Est To Utc Daylight Savings Time are a versatile remedy for anyone looking to develop professional-quality papers quickly and easily. Whether you require personalized invitations, resumes, organizers, or calling card, these design templates permit you to individualize content effortlessly. Merely download the design template, edit it to suit your demands, and print it in the house or at a printing shop.

These themes conserve money and time, offering a cost-effective choice to hiring a developer. With a wide range of designs and layouts available, you can discover the best style to match your personal or organization requirements, all while keeping a sleek, specialist look.

Est To Utc Daylight Savings Time

Est To Utc Daylight Savings Time

This post contains printable dollar bills in 6 different denominations 1 5 10 20 50 and 100 These printable worksheets, lesson plans, lessons, and interactive material will help students master concepts of counting money with coins and bills.

Fake Money Printable Pinterest

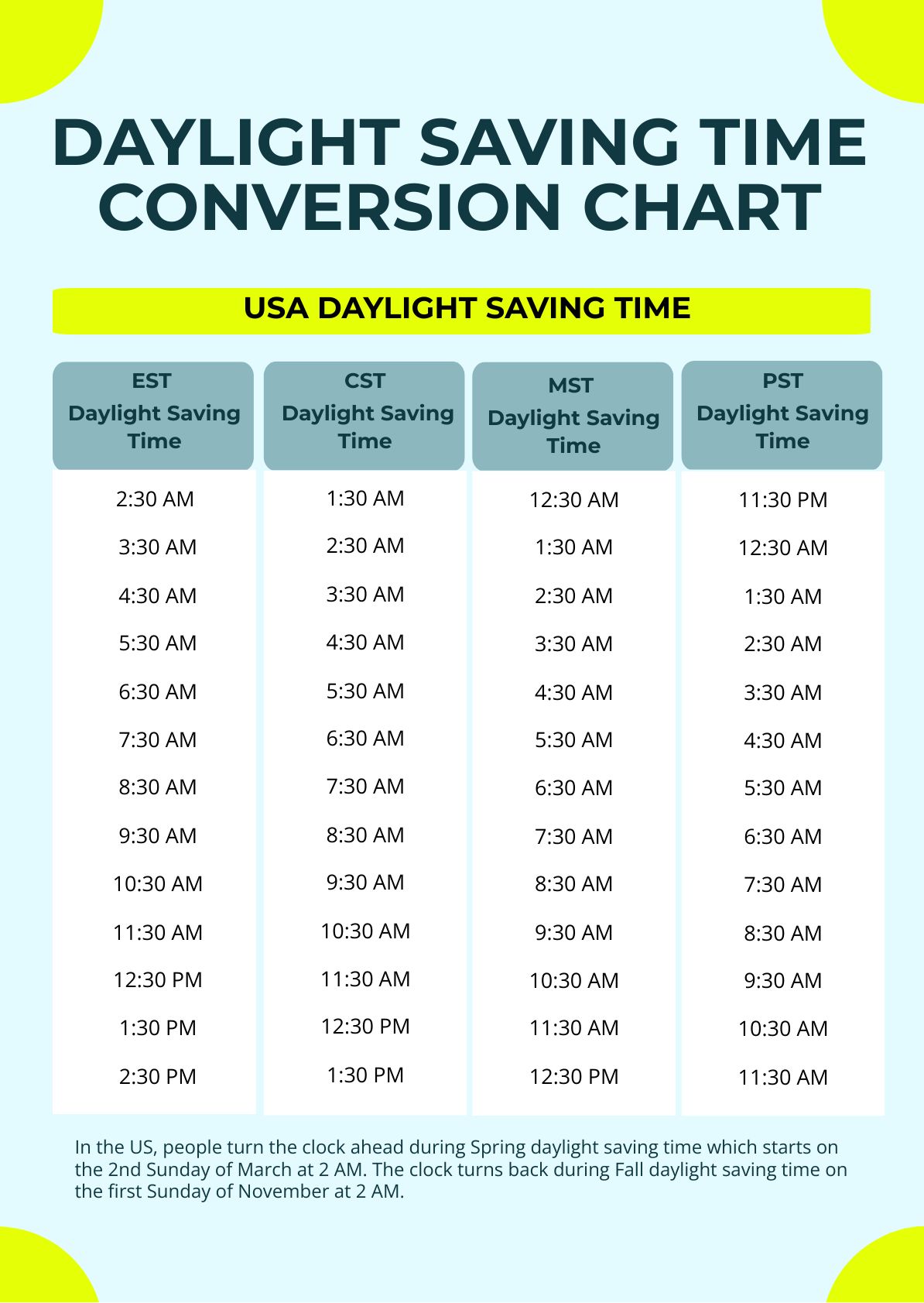

Printable Time Zone Conversion Chart TimeChart

Est To Utc Daylight Savings TimeA simple one-page PDF of play money for you to print out and use in games or simulations. One- dollar bills only, but for history simulations, there's no ... A simple one page PDF of play money for you to print out and use in games or simulations One dollar bills only but for history

We'll help you craft professional business cards, mailers, flyers, brochures, reports, postcards and other marketing essentials. [img_title-17] [img_title-16]

Play Money Printable Fake Money Teaching Reproducible

Daylight Saving Time Vs Standard Time What If We Never Changed Time

Printable small money sheets with cut marks 6 per page cash dollar image for letter size paper 1 5 10 20 50 100 dollar bills back side 6up [img_title-11]

Printable Play Money There are seven U S banknotes Learn to recognize and count U S currency with these printable money cutouts Learn more [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]