How To Calculate 64 1 3 are a flexible service for anybody wanting to produce professional-quality papers rapidly and conveniently. Whether you need customized invitations, returns to, organizers, or calling card, these themes permit you to personalize web content easily. Just download and install the template, edit it to fit your requirements, and print it in the house or at a print shop.

These themes conserve time and money, supplying an economical alternative to hiring a developer. With a wide range of designs and formats readily available, you can discover the excellent layout to match your personal or business demands, all while keeping a sleek, professional look.

How To Calculate 64 1 3

How To Calculate 64 1 3

Check out our disneyland ticket selection for the very best in unique or custom handmade pieces from our souvenirs events shops Here's an easy way to announce your trip to Disney - use these free printable Disney boarding pass tickets + envelope! Free PDFs and SVG cut files.

How do I print my tickets planDisney

How To Calculate 64 1 3Download and print these free Disney tickets to surprise your loved ones with the gift of a vacation. Perfect for Christmas or birthdays! Learn how to print your Disney eTicket for use at the theme parks of the Disneyland Resort including Disneyland Park and Disney California Adventure Park

Free “You're Going to Disney World!” Printable Character Letters and TicketsClick through the PDFs and see which character would excite your ... Facebook Facebook

Free Printable Disney Boarding Pass Tickets Cut File

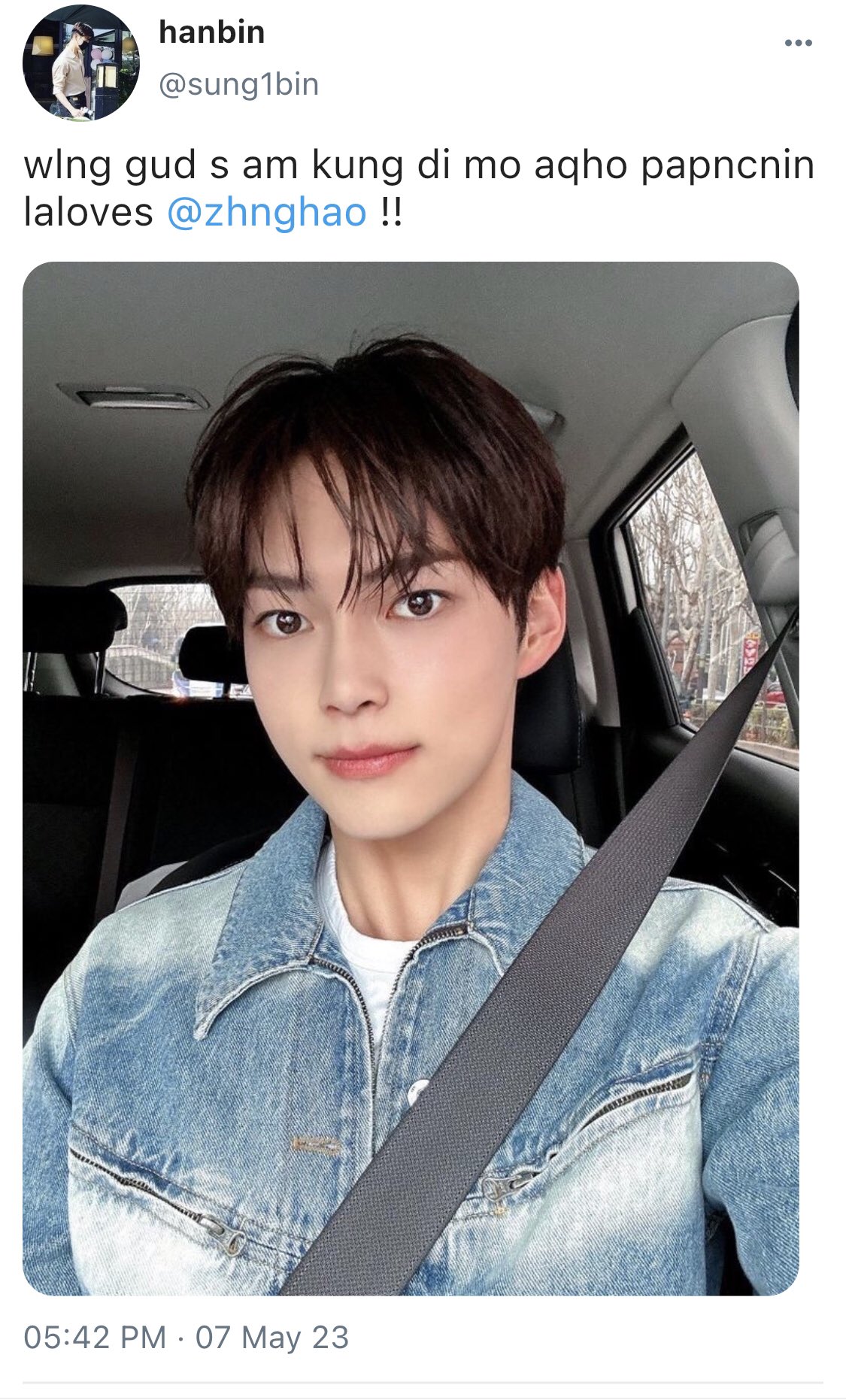

Printable Ticket to Disneyworld Boarding Pass Customizable Template Digital File You Fill and Print GIFTS Browse by interest for the best gifts Ke Haobin Au On Twitter 68 Https t co YCtalLScWn Twitter

