Cual Es El 30 De 475 are a functional service for any person aiming to produce professional-quality files swiftly and quickly. Whether you require personalized invites, resumes, planners, or business cards, these design templates allow you to individualize content with ease. Just download and install the design template, edit it to match your demands, and publish it at home or at a print shop.

These design templates conserve time and money, offering an economical choice to employing a developer. With a variety of styles and styles readily available, you can locate the best layout to match your individual or business demands, all while preserving a polished, expert look.

Cual Es El 30 De 475

Cual Es El 30 De 475

Free D D 5e spell cards of all official spells from the SRD to download and print yourself For your convenience the cards are grouped by class and level The cards are provided in a convenient A4 & Letter PDF format, making them easy to print at home, at your nearest copy shop, or through online printing services ...

Dnd Spell Cards Digital Download Printable Dnd Spell Book Etsy

Si El 20 De A Es Igual Al 30 De B que Porcentaje De A B Es B Xf

Cual Es El 30 De 475Dungeons and Dragons (D&D, DnD) Fifth Edition (5e) spells. A list of all the spells, spell index, create spellbooks, print them as cards or as a list. I d love to get my hands on some printable spell cards if anyone has any or knows where I can get them It would make their lives and by extension mine much

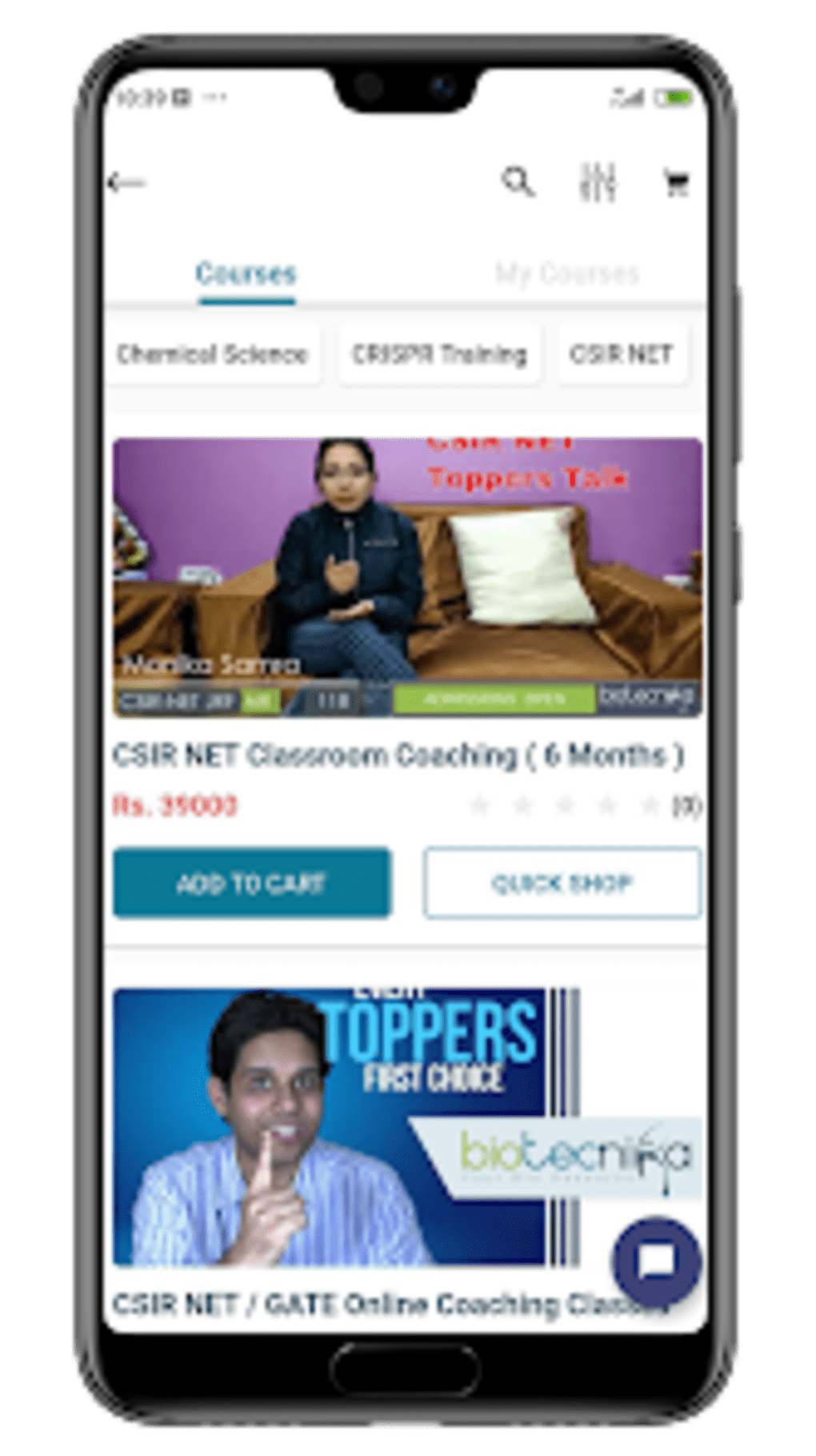

D&D Spell Cards are a useful addition to the game, that is very useful. Saves you time, gives a visual reference and representation of ... Biotecnika Official App APK Para Android Descargar Biotecnika Official App APK Para Android Descargar

320 Printable DND Spell Cards All Classes RPG Tabletops

Lo Mejor De Lo Mejor Las Gui as De Compra Definitivas De TechRadar

Might I suggest using card stock or a high weight paper 24 28lb and print out your spell cards using the content from the DM or player manual Cu l Es El Procedimiento Correcto Para Calcular El L mite De Rentas

Print spells cards for D D 5e for all classes Wizards warlocks sorcerers clerics paladins bards rogues and more Conozca Los Horarios De Los Cortes De Luz En Ecuador Para El 30 De Biotecnika Official App APK Para Android Descargar

