How Is P E Calculated are a versatile remedy for anyone wanting to create professional-quality records promptly and quickly. Whether you require custom invites, resumes, planners, or business cards, these templates permit you to personalize web content easily. Just download the template, modify it to fit your needs, and publish it in the house or at a print shop.

These templates conserve time and money, using a cost-effective choice to working with a developer. With a large range of styles and styles available, you can find the excellent design to match your individual or company requirements, all while keeping a sleek, expert appearance.

How Is P E Calculated

How Is P E Calculated

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Form W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ...

W 9 blank IRS Form Financial Services Washington University

The Price To Earnings Ratio Trailing PE Vs Forward PE Ratios YouTube

How Is P E CalculatedEasily complete a printable IRS W-9 Form 2024 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable W-9 ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Enter your TIN in the appropriate box. For individuals, this is your social security number (SSN) However, for a resident alien, sole proprietor, ... Boxbox It s A Big Day This Is The First Time Ever I ve Released Hellen Jimenez STCH Ministries

Forms instructions Internal Revenue Service

How To Calculate PAYE Income Tax Using Income Tax Calculator PAYE

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 KikoLicious

A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number TIN to report for example income KikoLicious On Tumblr

How To Calculate The PE Ratio How To Use The PE Ratio To Analyse

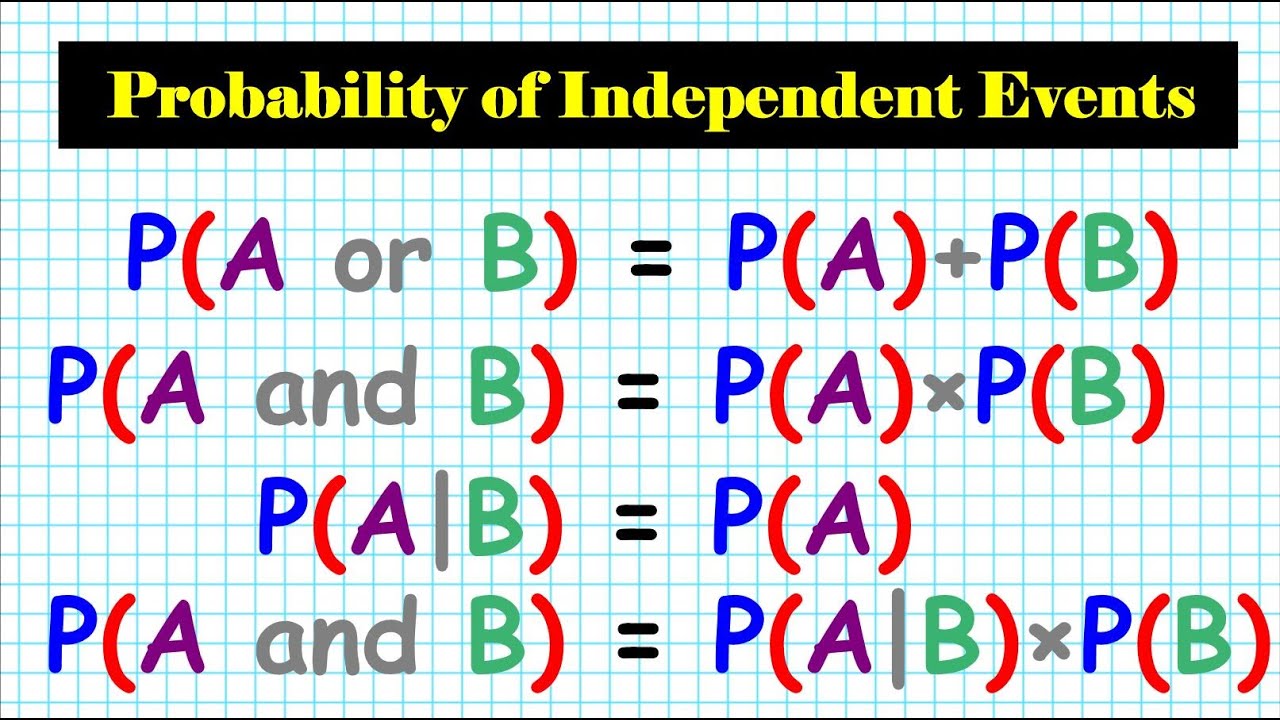

12 How To Calculate The Probability Of Independent Events P A Or B

Problem 20 Find P F Or E If P F And P E Are Independent YouTube

School Subjects Baamboozle Baamboozle The Most Fun Classroom Games

Megan Fox For Poison Ivy

KikoLicious

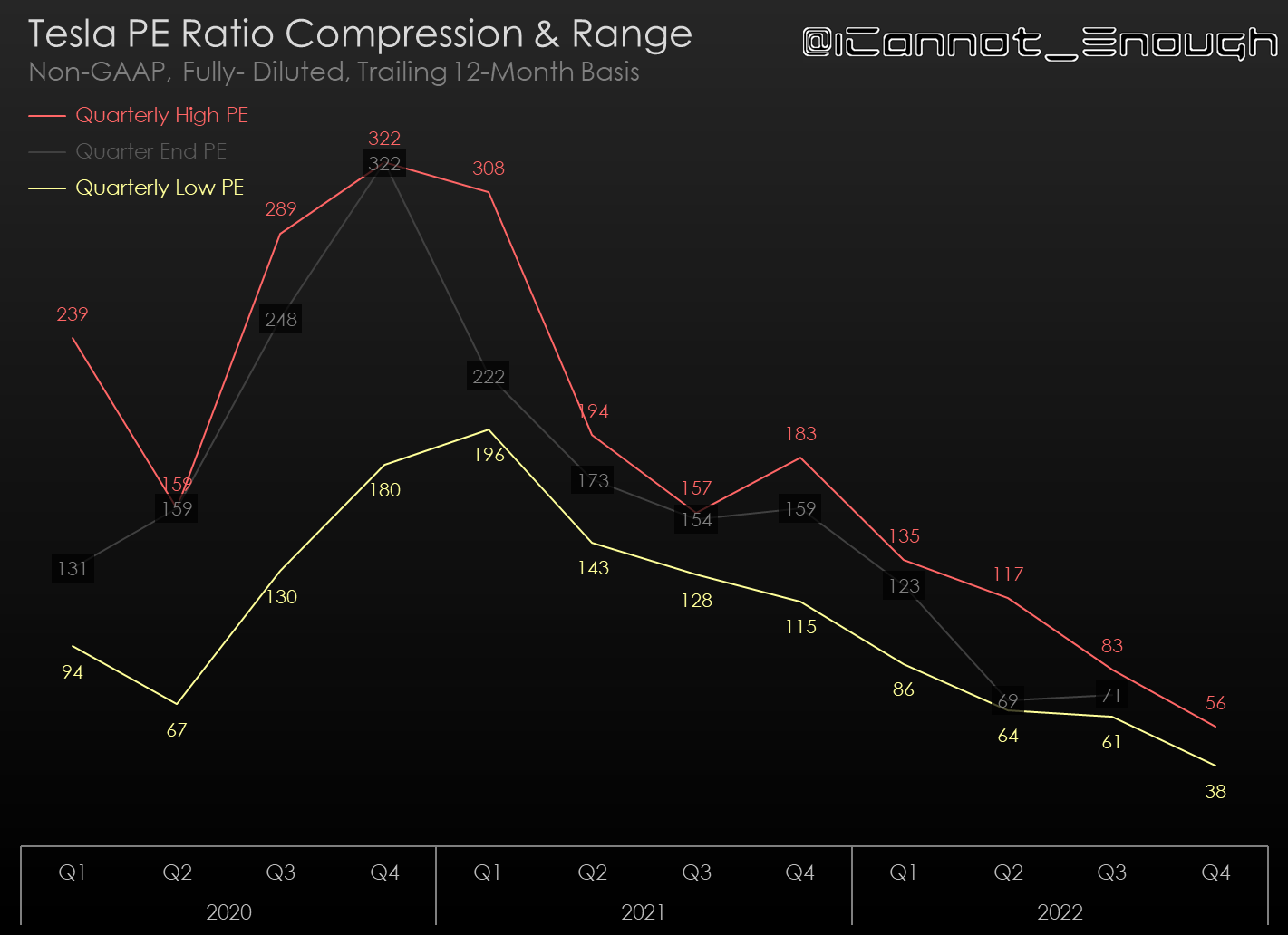

James Stephenson On Twitter Look How Much TSLA PE Ratio Has

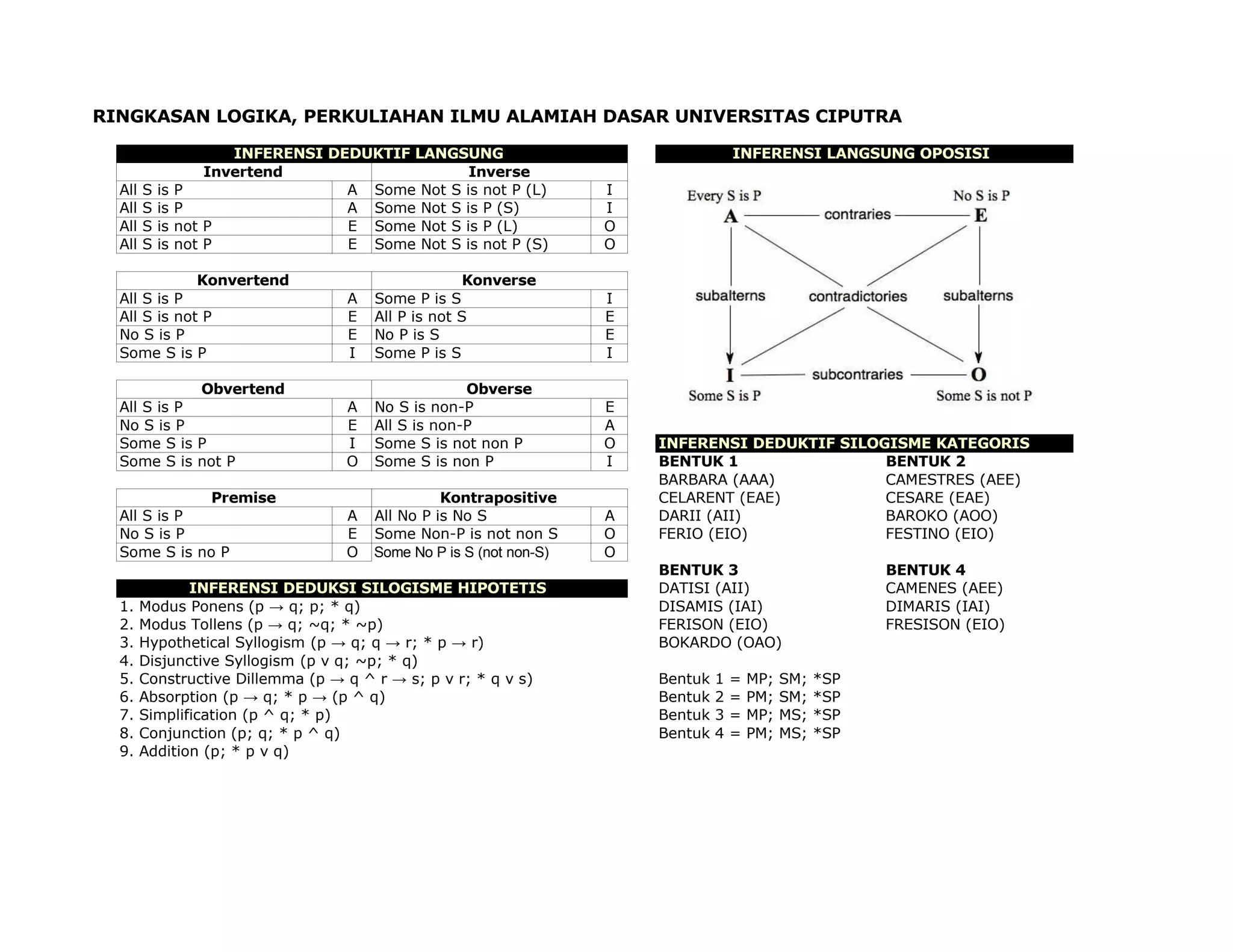

Ringkasan Logika PPT