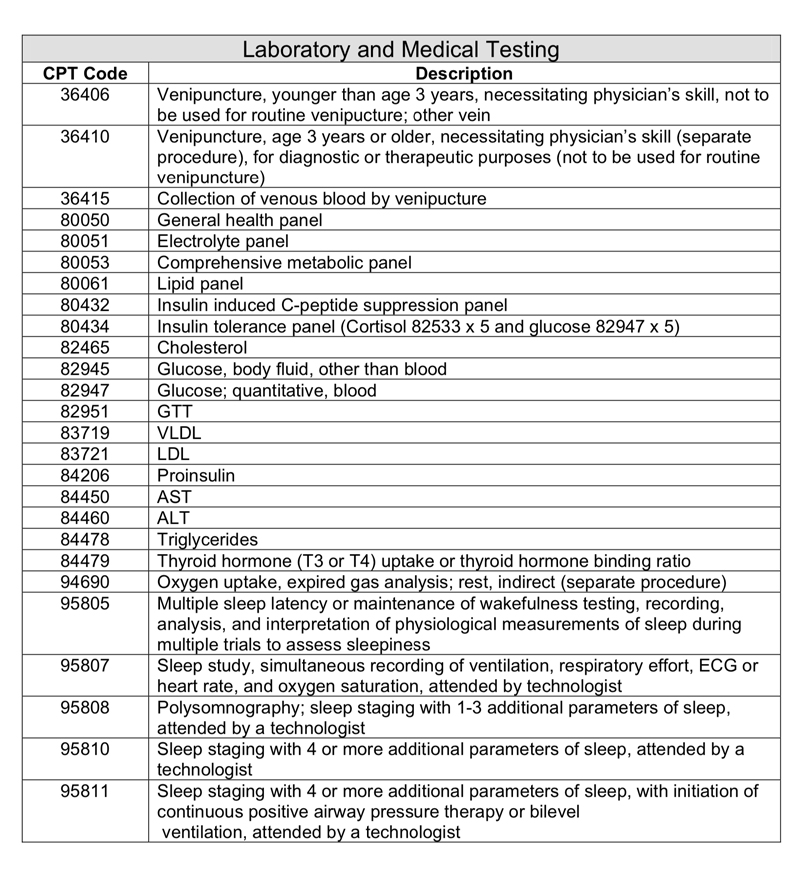

Obesity related CPT Codes Eat Smart Move More NC

Free printable dots and boxes game in many different sizes and configurations Play a small dot game or a large dots and boxes game [img_title-11]

Dots to dots game Connect the Dots games free printable Dot To Dot Puzzles and Activities for kids Free Printable Dot To DotEaster Preschool Worksheets [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]