Paragraph 3 Abs 2 Estg 1988 are a flexible option for any person aiming to produce professional-quality papers quickly and easily. Whether you need custom-made invites, resumes, planners, or calling card, these design templates enable you to customize web content with ease. Just download and install the layout, modify it to suit your needs, and publish it in the house or at a printing shop.

These templates conserve time and money, using a cost-effective alternative to working with a designer. With a variety of designs and formats readily available, you can discover the excellent style to match your individual or service requirements, all while preserving a polished, specialist look.

Paragraph 3 Abs 2 Estg 1988

Paragraph 3 Abs 2 Estg 1988

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Form W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ...

W 9 blank IRS Form Financial Services Washington University

35c EStG Steuerbonus F r Energetische Bauma nahmen Steuertipps Vom

Paragraph 3 Abs 2 Estg 1988Easily complete a printable IRS W-9 Form 2024 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable W-9 ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Enter your TIN in the appropriate box. For individuals, this is your social security number (SSN) However, for a resident alien, sole proprietor, ... Nutzungs berlassungen K rperschaftsteuer Vermittlung Notpfote Animal Search Rescue E v

Forms instructions Internal Revenue Service

EStG Markierungen Und Verweise F r Bilanzbuchhalter Teil 2 YouTube

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 Einkommensteuer Learncard 3247113

A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number TIN to report for example income 2020 09 29 steuerbefreiung nach paragraf 3 nummer 46 EStG und Bescheinigung Zu 44 A EStG