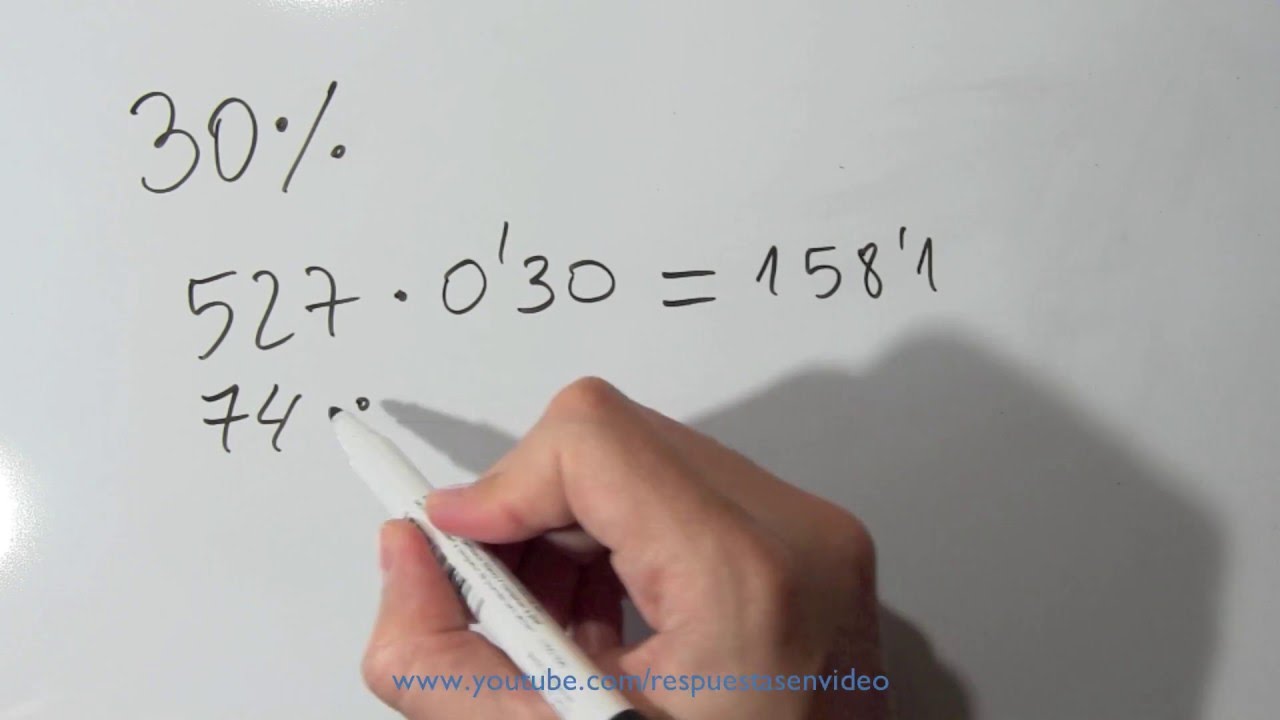

C mo Calcular El 30 Por Ciento Sacar Porcentajes De Un N mero O

Lanzamiento Regional Investigaci n Parlamentaria Global Sobre El

Lollapalooza 2024 Lineup Chile Melly Sonnnie

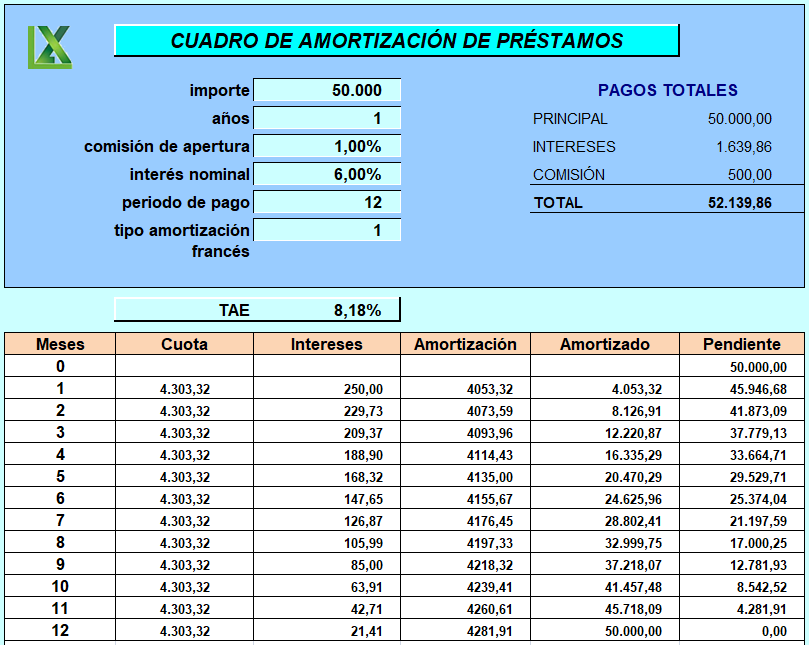

Espiritual Clima Amigo Prestamo 1 2 3 Moderadamente Rebaja Disfraces

