Difference Between A Professional Llc And Llc are a functional solution for anyone seeking to create professional-quality documents quickly and quickly. Whether you need custom invites, returns to, organizers, or calling card, these layouts allow you to personalize content with ease. Just download and install the theme, modify it to suit your demands, and publish it in your home or at a print shop.

These design templates save money and time, using a cost-efficient option to employing a designer. With a large range of styles and layouts readily available, you can discover the excellent layout to match your personal or organization demands, all while maintaining a refined, expert appearance.

Difference Between A Professional Llc And Llc

Difference Between A Professional Llc And Llc

The Official D D 5e Character Sheet PDF Enhanced Edition v1 7 by TheWebCoderChanged most of the fields to rich text so you can bold The newly designed character sheets for Dungeons & Dragons are now available on D&D Beyond's website.

Further Resources Dungeons Dragons DnD Beyond

Breaking It Down Non Profit Vs LLC Which One Holds The Power To

Difference Between A Professional Llc And LlcCharacter Sheet for ChildrenDyslexia-friendly sheetsHand-Written Sheets ($2.99)Futuristic Themed character sheet and a D&D 5e-based futuristic setting ... These files are zipped PDFs you may print and photocopy them for your personal use Fillable Character SheetFifth Edition Character Sheets

DnD Character Sheet optimized Retro Design. Compatible with the 2024 5th Edition of Dungeons & Dragons Incl. all of my DnD Playing Cards. DungeonBros. LLC Or C corp Which Is Best For Your Business Buzko Krasnov S Corp Vs LLC Legalzoom