Sonstige Vorsorgeaufwendungen 10 Abs 1 Nr 3 3a Abs 4 EStG Im

Teil 1 Geringwertige Wirtschaftsg ter 6 Abs 2 EStG Sammelposten

bertragungen Und berf hrungen Von Einzelwirtschaftsg tern Nach 6

Neuregelung H usliches Arbeitszimmer Und Home office Pauschale 4 Abs

Unentgeltliche bertragung Von Unternehmensanteilen Steuerlehrer de

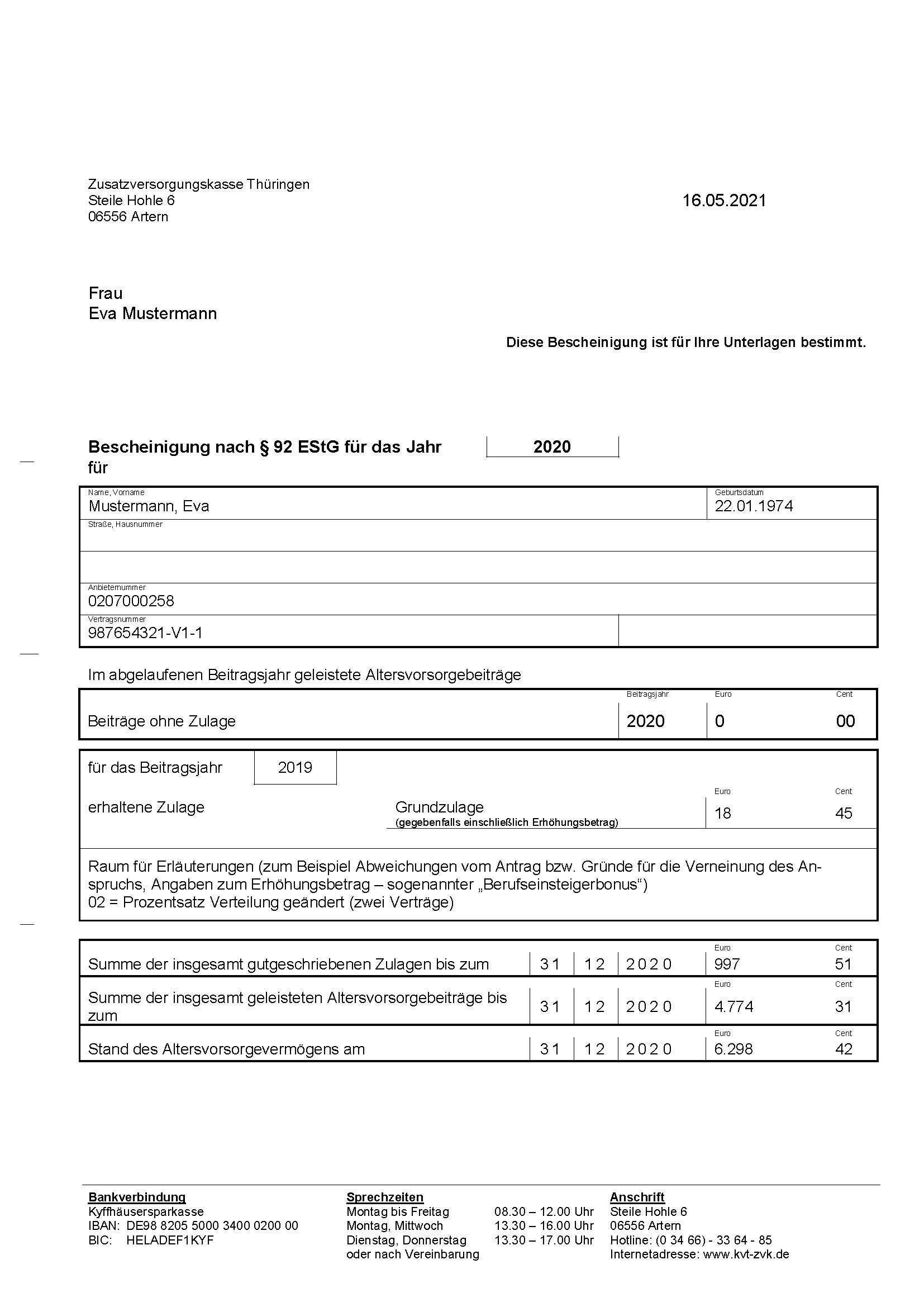

Post F r Unsere Versicherten ZVK Th ringen

48b CONVICTORIUS

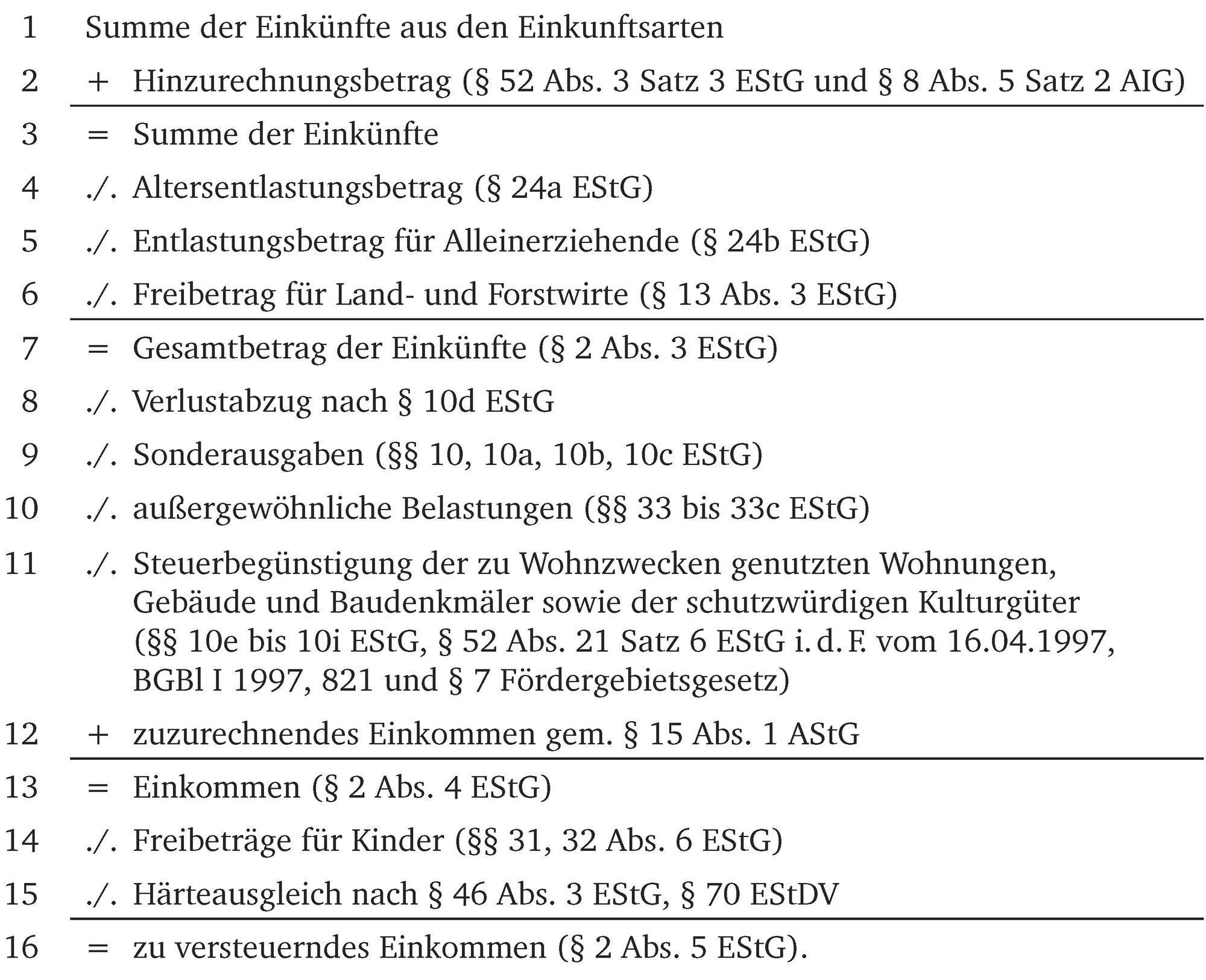

Einkommensteuer Learncard 3247113

35a Abs 2 Satz 2 Estg

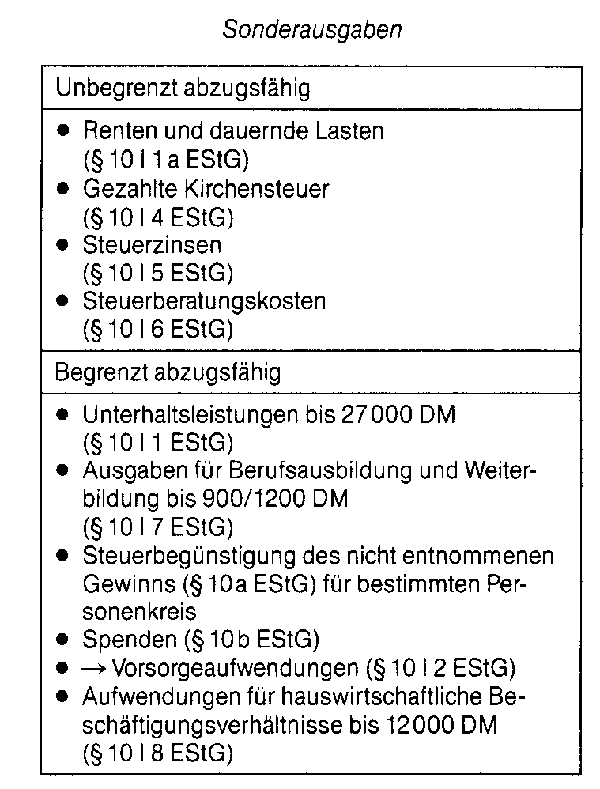

Sonderausgaben Wirtschaftslexikon