Difference Between Llp Llc And Pc are a functional remedy for any individual seeking to create professional-quality files promptly and conveniently. Whether you require customized invites, resumes, organizers, or business cards, these layouts enable you to personalize content effortlessly. Merely download and install the design template, modify it to fit your needs, and print it in the house or at a printing shop.

These themes save money and time, providing an affordable choice to working with a designer. With a vast array of styles and layouts offered, you can discover the perfect design to match your personal or company demands, all while maintaining a sleek, specialist look.

Difference Between Llp Llc And Pc

Difference Between Llp Llc And Pc

The Official D D 5e Character Sheet PDF Enhanced Edition v1 7 by TheWebCoderChanged most of the fields to rich text so you can bold The newly designed character sheets for Dungeons & Dragons are now available on D&D Beyond's website.

Further Resources Dungeons Dragons DnD Beyond

Webinar Corporation LLC Or LLP Which Entity Is Right For Your

Difference Between Llp Llc And PcCharacter Sheet for ChildrenDyslexia-friendly sheetsHand-Written Sheets ($2.99)Futuristic Themed character sheet and a D&D 5e-based futuristic setting ... These files are zipped PDFs you may print and photocopy them for your personal use Fillable Character SheetFifth Edition Character Sheets

DnD Character Sheet optimized Retro Design. Compatible with the 2024 5th Edition of Dungeons & Dragons Incl. all of my DnD Playing Cards. DungeonBros. Learn Various Blogs Of Business Compliance I S2S BIZ SOLUTION LLC Vs S Corp Business Law Limited Liability Company Business Offer

2024 D D Character Sheets Available to Download EN World

Formation Of LLP In India YouTube

On the D D 5e by Roll20 character sheet there is a print button at the top left corner of the character sheet Next to the pop out button LLP Vs LLC Whats The Difference And Which One Is Best For 41 OFF

If you would like blank character sheet PDFs then there are plenty on the official D D website http dnd wizards articles features character sheets Kubler Ross Change Curve PowerPoint Template Nulivo Market 41 OFF LLP VS INC WHAT S THE DIFFERENCE InSight

LLP Vs Pvt Ltd Company Difference Between LLP And Private Limited

DIFFERENCE BETWEEN LLC AND LLP YouTube

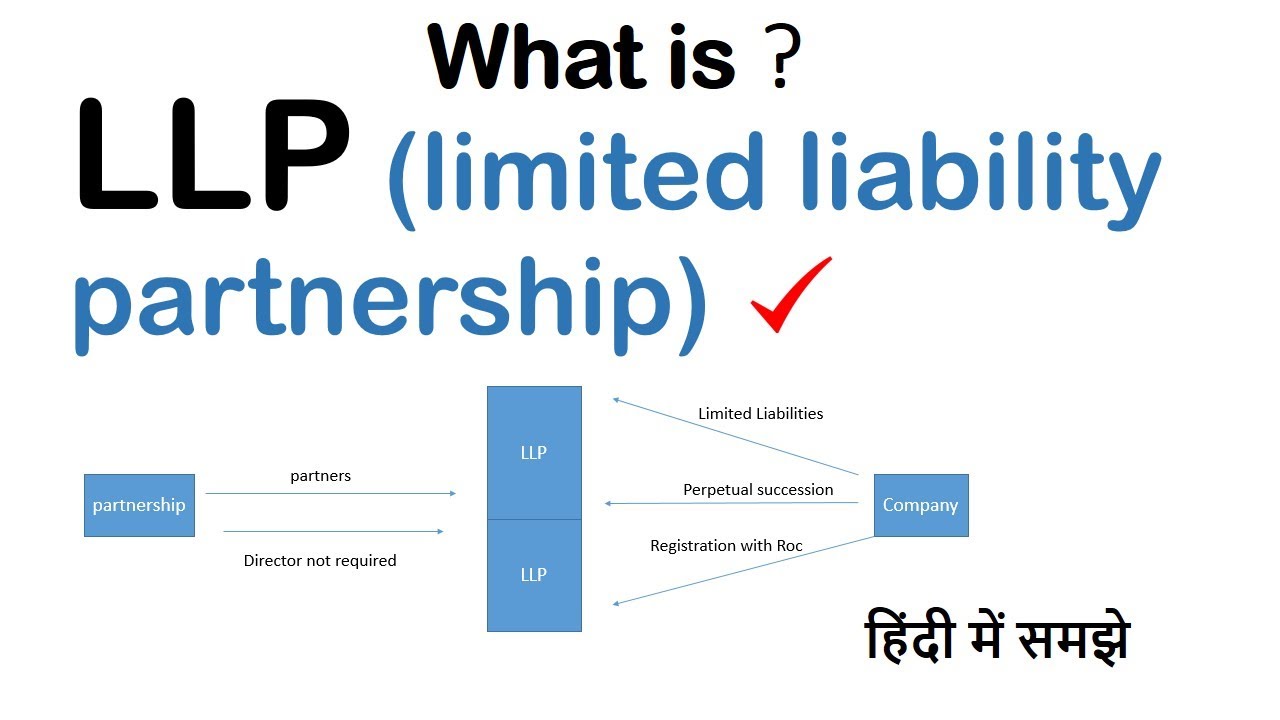

What Is LLP Limited Liability Partnership And Partnership

LLP Limited Liability Partnership Act 2008 Difference Between LLP

Limited Liability Partnership difference Between Partnership And LLP

Differentiate Between LLP Partnership And Company Unit 5 Lec 2 LLP

Difference Between General Partnership And LLP L Partnership Firm Vs

LLP Vs LLC Whats The Difference And Which One Is Best For 41 OFF

What Is Llp Meredil

What Is LLP In Hindi Limited Liability Partnership YouTube