How Many Times Does 24 Go Into 144 are a versatile option for anybody looking to produce professional-quality files rapidly and easily. Whether you need custom invitations, returns to, planners, or business cards, these templates enable you to customize content with ease. Just download the layout, edit it to match your needs, and print it in your home or at a print shop.

These design templates save time and money, offering a cost-efficient alternative to employing a designer. With a wide range of styles and formats available, you can discover the perfect style to match your personal or company needs, all while maintaining a sleek, professional look.

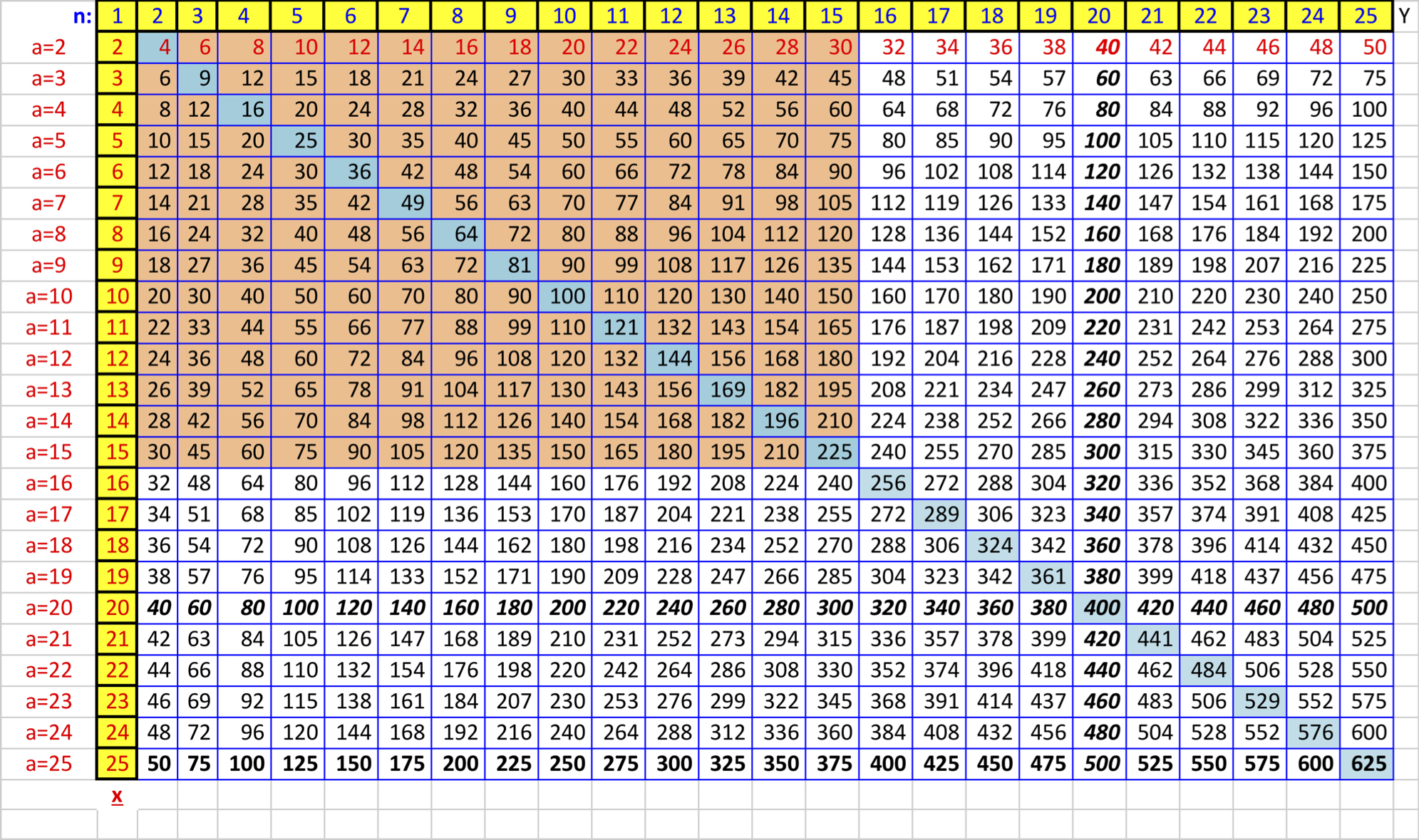

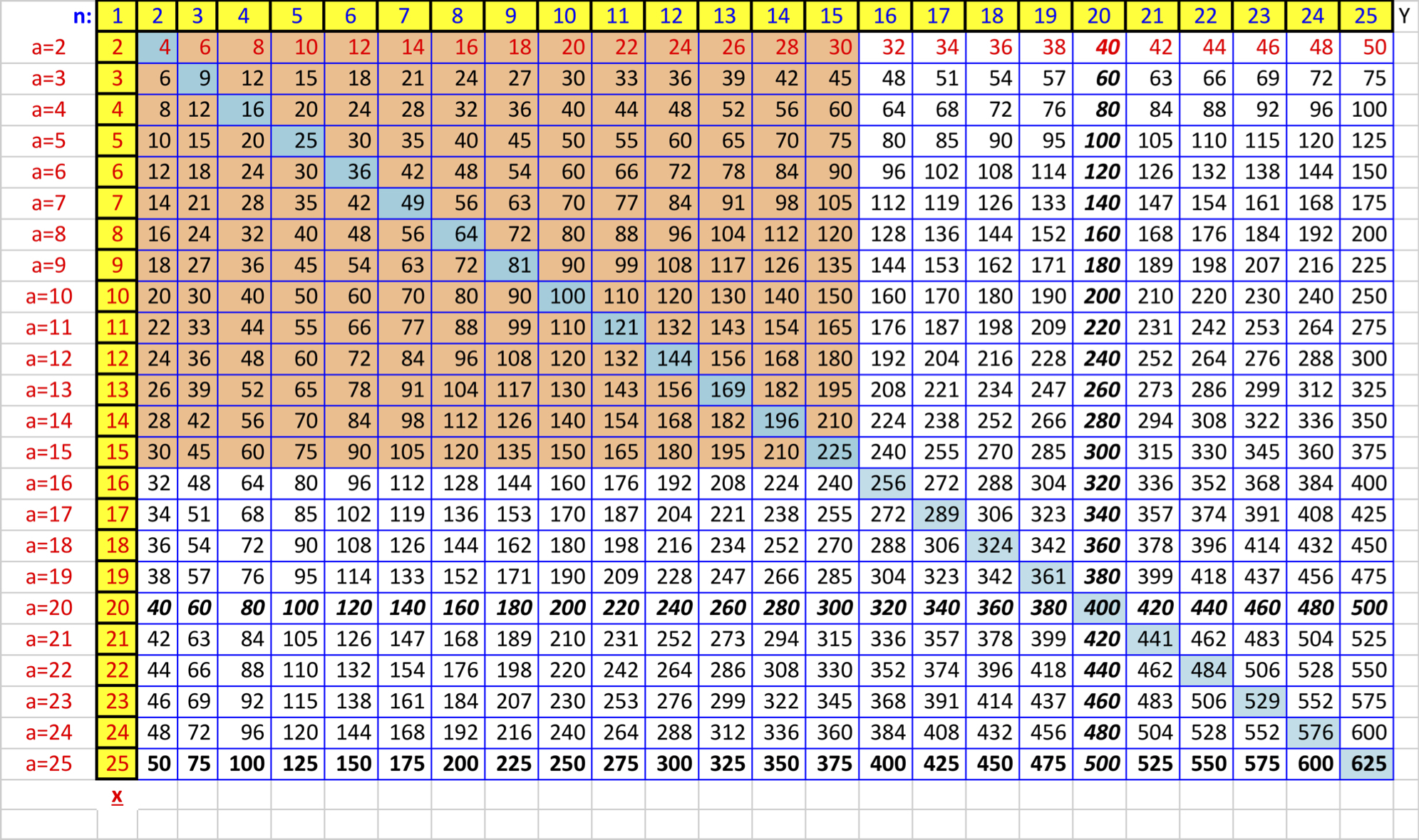

How Many Times Does 24 Go Into 144

How Many Times Does 24 Go Into 144

Do Not Disturb Sign Download Post this laminated sign to keep halls quiet during big tests Discover Pinterest's best ideas and inspiration for Do not disturb funny signs. Get inspired and try out new things.

Please do not disturb sign TPT

6 Times What Equals 216

How Many Times Does 24 Go Into 144Free printable please do not disturb sign template in PDF format. Create a please do not disturb sign with free fully customizable templates from Edit graphic editor

Create free do not disturb sign flyers, posters, social media graphics and videos in minutes. Choose from 240+ eye-catching templates to wow your audience. [img_title-17] [img_title-16]

Do Not Disturb Funny Signs Pinterest

Multiply Table 1 To 50

Imagine walking into your office and seeing a big bold door hanger smack at the entrance that says Please don t come in now There are things we re doing [img_title-11]

Check out our do not disturb sign printable selection for the very best in unique or custom handmade pieces from our signs shops [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]