How To File Form 3115 are a flexible option for anybody seeking to develop professional-quality documents promptly and easily. Whether you require personalized invitations, resumes, coordinators, or calling card, these templates enable you to customize web content effortlessly. Just download the design template, modify it to match your requirements, and print it at home or at a print shop.

These themes conserve money and time, offering a cost-efficient choice to hiring a designer. With a large range of styles and styles offered, you can discover the best layout to match your individual or service needs, all while maintaining a polished, specialist look.

How To File Form 3115

How To File Form 3115

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

How To Catch Up Missed Depreciation On Rental Property part I Filing

How To File Form 3115You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Form 3115 Source Advisors Tax Accounting Methods

About Form W 4 Employee s Withholding Certificate

How To File Form 1065 Online Multi Member LLC Partnership Tax Form

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Sample Accrual Schedule

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Tax Accounting Methods Recent Developments And Trends Ppt Download Form 3115 Definition Who Must File More

How To Catch Up Missed Depreciation On Rental Property part I Filing

Form 3115 Example Return 2024 IRS Form 3115 What It Is How To

How To File Form 8962 For 2022 Step by Step Guide On Premium Tax

3115 Form Now Required For ALL Business Owners With Depreciation

Form 3115

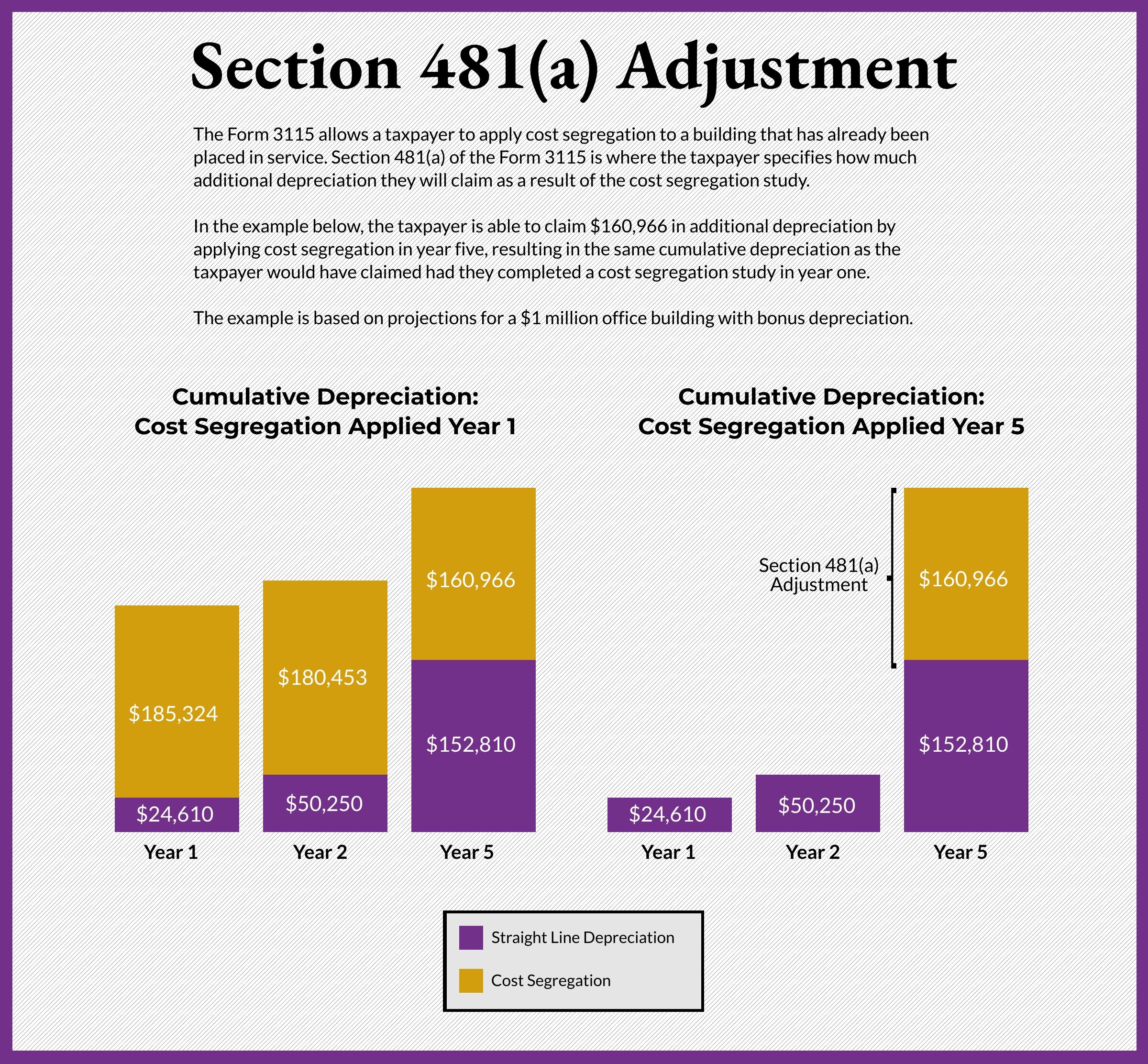

IRS Form 3115 How To Apply Cost Segregation To Existing Property

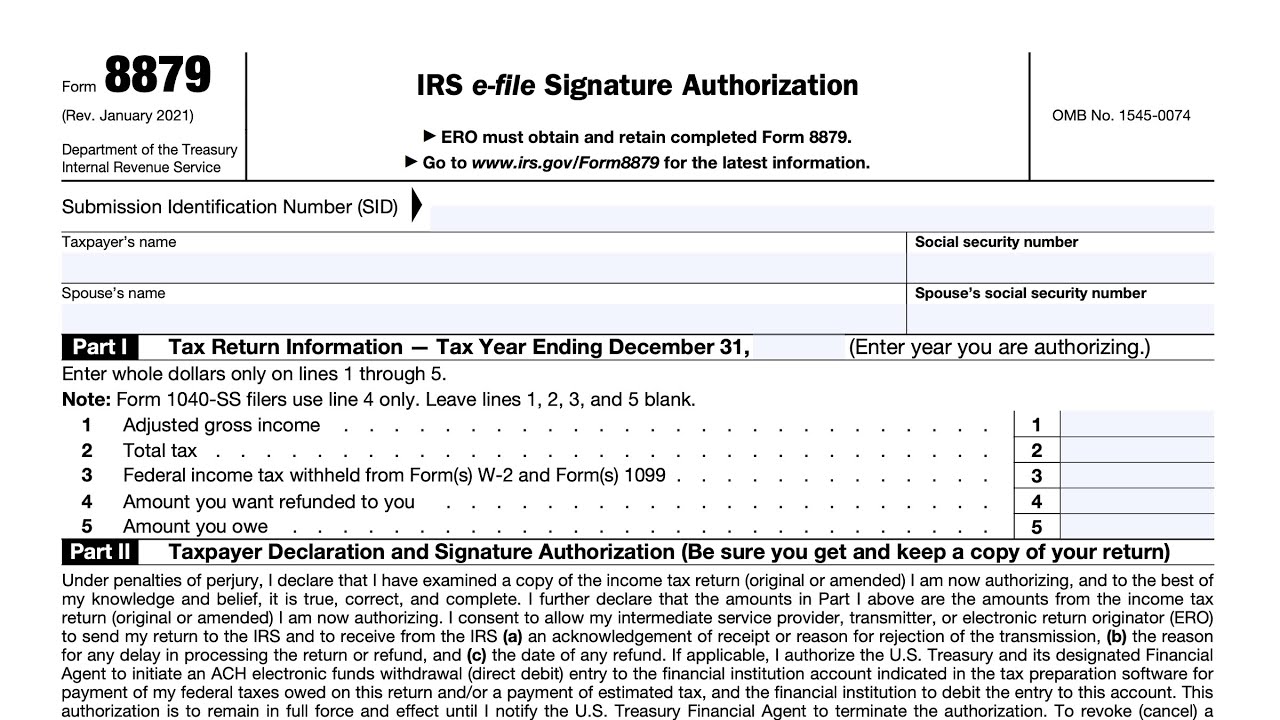

Downloadable Form 8879 IRS E File Signature Authorization 42 OFF

Sample Accrual Schedule

Form 3115 Application For Change In Accounting Method 2015 Free Download

Form 3115 Correcting Depreciation Line by Line Brass Tax Presentations