Create free free printable disneyland tickets flyers posters social media graphics and videos in minutes Choose from 10960 eye catching templates to wow Facebook Facebook

Valero Port Arthur Refinery

Ke Haobin Au On Twitter 68 Https t co YCtalLScWn Twitter

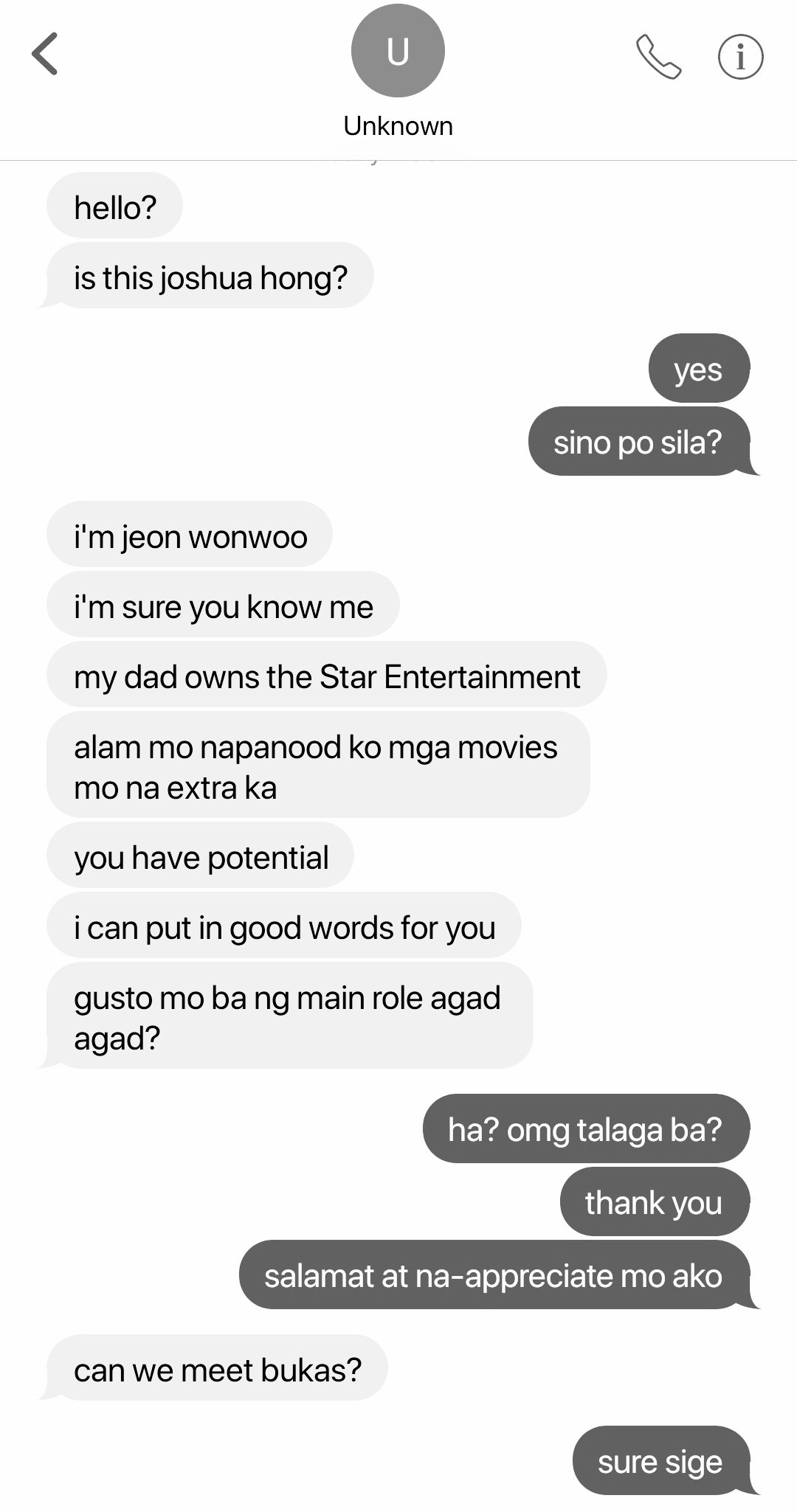

Duke On Twitter 48 Https t co aEhTmMTRci Twitter