Citaci n Facci n Inventario Solemne V 305 2023 Diario Avisos Legales

Calcular Porcentajes 20 De 30 Descubra As Vantagens E Emo es Do

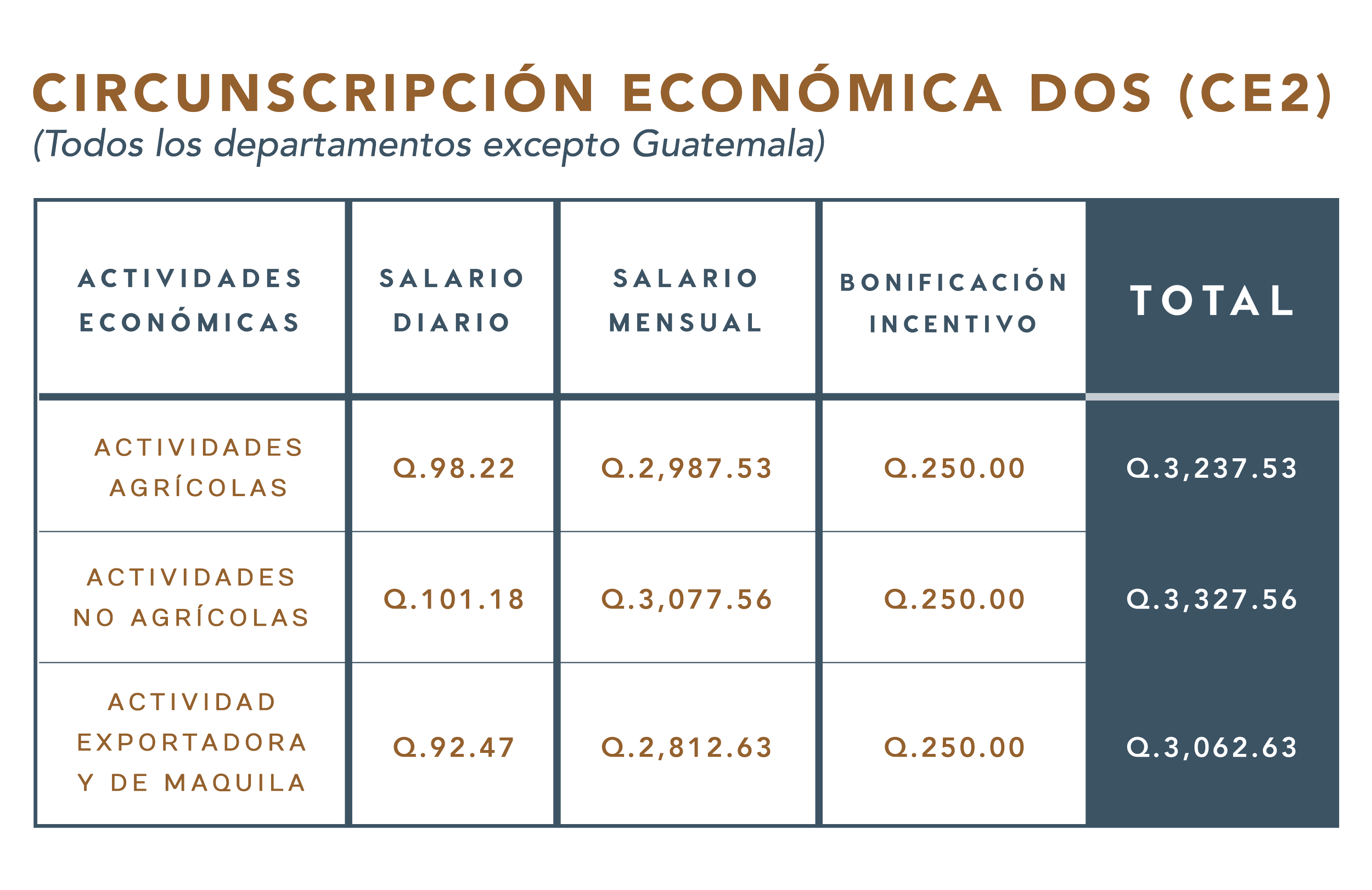

Nuevo Salario Minimo 2024 Frontera Nanci Valeria

Cu l Es El Procedimiento Correcto Para Calcular El L mite De Rentas

Biotecnika Official App APK Para Android Descargar

Biotecnika Official App APK Para Android Descargar