Rtx 4050 Vs 3050 Ti Reddit are a versatile service for anybody wanting to develop professional-quality documents quickly and easily. Whether you require customized invitations, returns to, planners, or business cards, these templates allow you to customize material with ease. Just download the design template, modify it to fit your needs, and print it at home or at a printing shop.

These themes save money and time, using a cost-efficient alternative to employing a developer. With a large range of styles and formats available, you can discover the excellent layout to match your personal or company demands, all while maintaining a sleek, professional appearance.

Rtx 4050 Vs 3050 Ti Reddit

Rtx 4050 Vs 3050 Ti Reddit

Free printable dog coloring pages for kids to print and color Fun and educational dog themed coloring sheets for children of all ages Discover printable dog coloring pages for kids, all these pictures are free. Dogs are joyful and affectionate animals, known for their diverse personalities ...

Dog and Puppy Coloring Pages ABCmouse

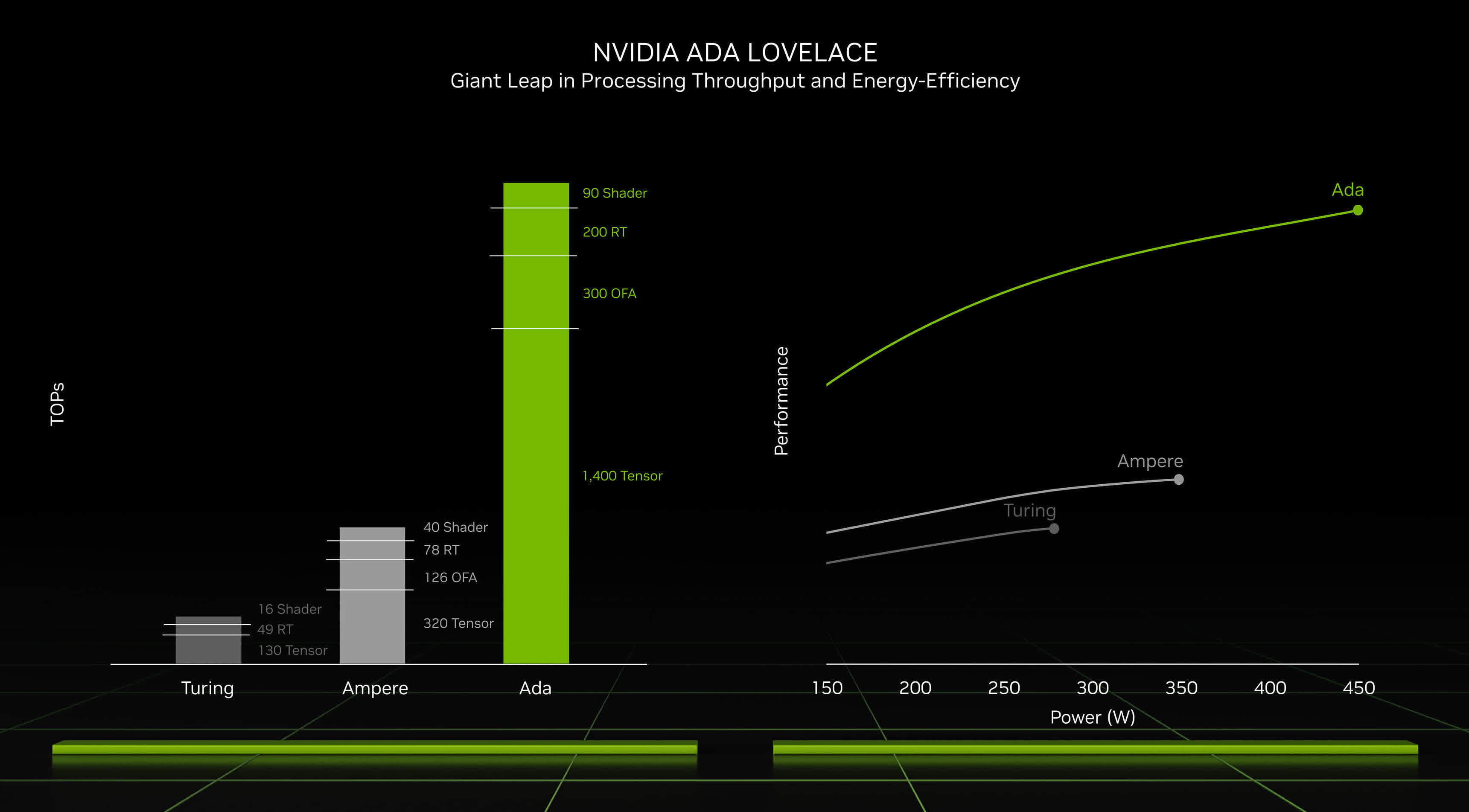

NVIDIA GeForce RTX 4080 Laptop GPU Vs NVIDIA GeForce RTX 4070 Vs NVIDIA

Rtx 4050 Vs 3050 Ti RedditExplore free printable dog coloring pages, from cute pups to realistic breeds, there's something for everyone. Download, print, & color now! Dog coloring pagesColoring pages dogsDogs to print and colorPrintable dog to colorColor pictures of dogsDog to print and colorDogs to color

We collected on this site more than 500 colouring pages of dogs. There are puppies, realistic and cute dogs, cartoon and easy dogs, Christmas themed and dog ... [img_title-17] [img_title-16]

Dog Coloring pages for kids Free PDF printables Just Color

[img_title-3]

We ve gathered adorable free dog coloring pages for kids and adults alike from simple illustrations your young ones can color to intricate patterns for teens [img_title-11]

Dec 20 2022 Explore Crafty Annabelle s board Dog Printables on Pinterest See more ideas about printables puppy party dog puppy party [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]