Section 10 13a Read With Rule 2a Yes No are a flexible option for any person wanting to develop professional-quality records swiftly and quickly. Whether you need custom-made invitations, resumes, organizers, or calling card, these themes permit you to individualize content effortlessly. Merely download and install the theme, edit it to match your requirements, and publish it in your home or at a print shop.

These layouts save money and time, providing an affordable choice to employing a designer. With a vast array of designs and layouts available, you can discover the best style to match your personal or business demands, all while preserving a polished, professional appearance.

Section 10 13a Read With Rule 2a Yes No

Section 10 13a Read With Rule 2a Yes No

Our dog coloring sheets are high resolution letter sized printable PDFs To download simply click on the image or the text link underneath the 26 coloring pages of dog to download and print (free PDF). Kawaii Dog. Snowman and a Dog. Group of Dogs. Family of dogs. Cute Dog. The dog and the rabbit.

Dogs coloring pages Super Coloring

Receipt Of House Rent Under Section 10 13A Of Income Tax Act PDF

Section 10 13a Read With Rule 2a Yes NoColoring pages of dogs. Cat coloring pages, dinosaurs coloring pages, dog coloring pages, coloring pages of horses. Free printable dog coloring pages for kids to print and color Fun and educational dog themed coloring sheets for children of all ages

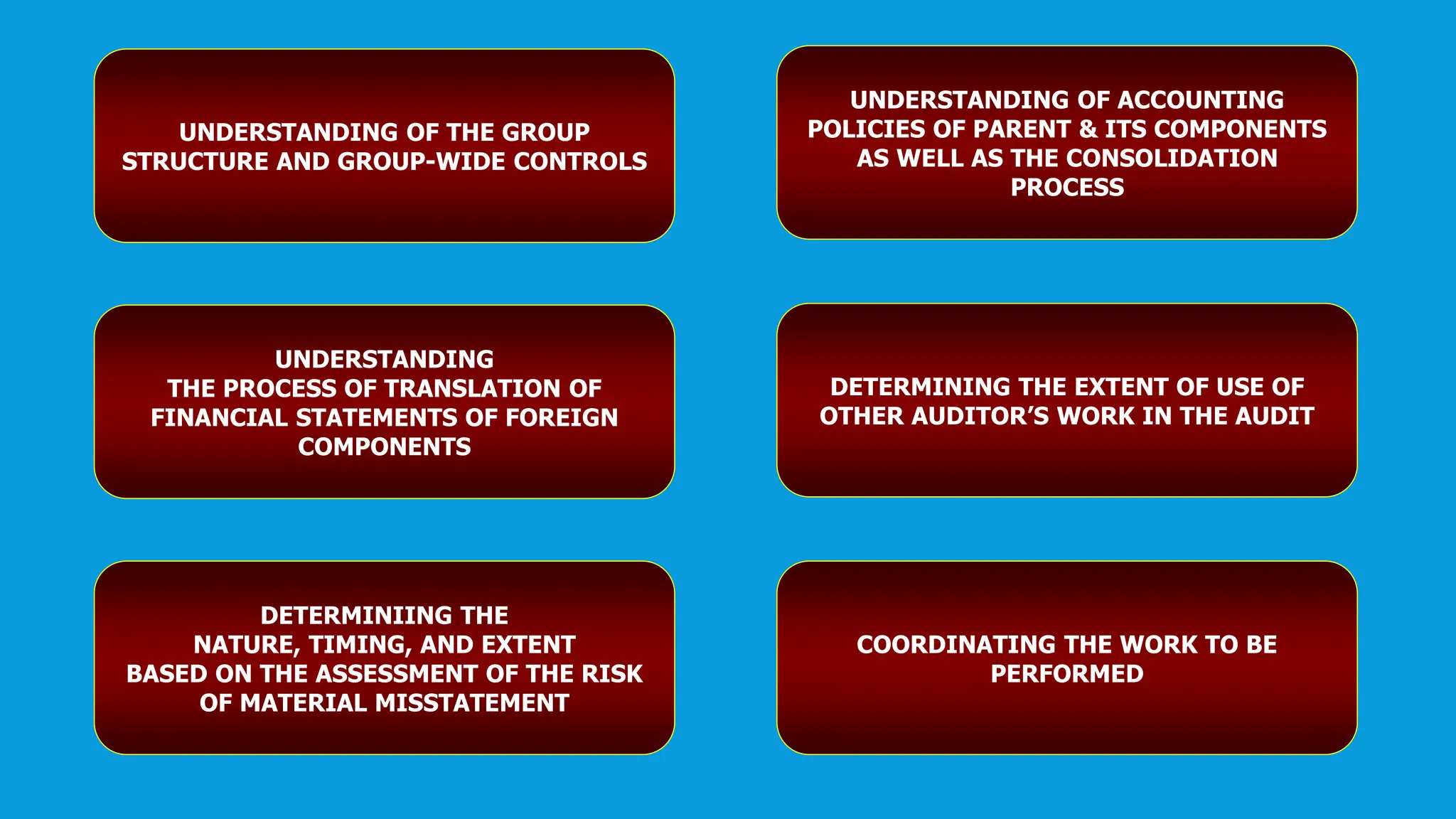

26,256 dog coloring page stock photos, vectors, and illustrations are available royalty-free for download. See dog coloring page stock video clips. Consolidated Financial Statements Audit PPT Consolidated Financial Statements Audit PPT

Dog coloring page to print free PDF LiloColors

HOW TO COMPUTE EXEMPTION IN HOUSE RENT ALLOWANCE I SECTION 10 13A I

Discover Printable Dog Coloring Pages for Kids all these pictures are free Dogs are joyful and affectionate animals known for their diverse personalities Consolidated Financial Statements Audit PPT

Explore a delightful collection of free printable dog and puppy coloring pages for kids From playful puppies to friendly adult dogs these pages offer both Consolidated Financial Statements Audit PPT Consolidated Financial Statements Audit PPT

How To Save Tax On House Rent Section 10 13A HRA Exemption Tax

HRA Calculation Income Tax Section 10 13A Of IT Act HRA House

Council Tax Section 13a Templates Are Here YouTube

Calculation Of House Rent Allowance HRA Income Tax Exemption Under

Free House Rental Invoice HOUSE RENT RECEIPT Invoice Sample Invoice

Unveiling The Secret Power Of Yes A Guide To Unlocking Success

Consolidated Financial Statements Audit PPT

Consolidated Financial Statements Audit PPT

Consolidated Financial Statements Audit PPT