Graph X 2 Y 4 1 are a flexible option for any individual aiming to develop professional-quality papers promptly and conveniently. Whether you need custom-made invites, resumes, organizers, or business cards, these design templates permit you to individualize content with ease. Merely download and install the layout, edit it to match your needs, and publish it at home or at a printing shop.

These templates save money and time, providing a cost-effective alternative to employing a designer. With a wide variety of styles and formats available, you can locate the best design to match your personal or organization needs, all while maintaining a sleek, specialist appearance.

Graph X 2 Y 4 1

Graph X 2 Y 4 1

Use the buttons below to print open or download the PDF version of the 1 to 100 Charts 4 Blank math worksheet The size of the PDF file Page 1. nrich.maths.org. © University of Cambridge. 1-100 Number Grid.

Number Chart blank 100

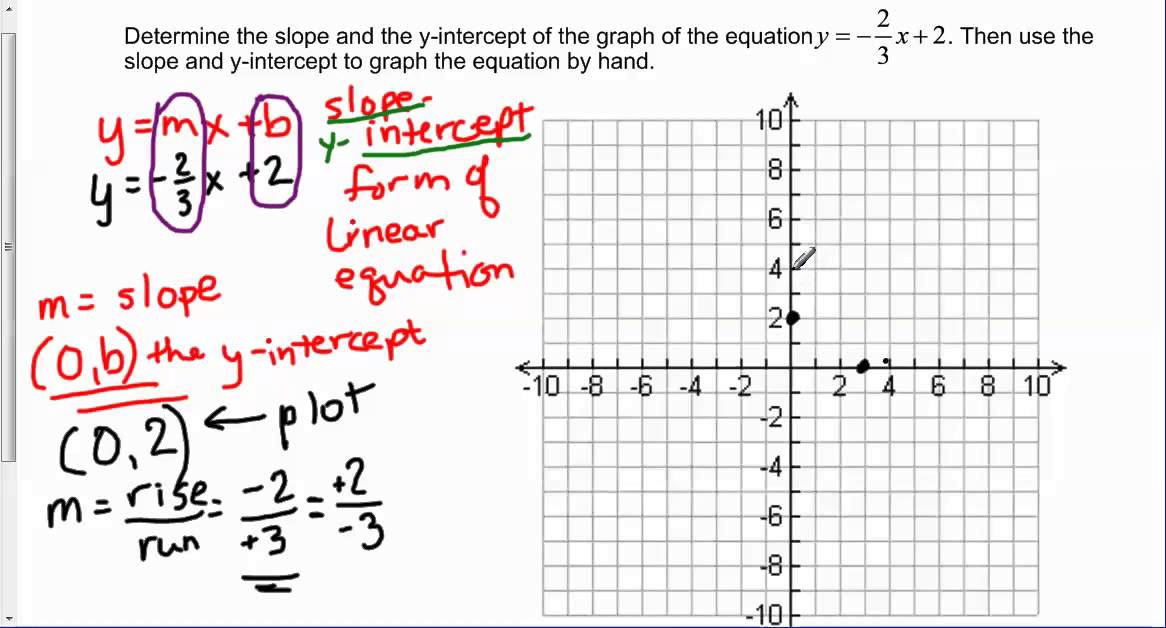

Determine The Slope And Y intercept Of Y 2 3x 2 The Graph The

Graph X 2 Y 4 1Write the numbers 1 – 10 in the spaces of the first row. •. Count by 10. Write those numbers on the chart. •. Write the number 25 where it belongs. This pack includes 4 printable charts that are ready to go INCLUDED RESOURCES 9 PAGES 1 Blank 100 Chart 1 Filled 100 Chart 1 Blank 120 Chart

This generator makes number charts and lists of whole numbers and integers, including a 100-chart, for kindergarten and elementary school children. Facebook Facebook

1 100 Number Grid NRICH

Free printable hundreds chart you can use to help students learn to count to 100 Print one 100 s chart for each student notebook and practice counting Facebook

This is plain version of a printable 100s chart including a number chart that is missing numbers as well as a blank hundreds chart that the student must fill Facebook Facebook