2024 D D Character Sheets Available to Download EN World

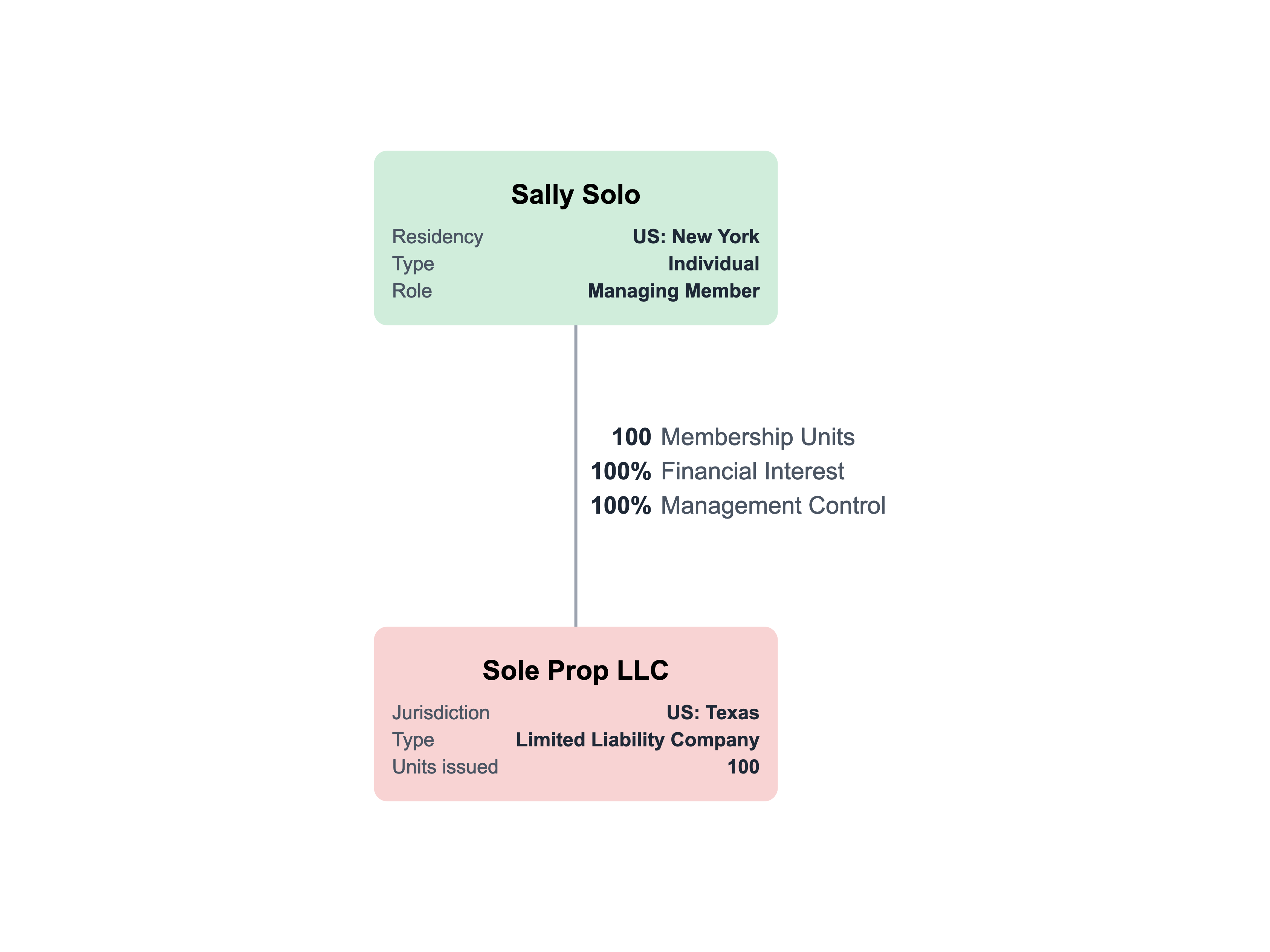

LLC Types

On the D D 5e by Roll20 character sheet there is a print button at the top left corner of the character sheet Next to the pop out button How Are LLCs Managed IncNow

If you would like blank character sheet PDFs then there are plenty on the official D D website http dnd wizards articles features character sheets Sole Proprietorship Vs LLC A Comparison LLC Vs Corporation How Does Each Work

What Is Does It Meanto Have A Designated Name Corporation Store

Anatomy Of An Academic Article Biology Research Guides LibGuides

INC Vs LLC Understand Confusing Business Terms 7ESL

LLC Vs S Corp Comparison

C Corporation Advantages

Callshovel4 MurakamiLab

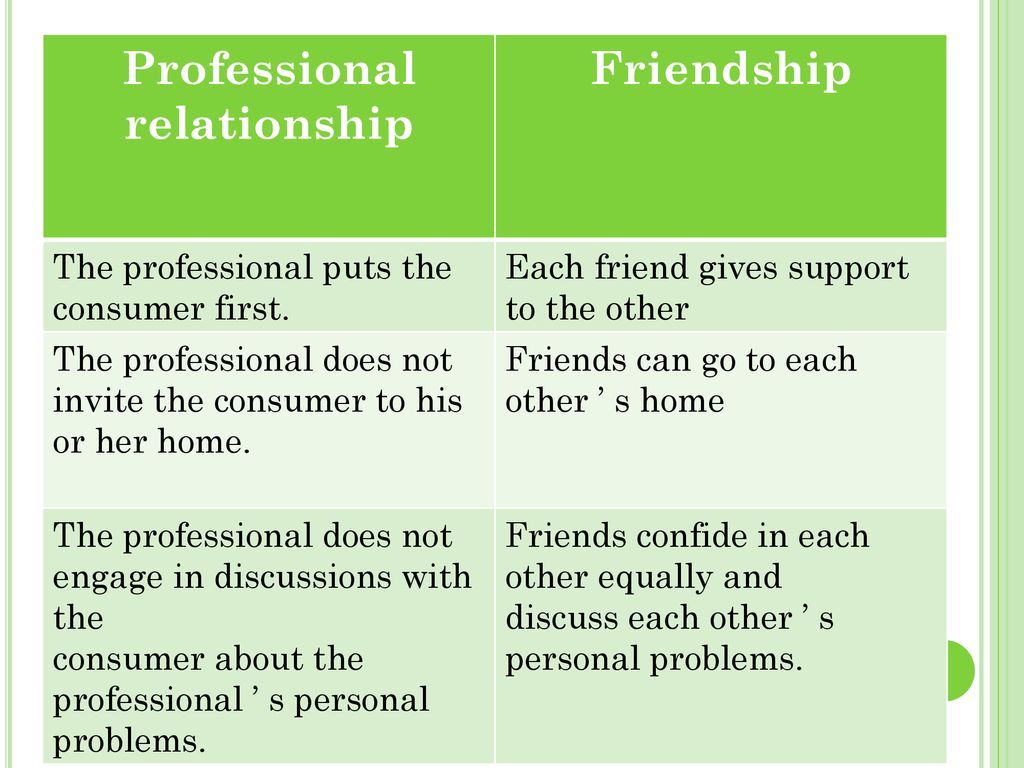

Working Relationship And Personal Relationship Describe Your Working

How Are LLCs Managed IncNow

Difference Between LLC And LTD

Limited Liability Company LLC 2023