Federal Tax Formula Excel are a versatile option for any individual wanting to develop professional-quality files swiftly and quickly. Whether you require personalized invites, returns to, coordinators, or calling card, these templates enable you to personalize content with ease. Merely download and install the theme, edit it to fit your requirements, and publish it in the house or at a print shop.

These templates conserve time and money, using an economical alternative to hiring a designer. With a vast array of styles and layouts available, you can discover the ideal layout to match your personal or organization requirements, all while keeping a polished, expert appearance.

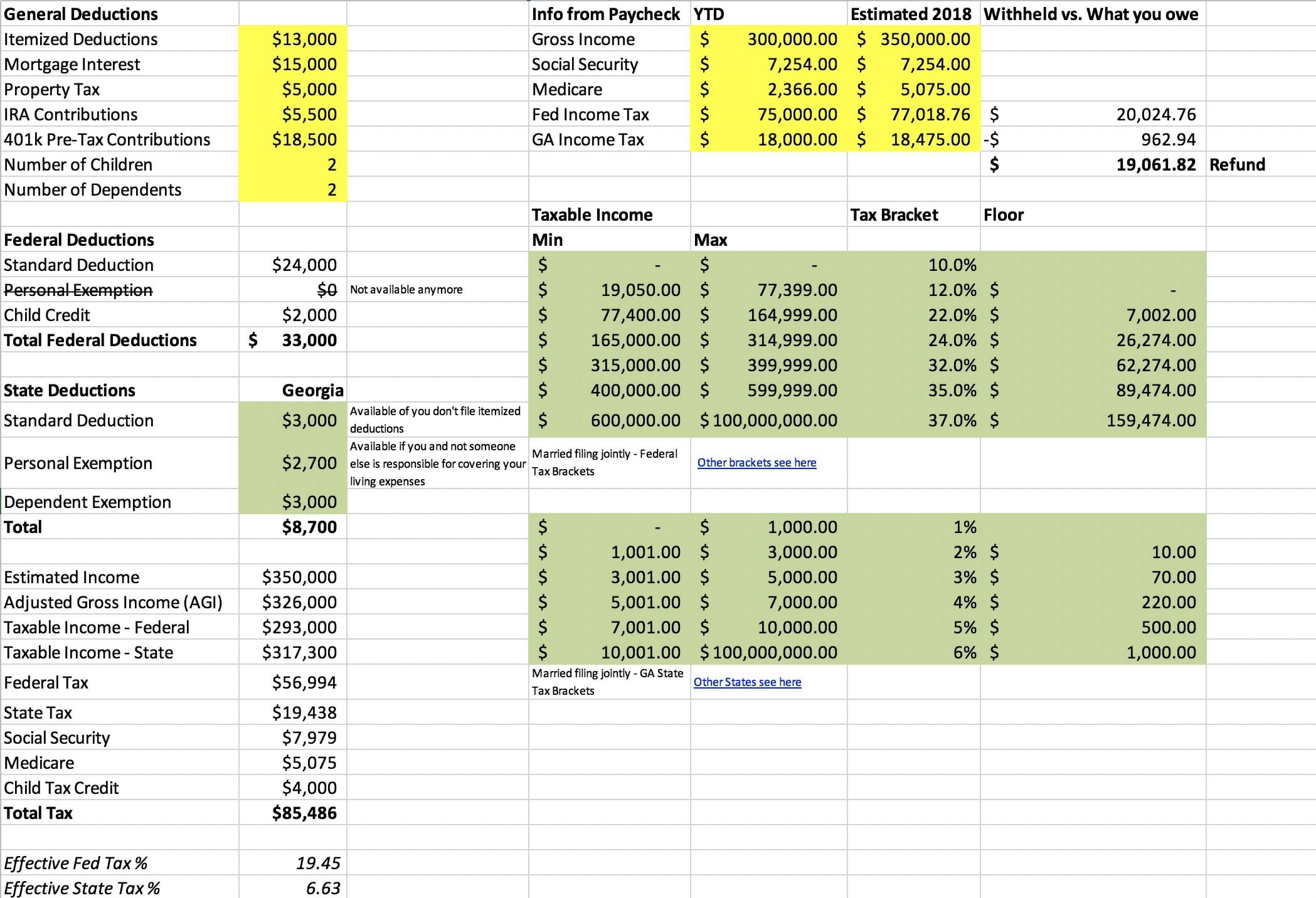

Federal Tax Formula Excel

Federal Tax Formula Excel

Does your name match the name on your social security card If not to ensure you get credit for your earnings contact SSA at 800 772 1213 You may complete a new Form IL-W-4 to update your exemption amounts and increase your. Illinois withholding. How do I figure the correct number of allowances?

Blank W 4 withholding forms Symmetry Software

INCOME TAX CALCULATOR 2023 24

Federal Tax Formula ExcelThis certificate is for Michigan income tax withholding purposes only. Read instructions on page 2 before completing this form. Issued under P.A. 281 of 1967. > ... Information about Form W 4 Employee s Withholding Certificate including recent updates related forms and instructions on how to file

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 PDF. Form 1040-ES. Estimated Tax ... [img_title-17] [img_title-16]

Form IL W 4 Employee s and other Payee s Illinois Withholding

Tax Return Calculator 2025 Free Hudson Paixao

NC 4 Employee s Withholding Allowance Certificate Documents Contact Information North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 [img_title-11]

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when [img_title-12] [img_title-13]

Income Tax Calculator 2025 India Zachary Flynn

Income Tax Calculator Budget 2025 Anita J Harrell

Excel Tax Calculator Australia 2025 Martha C Martin

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]